What kind of write-off of transport tax debts is this?

According to paragraph 1 of Art. 12 Federal Law No. 436 dated December 28, 2017, transport tax debts incurred by individuals and individual entrepreneurs as of January 1, 2015 are considered uncollectible and for this reason are written off. The corresponding fines and penalties are canceled along with the tax.

Transport tax amnesty is a procedure for writing off accumulated debt. It does not imply the abolition of the tax itself and, if the debt arose after 01/01/2015, it will have to be paid.

Taxes that were paid voluntarily or compulsorily before the entry into force of Federal Law No. 436 are not refundable.

Limitation period for transport tax for individuals

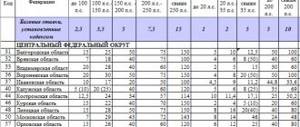

Everyone knows that individuals do not calculate transport tax on their own, but pay it on the basis of a notification received from the tax office (clause 3 of Article 363 of the Tax Code of the Russian Federation). Tax authorities must send such a notification no later than 30 days before the payment is due (Clause 2, Article 52 of the Tax Code of the Russian Federation). The transport tax must be paid by citizens no later than December 1 of the year following the expired tax period (clause 1 of Article 363 of the Tax Code of the Russian Federation). In 2021, this is Sunday, so the payment deadline is shifted to 12/02/2019.

For more details, see: “Tax notice for transport tax (sample)”.

At the same time, the Tax Code of the Russian Federation limits the period for sending a notification to the Tax Code: it can be sent no more than 3 tax periods preceding the calendar year of its sending (clause 3 of Article 363 of the Tax Code of the Russian Federation). For example, in 2021, the inspectorate has the right to demand payment of tax only for 2021, 2021 and 2021. The taxpayer is not required to make payments for earlier periods. That is, in fact, the Tax Code of the Russian Federation establishes a 3-year limitation period for the transport tax of individuals.

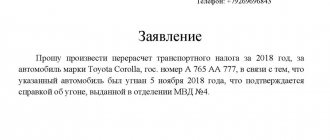

If your car has been stolen, and the Federal Tax Service requires you to pay transport tax, use the advice of ConsultantPlus experts and find out what to do in this case. If you don't have access to the system, get a free trial online.

Reasons and purpose of appointment

Constantly recording “bad” tax debts, which daily accumulate additional penalties and fines, is a useless burden for the tax service. These calculations require additional labor costs, but do not bring income to the country's budget. And in addition, the constantly growing amount of debt becomes unaffordable for the taxpayer and makes it impossible for him to pay the tax.

Therefore, the main goals of the law providing amnesty for a certain part of the population’s debts are as follows :

- facilitate the work of the Federal Tax Service;

- reduce the burden of citizens' debts;

- encourage taxpayers who were previously deterred by large amounts of debt to pay their dues on time.

Putting things in order in the tax collection system and freeing it from ballast in the form of the amount of debts that will no longer be paid will allow us to improve the work of the Federal Tax Service in the future, making it more efficient and clear.

Who does it apply to?

The 2021 transport tax amnesty applies to all individuals and individual entrepreneurs who are car owners and transport tax payers.

Regardless of the social status of a citizen (pensioner, student, unemployed), his place of residence, the reason for the formation of the debt and its size, the entire amount of the debt will be written off if it was formed before January 1, 2015 .

The transport amnesty does not apply to traffic police fines.

About tax

Is it possible to write off transport tax beyond the statute of limitations? Paying the vehicle tax is an obligation for both ordinary people and legal entities. persons The tax authorities do the calculations for the past period for ordinary people, and the company itself must determine the amount of tax.

As soon as the tax year ends, the payment must go to the state treasury. If the period has expired, the citizen may be held accountable for non-payment for non-compliance with current legislation. The amount of debt is determined taking into account the required payment made by the person.

The arrears arise on the day following the last date of payment or on the next day after the submission of the application for payment at the end of the allowable time.

The statute of limitations for transport tax for all individuals is the time after which the debt cannot be collected. In order to make the payment correctly, you need to familiarize yourself with the contents of Article 363 of the Tax Code of the Russian Federation. This regulatory act reflects the need for a citizen to transfer funds to the deposit of the tax authority, which carries out vehicle registration. Repayment can be made by advance payment.

Many vehicle owners are interested in transport tax and whether there is a statute of limitations for collection. The law defines a period of thirty-six months, after which the Federal Tax Service cannot collect the debt for interest and penalties. The tax for vehicles must go to the country's treasury.

It must be remembered that the use of this period is defined in the regulations of our country. There are nuances for ordinary citizens and organizations. The Tax and Duties Service can forcibly collect arrears of motor vehicle tax.

According to Article 356 of the Tax Code of Russia, the transport tax is mandatory for car owners.

To make a payment, you need to have a message sent by the tax authority. It arrives in the mail thirty days before the end of the payment period. The law establishes that the notification must be received by the car owner before the first of October.

