Prices for new cars continue to rise in Russia. In 2021, the list of cars subject to luxury tax has expanded again. In 2017, the list included 909 models, and now 217 more have been added to them. Thus, the total number of cars subject to the tax is 1,126 units. Which cars are subject to additional taxation, as well as how to calculate the amount of tax - read the article.

Why is there a luxury tax on cars?

- Replenishment of regional budgets.

- Support social balance.

- Stimulating demand for domestic cars that are not subject to an additional coefficient.

REFERENCE

Luxury tax – this is the coefficient that increases the amount of transport tax in 2021. Payment of transport tax applies to all owners of passenger cars. For cars whose cost exceeds 3 million rubles, when calculating the amount of transport tax, an additional coefficient is applied in accordance with clause 2 of Article 362 of the Tax Code.

List of cars subject to luxury tax

The biggest factor in all of these additional costs is the cost of the vehicle. Namely, the official price of the car. That is, if a person bought a car second-hand, for example, for two and a half million rubles, and its real price, presented in automaker catalogs, exceeds three million, then the owner will still be required to pay this tax.

In order to avoid troubles with the above-described point, it is necessary, before making a purchase, to go to the official website of the Ministry of Industry and Trade and view the list of cars for which the car owner will be required to pay luxury tax in 2018. This electronic document can be updated daily, so it is recommended to periodically visit the government resource to always be up to date.

Another important point is that car owners who fall under the luxury tax pay this fee annually on one receipt along with the regular transport fee. That is, if the car is included in the list of luxury vehicles, then its car owner will receive a receipt with the coefficient already added.

New list of cars subject to luxury tax in 2018 – Ministry of Industry and Trade

The introduction of a luxury tax in the Russian Federation is not an innovation. Transport taxes have been collected in Russia for several years now. It applies not only to passenger cars, but also to other vehicles: sea and river transport (including yachts, boats), aircraft.

When searching for information about the luxury tax, Russian citizens are most often interested in the list of car models subject to additional taxes in 2021. The Ministry of Industry and Trade published a 44-page document including a complete register of “luxury” cars. View the list on the official website of the Ministry.

The Ministry of Industry and Trade obliges owners of cars over a certain value to pay a luxury tax, regardless of the price at which they were purchased. Thus, the list may include cars whose purchase price was less than the current market value. This is due to the constant increase in prices for vehicles due to inflation, changes in exchange rates, etc.

Despite price hikes, the government has yet to increase the threshold for car prices eligible for luxury tax deduction. Because of this, the list of cars is constantly expanding. In 2021, additional expenses will have to be incurred by car owners whose cars are valued at more than 3 million rubles. However, some cars more expensive than this amount are not on the list, so you should check the official list before paying the tax.

About half of the list consists of cars costing from 3 to 5 million rubles, and they can hardly be called luxury. Just 4 years ago, when purchased, they cost less than 2 million and were barely entry-level premium.

Basic concepts and nuances of the law

The luxury tax is calculated using a special factor that is added to the regular annual vehicle tax formula. The size of this additional multiplier depends on two factors:

- The official value of the vehicle;

- Year of its release.

That is, to accurately calculate the tax, you need to know the coefficient, which can be obtained from the following data presented on the official website of the Ministry of Industry and Trade:

- Cost of the car: from 3 to 5 million rubles. Cars up to one year: coefficient – 1.5, two-year-old cars: coefficient – 1.3, three-year-old – 1.1.

- Car price: from 5 to 10 million. The coefficient is 2 if the vehicle is less than five years old.

- Transport price: from 10 to 15 million rubles. Age – no more than 10 years. Coefficient – 3.

- The price is above fifteen million rubles. The coefficient is similar to (3), but the age of the vehicle covered by the law is increased: up to 20 years.

Article on the topic: How to properly dispose of an old or salvage car

That is, having this information, you can quite simply calculate the amount of tax in 2018. But, before making the final calculation, it is important to know a few more important points that the state came up with.

Luxury odds size in 2021

The formation of an increasing coefficient depends on such indicators as:

- Cost of the vehicle.

- Vehicle production date.

The higher the cost of the car, the higher the coefficient. However, as the age of operation of a passenger car increases, the tax amount becomes smaller, and upon reaching a certain limit, the luxury tax is canceled.

IMPORTANT

When calculating the tax amount, you need to pay attention to the vehicle's equipment.

The same model, for example, a Ford Explorer, is subject to the tax in the extended Limited trim level, but the base trim level is not subject to the additional factor. When calculating the luxury transport tax, the price category of the passenger car is taken into account. Depending on the cost, a coefficient is assigned:

- First category (3-5 million rubles) – 1.1. Suitable for cars up to 3 years old.

- Second category (5-10 million rubles) – 2. Applicable for cars up to 5 years old.

- Third category (10-15 million rubles) – 3. Applicable for cars up to 10 years old.

- Fourth category (more than 15 million rubles) – 3. Applicable to cars up to 20 years old.

REFERENCE

In 2021, the coefficient for passenger cars worth 3-5 million has been reduced. Previously, it ranged from 1.1 to 1.5 depending on the age of the car. According to the amendment to Art. 362 of the Tax Code of the Russian Federation, Federal Law No. 335-FZ, when calculating transport tax, a minimum coefficient of 1.1 will be applied to all cars.

