Basic facts about the tax deduction

A tax deduction is an amount of money reimbursed for tax previously paid for a certain reporting period. The funds are returned to the payer from the regional treasury. At the moment, there are several options for compensation of expenses associated with the acquisition of various types of property. However, this does not include the car tax deduction.

Categories of expenses that are reimbursed to citizens at the expense of the state:

- Individual housing construction.

- Reconstruction, major repairs of a residential building.

- Repayment of mortgage loans.

- Costs incurred in obtaining higher education.

- Payment for services of medical institutions.

- Formation of a material fund for future retirees.

Thus, receiving state compensation becomes possible in different cases and situations. But at the moment, the car tax deduction in 2021 is not approved by law and is valid only for the sale of a vehicle. The existing restriction is explained by the fact that a car is not an essential item, unlike housing, real estate repairs, and the cost of medical procedures.

About taxes

Taxation is not imposed directly on the purchase of a vehicle. Therefore, the person who purchases the car will not have to pay any additional amount on top of the cost of the goods.

However, the seller may be required to give a portion of the proceeds to the government. Cars that have been owned for less than 3 years are taxed. If they belong to a person longer, then he will not have to pay anything. This measure was primarily introduced in order to limit the actions of fraudsters who, immediately after receiving the rights to cars, sold them.

A car whose cost is less than 250,000 rubles is not subject to tax. A person can sell it freely, and he will not have to give part of the income to the state. However, if, without good reason, the selling price is significantly lower than the purchase price, this may raise suspicions. There have been cases when a person deliberately indicated a price lower in a contract for the purchase and sale of a car in 2021 than what he actually demanded from the buyer.

According to the law, if the car was subject to tax, its amount cannot be lower or higher than 13%. This is a set value that applies in absolutely all cases. However, it should be understood that this percentage is not calculated based on the amount for which the car was purchased. After all, in this case the tax turns out to be quite large. A person must subtract from the sale price the price at which he purchased the vehicle at the time. The result will be a taxable amount. It represents the profit received.

Refund when buying a car

The purchase of a car is not included in the list of items for which a deduction is due. This is stated in Article 220 of the Tax Code of the Russian Federation. For other cases, the possibility of a 13% refund remains available. This is also true when selling a vehicle.

Who is entitled to a refund?

The number of citizens entitled to receive a tax deduction for a car includes those who consistently declare income and also repay payments in a timely manner in the form of 13% of their amount. However, this only applies to transactions related to the sale of a car. When purchasing a vehicle, it will not be possible to return the property interest, regardless of belonging to preferential categories.

Three year rule

Despite the fact that the new version of the law does not provide for an income tax refund when purchasing a car in 2021, there is an opportunity to save significantly. To do this, you need to know the specifics of taxation of vehicles, taking into account their cost and period of ownership.

Attention! If the purchased used car has been in use for more than 3 years, it is not subject to tax, regardless of the price. Payment is made only if the car has been owned for more than 3 years and costs more than 250 thousand rubles.

List of documents

In order to carry out any income tax transactions, including obtaining a property deduction when purchasing a car in 2019, you need to make sure that you have the necessary documentation. Otherwise, it becomes impossible to prove the right to a refund of the amount spent.

What papers are needed:

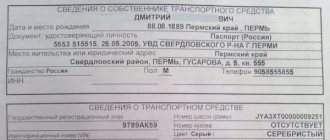

- Vehicle passport (which must contain information about the transaction).

- Car purchase agreement (with paid price).

- Payment receipt (if the car was purchased at a car dealership).

- A receipt issued to the driver when he paid personal income tax.

- A copy of the passport of a citizen of the Russian Federation.

- TIN.

It is important to know! Provided there are no changes to the new law, you cannot receive a tax deduction when buying a car in 2021. However, you can exercise your right to financial compensation or benefits if you sell your car.

Tax when buying a new car

When purchasing a new or used car, you will have to pay a state fee before registering with the traffic police, otherwise employees will be forced to refuse the operation.

Income tax is not paid in this case, because the owner does not receive any benefit from the purchase of the vehicle, so only the former owner pays it.

