Procedure for selling a vehicle by a legal entity

A private citizen or an organization can sell a car. In the first case, the transaction is carried out in a standard way: a purchase and sale agreement is drawn up between the seller and the buyer or a general power of attorney is issued. Payment for the car is made in cash.

If the seller is a legal entity, the situation becomes more complicated. The parties need to draw up a sales contract, and the current owner of the car - the organization - needs to carry out the following procedures:

- The head of the company issues an order to sell the machine. In an LLC, the decision to sell a car is approved by the general meeting of founders. Even if the owner is one person.

- It is required to estimate the cost of the car with the assistance of specialists.

If a transaction occurs between two legal entities, the buyer company also issues a corresponding order.

Buying a car from a legal entity

Buyers believe that an officially registered company provides more guarantees than a reseller on the car market. In fact, it turns out that organizations deceive motorists much more often than individuals.

What vehicles can be purchased from companies:

- Cars that enterprises write off from their balance sheets after their depreciation period has expired.

- Cars that are sold because the organization no longer needs them.

- Cars that have become unnecessary after updating the fleet.

- Cars sold to pay off debt.

- Cars being sold due to liquidation of the enterprise.

- Used cars in car dealerships.

When buying a car at a dealership, a car enthusiast runs the risk of stumbling upon a fly-by-night company or purchasing a problematic car . The salon acts only as an intermediary and is not responsible for the technical condition of the vehicle.

Purchasing a vehicle that is on the company’s balance sheet risks that the buyer will receive a worn-out vehicle that will constantly need repairs. Therefore, you need to identify a reliable reason for the sale and make a purchase decision on this basis. If a car is being sold due to a fleet renewal, most likely its parts are worn out and the buyer will encounter problems.

Reasons for selling a car by a legal entity

Organizations get rid of their own transport in the following circumstances:

- the car needs to be written off as wear and tear reaches a certain level, or its depreciation period ends;

- the company's vehicle fleet was significantly updated, which resulted in an oversupply of transport;

- the company lacks financial resources, and selling the car will help cover the deficit;

- the selling organization no longer needs to use this machine;

- The company is in the process of reorganization or liquidation, so it needs to free up its balance sheet.

Transaction procedure

The sale of a car by a legal entity to a private citizen takes place in several stages:

- The parties draw up a purchase and sale agreement. The document must contain information about the legal entity and personal data of the buyer, the cost of the vehicle and other important nuances.

- Payment is being made. By agreement, the buyer can deposit money into the organization’s current account, or transfer it personally to a representative of the company.

- An act of acceptance and transfer of the vehicle is drawn up.

- The buyer applies to the traffic police department to register the vehicle with the state. As a result, information about the new owner is entered into the car’s title.

The buyer of the vehicle is required to sign a purchase and sale agreement, deposit money and register the vehicle with the state. The procedure for buying and selling a vehicle between an organization and a private citizen is similar to that between two individuals. The difference is that the seller - a legal entity - needs to issue an appropriate order.

Selling Features

Before signing the purchase and sale agreement, the buyer is advised to check the legal integrity of the company. Otherwise, you may be left without a car and without money.

First, you need to find out why the company sells a fleet of vehicles, whether it is in conflict with the law, and whether it pays taxes regularly. All information can be found on the Internet. The buyer needs to check:

- The presence of legal claims against the seller.

- His tax payments. The official website of the Federal Tax Service is used for this.

- Availability of enforcement proceedings. To help - the web resource of the FSSP of the Russian Federation.

- Business reputation. To find out this information, just enter the company name into any search engine.

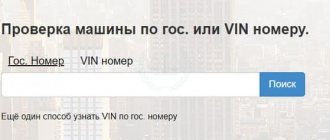

The next step is to check the car itself. A potential buyer can make inquiries about the vehicle using the following databases:

- traffic police;

- FSSP - check the owner of the vehicle for debts;

- Verification sites checking VIN number;

- Pledge registry.

How can an individual buy a car from a legal entity?

There may be several options for individuals to purchase a vehicle from a legal entity:

- Purchasing a new car at a car dealership.

- Purchasing a used vehicle that the organization is selling as unnecessary.

In this case, there are no fundamental differences from a standard purchase and sale transaction. The procedure is carried out according to the usual scheme described in the Civil Code of the Russian Federation. There are only two nuances that distinguish this type of relationship:

- the need to check the seller for legal purity;

- additional documents when drawing up the contract.

Checking for legal purity

The main danger of this type of transaction lies not in the condition of the car, but in the legal purity of the seller. Various financial problems are a common situation in the activities of any organization. Before purchasing a car, you should check the seller in the following ways:

- Obtaining an extract from the Unified State Register of Legal Entities. This is a basic check that you cannot do without. This can be done on any website that provides information about counterparties, or on the portal of the federal tax service. As introductory information, you will need (one point is enough): the name of the company, full name of its founder, legal address, identification codes (TIN, OGRN). Thanks to the extract from the Unified State Register of Legal Entities, you can filter out:

- fly-by-night companies registered several months ago and already selling off their property;

- taxi or leasing companies selling vehicles that are unlikely to be in good condition. The main area of activity is also indicated in the statement;

- companies with a large number of founders. If the amount of the car sale is more than 25% of the legal entity’s fixed assets, then written approval from all co-founders will be required. Closing the deal may take a while.

