Types of car insurance

Every driver needs insurance. It will be needed to register the car with the traffic police and to compensate for damage in an accident. Car insurance can be compulsory (OSAGO) or voluntary (hull insurance).

OSAGO.

Drivers are prohibited from driving without a compulsory insurance policy. If during registration the traffic police did not request insurance, they will in any case ask for it in the future. The first time you will be fined 800 rubles for driving without a policy, the second time - 5000. The third time - deprivation of your driver's license.

The MTPL policy only insures the driver's liability on the road. If he caused an accident, the insurance company will compensate the injured party for the damage.

| Situation | Amount of insurance payment |

| The driver was involved in an accident with one or more participants | Up to 160 thousand rubles for damage to property for all injured participants in an accident. |

| Someone else's car was destroyed in an accident | Up to 400 thousand rubles. |

| The driver or passengers of the injured party were injured in the accident | Minor injuries - up to 150 thousand rubles. Threat to life - up to 500 thousand rubles. |

| Pedestrian hit | Up to 500 thousand rubles. |

The insurance company will not compensate for damage if:

- the driver was at fault for the accident and his car was damaged;

- the driver demolished a billboard or pole;

- the car was stolen;

- spontaneous combustion occurred;

- hooligans broke car windows or removed tires.

If the driver is involved in an accident, he informs the insurance company about the incident within 5 days. The insurance company makes a decision on payment within 20 days. If the time is up and the insurer has not yet made a decision or has not paid the money, penalties are applied to him by law.

DSAGO.

A voluntary civil liability insurance policy will be needed in cases where the driver wants to increase the amount of insurance payments to the injured party from 500 thousand to a million rubles.

To receive an insurance payment under MTPL, the damage to the injured party must be more than 160 thousand rubles - the maximum one-time payment under MTPL.

The DSAGO policy refers to voluntary motor insurance and comes only as an annex to the compulsory motor liability insurance policy; It cannot be purchased separately. Insurance companies set the price for a DSAGO policy depending on engine power, year of manufacture of the car, driver experience and other factors.

Casco

. A comprehensive insurance policy covers more risks compared to compulsory motor liability insurance. If you get into an accident, knock over a billboard, or someone else’s car blows off your bumper in the parking lot and runs away, the insurance company will compensate for the damage. If the car is stolen, under a comprehensive insurance policy the insurance company will pay 100% of the market value of the car. To receive payments for insurance claims during the year, the driver must pay the full amount of insurance in advance.

Casco is always more expensive than OSAGO. But it is not issued to cars older than 5 years or if the car has a low market value.

"Green map".

If the driver is planning a trip abroad, he must additionally obtain a “green card” - a mandatory insurance policy for driver liability abroad. If you get into an accident in another country, your insurance will cover the damage.

Life insurance.

You can register your life and your passengers. The amount of payments reaches a million rubles.

Features of extended insurance

The main feature of DSAGO compared to compulsory motor liability insurance is voluntariness. Neither the law nor the rules of insurers can oblige a driver to enter into an additional insurance contract. Purchasing and using the policy is at the discretion of the driver.

The main MTPL policy has a legally fixed maximum payment amount; DSAGO has no such restrictions. The amount of additional compensation is determined by the parties when concluding the contract.

An additional policy is always linked to the main one, so they have the same validity period.

In addition, for an additional fee the insurer may include related services:

- Calling the emergency commissioner and his assistance.

- Carrying out technical work at the scene of an accident.

- Tow truck services.

According to other principles and parameters, additional insurance is no different from a regular insurance policy.

How to apply for an insurance policy?

You can issue a policy at the offices of the insurance company or on its website, as well as through the MFC and the “Unified Agent”.

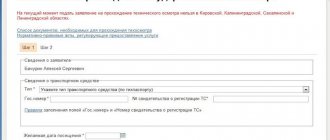

Through MFC.

Find out which branch in your region can issue insurance. Call the MFC hotline +7 (by region) and make an appointment to avoid standing in line.

Through "Unified Agent".

The website of the Russian Union of Auto Insurers contains a list of insurance companies where you can issue an electronic MTPL policy.

The system includes only verified and licensed insurance agents. Select any company from the list, follow the link and register on the insurance website. You can link your profile to your State Services account, and the system itself will take the necessary documents.

