The main task of a business is to bring profit to its owner. All other goals may be related, but without solving the main task they are of little importance. The money earned can be used for further development of the business, but the owner takes some of the funds for himself.

Usually, the founders of an LLC have problems with withdrawing money for their own needs. According to the law, the company owner can receive them in the only way - in the form of dividends, on which he must pay 13% personal income tax. In addition, dividends are distributed in a special manner, for example, the decision to pay them can be made no more often than once a quarter.

Some individual entrepreneurs, drawing an analogy with the founders of an LLC, doubt whether it is possible to spend money from a business for personal purposes? Yes, you can. In this article, we have discussed in detail how to withdraw or transfer money from your checking account to your current account. There is no need to pay any additional taxes.

And here we’ll tell you a little about something else - is it possible to spend money from a current account directly on personal needs, without transferring it to an individual’s card?

Algorithm of registration procedures

Registering a car requires a number of actions:

- Make an appointment (online, using the department’s website, visiting the institution in person or by phone);

- Apply to MROE with an application for registration;

- Collect and provide a package of documents to the inspector;

- Pay the state fee;

- Go through the vehicle inspection procedure.

- Receive registration documents, state numbers.

List of documents

To register an individual entrepreneur's car, you will need the following documents:

- application for vehicle registration. The document is filled out by hand on a special form, in accordance with legal requirements. When submitting an application, a mark from the traffic police officer on acceptance of the title papers is required;

- if the car is registered by an authorized person, a copy of the order, with the corresponding resolution, will be required;

- documents for the LLC: a copy of the individual entrepreneur registration certificate, certified by a notary;

- internal regulations of the LLC;

- a document confirming registration with the tax office;

- extract from Rosreestr;

Some types of vehicles require special permission from Gostekhnadzor (truck crane, loader, etc.).

Sample application

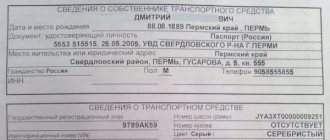

When registering a car, an individual entrepreneur fills out a special application for registration of the car with the traffic police. The text of the document contains the following information:

- name of the state inspectorate, address;

- Full name of the applicant;

- company details (LLC address, name, TIN);

- brief information about the activities of the individual entrepreneur;

- car data: make, model, color, engine size, additional equipment, etc.;

- list of attached documents;

- date of writing, signature of the applicant.

Applications for registering a car as a legal entity here:

What fee will I have to pay to register a car?

The entrepreneur receives an invoice for payment already generated by the program or the traffic police inspector. The amount in the receipt directly depends on the volume of service. When registering a vehicle with license plates , these plates are simply reissued, and the state duty will be an order of magnitude lower than when registering a vehicle that requires new plates.

Pros and cons of registering a car as an individual entrepreneur

- When an entrepreneur uses a car indirectly for commercial activities. For example, for business trips, purchases, movement around the city, etc. Registration makes it possible to maintain personal transport at the expense of the organization, thereby also reducing the tax base. And the car still remains the personal property of the individual entrepreneur, and not the enterprise.

- An individual entrepreneur whose type of activity is directly related to the organization’s use of vehicles (freight transportation, delivery, taxi service, etc.) In these cases, registration of a car with the traffic police is necessary to obtain special state licenses. numbers (yellow numbers for taxis).

Taxi: business or work

Surely everyone who was interested in the activity of transporting passengers has heard that this requires a “license”. This is the name for a work permit, which can be obtained from the Ministry of Transport or authorized departments of local executive authorities. Moreover, it is available only to individual entrepreneurs or legal entities.

Therefore, those who plan to make the transportation of passengers their business must first register as an individual entrepreneur. It will be possible to carry out transportation either independently or by attracting workers. Moreover, an entrepreneur can have several cars (each with its own permit), which will allow him to increase his income. It is not at all necessary to own a car; for example, a lease agreement is sufficient.

But there are ways to transport passengers legally and without individual entrepreneur status:

- You can get a job in a taxi service as a driver with your own car. In this case, the employer - a company or individual entrepreneur - receives permission to operate. An agreement is concluded between him and the driver, which spells out all the nuances of cooperation. The advantages for the driver are that he does not need to register, calculate taxes and pay insurance premiums, and also submit reports to the Federal Tax Service. The downside is that 13% will be withheld from earnings in the form of income tax (NDFL).

- Obtain the status of a self-employed person and enter into an agreement with a taxi service. A work permit is also issued to the employer - an organization or individual entrepreneur. Unlike working under a contract as an individual, the tax will be lower, but you will have to pay it yourself. The company will not make contributions to the driver’s pension insurance, so he will not receive a pension during the period of such cooperation.

These options for activities without opening an individual entrepreneur may be suitable for those who consider private transportation services as a part-time job. If you plan to make a business out of this area and scale it up in the future, you must first obtain the status of an individual entrepreneur.

For those who are wondering how to open an individual entrepreneur to work in a taxi, our step-by-step instructions will help. The whole process is divided into several stages consisting of simple actions. You can arrange everything yourself - it will not require a lot of time and money.

