When applying for compulsory motor liability insurance in Rosgosstrakh, sometimes an error occurs due to the overestimation of the KBM indicator. The growth of the bonus-malus directly affects the cost of compulsory car insurance. In order not to overpay for the extension of compulsory motor liability insurance, you should know the ways to correct the KBM in Rosgosstrakh. The fastest and most reliable option for recalculating the coefficient is to use specialized online services. For a few hundred rubles, car owners can reduce the coefficient in just 1 minute. The services operate legally: all data is synchronized with RSA. A day after the restoration of the KBM, you can apply for compulsory motor liability insurance at Rosgosstrakh at a discount.

What is KBM and how is the coefficient calculated?

The KBM (bonus-malus) coefficient is used when calculating the cost of an MTPL insurance policy. It characterizes the degree of accident-free driving of a particular driver. The calculation is made on the basis of data from the RSA (Russian Union of Auto Insurers), where there is information about compulsory motor liability insurance, and the traffic police databases.

A bonus-malus is assigned to each driver who drives a vehicle in the Russian Federation. When you obtain a license, the coefficient is maximum, but with each year of driving without accidents, the coefficient decreases. And on the contrary, if the owner of the car is the culprit of an accident, his MPV will increase again next year. This will affect the cost of MTPL insurance: you won’t be able to get it at a discount even online.

Depending on the driver’s experience and the period of accident-free driving, the bonus malus can either increase or decrease the amount of insurance. The maximum discount is 50%. It is provided to drivers with at least 10 years of accident-free driving experience.

The maximum discount at Rosgosstrakh is also 50% of the coefficient. Considering that the vehicle owner cannot significantly influence other factors in the calculation of compulsory motor liability insurance, the value of the bonus-malus is decisive when calculating the cost of insurance.

How to lower the BMR

Thus, we were convinced that KBM directly affects the cost of compulsory motor liability insurance. Of course, no one wants to pay one and a half or even 2 and a half times more for an MTPL policy, what to do then, you ask? Do not take out a policy! Before you contact us! We can lower your BMR. All you need to do is fill out an application in the form below. Our specialists will contact you and help you lower your BMI, after which you can come to any insurance company and take out a compulsory motor liability insurance policy at a reduced price.

Application for reduction of BMC

Before sending, please check that your contact information is filled out correctly.

KBM reduction

Is it profitable to lower the BMR?

To evaluate how profitable it is to lower the BMR, let's look at an example. Let's say you have the 2nd class of KBM, that is, the coefficient itself is 1.4 (for example, you had an accident and your coefficient was increased) and your cost of compulsory motor liability insurance was 15,000 rubles. Next, you contacted our company, and our employees lowered your BMI by only 1 class and now the coefficient value is 1, then the new cost of insurance will be 10,715 rubles! That is, you saved 4285 rubles, you will agree that this is not small money. Moreover, this value of the BMI is retained by you, that is, next year the cost of insurance, subject to accident-free driving, will be the same or less!

I think you are convinced that lowering the BMR is beneficial.

Result guarantee

How can we check our work? – very simply, there are a lot of services for checking KBM in the RSA database. After completing the KBM downgrade procedure, which takes 1 to 3 business days, you will check your KBM in the database and see that it has indeed been lowered! We are always for the client and value our reputation!

How to find out your KBM coefficient

There are many sites on the Internet that offer to find out and restore the KBM within 1–2 minutes. Not all Internet resources are safe. When calculating the coefficient, you should remember that it is not recommended to enter personal data on sites that are not the official pages of insurers. This risks loss of personal data and problems with fraud. Methods that allow you to check your OSAGO coefficient for free and safely are presented in the table.

| Source organization name | Link to check bonus malus |

| Official website of Rosgosstrakh | https://www.rgs.ru/products/private_person/auto/osago/kbm/proverka_ispravlenie_kbm/index.wbp |

| Partner site | kbmka.ru |

The odds checking options proposed in the table are free official ways to find out the size of the malus bonus. To check what the value of the OSAGO coefficient is, you should enter the following parameters:

- FULL NAME.

- Date of birth.

- Series and number of driver's license.

Information about the KBM is provided online. The verification speed is less than 1 minute.

Principles for determining KBM OSAGO

Clients who take out MTPL insurance for the first time are assigned a coefficient equal to 1 - no incentives, no penalties, because it is not clear how carefully the driver will drive the vehicle. The longer you drive and the less often you cause accidents (ideally, not at all), the more you will be able to reduce the coefficient.

