Home/OSAGO/Increasing coefficient of MTPL after an accident

The law obliges citizens to purchase a compulsory motor liability insurance policy. Without it, you will not be able to get on the road while observing traffic rules. For insurers, selling a policy is an additional way to earn money. However, it is beneficial for organizations to only work with customers who do not have accidents. If an accident does occur, this will affect the cost of the MTPL policy. The insurance price can be adjusted depending on the number of accidents in the driver’s history by increasing the MTPL coefficient after an accident. In 2021, its value may change depending on the number of insurance claims.

What is KBM?

BMC or bonus-malus coefficient is an indicator that is used when calculating the insurance premium. There are 14 accident classes. Depending on them, a person may receive a discount or will be forced to pay more for the purchase of an MTPL policy. Initially, the indicator does not affect the cost of insurance. If a person has driven without accidents for a year, he is given a discount. It adds up. The maximum value of the indicator in 2021 may reach 50%. The opposite situation is also possible. If the insurance company suffered losses due to the fault of a citizen, the coefficient increases. As a result, the price of an MTPL policy may increase by almost 2.5 times.

Attention! If you have any questions, you can chat for free with a lawyer at the bottom of the screen or call Moscow; Saint Petersburg; Free call for all of Russia.

Have you been involved in an accident – does the BMI always change?

KBM is one of the coefficients used in calculating the final price of the MTPL policy for each driver. It was introduced as a measure to improve driving accuracy. Its essence lies in assigning each driver a certain class, which gives the right to a discount when calculating the price of insurance, or vice versa, increasing the cost of compulsory motor liability insurance. The use of an increasing or decreasing coefficient depends on the class assigned at the beginning of the year.

Expert opinion

Maria Mirnaya

Insurance expert

OSAGO calculator

The class is not a static indicator , but changes based on the results of each year. Initially, a novice driver is assigned the 3rd KBM class with a coefficient equal to one. It does not provide any benefits, but does not increase the base tariff. For accident-free driving, your personal rating increases by one point, which gives a 5% discount compared to the previous year. The maximum possible indicator is class 13, which provides a discount of 50% from the base price of the policy.

The BMI after an accident does not decrease uniformly, but depending on several factors - the number of insured events per year, the initial class in the CBM system.

A rating reduction does not occur for every accident, but only under the following conditions:

- The driver was found to be at fault for the accident.

- The injured person contacted the insurance company for compensation.

- The victim’s appeal was satisfied, and the damage caused to him was compensated.

That is, a reduction in the CBM class is possible if the actions of the insured client caused a loss to the agency in the form of compensation payments to the victims.

Insurance coefficients for road accidents

The OSAGO coefficient is established by Article 9 of the Federal Law No. 40 of April 25, 2002 On the Automobile Citizen. A whole list of indicators falls into this category. They are divided into two main groups - fining and rewarding. The first of them includes indicators designed to hold drivers who ignore the rules accountable. They are intended to encourage compliance with traffic rules. The second group includes coefficients that simplify the purchase of insurance for persons complying with traffic rules. The coefficients included in the category are aimed at reducing the number of accidents. In 2021, there are 6 main increasing coefficients:

- Kt. The level depends on the number of accidents occurring in the region where the driver is registered. Ordinary residents of small towns pay less.

- Book Depends on compliance with the terms of the insurance contract. If they are violated, this will entail an increase in the cost of the policy.

- Kvs. Depends on the age of the driver and his driving experience. The older the citizen, the lower the cost of issuing compulsory motor insurance.

- The KBM coefficient is allocated separately. It depends on the driver's accident level.

- KN —violation coefficient.

- KM - power factor. Depends on the strength of the car engine.

How is KBM calculated?

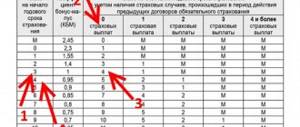

The bonus-malus coefficient in 2021 can be increasing or decreasing. It depends on the class of the car enthusiast. The easiest way to determine the value of the indicator is based on the table. Initially, the KBM is set at level 1. The driver is assigned class 3.

If a citizen does not violate traffic rules and does not take part in accidents, his MAC increases every year. As a result, a 5% discount is provided. The classes are indicated in the column on the left. So, if a person has been driving without incident for 10 years, he will be assigned class 12. The discount amount is displayed in the Impact on the insurance price column. Accident-free driving for 10 years allows you to receive a 50% discount.