If you take out a policy through the MFC or the “Unified Agent”, you are guaranteed to receive payments, even if the insurance company goes bankrupt.

Registration of an MTPL policy

After reviewing the application and checking the provided documents, the insurance company issues a package of documents to the policyholder. As before, in 2021 this package will include:

- original policy,

- auto liability insurance rules,

- insurance memo,

- payment receipt stub.

After this, the insurance contract is considered concluded and will be valid for the period specified in the policy. As a rule, motorists prefer the standard option - insurance for 1 year, but in special cases it is more profitable to choose a shorter insurance period. After the expiration of the period specified in the insurance document, the procedure for obtaining a policy will have to be repeated.

After receiving the MTPL policy, it would be a good idea to check its authenticity using the RSA database on the official website of the department.

What documents are needed to obtain insurance?

To obtain insurance, the driver needs:

- application - usually completed on site at a branch or directly on the website;

- passport of a citizen of the Russian Federation;

- driver license;

- original PTS and vehicle registration certificate;

- original certificate of ownership of the car;

- technical inspection and diagnostic card;

- old policy, if any.

To submit an electronic application, documents are required in electronic form. The driver is given 10 days from the date of purchase of the car to obtain insurance.

Possible difficulties during registration

Any procedure that is performed using information technology may periodically produce errors. What difficulties are most often encountered when registering online:

- technical problems and errors on the insurer’s website;

- when redirecting information to the RSA website, the right of registration will be transferred to a completely different company;

- inclusion of additional services in the policy without notifying the policyholder;

- If an accident occurs, the insurer may refuse to pay, citing incorrect information in the electronic policy.

All problems that arise can be solved, the only drawback is that time is lost during the investigation. As practice shows, the OSAGO policy obtained online rarely causes difficulties for its owners. To avoid unnecessary problems, you should choose reliable insurance agents who will always come to the client’s aid and help them understand the current situation. It is necessary to check the data from various reliable sources, for example on the website of Rossgosstat or the Central Bank of the Russian Federation.

How to choose an insurance company?

Fraudsters operating under the guise of insurance companies sell policies without a license. The fine for providing fake insurance to the traffic police is 5,000 rubles. To avoid falling for attackers, pay attention to several points.

License.

Ask the insurance company to see their license. You can check the authenticity of the license for the right to sell compulsory motor insurance or motor insurance on the website of the Bank of Russia. If this is an insurance broker or agent, ask him to present a certificate that allows him to represent the interests of the insurance company and sell the insurance policy.

Reputation.

Check the reputation of the insurance company - mentions in the media, social networks, recommendation services, news on the RSA website. Look at what they write about the company in independent ratings.

Experience.

Find out how many years the company has been offering services on the market. To do this, ask to see the constituent documents and articles of association.

Volume of insurance payments.

Find out in what cases the insurance company refuses to pay the insured amount and what affects its volume. Ask what the maximum lump sum amount will be paid under the comprehensive insurance policy and what may affect it.

If you already have an insurance policy, you can check its authenticity on the RSA website.

Who benefits from applying for DSAGO

Insurance with an increased limit will be useful to all drivers who want to minimize their risks on the road. DSAGO is especially useful if the injured participant owns an expensive car, and its repair may cost more than the maximum payment under the compulsory motor liability insurance policy.

For example, to restore a damaged car, 900,000 rubles are required, while a regular MTPL policy only covers a maximum of 400,000 rubles. The difference of half a million must be compensated entirely at the expense of the person responsible for the accident. You can issue a DSAGO for the specified amount for several thousand rubles, which is significantly more profitable given such significant risks.

In addition, additional insurance also covers damage caused to the life and health of other participants.

Thus, all expenses exceeding the maximum payment under compulsory motor liability insurance will be transferred not to the driver, but to the insurance company.

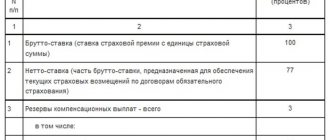

How much does car insurance cost?

There is no fixed price for registration of comprehensive insurance or compulsory motor liability insurance. For each driver, the insurance company makes an individual calculation based on:

- car brand;

- Year of release;

- models;

- modifications;

- engine power;

- the period for which the insurance is issued;

- region of residence;

- region of registration of the owner;

- the number of drivers allowed to drive;

- age and experience of each driver.

