What is recalculation

Recalculation of the fee is a change in its amount as a result of some special circumstances. It is carried out both in a large and in a smaller zone.

The message, which arrives at the address once a year, contains information about calculations for the last tax period and calculations of fees. The authority has the right to recalculate only for the last 3 reporting periods.

If a citizen has paid more than necessary, then the amount can be:

- Credit it against your tax for the next term.

- Give to a citizen or company.

The last option is only possible if a special application has been submitted with the details of a personal account to which the money can be transferred.

How is an application completed?

Regardless of the current situation, the basis for recalculating the car tax is an application. The document can be filled out in person on a form (transferred by a Federal Tax Service employee) or on the official website of the tax office. The completed document is transmitted in one of the following ways:

- Independently (transferred by the owner of the car).

- With the involvement of a representative (if there is a power of attorney from a notary authority).

- Via the Internet (on the official website of the Federal Tax Service). Here you cannot do without an electronic signature or logging into your personal account.

- Using Russian Post.

The header of the application contains information about the owner of the vehicle, namely full name, contacts and registration (residence) address. Next, the word “Application” is written in the center of the sheet, and below is the reason for its submission (“to recalculate the transport tax”).

The general part contains the following information:

- Please reconsider the transport tax.

- A reference to legal norms that stipulate the owner’s right to demand a recount.

- Parameters of the car for which the tax must be calculated (registration number, model, type, year of manufacture, VIN).

- Reasons requiring recalculation of car tax.

- Option to receive a response from the Federal Tax Service after completing the calculation work. There are several options available here - sending by Russian Post, handing over in person (you must have your passport with you) or sending by e-mail.

The following lists the documents that are attached to the application and confirming the need for recalculation. At the bottom is the day the application was submitted and the signature of the vehicle owner.

Download an application to the tax office for recalculation of transport tax (sample)

Who might need it

For individuals, transport tax recalculation is possible:

- If you made a mistake.

If an inaccuracy is found in the power of the machine that is subject to the fee, or if the wrong rate is indicated, or benefits are not applied, then you need to go to the inspection soon.

You must provide a passport and originals of all required documents that are needed to correct the error. You also need to write a statement.

Sometimes the service requests additional data from the traffic police or another authority that has the information necessary for clarification.

- If the car is sold, but the information was not received in a timely manner.

To prove the need for recalculation, you need to go to the tax office and hand over the original sales contract to the employee. After recalculation, the message is sent to your address a second time.

- If the car is stolen and there is a certificate from the traffic police about it.

Thus, recalculation will be done only for the time during which you used the vehicle. If there is evidence that the car has been stolen, then tax officials make a calculation based on the submitted papers.

- When changing your place of residence or registering your car.

The secondary calculation of the fee is made on the basis of the application and submitted documents that confirm this provision.

What are the reasons for the recalculation?

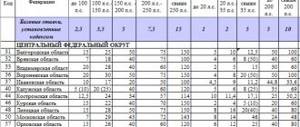

If new conditions arise for calculating transport tax, it becomes necessary to recalculate the previously established amount to be paid. Moreover, such a procedure can either increase or decrease the amount. The event may affect only the last three reporting periods (calendar years), previous tax payments will remain unchanged. If an excess amount of money has been paid, it can be offset against the subsequent reporting period or returned to the taxpayer to his current account. This decision is made directly by the owner of the vehicle. Reasons for recalculation may be:

- Error in tax notice;

- Sale of a car during the reporting period;

- Car theft;

- Change of residence of the taxpayer.

In the first case, an error may be considered an incorrect indication of the vehicle capacity, tax rate, or non-application of an existing and confirmed benefit. The second case also suggests the presence of an error - the non-application of a reduction factor. Thus, if the direct legal ownership of a car during a calendar year was 10 months, then a reduction factor of 0.833 (i.e. 10 / 12) should be applied, and not 1, as in the case of ownership of a car during the entire calendar year.

In the event of a vehicle theft, the owner's obligation to pay tax is removed until the vehicle is returned or forever, but to do this, a police certificate must be provided to the tax office confirming the fact of theft or theft. If this is not done, the tax will be calculated according to the usual scheme. The same applies to a change of place of residence of the car owner, because along with this the OKTMO changes, as well as the tax rate (in case of a change of region of residence). Accordingly, if you do not inform the Federal Tax Service about such changes, the tax amount will be calculated based on old data. The taxpayer must report all changes that are significant for the calculation of tax liability by submitting an appropriate application.

Recalculation for sold vehicles

The owner of the car, who sold the vehicle and received a message from the service for the period after the transaction, must request that this misunderstanding be resolved. In another situation, ignoring reports from the tax office may result in penalties for evading payment of fees.

