Samples of powers of attorney for an individual to represent the interests of an LLC

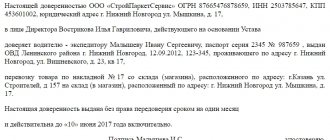

ATTENTION! Look at the completed sample power of attorney for representation of interests:

DOWNLOAD samples of powers of attorney for an individual to represent the interests of an LLC:

- general power of attorney to represent the interests of LLC

- power of attorney to represent the interests of the LLC to the tax authorities

- power of attorney to represent the interests of the LLC in law enforcement agencies

- power of attorney to represent the interests of the LLC in court

- power of attorney to represent the interests of the LLC in the arbitration court

- power of attorney to represent the interests of the LLC in the insurance company

- power of attorney to represent the interests of the LLC in the bank

- power of attorney to represent the interests of the LLC in government bodies

How to compose a document

Power of attorney to represent the interests of LLC physical. to a person - a document that allows you to transfer to an individual the rights to perform certain actions on behalf of the LLC. Let's take a closer look at what powers of attorney an organization can issue and how to draw them up correctly. The form of ownership of the organization and the type of activity do not matter when drawing up.

Attention! Our qualified lawyers will assist you free of charge and around the clock on any issues. Find out more here.

The only important requirement is the correct execution and indication of all powers transferred to the representative.

The power of attorney must contain:

- LLC details (full name, INN, ORGN, name of the tax authority with which the organization is registered),

- Full name and passport details of the director (the person who acts as the principal),

- Full name and passport details of the attorney,

- listing of all powers,

- possibility/impossibility of transferring rights to represent the interests of the organization,

- validity period of the power of attorney. Here you can indicate in which cases the document may be terminated, or, conversely, indicate that it is not subject to revocation,

- signatures of the trustee and principal,

- date and stamp.

Watch the video. How to issue a power of attorney:

Mandatory registration rules for legal entities

When it comes to a legal entity, the following rules must be observed:

- the certificate of authority must only have a printed form;

- it is impossible to transmit the text through authority without the signature of the manager and the seal of the organization;

- You cannot use paper without a date of preparation or entry into force, from which a general record of the validity period will be kept, and in the notarial version it is necessary to display the deadline for the power of attorney in numbers and in words.

If you intend to act outside the country where the entrustment of rights took place, the power of attorney document must be legalized using an apostille - a stamp of the regional department of the Ministry of Justice. However, first you should check whether the country is on the list of those that have an agreement with the Russian Federation on this topic. Sometimes counterparties additionally ask for another, local notarial processing or notarized translation.

General power of attorney from a legal entity

When drawing up a general power of attorney, the description of powers includes general wording that conveys the total scope of the representative’s rights without specification.

For example:

- manage the company’s funds (cash and in accounts),

- represent the interests of the LLC in all government bodies and institutions,

- represent the interests of society in courts,

- send and receive correspondence on behalf of the company.

Power of attorney for representation in court from a legal entity.

How to issue a power of attorney for the right to sign, read here.

How to draw up a power of attorney from an individual entrepreneur to conduct business, read the link: https://novocom.org/dokumenty/doverennosti/doverennost-ot-ip-na-fizicheskoe-lico-na-vedenie-del-obrazec.html

A general (also known as general) power of attorney is issued in writing. The document must bear the signature of the director and the date of preparation.

Note! In accordance with the Civil Code of the Russian Federation, affixing the seal of a legal entity to a power of attorney is now not required, but it will not be superfluous, since in practice it continues to be used.

Power of attorney from the organization

A power of attorney from a legal entity to an individual is a written document that clearly defines the actions that the attorney can perform on behalf of the organization and in its interests legally. Depending on the purpose of issuance, a power of attorney may provide for a single action in the interests of the organization in front of third parties (for example, receiving valuables on an invoice) or long-term performance of any actions (representation in court, receiving correspondence by mail, etc.).

The following may act as proxies:

- employees of the organization;

- persons with whom the organization is bound by civil law agreements.

A power of attorney can also be issued to third parties who do not work for the organization. It is important that the attorney does not raise doubts in the principal, since from the moment the power of attorney is signed, he bears full responsibility for actions performed using the document.

Types of powers of attorney:

- general power of attorney from a legal entity to an individual – provides for the broadest powers;

- special – allows you to perform specific actions within a certain period of time;

- one-time – gives the trustee powers only to perform a specific task.

The document must be certified by the signature of the manager (or other authorized person) and the seal of the organization, if any.