If the car is older than three years and has a low market value, the insurance amount will be lower. If the car’s power is 100–120 l/s, then the policy for it will be cheaper. To get a discount or reduce the cost, you need to take out insurance in the same place where the driver lives and is registered. If there is only one driver driving a car, over 30 years old and with extensive experience, insurance will cost him less than a young driver.

If the driver previously had a policy and a good insurance history, he can receive a 5-10% discount. To calculate the cost of your policy, consult your insurance company or use special online calculators.

Insurance participants: basic rights and obligations

There are always multiple parties involved in auto insurance. Each of them has their own rights and obligations under the contract that they must comply with. According to the law of the Russian Federation, they are:

- Owner of the vehicle.

- An authorized representative or his legal representative.

- Drivers who are authorized to operate vehicles.

- Insurance Company.

The first three categories are on the one hand, operators working in the market, on the other. It is better to consider the rights and obligations of the parties in the table.

| Party to the contract | Rights | Responsibilities |

| Policyholder | Receive timely compensation if it is provided for by the terms of the contract | Make timely payment of the insurance premium for the company’s services |

| Terminate the agreement early | Notify the insurance company about any changes in personal data | |

| Choose an insurer at your own discretion | Perform all actions in accordance with traffic regulations in the event of an accident | |

| Protect your rights and legitimate interests in the prescribed manner | Providing timely information to the insurer about the occurrence of risks | |

| Prevent or minimize damage in the event of an insured event | ||

| Insurer | Check the information provided by the client | Hand over to the other party a completed copy of the contract and the policy on a strict reporting form |

| Send requests to the competent authorities | Carry out measures to reduce the risk of insured events | |

| Take measures necessary to reduce losses | Make timely payments stipulated by the contract | |

| Perform calculations in accordance with formulas approved by regulations | Maintain confidentiality and do not transfer client information to third parties | |

| Terminate the contract if the client does not pay for the services on time | Provide complete information about the selected type of insurance | |

| Refuse to issue a policy in cases provided for by law | Explain to the client the reasons for refusal to issue a policy | |

| Conduct an assessment of possible risks | Receive applications and complaints from clients for consideration |

The law clearly defines who can be an insurer. This is a company that has received a license to carry out this detail and is an incoming RSA. In turn, either the owner himself or any of his authorized representatives can act as an insured, who undertakes to pay the company’s premium and comply with all obligations under the contract.

What should you pay attention to in a contract?

When you have chosen an insurance company and are ready to enter into a contract, read it carefully. Please note the following points.

Period for notification of an insured event.

This is the time in which the driver must inform the insurance company about the accident. Under standard conditions, notice is given within three days. If this period expires, the insurer may refuse to pay. Then you will have to compensate for the damage yourself.

Franchise.

Franchise can be unconditional or conditional. With an unconditional deductible of 20 thousand rubles in the event of an accident, the payment will be reduced by this amount. If the deductible is conditional, then the insurance company will pay money only if the damage exceeds 20 thousand rubles. Insurance with deductibles costs 20–40 thousand rubles less.

Wear calculation.

From the insurers' point of view, the car loses up to 15–20% of its original value. Find out how the insurance company will calculate payment annually - based on the age or mileage of the car.

Amount and procedure of insurance payments.

It is possible that, under the terms of the contract, in the event of a second insured event, the company may reduce the amount of payments or automatically include a deductible in the calculation of compensation.

Documentation.

If it is stated that the insurer can request those documents that it needs without a pre-agreed list, there is a risk that payments will be denied due to “missing documents”.

Time to decide on payment.

Usually this is up to 30 days. If this item is not there, ask to be added, otherwise the insurer may delay the process for 3–6 months.

Specify how the damage will be assessed - by a special examination or based on invoices from the service station. Ask in what cases payments will be denied. If the contract states that the insurance company will not pay in the event of a gross violation of traffic rules, it should not be signed. The insurance company will be biased towards any insurance claim.

MTPL agreement: basic concepts

Among the legal features of such contractual obligations for motor vehicle citizenship are:

- Consensus – events that are expected to occur in the future are written down;

- 2-party – always concluded between 2 parties (the policyholder and the insurer);

- Reciprocity - is made solely by mutual consent of the parties;

- Payment – involves the obligatory payment of an insurance premium (payment).