A traffic accident will result in an increase in the MBI. Its level depends on the number of incidents in which the driver took part. Let's say the driver is assigned class 1. During the insurance period, 1 accident occurred. To understand how it will affect the price, you need to find your class and compare it with the Number of accidents column. It contains the letter M. Then you need to return to the Assigned class column and find the corresponding designation. It turns out that the price will increase by 145%.

| Assigned class | Indicator value | Impact on insurance price | Number of accidents in which the driver was involved during the insurance period | ||||

| No one | 1 | 2 | 3 | 4 or more | |||

| M | 2,45 | 145% | 0 | M | M | M | M |

| 0 | 2,3 | 130% | 1 | M | M | M | M |

| 1 | 1,55 | 55% | 2 | M | M | M | M |

| 2 | 1,4 | 40% | 3 | 1 | M | M | M |

| 3 | 1 | 0% | 4 | 1 | M | M | M |

| 4 | 0,95 | -5% | 5 | 2 | 1 | M | M |

| 5 | 0,9 | -10% | 6 | 3 | 1 | M | M |

| 6 | 0,85 | -15% | 7 | 4 | 2 | M | M |

| 7 | 0,8 | -20% | 8 | 4 | 2 | M | M |

| 8 | 0,75 | -25% | 9 | 5 | 2 | M | M |

| 9 | 0,7 | -30% | 10 | 5 | 2 | 1 | M |

| 10 | 0,65 | -35% | 11 | 6 | 3 | 1 | M |

| 11 | 0,6 | -40% | 12 | 6 | 3 | 1 | M |

| 12 | 0,55 | -45% | 13 | 6 | 3 | 1 | M |

| 13 | 0,5 | -50% | 13 | 7 | 3 | 1 | M |

How much will the KBM change after the accident in 2021?

Previously, information about road accidents was not entered by insurance companies into the general database of insurers. Today, it will not be possible to influence the coefficient, since all this data is available. How insurance changes after an accident for the culprit is usually explained by the insurance agents themselves in an individual case.

In the first year of validity of the insurance contract, the bonus-malus coefficient is 1. In this case, the car is automatically assigned class 3. With further cooperation, the changes will look like this:

- The absence of incidents and problems while driving increases the class of the car by one (4th class), while the coefficient itself is reduced to 0.95. Thus, the next insurance year will cost the car owner by as much as 5% less.

- If one incident occurs during the policy year, the compulsory motor liability insurance increases by 55% for the next year, the coefficient itself becomes equal to 1.55, and the vehicle class is downgraded to first.

- More than one incident automatically reduces the class of the car to M. In this case, the price of insurance increases by as much as 145%, which means that the bonus malus will already be 2.45, which corresponds to the maximum possible value.

It is not necessary for the car owner to make calculations independently and know how the Bonus-Malus coefficient is calculated. To do this, you can use a visual table.

The presented table of the MTPL increasing coefficient will allow you to accurately determine the size of the discount or allowance for beginners and experienced drivers. However, you should take into account another special discount, which is assigned to a client with ten years of driving experience in the absence of problems with violation of rules and traffic accidents. In this situation, it will be 50% of the possible assigned cost.

When does the OSAGO coefficient change?

The KBM coefficient can increase, decrease or remain at the same level. Its application is regulated by Appendix No. 6 to the Directive of the Central Bank of the Russian Federation No. 5000-U dated December 4, 2021. If a citizen does not get into an accident, the indicator begins to decrease. This leads to lower insurance costs. Accidents entail an increase in the CBM indicator. As a result, the price of MTPL will increase. However, there are cases when the coefficient remains at the same level. This is possible if the maximum discount level has been received. The accident will not affect the value of the KBM indicator in the following situations:

- MTPL insurance was purchased for a transit type vehicle;

- the MTPL policy has been issued for the trailer;

- the citizen is not to blame for the incident.

Please note

: The above rules do not apply to foreigners. If the case does not fall under the above list, the value of the compulsory motor liability insurance coefficient after an accident is adjusted in the standard way.