- Checking for tax debt. This verification option is carried out on the Federal Tax Service website. You only need the TIN of the legal entity. A “good” company should not have tax arrears.

- Checking for registration changes. You can find out about submitting documents to make changes to registration data on the tax service website, in the “Information about submitted documents” section. You will need the OGRN and the full name of the organization. If a company has applied for such changes within the last year, this should raise red flags.

- Bankruptcy check. It is carried out according to the unified federal bankruptcy register. To verify, you need the full name of the legal entity and any identification code.

- Checking for arbitration claims against the organization. For these purposes, it is worth using the free portal “Electronic Justice”. To obtain information, an INN or OGRN is sufficient.

- Checking for the presence of unfinished enforcement proceedings. The car can be confiscated by bailiffs, even after the transaction is concluded. You can check it on the FSSP website. To obtain data, you will need the name of the legal entity and the region of its registration. There should be no data on the presence of production facilities.

What documents should a legal entity have?

Standard package of documents for concluding a transaction:

- documents for the car (PTS, STS, diagnostic card);

- purchase and sale agreement in 3 copies;

- vehicle acceptance certificate;

- order of the founder to sell the car;

- conclusion on the market value of the vehicle;

- a copy of the statutory documents;

- TIN and extract from the Unified State Register of Legal Entities;

- documents confirming the ownership of the car;

- certificate of absence of collateral and encumbrances;

- power of attorney for a representative.

The distinctive features of this type of transaction are the presence of a management decision to sell and a conclusion on value . Detailed description of these documents:

- Order of the founder on the sale of the vehicle. The authorized person who issued this document may be the general director or the board of directors (collective, recorded decision). The paper contains all the data about the object of sale, its price and other terms of the transaction. The order is certified by signature and seal. One copy of the document is given to the buyer.

- Conclusion about the cost of the car. It is necessary to exclude financial fraud and the sale of cars at a reduced price to interested parties. An opinion can be drawn up by a third-party expert not related to the legal entity. It is important that the price indicated in the document is in the same range as the market price. Otherwise, the tax service may be interested in the transaction.

Documentation

At the end of the transaction, the buyer must receive the following papers:

- a copy of the purchase and sale agreement;

- PTS and STS cars;

- inspection card.

The seller is not obliged to transfer the MTPL policy to the buyer. The new owner of the car draws up a document in his name.

Car purchase and sale agreement

There is no need to deregister the vehicle and notarize the purchase and sale agreement.

If the owner wants to keep the previous license plates in order to use them on a new car, he must submit an application to the traffic police. In this case, the license plates will be stored by the traffic police for 180 days.

The execution of an agreement between legal entities and individuals is carried out in accordance with standard requirements. The section where the seller is indicated must contain all significant details of the current owner of the vehicle. The individual signs the agreement, and the enterprise puts the stamp and signature of the head of the institution on it.

Disadvantages of buying a car from legal entities

You need to know the nuances and possible fraud schemes when buying a car from an organization in order to save your nerves and money. Disadvantages of this deal:

- You may encounter a fly-by-night company . It doesn’t matter whether the transaction is concluded with a car dealership or with another enterprise. The buyer signs the contract, gives the money in cash to the company employee and receives the car. After some time, the head of the organization reports the theft and says that his employee completed the transaction without his consent, and then disappeared with the money. As a result, the buyer is left without money and without a car, which will be confiscated by court decision.

- You can buy a vehicle from an individual . An employee of an enterprise can draw up an agreement without specifying the details of the organization. This is then considered an agreement between individuals. The employee hands over the car, takes the money himself and disappears. The director of the company may not be aware of such a scheme and may himself become a victim, unlike the previous fraud scheme. To protect yourself, you need to read the contract carefully.

- You can purchase a used vehicle . Everyone knows that mileage varies, and this is not an indicator of the condition of the car. Therefore, before buying, you need to pay attention to other signs: how worn the seats and steering wheel braid are, whether there are any leaks of technical fluids, what condition the sills and bottom are in.

- You can buy a car that is pledged to a bank or under arrest from bailiffs . To avoid falling into such a trap, you need to check the car in open databases before purchasing.

- You can buy a car at an inflated price . It is best to make an independent assessment of the value of the car if the buyer does not understand this on his own. The expert will assess the condition of the car and the price level on the market. If a company is trying to sell a car at book value and provides a certificate from the accounting department, this is a reason to think about an independent audit.

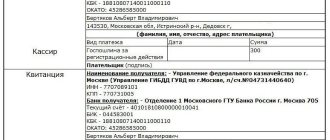

To protect yourself from scammers, you need to study information from open sources : how long the company has been operating, who the director is, what is the registered address. You can look for reviews about the company on the Internet, they will provide a lot of information. You need to remember that money for the car must be given only to the cashier, where they are required to issue a receipt.

Registration of vehicles with the traffic police

The fact that the car is purchased from an enterprise and not from a private individual does not change the scheme for registering it with the State Traffic Inspectorate.

The new owner has 10 days to register the vehicle. You need to bring to the traffic police department:

- application for state registration of the car;

- applicant's passport;

- vehicle registration certificate;

- technical inspection report;

- purchase and sale agreement;

- OSAGO insurance policy.

The vehicle registration service is paid - 2000 rubles. A receipt confirming the fact of depositing funds must be submitted simultaneously with the application. You can make an appointment with the traffic police through the Gosuslugi.ru portal.