Now you need to establish what is considered the real reason for sending a tax report in your direction. If this is a fee for the previous period, then it must be paid, but if not, the report must be sent to the current owner.

When answering the question regarding how to recalculate transport tax in connection with the sale of a car, many nuances should be taken into account. If this happened illegally, then you need to go to the service and the MREO in order to justify the refusal to pay the fee for sold vehicles.

If the message was sent by mistake, then you need to submit an application to the Federal Tax Service and the State Traffic Safety Inspectorate with a request to bring the data and papers into proper condition. When signing the contract, you should eliminate your mistakes. Avoiding unpleasant surprises when buying and selling is quite simple.

After 10 days have passed, you need to send a request for data about a specific car to the traffic police. This way you can find out whether it has been re-registered to the new owner.

If you succeed in contacting the new owner, you will need to request that the vehicle be registered. If this cannot be achieved, then you should contact the traffic police and submit an application for disposal or search for the vehicle. Naturally, the tax will not evaporate and will have to be paid. Therefore, you need to go to a qualified lawyer to restore the truth.

If you managed to re-register your car, then you should do the following:

- You need to get a certificate from the traffic police, which will confirm your registration.

- You need to go to the regional tax office with the original certificate.

- Next, you should draw up an application, indicating in it information about the new owner and the date of the contract.

- A copy of the purchase and sale agreement must be attached to the papers.

After these manipulations, a decision will be received stating that the payment has been withdrawn from you.

In what situations is updating information required?

Recalculation of transport tax for individuals is carried out in the following cases:

- Mistake by Federal Tax Service employees . In the work of any government body, there is a human factor that all citizens (including car owners) need to remember. Inaccuracy in engine power or rate may lead to a distortion of the actual tax parameter. In addition, the Federal Tax Service employee could not notice that a person has a benefit and calculate the payment at full cost.

In order not to overpay money, it is important to contact the Federal Tax Service and bring the necessary package of documents. It is also written here. Sometimes (for example, if the power is indicated incorrectly), tax officials request information from the traffic police (in the department where the vehicle was registered).

- Car sale . There are situations when a person has sold a vehicle, but the information does not reach the Federal Tax Service for a long time. In this case, tax officials send a notification to the previous owner. To avoid such a situation, you need to contact the local Federal Tax Service and submit an agreement confirming the fact of the transaction. After the data is clarified, a notification is sent to the new owner.

- Vehicle theft . According to the law, the tax is calculated for the period of use of the car. If a car is stolen, and the owner can confirm this fact with documents, Federal Tax Service employees are required to recalculate the tax. During the calculation process, the period when the vehicle was stolen is subtracted from the total billing period.

- Change of place of residence (vehicle registration) . As in previous cases, it is impossible to do without recalculating the transport tax. The work is carried out at the regional office of the traffic police, and the basis is the application submitted by the owner and a package of papers confirming the fact of the move.

If the car is stolen

Cars that are wanted are not subject to taxation. At the owner's request, if the property is stolen, its registration will also be canceled.

Many people are concerned about the question of how to recalculate the transport tax on a stolen car. It is advisable to adhere to this order:

- Go to the police and file a report of the car being stolen.

A criminal case will be opened. The Ministry of Internal Affairs will provide you with a document about the theft or the initiation of a case. You also have the right to stop registering the car. A certain branch of the traffic police will notify the authority about this 10 days after the registration is stopped.

- You need to go to the tax office to carry out a secondary calculation.

You should submit a certificate from the traffic police, as well as an application for recalculation of the transport tax.

If you are not able to hand over the necessary papers, then you do not need to go to the police for them a second time. Based on the submitted application, the tax inspectorate itself will request information from the traffic police.

According to the certificate, if the car is decorated after the 15th of any month, then the payment will no longer be deducted from the next month. If the vehicle was stolen before the 15th, then this month is not taken into account when calculating the fee.

Legality of action

Despite the fact that the recalculation procedure often occurs when the taxpayer discovers certain inaccuracies in the tax notice and according to the application he has completed, the tax authorities can arbitrarily change the tax amount.

Typically, the amount of tax on a vehicle changes upward, and the taxpayer receives arrears, for which penalties are subsequently charged.

Despite the ambiguity of the situation, the tax authority has the right to recalculate previously paid transport tax indicating the changes in the relevant notification. This action is regulated by Articles 31 and 32 of the Tax Code of the Russian Federation.

In cases where the taxpayer does not agree with the recalculations made on behalf of the tax inspectorate, he is obliged to prove the illegality of these actions by submitting the necessary documents.

In order to avoid the accrual of penalties, the taxpayer should carefully read the tax notice received and immediately report any errors found in the document to the tax office, regardless of the direction in which the tax amount changes when the recalculation is made.