Increasing coefficient for compulsory motor third party liability insurance after an accident

Initially, the driver is assigned third class. It allows you to purchase an MTPL policy in 2021 at a standard price. If you manage to drive for a year without an accident, the class level increases. This allows you to count on a discount. The procedure is performed at the time of insurance renewal. The maximum discount level is available to persons who have reached class level 13. To get it, you need to renew your MTPL for 10 years and not get into an accident.

IMPORTANT

Every year without an accident allows you to count on a 5% discount. If the driver has not been involved in an accident within 10 years, insurance will be 50% cheaper. However, if at least one accident occurs, the CMV immediately becomes smaller. As a result, the price will increase. The class can be lowered by 2-7 grades. It all depends on the number of insured events during the reporting period. The more often you get into accidents, the lower the level of trust on the part of the insurer.

When the driving class drops below level three, penalties apply. This is reflected in the tariff. The cost of insurance can increase almost 2.5 times. The class cannot be lower than level M. If a citizen hopes to return to the standard fare, he must drive for at least 4 years without an accident.

How to avoid increasing the cost of your policy in the future

When insurers did not have a unified database of insurance histories, the driver could hide the fact of past violations by contacting another insurance company. However, at the moment this is impossible, since when concluding a contract, an insurance company employee checks information about the motorist.

After several accidents, the cost of insurance can increase almost 2.5 times, which is unprofitable for the driver. This forces him to look for loopholes to reduce the price of compulsory motor insurance. There are 2 ways to reduce the cost of a car title after increasing the BMR:

- take out insurance for another motorist. For example, when both spouses use a car in a family, you can remove the violator from the policy and sign up the insurance for a more careful driver;

- purchase of MTPL without restrictions. In this case, the KBM is reset to zero and equal to one; it does not decrease or increase regardless of the number of accidents.

On a note! The price for a policy with an unlimited number of persons allowed to manage it is an order of magnitude higher than for a regular OSAGO. Therefore, if this type of policy is issued in order to reduce the cost of insurance due to increased BMI, you need to weigh whether such a step will be beneficial.

How does the OSAGO coefficient increase after an accident?

The value of the indicator depends on the number of incidents that the person encountered during the validity period of the insurance policy. Each situation is considered individually. The decision to increase the value of indicators is made by the commission of the insurance company. It operates within the framework of the norms of the Civil Code of the Russian Federation, Federal Law No. 40 on OSAGO, as well as Federal Law No. 4015-1 On the organization of insurance business in the Russian Federation. If the standards are not observed, the citizen has the right to go to court and demand compensation for damage. However, this fact remains to be confirmed.

Newcomers are especially strictly controlled. If a citizen took part in one incident, he will be assigned first class. The KBM coefficient will drop to a level below average. The price of insurance will increase by 55%. If a driver is involved in two or more accidents, he is assigned class M. The coefficient increases to 2.45. When buying a policy next time, a citizen is obliged to pay 145% more than in the standard case.

If a person uses the services of one insurer for a long time, control is less stringent. Typically this is reflected in a discount for one year of perfect driving. If a person drove for 10 years without an accident, but during the insurance period was involved in an accident three times, he will be assigned a standard level. It should be taken into account that the value of the indicator reflects the number of accidents that occurred during the entire period of validity of the insurance policy, and not just incidents in one year.

Is it possible to do a recalculation?

It will not be possible to recalculate the KBM until the next period. We'll have to wait for it to gradually decrease. However, there are a few tricks here:

- firstly, you can apply for compulsory motor liability insurance without restrictions. In this case, the BMR will be equal to one, and will not fall to 2.45 even if there are 4 accidents per year;

- secondly, do not include the culprit of the accident in the OSAGO motor third party liability policy after an accident in the upcoming insurance period - in this case, the cost of insurance will not increase, since the coefficients of all admitted motorists are taken into account.

If the bonus-malus is calculated incorrectly due to the fault of the insurance company, the error can be corrected by providing the insurer with a motor vehicle claim for the past year. In the event that the insurance company has ceased its activities, the KBM is subject to restoration upon a written application to the RSA and the Central Bank of the Russian Federation.

How long does the increased MTPL coefficient last after an accident?

Attention

The validity period of the MTPL increasing coefficient after an accident reflects the principle of concluding a contract. Typically, insurance is provided for one year. The validity period of the coefficient will be identical to this period. When it is completed, the indicator will change. It may increase or decrease.