For each year of accident-free driving, the insurer must reduce the BMR by 5% until it has been reduced to the maximum. For example, a single accident due to your fault reduces your KBM to an additional factor of 1.55, two or more accidents - to 2.45. After this, some period of accident-free driving is necessary so that you can gradually work your way up to the initial coefficient, and then become eligible for a discount.

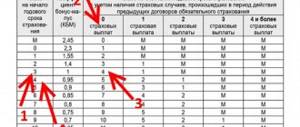

However, instead of the numbers 2.45, 0.8, etc. you may encounter the numbers 1, 2, 3,... 13 and the letter M. These are class designations. Each specific coefficient is designated by the class to which it belongs. So, initial = third, and as we remember, the starting coefficient is equal to one. The youngest (most expensive) class is M. The coefficient, accordingly, is 2.45. And the highest class is 13th with a coefficient of 0.5. You can find a complete table of classes on the Internet.

Previously, this coefficient was assigned to the car, now - to the driver. This means that when changing a car, your coefficient will be applied when concluding a compulsory motor liability insurance contract for a new car (the obligation to do this within ten days from the date of purchase of the vehicle is enshrined in law). This also means that if at least one other driver is included in your insurance, then his bonus-malus coefficient may differ from yours.

It must be taken into account that there can only be one coefficient, even if several drivers are included in the insurance. If their coefficients differ, then the higher one will be taken into account when calculating the insurance premium. This is understandable - no matter how skillfully and carefully you drive 364 days a year, an inexperienced driver included in the insurance can get behind the wheel of a 365 and cause an accident.

All data on the drivers themselves and their coefficients are sent to the automated information system of the Russian Union of Auto Insurers (RUA), an organization that issues licenses to insurers and controls their activities. On the RSA website you can check your MTPL KBM class and see if it needs to be lowered. You will need to enter your passport details and VIN (or body and chassis numbers if you have a Japanese car that does not have a VIN).

What causes the KBM error?

When calculating discounts in Rosgosstrakh, problems sometimes arise due to an increase in the size of the coefficient. Since an increase in the indicator contributes to an increase in the cost of the insurance policy, the vehicle owner should know the reasons contributing to this phenomenon. A list of errors causing an increase in the coefficient is presented in the table.

Reasons for the growth of KBM in Rosgosstrakh

| Description of the problem | Details |

| Technical malfunction in Rosgosstrakh databases | The growth of the indicator is due to failures in the software of Rosgosstrakh |

| Insurance company employee's mistake | An employee of Rosgosstrakh made a mistake when entering data, which is why the cost of the coefficient increased |

| Changing vehicle owner data | A change of name or any replacement of documents may lead to changes in data in the RSA and insurance company databases |

| Change of insurer | When transferring from another insurance company to Rosgosstrakh, the previous insurer does not always transmit information about KBM to the new company in a timely manner |

| Liquidation of an insurance organization | In case of bankruptcy of a legal entity, reorganization of an insurance company and other large-scale changes in the company, there is a risk that the data will be incorrect |

| Calculation system error | Services for checking KBM periodically fail, for example, during the process of updating databases |

| The driver is included in several policies at the same time | Technical malfunction caused by “duplication” of data in the systems |

Regardless of the reason that led to an increase in the bonus malus in Rosgosstrakh, the owner of the OSAGO is recommended to reduce the size of the coefficient to the correct value. Otherwise, you will have to renew the annual policy with increased payment.

How does the coefficient affect the price of an insurance policy?

When a driver contacts the insurance company for the first time, he is assigned class 3, meaning a zero discount and no bonus. No earlier than a year later, this indicator increases by 1 point. If the driver purchases a new policy, then its price is reduced by 5% from the base rate. In the future, provided there are no accidents, a citizen can reduce the cost of insurance by 50% for 10 years. This is the maximum bonus, which cannot be increased.

The driver will remain at this level until he changes the terms of the agreement or commits an accident. In such cases, the insurer's rating drops significantly. On average, he loses half the premium. After this, the question of how to reduce the cost of compulsory motor liability insurance can be raised no earlier than in a year, in the absence of insured events due to the fault of the vehicle owner.

Article on the topic: Features of issuing compulsory motor liability insurance for a car, rules and procedure for obtaining a policy

When a client causes two accidents during the year, he rolls back 10 points. So, if there is a higher 13th class, it is assigned 3 with a zero discount. If the rating is lower, then the citizen goes into the negative category with increasing coefficients, and for the policy he will have to pay significantly extra for each minus point. In this case, the rate does not apply to the car, but only to its owner. The history of his behavior on the road is tracked by the registration number of the license, not the vehicle.