Some people believe that when buying a car you can return 13% of personal income tax, as in the case of purchasing an apartment, but in fact this is not the case. The law establishes a list of cases in which a personal income tax refund is possible:

- housing construction;

- charity;

- getting an education;

- treatment.

The absence of the possibility of a 13% refund for a car is explained by the fact that transport is not a means of necessity.

All cars lose significant value when sold on the secondary market. To save a little, you can use a tax deduction: thanks to it, you can return up to 250,000 rubles, but this amount depends on the cost of transport.

Receipt procedure

The collected documents must be submitted to the Federal Tax Service. This can also be done online using the State Services portal. It is important to remember that in order to receive a tax refund on a car purchase in 2021, you must meet several requirements that are presented in the tax amendment bill.

These include the following:

- The maximum deduction amount should not exceed 500 thousand rubles.

- The opportunity to get a tax refund when buying a car only applies to new cars.

- The right of compensation applies to vehicles manufactured and released on the territory of the Russian Federation

Calculation example

As with other forms of deduction, a citizen can return the full amount of the tax paid. However, this rule applies only if the total amount does not exceed 65,000 rubles.

The amount of compensation depends on the price of the car. To calculate, you need to determine the 13 percent share that you had to pay in tax. To do this, just use a calculator. The cost of the vehicle should be divided by 100 and multiplied by 13.

It is important to know! If the price of the car was 500 thousand rubles, then 13% of this amount is 65 thousand. This is the maximum amount of deduction that they will be able to receive upon purchase if changes to the law are approved.

Fees included in the price of auto dealers

Despite the fact that all taxes and fees in this case must be paid by car dealers, because They are the ones who benefit from the sale of goods; in fact, such payments are usually included in the cost of cars:

- tax on the import of transport into the country;

- recycling collection;

- VAT.

As a rule, the overpayment in the form of taxes for the buyer reaches huge amounts, calculated from the total cost of the equipment. For example, consider the calculation using the following formula:

The starting price of the car in the showroom is VAT 18% – the price of customs duty – recycling fee.

For example, a Seat car in its basic configuration costs 750,000 rubles. To find out its value minus all taxes, you need to do the following:

750,000 – 135,000 (VAT) – 44,200 (disposal fee) – 345,928 (customs duty) = 224,872 rubles.

Thus, the actual cost of vehicles can be several times lower if all fees are subtracted from the prices, but it is not profitable for car dealerships to do this, because In this case, they will lose profit.

Tax on importing cars into the country

Each type of tax included in the cost of new cars should be considered separately, because Some of them must be paid not only by legal entities, but also by individuals.

For example, fees for importing vehicles into the territory of the Russian Federation, which consist of the following indicators:

- engine type: you will have to pay more for a diesel engine than for a gasoline engine;

- assessment of the cost of equipment in accordance with an expert opinion (can be carried out in individual cases);

- recycling fee for environmental control, in which case a certificate of conformity is issued;

- customs clearance fee.

The first part of the payments consists of customs clearance, and the second – taxes and fees. The amount of duty depends on the price of the vehicle, and this can be seen in the table below:

| Cost of the car (customs) | Amount of duty |

| Up to 325,000 rub. | 54%, but not less than 2.5 Euro per 1 cm3 |

| From 350,000 to 650,000 rubles. | 45%, but at least 3.5 Euro per 1 cm3 |

| From 650,000 to 1,625,000 rubles. | A similar percentage, but not less than 5.5 Euro per 1 cm3 |

| From 1,625,000 to 3,250,000 rubles. | The rate is at least 7.5 Euro per 1 cm3 or 48% |

| From RUB 3,250,000 to RUB 6,500,000. | 15 Euro per 1 cm3 or 48% of the customs value |

| More than 6,500,000 rubles. | 48% or 20 Euro per 1 cm3 |

The calculation of the cost of customs duties changes for cars “aged” from 3 to 5 years or more than 5 years, regardless of the country of origin.