The norm is not always observed. Much depends on the insurer. Often organizations take advantage of the inexperience of owners. In order to continue to force the citizen to pay a large amount, the documentation deliberately does not indicate the validity period of the CBM. There are known situations where the indicator was overestimated by accident.

Experts advise keeping records yourself. To do this, you need to find out when the policy was issued and how long it will be valid. Additionally, information about the date of conclusion of the contract is required.

Increasing KBM OSAGO after an accident, if not at fault

Questions arise when the owner of the car was not driving, or the accident was not his fault. In the latter case, there is no change in the BMC. However, it will be necessary to prove that another person was the culprit of the incident. Typically, insurance organizations refuse to compensate for damage if there is indisputable evidence of the car owner’s guilt. To assert your rights, you must obtain a conclusion from law enforcement agencies. The evidence is also provided by the video recording. Therefore, experts advise installing the equipment even on old cars, the equipment of which does not provide for this.

Several drivers can be included in the insurance at once. In this situation, the increase in BMV will occur only for the person who was driving at the time of the incident. The norm applies if the citizen’s guilt is proven. The law does not allow increasing the value of the indicator if the traffic police representative has not confirmed that the driver’s actions resulted in the occurrence of the incident. If a person is involved in an accident through no fault of their own, the incident will not appear on the driving record. It is believed that it remains accident-free.

How to bypass the MTPL increasing coefficient after an accident?

Not all drivers are willing to pay additional money for insurance. Therefore, attempts are being made to avoid an increase in the bonus-malus coefficient after an accident. Previously, the following methods helped:

- transfer to another insurance organization;

- concealment of information about the incident at the time of change of insurer;

- purchasing an MTPL policy for another person.

Usually the latter method was used. The trick worked if the policy was issued to several citizens at once. An increase in the indicator after an accident occurred only in the person who was driving at the time of the accident. Moreover, if the policy is issued to several persons at once, the maximum cost was set depending on the data of the drivers. To avoid increasing the price of insurance, individuals did not include the problem driver in the MTPL policy. In this situation, the coefficient did not change. This method was most suitable for married couples.

However, due to the creation of a unified RCA database, most of the above methods do not work. In 2021, the most reliable way to avoid increasing the compulsory motor vehicle insurance coefficient after an accident is not to participate in an accident. Insurers and authorized bodies monitor changes in the indicator. Frauds are monitored. A number of motorists claim that they managed to reset the indicator value. The action was completed without renewing the policy for a year. However, such situations are accidental. Information about the incident is entered into the general database within 15 days from the moment of the accident. Subsequently, it is enough to indicate the citizen’s ID number to find the data.

For your information

If a person wants to avoid a higher MLA after an accident, they can try to negotiate personal compensation for damages. In this case, the insurer is not contacted, and traffic police representatives are not called. The method is considered risky. Not every driver will agree to meet the culprit of the incident halfway. If the accident occurred due to the fault of another person, you need to understand that an oral agreement does not guarantee the provision of funds. The method is recommended to be used if the amount of the insurance payment is less than the amount of money that will have to be provided for the subsequent renewal of the policy.

Deliberate attempts to avoid increasing the BMV after an accident are punishable. If a person does this, he may be brought to administrative responsibility in 2021. In some cases, criminal penalties are applied.

How does the BMI change after an accident?

When determining the calculation rules for the bonus-malus coefficient for a particular case, the guilt that has been proven is taken into account. If this was not done, then the driver is considered innocent. In addition, a prerequisite is the fact of payment of compensation to the injured party.

If it's not your fault

When the traffic incident occurred. But the driver’s guilt was absent or not proven, this will not affect the coefficient under consideration. In this case, there is no point in talking about accidental driving, since the accident was caused by another party.

If the guilt is mutual

When both parties are responsible for an accident, they may have different degrees of blame. However, when calculating the BMR, everyone is considered to bear equal blame for what happened. For each of them, the coefficient will be recalculated according to the general rules.

If you are to blame

The culprit's bonus-malus coefficient will change in accordance with the general rules. As a result of the accident, it will increase in accordance with the general rules of calculation. However, this will only happen if there has been an application for payment to the insurance company. For example, if the parties settled the relationship independently, then this will not have an impact on the cost of compulsory motor liability insurance.