How to pay transport tax if there is no receipt is explained in the article: receipt for transport tax.

Where to find out the transport tax debt, see the page.

Find out the list of cars eligible for luxury vehicle tax in 2019 from this information.

Actions of an individual

If a citizen disagrees with the calculations provided in the report (the report is delivered no later than 30 days before the payment period), he can act in two ways:

- Contact the tax office and verbally state your claims, showing the required evidence.

- Send an application by mail to the Federal Tax Service, which is attached to the message and is necessary for registering such claims.

After rechecking all the data, if the service agrees with the objections, the tax is recalculated and an updated report is sent to the citizen. Individuals who have not received a notification from the service about payment of transport tax must independently notify the tax office of the presence of a vehicle in 2021.

Which service should I contact?

A citizen who has drawn attention to inaccuracies in vehicle tax calculations made in the notification must contact the tax office located at the place of his actual residence.

If the taxpayer was denied the recalculation procedure, and the fundamental documents for this are in hand, then the citizen has the right to go to court with a corresponding claim.

The statement of claim is submitted to the judicial authority, which is located in the same territory as the defendant (tax office).

To apply to the judicial authorities with a statement of claim for refusal to recalculate transport tax, you must submit the following papers:

- document-basis for making changes to the relevant tax;

- a response received from the tax authorities with a justified refusal in this procedure;

- a receipt confirming payment of the state duty;

- other documents, the provision of which may be necessary (at the request of the judicial authority).

After all the documents have been collected, they, along with the statement of claim, are submitted to the judicial authority. Only after filing a claim and the necessary documents can a date and time be set for a trial on this issue.

Both the plaintiff (taxpayer) and the defendant (tax authority employee) are present at the trial.

Only a court decision can be considered the final answer to the disagreements that have arisen.

How to write a statement correctly

The re-calculation of the fee is carried out on the basis of papers that prove the existence of the right, and an application for recalculation of the tax on an individual’s vehicle. The form can be purchased at the inspection branch.

You can submit the document:

- Personally.

- By proxy.

- Russian Post.

However, for greater convenience, it is best to find out how to electronically submit an application for recalculation of transport tax. To do this, you need to use the main portal of the Federal Tax Service, in which you must have an account or a virtual signature.

The forms must be filled out in this way:

- Submit a request for recalculation.

- Indicate articles of laws that confirm the right to petition.

- Provide information about the vehicle.

- Explain the reason for the recalculation.

- Write a method for obtaining information regarding the consideration of an application (by mail, etc.).

And be sure to attach the required papers.

Recalculation of transport tax in connection with the benefit

A certain category of citizens has the right not to pay vehicle tax. These include pensioners, large families, disabled people of groups 1 and 2, as well as heroes of Russia and the USSR. If the tax at the end of the year does not take into account the car owner’s right to a benefit, you need to contact the tax office with an application and documents confirming the legality of applying the benefit.

It is not necessary to use the benefit. That is why the tax office does not begin to apply it automatically.

To receive your legal deduction, the beneficiary must submit an application for a transport tax benefit and, if necessary, an application for recalculation for the last three years.

Owners of large trucks weighing more than 12 tons are required to pay tax according to Plato. It provides for tolls on federal highways. For such motorists, a tax benefit is also provided. If the calculation is incorrect, the owner has the right to recalculate the accrued tax.

How to write an application for transport tax benefits?

Documentation

Not everyone understands what documents are needed to recalculate transport tax. It is curious that the package of papers that will be needed for recalculation depends on the case.

But you still need to give:

- Passport.

- TIN.

- Papers for the car.

In a separate case, you will need to transfer:

- A certificate from the traffic police in case of theft or deregistration.

- A document about the machine's power or the result of an examination.

- Documentation of rights to benefits (certificate of a pensioner, disabled person, etc.).

Submitted papers are submitted in their original form, as copies are not considered a reason for reviewing the fee.

What documents need to be attached to the application?

When submitting in person or sending by mail, the car owner who is counting on recalculation of the technical tax must attach the following documents to the application.

- Passport of a citizen of the Russian Federation (or other identification document);

- TIN, if any;

- Documents confirming ownership (PTS);

Copies of these documents are attached to the application, regardless of the reason for the recalculation.

In addition to them, the inspector may request supporting documents upon admission. These include:

- Purchase/sale agreement and document on deregistration of the car from the traffic police;

- Certificate of car theft;

- PTS or other document confirming technical characteristics;

- A document allowing the benefit to be applied.

The most convenient way is to come to the tax office with the specified documents and fill out an application for recalculation on the spot, since most inspectors require you to provide original documents.