This type of agreement must be concluded in writing, and if this does not happen, then the document is considered void.

In the document, the parties to the agreement are 2 persons, namely:

- The policyholder can be either an individual or a legal entity. The individual signs the agreement personally, and on the part of the legal entity - his authorized representative;

- Insurer – insurance company (always a legal entity).

By concluding a contract, the policyholder (car owner) pursues the goal of: at the expense of the insurer, to compensate for losses to 3rd parties. From this we can conclude that contractual relations are concluded in the interests of third parties (their circle is unlimited and they are not directly indicated in the contract). Such a third party can be any person (individual/legal entity). It depends on who and whose particular interests were damaged in the accident.

Government agencies are a special subject of the agreement, since without action on their part no payments will occur. After all, the party injured in an accident can hope to receive compensation for damage from the insurer only if it provides a certificate of the accident, which is drawn up by traffic police officers.

According to compulsory motor liability insurance, the object of contractual obligations is understood as the civil liability of the car owner for the harm that he caused by his actions while driving the vehicle. It is important to understand that among the risks there are only such as damage to property, as well as harm caused to the health and life of the injured party. At the same time, the category of compensation under compulsory motor liability insurance does not include moral damage. All losses associated with such harm are determined by the court, which decides the fate of the claim, sent directly to the culprit of the accident.

Where is the best place to apply for compulsory motor liability insurance?

Today there are a large number of insurance options; many people choose where it is better to insure their car with an insurance company. Tariffs differ in different organizations; the type of vehicle plays an important role; it is cheaper to issue a policy for a passenger car in one place, but it is more profitable to insure a bus, a truck, or obtain a policy for a motorcycle in another.

First of all, you should pay attention to the ratings of insurance companies, whose prices can always be found online. If necessary, you can always ask your friends; forums are considered a source of useful information.

For many, the cost of services is decisive, which is not always correct. First of all, it is recommended to pay attention to the reliability of the company.

How to make car insurance cheaper

Every car owner wants to get OSAGO insurance cheaply, because often the cost of concluding a contract significantly hits the pocket.

There are several ways to get cheap MTPL insurance for your car.:

- choosing an insurance company with a low base rate;

- reducing the insurance period - this option is suitable if you need to use the vehicle for a limited period of time;

- use of the CBN discount for the absence of an accident;

- promotions when taking out 2 or more MTPL policies;

- adding yourself to the driver’s policy with at least 3 years of experience and at the age of 22;

- registering a car in a region with a low territorial coefficient.

In one of our articles, we have already indicated companies with low basic tariffs, which will help you get an OSAGO policy inexpensively.

Why can an insurance company refuse to insure a car?

The insurance company does not have the right to unreasonably refuse to issue an insurance contract; the legislation provides for administrative liability for this. However, today there are four reasons why an insurance company can legally refuse to sign a contract.

The reason for refusal may be:

- lack of connection with the automated SAR system;

- lack of a power of attorney when applying for insurance on behalf of a legal entity or individual entrepreneur;

- failed technical inspection of the vehicle;

- provision of an incomplete package of documents.

All other reasons are considered insufficient for refusal. An error in the policy is not grounds for denial of insurance. But it should be remembered that such a policy will be considered invalid upon presentation.

It is also possible to insure a car without a car; in other words, to obtain compulsory motor liability insurance, it is not necessary to provide the car for inspection. The insurance company has no right to refuse to conclude a contract in such cases.

Problems with registration of compulsory motor liability insurance often arise when insuring a taxi; the refusal of the insurance company in this case is also considered illegal.

Many car owners do not know what to do if they cannot insure their car. After receiving a refusal to issue an MTPL agreement, you must request written confirmation. Refusal may be given by a supervisor or authorized employee after a corresponding request is received.

Necessary actions:

- Writing an application requesting a written refusal.

- Endorsement of the application by the secretary.

The wait may take several days, after which a response should follow. It is also recommended to provide audio or video recordings as confirmation; the insurance employee must introduce himself in the recording.

It is recommended to write complaints to the company’s website, as well as to the portal of the Russian Union of Auto Insurers.