When is notarization required?

Notarization is not necessary, but there are situations in which a visit to a notary is indispensable:

- if the representative will make transactions on behalf of the company,

- for filing applications for state registration of completed transactions (purchase, sale, rental, etc.),

- if the representative’s powers include the disposal of rights registered in Rosreestr (for example, completing the sale of a land plot - the ownership right is registered in the Unified State Register of Real Estate).

Is it possible to revoke a general power of attorney?

Types of powers of attorney

The Civil Code of the Russian Federation does not provide for the division of powers of attorney into types, however, an unofficial classification still exists:

- one-time Compiled for one-time execution of orders. For example, 1 time to receive correspondence or cargo on behalf of an LLC,

- special. To perform an unlimited number of similar actions. For example, representing the interests of society in courts,

- general. Grants the maximum number of rights, does not require specification of each power.

Required documents and cost of notary services

When notarizing a power of attorney, the personal presence of the director is required. The presence of a trusted person is not necessary, but it is necessary to know his passport details.

For notarization you need:

- principal's passport,

- passport details of the authorized person,

- LLC details: ORGN and INN,

- articles of association,

- order for the appointment of a director,

- stamp sample,

- a fresh extract from the Unified State Register of Legal Entities (please note that the validity period of the extract is only 30 calendar days).

How to issue a power of attorney to receive goods and materials?

The cost of a notary service will range from 1,000 to 3,000 rubles (depending on the specific case and city).

What you can’t do when registering

The legislation allows each organization to use its own sample power of attorney from a legal entity; it is allowed to adopt developments and forms obtained from other enterprises or from the Internet. The most general sample can be downloaded below, in two versions to choose from:

Example of a power of attorney from a legal entity to an individual No. 1.

Example of a power of attorney from an organization to an individual No. 2.

The only standard form is the power of attorney form for receipt and transfer of goods and materials, form M-2, a sample of which is also available at the link below.

Power of attorney form in form M-2.

With all this, there are unacceptable actions that are common to everyone. When registering a DULFL, in order to avoid problems with its true legality, you cannot:

- leave the paper without an issue date that determines the validity period;

- certify it with a facsimile instead of a real handwritten signature;

- leave the ID without a seal, unless we are talking about an individual entrepreneur without one;

- exercise the right of subrogation without first indicating this fact in the original document and without having the mark certified by a notary;

- issue a form of power of attorney M-2 for the receipt of goods or property assets without a recorded sample of the signature of its bearer;

- leave the paper without a visa for the chief economist when it comes to manipulation of material assets;

- make remarks in an already certified text, arbitrarily correct errors by crossing out, making corrections, leaving blots or blots in important places.

In addition, you need to remember that some types of entrusted actions in Russia require additional documentation on hand.

How to revoke a power of attorney

To revoke a power of attorney, a legal entity must:

- notify in writing the authorized representative representing the interests of the LLC,

- receive from the bearer a document that has lost its validity,

- notify third parties to whom the representative presented a power of attorney of the cancellation of the powers of the proxy.

What to do if the document is lost?

Third parties should be publicly notified of the termination of the power of attorney by submitting an advertisement in the Kommersant newspaper. After 30 calendar days, it is considered that third parties have been notified of the revocation of the power of attorney.

Watch the video. Notarized powers of attorney for registration: application practice

Power of attorney to the tax office

The life of an accountant is not easy. Especially if the Federal Tax Service does not accept documents without a power of attorney. But this is no reason to despair. After all, it is very simple to arrange them. The main thing is that the principal writes that all the documents that you provide for verification are current. This type of power of attorney requires certification by a notary.

Upon provision of such a document, a representative of the company can interact with the tax authorities: give or receive any papers, sign, make extracts and perform other actions provided for by law and listed in the power of attorney.

A power of attorney is required if the employee’s right to represent the company in the INFS is not stipulated in the Charter. A notarized declaration of such a power of attorney is required. The required components of a power of attorney are similar to any document of this type: details of the parties, a list of powers, validity period, a statement of the right to sub-power, the signature of the authorized representative and its certification by the management of the company, and, of course, the signature and seal of the management. The power of attorney will not be valid if:

- the date is not indicated or it is in the wrong format (numbers must be indicated in words);

- the signature is not personal, but facsimile;

- the signature of the individual is not certified;

- there is no seal of the organization (except for those cases when it is not used according to the charter);

- blots, corrections, erasures were made;

- there is no corresponding mark on the original power of attorney, if the document is not the primary one, but is being transferred.