The transport fee is calculated for the previous year. Debt collection is carried out within three years; after this time, arrears cannot be collected from citizens and organizations, this is illegal.

How to write off?

The transport tax debt is written off “automatically ,” i.e., without the direct participation of the taxpayer. To make such a decision, the information contained in the Federal Tax Service database is sufficient. However, the law does not oblige the tax service to inform the debtor about the debt write-off. Every taxpayer can check this information on the official Internet resource of the Federal Tax Service or on the State Services website.

If, after checking, it turns out that the transport tax debt incurred before 01/01/2015 was not written off, you must contact the tax office at the place of registration to correct the error.

The law does not establish exact deadlines for writing off debts. Therefore, if a citizen is interested in having this measure taken against him as quickly as possible, he can speed up the amnesty process on the following grounds:

- According to the law of May 2, 2006 No. 59-FZ “On the procedure for considering appeals from citizens of the Russian Federation,” you can write an application to the tax service with a request to apply the measures provided for by Federal Law No. 436, and receive a response within 30 days.

- You can contact the tax service with an application for a reconciliation (in accordance with Article 21 of the Tax Code of the Russian Federation), after applying within 15 days, a reconciliation report will be drawn up, which will reflect all existing debts.

You do not need to provide any declarations or additional certificates to the tax office to write off the debt.

Legislation on tax amnesty

On December 28, 2021, the President of the Russian Federation signed Federal Law No. 436, it directly concerns changes to the first and second parts of the Tax Code. The law should come into force after 10 days, which means that it is relevant already in the current year 2021. Regulatory acts contain orders to write off debt on transport and other taxes. What are the reasons for such innovations?

The bottom line is that the statute of limitations for collecting tax debts is three years. During this period, the debt is accumulated, and the state can forcibly claim taxes and the amount of accumulated penalties. This task is carried out by bailiffs. The extreme measure is the arrest of accounts and confiscation of property. If three years have already passed since the last date of tax payment, then the bailiffs will no longer be able to bring the debtor to court. However, other measures can be taken:

- prohibition of registration actions;

- refusal to issue the necessary certificates;

- ban on travel outside the Russian Federation.

The accumulated debts are a consequence of the imperfections of the entire tax system. More than 42 million people are in debt to the state, some of them are not going to pay at all. Debts and fines accumulated even if the person died or the car was not deregistered in a timely manner.

To solve this problem, the authorities decided to amnesty debts, including transport tax.

Attention! Article 12, paragraph 1 establishes that arrears (debt) for transport tax accumulated by individuals before 01.01 are considered uncollectible and are subject to write-off. 2015.

What to do if enforcement proceedings have been initiated regarding debt?

If enforcement proceedings have already been initiated against the debtor for payment of transport tax, then there is no need to wait until the debt is automatically written off. Bailiffs are not required to write off debt, unlike the tax service. Therefore, a citizen against whom enforcement proceedings have been initiated for tax evasion should :

- Contact the tax service with an application for the issuance of an official document confirming the write-off of transport tax debt or a reduction in its amount.

- Write an application to the Federal Bailiff Service to close the debt collection case or to reduce the amount of the debt collected, based on the tax service document and Federal Law No. 436.

After the citizen’s official appeal and provision of the necessary documents, the enforcement proceedings will be closed or the amount of collection will be reduced. But the performance fee will not be written off, because it does not fall under the tax amnesty law.

What is tax amnesty

The amnesty implies a complete reset and write-off of arrears as of 01/01/2015. Transport tax is assessed annually. For example, from 2011 to 2015, an individual had a debt amounting to 2,000 rubles, the fine for non-payment was 500 rubles, the total debt was 2,500 rubles. In the period from 2015 to 2021, the transport tax debt amounted to 1,200 rubles. Based on the situation, at the moment they have the right to collect only 1,200 rubles from a person, since previously accumulated debts must be written off.

What is the overall scale and what segments of the population will it affect?

The 2021 tax amnesty is the largest in the history of modern Russia. Previously, relaxations in tax policy concerned only additional fines and penalties that accumulated over the debt during non-payment, but the debt itself continued to be registered with the citizen.

According to Federal Law No. 436, the entire amount of debt is written off, regardless of its size, and is limited only by the date of occurrence. The car tax amnesty will affect a large part of the population of the Russian Federation , since many car owners have debts. In total, about 42 million citizens and 1.5 million individual entrepreneurs are subject to the tax amnesty law.

According to preliminary calculations, after the end of the amnesty, more than 100 billion rubles will be written off, of which about 40 billion are “bad” debt, which the state has no way to collect.

There are other useful articles about transport tax on our Internet portal:

- Privileges.

- How to check and pay?

- What to do if the tax comes on a sold car?

- Features of accruals for motorcycles, self-propelled vehicles, trucks and won cars.

- Statute of limitations for collection and compensation.