There are several ways to clear cars through customs, which can save money, but are not entirely legal, and some of them carry administrative or even criminal penalties:

- Unit-by-unit import: STS and license plate numbers of supposedly “broken” vehicles are prepared, but instead, equipment of a similar brand is imported from abroad.

- Inheritance: a car is registered in the name of an elderly person, who subsequently includes this property in his will. When a citizen dies, the vehicle becomes the property of the actual owner, and inherited property is exempt from duties.

- Reducing engine displacement and increasing the year of manufacture. To do this, documents with incorrect data are fabricated in a foreign country.

- Temporary importation by a foreign mission. This option is only suitable for non-residents of the Russian Federation.

- Import of a car for special purposes for citizens with physical defects by social welfare authorities. As a rule, such equipment is documented as charitable assistance to a specific person from a foreign citizen, and the recipient is usually registered with social security.

Value added tax

VAT is another type of tax that may be included in the sales receipt when purchasing a car at a car dealership.

As a rule, it is displayed as a separate line in the document.

Buyers are not required to pay it, and some organizations may be exempt from it:

- companies that, due to their activities, already pay VAT;

- non-residents of the Russian Federation;

- executive authorities and other state or municipal organizations.

All enterprises belonging to the above circle can return VAT when selling equipment, because their money had already been spent on such purposes. To return the money, you must contact the territorial office of the Federal Tax Service with a corresponding application, because it is impossible to automatically return paid fees in Russia.

Let's look at an example:

Lux LLC purchased a car in March 2010 at a price of 150,000 rubles, and VAT in the amount of 22,000 rubles was also paid. and subsequently returned from the budget. A month later, the car was sold for 118,000 rubles, of which VAT was 18,000 rubles. The amount of depreciation during operation is 54,000 rubles.

The company's accounting policy provides for the determination of revenue for VAT on payment, so the original cost of the equipment, as well as depreciation and residual price, will be written off.

Recycling collection

This type of fee appeared in Russia only in 2012 in order to ensure the environmental safety of the environment and human health from the harmful effects of cars during their operation.

Initially, it was planned that all the money received in this way would be used to improve the environment, but now it is actually intended for the further safe disposal of each piece of equipment for which this tax was paid.

Some people believe that every citizen is required to pay a recycling fee when purchasing a car, but this is not at all true, because Such transfers are made only in two cases:

- If equipment is imported from abroad. For example, an individual buys a car in Japan and independently delivers it to Russia. The fee is paid once upon import.

- If a used car is purchased from a person who is exempt from paying the recycling fee or who has not transferred it within the established time frame.

Thus, recycling fees are paid only once for each vehicle, regardless of the number of owners. In most cases, this is done by car dealerships when delivering new cars.

There are several situations where citizens or organizations may be exempt from paying recycling fees:

- If the car is over 30 years old, it is used for non-commercial purposes, and the numbers of its engine, frame and body are also preserved.

- If the equipment is registered as the property of diplomatic missions and consulates, or employees employed in such bodies.

- If the transport is imported into the territory of the Russian Federation by a participant in the program for the resettlement of compatriots from abroad, and uses it for personal purposes.

The basic (minimum) recycling fee rate for passenger cars is RUB 20,000; for freight, passenger and commercial passenger transport – 150,000 rubles.

To save on taxes and fees, you should give preference to small cars with a small amount of horsepower and a small engine capacity per cm3. This will not only significantly reduce the amount of various payments, but also significantly reduce gasoline costs. There are no other ways to save, except for the use of benefits for certain categories of citizens.

Purchase on credit

The question of whether tax compensation is provided for persons who purchase a car on lease or on a car loan is quite relevant. At the moment, the article of the code regulating the procedure for obtaining a deduction does not contain information regarding transport or other movable property. Based on this, until the adoption of a new law, it is impossible to return the funds spent on tax when buying a car.

The question of whether it is possible to return the tax paid when purchasing a car is relevant for many citizens. Current legislation provides for a number of cases in which it is possible to receive a deduction in the amount of 13% of the value of the property. However, the list only includes real estate properties. Therefore, it is impossible to refund the amount of tax paid when purchasing a car until amendments are made to the tax code.