What to do if you mistakenly increased your compulsory motor liability insurance ratio?

If a citizen moves to another insurance company, the CBM must remain at the same level. However, the insurer can take advantage of the driver’s inexperience and assign him a starting third category. The main argument is the lack of information about the citizen in the RSA database. If a person knows that he is entitled to a discount, the following actions are acceptable:

- personal request for information in the RSA database;

- visit to the previous insurer and obtain a certificate of cooperation;

- obtaining information from the Union of Insurers.

Nuances

The law does not allow insurers to independently change the BMR. If this happens and the organization’s actions are not justified, you can send a complaint. It is submitted to law enforcement agencies. However, you need to understand when an organization’s actions are legal. In this situation, it will not be possible to change the increasing coefficient. The law allows an organization to increase the price of compulsory motor liability insurance if:

- the citizen fled the scene;

- the early person flouted the rules and drove without insurance;

- false data about the characteristics of the accident were provided;

- at the time of the accident the person was under the influence of alcohol or drugs;

- the accident was caused intentionally.

If it is proven that the citizen is not the culprit of the incident, the MSC remains at the same level. If the policy is renewed for the next year, a discount must be provided.

| Question | Answer |

| When does the MTPL increasing coefficient change in 2021? | When renewing insurance. |

| Will the MBI increase if the driver is not at fault in the accident? | No, the indicator will remain at the same level. |

| How to avoid increasing the BMR? | Follow traffic rules and try not to get into accidents. |

| What to do if the MTPL ratio was increased by mistake? | Contact the previous company and get a certificate or check the RSA database yourself. The data is then provided to the new insurer. If he refuses to change the coefficient, legal proceedings can be initiated. An alternative is to send a complaint to the authorized body. |

Comments Showing 0 of 0

General information

Bonus-malus is a certain indicator that is assigned to the driver taking into account his insurance record.

It may change at the end of the year, making it possible to purchase a new policy at a discount or, conversely, at an increased price.

In general, you will have to pay more if the driver has an accident, and the traffic police found the person guilty of them.

At the same time, insurers will upgrade the driver’s class for reliability and caution, giving him the opportunity to take advantage of a discount.

This was done in order to reduce the insurance company's risk by forcing people who are more likely to get into accidents to pay a higher price for the policy.

At the same time, accuracy and compliance with traffic rules are encouraged by insurers.

Particularly diligent drivers may well receive a 50% discount on the policy if they reach the maximum - level 13 of the KBM.

Initial data

Each driver has his insurance history, which shows how many payments and in what volume were requested for accidents for which the person was the culprit, according to the traffic police.

If there are many such payments, then the bonus-malus coefficient decreases in the class, increasing the amount of payment for insurance services.

A driver who is careless and often breaks the rules will pay more than a person who drives well and does not cause accidents.

You should know who is assigned the CBM, what laws regulate this, and of course how this bonus changes.

After all, with or without accidents, the parameter changes occur according to a certain, pre-calculated schedule.

So, if a driver has not been in an accident for several years for which he was found guilty, he can count on a favorable price for the policy in comparison with its previous price.

Who does it apply to?

KBM applies to all drivers who have taken out MTPL insurance, and there are no exceptions.

If the driver is a beginner, then he is assigned a basic class number 3, and when he is already experienced, the class can be lowered or increased accordingly.

Any driver has a CBM, and it depends only on the number of accidents or accident-free years, since even with one accident the class will be reduced, and increased only if there are no accidents.

Therefore, insurers should find out how the BMR decreases after an accident.

Normative base

All regulations regarding insurance are contained in the legislation of the Russian Federation.

For example, there is law 40-FZ “On compulsory insurance of civil liability of vehicle owners.”

It is extremely important because it contains information about which companies can provide insurance services to the consumer.

Having familiarized yourself with the legislation, you can imagine how the amount of compensation can be calculated and, accordingly, determine the possibility of its payment.

Since car insurance is compulsory in Russia, there is a clear penalty for not having it.

According to the Code of Administrative Offenses of the Russian Federation, if the driver simply forgot insurance, then Article 12.3 implies a fine of 500 rubles.

But when the policy is overdue, or it has been established that it was not issued in principle, then Article 12.37 establishes a fine of 800 rubles for such an offense.