Luxury Tax Increasing Coefficients

The surcharge applies to the average cost of the vehicle and the upper limit is inclusive. In 2018, the following coefficients apply:

1.1 – at a cost of 3 – 5 million rubles, if manufactured 3 or less years ago;

2 – at a cost of 5 – 10 million rubles, if made 5 or less years ago;

3 – at a cost of 10 – 15 million rubles, if made 10 or less years ago;

3 – at a cost of 15 million rubles. or more if made 20 or less years ago.

How to Calculate Luxury Tax on Cars in 2021

You can find out the tax amount yourself. To calculate how much you will have to pay in addition to the transport tax, you can use a special calculator or formula:

To calculate the full amount of the fee, you need to multiply the coefficient by the basic transport tax rate, as well as the number of horsepower of the car. The greater the engine power, the higher the collection amount will be.

ATTENTION!

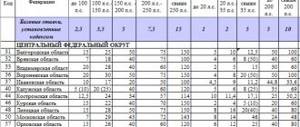

The luxury tax rate for cars varies in different regions of Russia according to local laws. When calculating, the rate of the region in which the car is registered is used. It depends on specific factors and is regulated by local authorities. The spread of rates across the country is quite high. Thus, in different territories, the transport tax for a car with a power of 100 hp is. is:

- Chechnya - 200 rubles;

- Ingushetia – 500 rubles;

- Chukotka Autonomous Okrug – 500 rubles;

- Trans-Baikal Territory - 600 rubles;

- St. Petersburg – 2500 rubles.

Instructions for calculating luxury tax

Based on everything written above, we can finally calculate the amount that will have to be paid to the state annually for the opportunity to own such a vehicle. How to do it right:

- Go to the website of the Ministry of Industry and Trade, find your brand in the list of cars and find out its official cost;

- Get information on the year of manufacture of the car in order to finally decide on the additional coefficient;

- Look at the vehicle's passport for its power;

- Find out the tax rate for the place of vehicle registration.

Further calculation is shown with a clear example.

Initial data:

- Place of registration: Krasnodar Territory;

- The power of the power unit is 249 horsepower. That is, the tax rate for this engine and region is 75;

- The cost of the car is three and a half million rubles;

- Age – one and a half years. It turns out that the coefficient for this vehicle option will be equal to 1.3.

Article on the topic: The best Japanese crossovers and SUVs

The following is the simplest calculation:

Horsepower multiplied by tax rate and luxury factor: 249 x 75 x 1.3. It turns out that the owner of such a car will have to pay the state 24,277.5 rubles this year.

Who doesn't have to pay luxury tax in 2021?

Certain categories of people may be able to avoid paying additional fees. The following persons are exempt from paying tax in 2021:

- disabled people of groups 1 and 2;

- WWII veterans;

- heroes of the Russian Federation and the USSR;

- participants in various military operations;

- liquidators of the consequences and victims of the Chernobyl nuclear power plant;

- parents with many children.

Thus, in order to avoid paying tax in a legal way, you can re-register the vehicle in the name of a person subject to benefits. However, it is worth considering that the exemption from paying the fee can only apply to one vehicle with an engine power not exceeding 150 horsepower. The beneficiary will have to pay for the remaining vehicles.

Luxury Car Tax 2018 - Car List (List current in 2021)

Lexus, Jaguar, Chevrolet Tahoe, Patrol, Porsche Cayenne, Prado and Cruzak - by law, all these brands are included in the list of luxury brands. Owners of all of the above cars will have to multiply the standard price by the so-called luxury factor. At the same time, experts predict that due to the appreciation and fall of the ruble, the tax contribution will have to be increased in the future. Already in January, March and April next year, the relevant ministry will prepare new rules for payments.

In many European countries, the tax is determined solely from the horses and not the stamps. In addition, an amount is contributed to the regional budget if you have a yacht or snowmobile.

Luxury home tax: how to avoid paying

A large number of benefits, as always, were included in the country's legislation. pensioners, disabled people, veterans and heroes, as well as even sculptors receive a fairly attractive discount. But even these discounts do not apply to houses with a high cadastral value. So in Russia, everyone whose car or quart costs many millions of rubles is subject to the obligation to pay increased taxes. You can outwit the legislation only if you do not publish the entire footage or look for other workarounds.

Why on earth am I required to pay tax on my Volkswagen Touareg?

With such that, according to the law, in this regard, everyone is equal - both enterprises and individuals (with the exception of those whose engine power is equal to or less than 75 hp - Volkswagen Touareg cars, as you might guess, are not included here). The amount of transport tax depends on:

- 1. Prices for the car (if it is > 3 million rubles).

- 2. The subject in which the car was registered (each region has the right to set its own tax rate).

- 3. Engine power (the same Bavarians are often equipped with engines ... hp - accordingly, this number should be multiplied by the tax rate).

Taking into account the above, and bearing in mind the base rates established by law for any subject of the Russian Federation, we decided to publish a table of the total amounts of transport tax for various regions - using the example of Volkswagen Touareg cars.