Free consultation on business registration

Table and addresses of traffic police departments for registering a car on an individual entrepreneur

| Addresses for registration of vehicles on individual entrepreneurs | Traffic police work schedule for registering a car for individual entrepreneurs | Phone numbers for help |

| Moscow, st. Verkhnyaya Krasnoselskaya, 15 A | 8.00 - 20.00 (Tue) 8.00 - 18.00 (Wed. - Fri.) 8.00 - 17.00 (Sat.) Mon. and all - day off | 8 |

| Moscow, Volkhovsky lane, 16/20, building 3 | 8.00 - 20.00 (Tue) 8.00 - 18.00 (Wed. - Fri.) 8.00 - 17.00 (Sat.) Mon. and all - day off | 8 |

| Moscow, st. Lobnenskaya, 20 | 8.00 – 20.00 (daily) | 8 |

| Moscow, st. Vagonoremontnaya, 27 | 9.00 - 18.00 (Mon. - Thu.) 9.00 - 17.00 (Fri.) Sat. and all - day off | 8 |

| Moscow, Poslannikov lane, 20 | 8.00 - 20.00 (Tue) 8.00 - 18.00 (Wed. - Fri.) 8.00 - 17.00 (Sat.) Mon. and all - day off | 8 |

| Moscow, st. Tvardovskogo, 8, cor. 5 | For legal entities 9.00 - 18.00 (Mon. - Thu.) 9.00 - 17.00 (Fri.) Sat. and all — day off For individuals Around the clock (20.00 - 8.00 only through government services) | 8(499) 740-14-15 |

| Moscow, Khoroshevskoe highway, 40 | 8.00 - 20.00 (Tue) 8.00 - 18.00 (Wed. - Fri.) 8.00 - 17.00 (Sat.) Mon. and all - day off | 8(495) 940-11-19 |

| Moscow, st. Yunosti, 3 | 8.00 - 20.00 (Tue) 8.00 - 18.00 (Wed. - Fri.) 8.00 - 17.00 (Sat.) Mon. and all 9.00 – 18.00 (only through government services) | 8 |

| Moscow, Signalny proezd, 9 | 8.00 – 20.00 (daily) | 8 |

| Moscow, Mira Avenue, 207, bldg. 1 | 8.00 - 17.00 (Tue - Sat) Mon. and all - day off | 8 |

| Moscow, st. Pererva, 21 | Around the clock | 8 |

| Moscow, st. Nagatinskaya, 2, building 3 | 8.00 – 20.00 (daily) | 8 |

| Moscow, st. Academician Glushko, 13 | 8.00 – 20.00 (daily) | 8 |

| Moscow, st. 50th anniversary of October, 6, cor. 1 | 8.00 – 20.00 (daily) | 8 |

"serves-gibdd.ru". Basic operating principles

The online platform “serves-gibdd.ru” gives entrepreneurs engaged in business the opportunity to relieve themselves of all worries about registering a car. The company’s specialists will promptly register the individual entrepreneur’s vehicle with the traffic police :

- information and legal support on vehicle registration issues, interaction with various territorial divisions of the traffic police;

- preparation of documents;

- payment of state duty;

- sending/accompanying the principal's car to the required MREO site for inspection.

The professionalism of the employees of “serves-gibdd.ru” and many years of experience are the basis that guarantees the flawless registration of your car.

We KNOW all the legal norms of the legislation, which is effective and we use it in the interests of our clients - YOU. Price from 5800 rubles

How to buy a car as an individual entrepreneur?

Purchasing a private vehicle involves several nuances and features:

- The vehicle is purchased for business needs, therefore transactions of this kind are formalized by a supply agreement (Article 506 of the Civil Code of the Russian Federation);

- such a purchase is not subject to Federal Law No. 2300-1 “On the Protection of Consumer Rights”, since the individual entrepreneur is not a consumer;

- all controversial situations are regulated by the articles of the Civil Code of the Russian Federation, which describe the validity of the supply agreement, as well as by the document itself. Therefore, it is necessary to draw up an agreement in detail, specifying the rights and obligations of the parties, and measures of enforcement in case of violation;

- purchase costs are taken into account in individual entrepreneur taxation. Depending on the system in which the individual entrepreneur operates, they may be included in VAT deductions or appear among expenses when calculating income taxes;

- The vehicle must be registered as a fixed asset. This action is necessary for the correct calculation of the tax base.

An individual entrepreneur can buy a vehicle either by transferring funds to a current account (by bank transfer) or for cash.

By bank transfer

Since the amount for a car reaches several hundred or millions of rubles, non-cash payment is the most convenient option. This method has its own nuances:

- When transferring funds through a card, the seller will have to pay a commission of 5% of the amount. In order for mutual settlements to be correct, it is necessary to increase the cost of the car by the amount of the bank’s commission.

- When transferring money through an account, a commission will be deducted from the buyer. Its size may be significantly smaller than the first option (depending on the bank’s conditions).

When choosing a payment method, you should also consider the purpose of the purchase. For personal use, it would be more correct to make payments from your own account, for business needs - from an individual entrepreneur’s account.

In cash

This payment option can be beneficial when purchasing a new car at a dealership. Upon receipt of cash, the management of the car dealership can provide a good discount on the vehicle. However, the use of cash individual entrepreneurs is possible only in the following situations:

- remuneration of your employees;

- under report;

- payment for services of third parties (contractor);

- refund;

- payment for the services of a paying agent.

The purchase of a car must be approved for one of these needs. For example, issue cash against a report .

State duty

The amount of the state duty for registering a vehicle with the State Traffic Safety Inspectorate is regulated by the Tax Code of the Russian Federation. In 2019-2020 its size is:

- Obtaining new license plates: for motorcycles - 1500 rubles, for other vehicles - 2000 rubles.

- Making changes to the PTS if there are empty columns in it – 350 rubles.

- Issuance of a new PTS if there is no space for storing data in the old one, or if it is lost or damaged – 800 rubles.

- Issuance of a new STS – 350 rubles.

There are two ways to save when paying state fees:

- having waived the need to obtain new license plates, replacing them when the owner of the car changes is an optional condition;

- complete the registration procedure using the State Services portal. In this case, you can count on a 30% discount.