Calculation of coefficient

To understand how to lower the CBM, you need to understand the criteria by which it is assigned. This is a basic count that affects the total amount that will have to be paid upon completion of the contract.

The KBM class is influenced by the following factors:

- driving experience;

- age;

- health status;

- the presence of emergency situations due to the client’s actions and their severity.

The subjective factor should also be taken into account. Being self-supporting organizations, insurance companies use various tricks to increase the price of the policy and reduce the amount of insurance.

So, the main reasons for the decrease or absence of a high class may be the following:

- Failure to enter an existing KBM into the database. This happens when a new contract is drawn up by hand with a manager visiting the client’s address. In such cases, there may be no network access, leaving the agreement on paper. Yes, and they can lose her.

- Error when entering personal data when purchasing electronic MTPL. Here we are talking about incorrectly typed numbers, letters and dates.

- When filling out, the letter “O” was deliberately replaced with the number “0”. It is very difficult to identify this externally, but the system perceives the driver as a new subject in it.

- Server error. Failures in the operation of the resource are not uncommon, and if you are confident that you are right, you should insist on re-entering the information.

- The owner of the vehicle changed his license, passport, and last name and did not notify the insurer about this.

- Issuing a fictitious policy. The form is printed on a color printer, filled out, but not entered into the register. This situation is unpleasant not only in terms of material losses. Traffic police officers can detain a vehicle if they run it through the database and do not find the purchase of compulsory motor liability insurance there.

Related article: Civil liability insurance for vehicle owners

Attention! In some cases, agents deliberately distort data in order to increase the price of the policy.

Why is it necessary to restore the KBM?

Restoring the KBM will help:

- Eliminate the cause that led to the error.

- Return discounts for compulsory motor liability insurance at Rosgosstrakh. The amount of the insurance premium when extending compulsory motor liability insurance will be lower.

- Improve the car owner's rating. When renewing a policy with Rosgosstrakh, clients with the lowest bonus-malus value receive additional discounts from the insurer.

To receive a discount when applying for compulsory motor liability insurance at Rosgosstrakh, you must restore the bonus malus before the policy renewal date. Otherwise, insurance will be calculated based on the increased coefficient.

All methods of restoring KBM

There are several options that allow you to return the MTPL discount at Rosgosstrakh. Not each of them guarantees a quick and 100% solution to the problem. The list of options for returning the bonus-malus discount is presented in the table.

How to restore KBM in Rosgosstrakh

| Option name | Details |

| Complaint to Rosgosstrakh | Written appeal to the insurance company. You can complete it online by sending the data by email, or send it by registered mail to the head office. Insurer response time: up to 2 weeks |

| Contact RSA | A claim is drawn up on the RSA website on behalf of the Rosgosstrakh client. Application review period: no more than a month |

| Paid online services | Instant restoration of the bonus-malus discount. The service is paid. The price depends on the chosen service. |

The choice of method for restoring the KBM is the prerogative of the Rosgosstrakh client. The fastest and most proven option that allows you to return the bonus-malus discount is to turn to special services.

What to do if the KBM is not true

In this case, it is necessary to write an application to the insurance company demanding the correct application of the CBM or change the insurance company.

If, during the conclusion of a contract, the insurer tries to apply a BMI lower than specified in the AIS OSAGO (although this rarely happens), you must insist on transferring reliable data to the database. This will allow you to avoid incorrect data in the AIS when changing your insurance policy in the future or when adding friends or relatives to the policy.

If the values coincide, but the KBM still does not correspond to the real indicators, you need to check how much the data entered in the policy coincides with the actual ones. There may be inaccuracies that appeared after changing the last name and other information about the policyholder. The Investigative Committee must be notified of such a discrepancy in writing, attaching documents confirming this fact to the application. In the application you need to ask for a recalculation of the KBM.

Step-by-step instructions for restoring KBM

Restoring discounts in specialized online services (for example, the KBMka portal) is carried out for a fee. However, the method allows you to return the discount 100% without waiting a long time for a response from PCA or the insurer.

Step-by-step instructions on how to return the KBM value (using the example of the site “https://kbmka.ru/”):

- Go to the portal page.

- Enter data: full name, date of birth, driver's license.

- Check information about the coefficient size.

- Click on the “Restore” button.

- Pay for the service.

- Wait for an answer.

- Check information about the coefficient size.

The operation takes no more than 2 minutes. Data on KBM is automatically updated in all databases, including RSA and traffic police databases.