Finding a program for buying a car on credit is not difficult. It is more difficult to pay large sums every month to repay the debt to the bank, to which the car is pledged as collateral for the entire loan term. Selling a car on credit while collateral restrictions are in effect is not so easy. A detailed study of the nuances of transactions with collateral will be required in order to find a profitable buyer and sell without problems with the law prohibiting any transactions with property registered as collateral.

Terms of sale of a credit car

When purchasing a car in installments, movable property becomes the collateral property of the financial institution. Sale of transport is possible only after the request is approved by the bank.

Basic conditions for selling a car on credit:

- timely notification of the bank about insolvency;

- obtaining permission from a financial institution to sell transport;

- loan re-issuance.

The law does not establish fixed conditions for the sale of a car purchased on a loan. The procedure is determined by the financial organization that issued the funds. The procedure is carried out taking into account the terms of the agreement.

How much cheaper is a credit car sold?

Nobody wants to deal with a credit car, fearing troubles with the bank or unexpected problems with creditors or FSSP employees after the transaction. The second disadvantage of selling a secured car is the lengthy processing of the transaction. If a regular sale is completed within half an hour, it is possible to sell a car on credit in a few days. To convince the buyer to agree with such inconveniences, it is necessary to have additional trump cards - exceptional conditions for the transaction and a good discount from the market price.

Experts recommend starting the sale with a 5% discount on average car prices, and if there is no interest on the part of buyers, gradually reducing the price. It is known that car dealerships undertake to sell a vehicle only if they promise to reduce the cost by 15-20%. This reward will be enough for the car dealership to begin to deal with the nuances of removing the deposit and finding a future buyer. If the car is damaged, the price is unlikely to cover the debt to the bank, which means additional funds will be needed to completely cover the debt.

Sales options

Financial difficulties are a common reason for selling a pledged vehicle. Legal grounds for sale are dismissal, layoff, decrease in income, birth of a child, illness of a close relative.

It is important to know! To satisfy the request, the citizen must document his own insolvency. Financial organizations have established ways to sell a credit car in accordance with Russian legislation.

Through a car dealership

Official dealers offer clients a trade-in program. The main condition is the sale of the movable collateral in the showroom and the purchase of another vehicle. The price is automatically reduced by 10-15% of the market value of the car. The money received will be pledged to purchase a new car along with a CASCO insurance policy to pay compensation in the event of an accident.

If the price of the selected vehicle is higher than the previous model, the borrower has the right to pay the difference at his personal expense. For the provision of services, commercial companies charge interest, which is not taken into account when repaying debt to the bank.

Via bank

To carry out a legitimate transaction, you need to notify the company that issued the loan about the difficulties that have arisen. Selling a car without notifying the financial institution may be considered fraud.

Banks have determined the ways to legally sell a credit vehicle:

- changing the form of monthly payment;

- holding an auction;

- re-registration of the borrower.

If insolvency is confirmed, banks may grant a deferment or reduce the amount of proceeds. Reducing the interest rate increases the loan term. When selling a car through auction, the amount of possible profit is reduced. This option is not a way to sell vehicles. But changing the form of monthly payment allows you to minimize the financial burden.

The funds received at the auction may not cover the loan amount. To pay off the remaining loan, you will have to contribute personal savings. A citizen has the right to independently find a potential buyer willing to purchase collateral movable property. To reissue a car loan, it is enough to notify the bank to check the solvency of the future borrower. In this case, the vehicle is sold at a reduced price, which obliges the new owner to continue repaying the loan to the financial institution.

Re-registration of the collateral

When receiving a loan, the vehicle becomes the property of the borrower, but he does not have the right to dispose of the property until the funds are fully paid to the bank. Therefore, citizens are interested in whether a car can be sold if it is on a car loan. For legal implementation, the client has the right to change the pledge. Instead of a car, the borrower can offer real estate or land to the financial institution as a guarantee of timely repayment of the loan. The new object should not cost less than the previous collateral.

Advice! After re-registration of documents, the citizen becomes the full owner of the vehicle, which can be sold legally.

Car loan refinancing

Debt repayment is an alternative option for selling a secured vehicle. Ways to pay the full amount are to apply for a consumer loan or change the owner of the car. The refinancing program allows you to take out a loan from another bank on more favorable terms and for a longer period. A citizen has the right to independently find a potential buyer who will give cash for early repayment of the loan.

Is it possible to sell a credit car?

A lien is not a lien, so the words about the impossibility of selling a car until the debt is paid are a clear exaggeration. However, the pledge involves protecting the financial interests of the lender who has provided the borrower with the amount necessary for the purchase. Selling a credit car is more difficult to execute, but it is quite possible. The main thing is that the pledge holder is aware of the upcoming transaction and gives the go-ahead for it to proceed.

There are several options for how to sell a pawned car. The choice depends on the specific circumstances of the sale and the willingness to comply with certain nuances.

The scheme of the transaction for the alienation of credit vehicles depends on who stores the original title - the bank or the borrower.

PTS in hand

In rare cases, the vehicle passport remains in the hands of the car owner. This means that the borrower will have all the necessary documents to complete the transaction. To sell a credit car with a title in hand without breaking the law, you must obtain the consent of the lender.

Scheme for approving a transaction with the original PTS in hand:

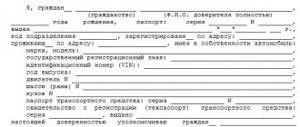

- Contact the bank with a notification of the planned sale of the vehicle. The borrower writes an application in free form, or takes a form from a branch of a credit institution.

- When considering the application, the bank employee will offer to agree on one of the available options for conducting the transaction.

- The borrower has the right to choose: to independently search for a seller or transfer authority to the bank, obtain another loan to close the car loan and remove the collateral. It is possible to involve a car dealership in the sale, or the car is transferred for sale through an auction.

- Depending on the choice of the car owner, further steps will be adjusted and controlled by a representative of the creditor, since the removal of collateral and liquidation of credit debt is in the direct interests of the financial institution.

Even if the PTS is in hand, this does not eliminate the need to coordinate the transaction with the bank. You need to be prepared to delay the process due to the need to coordinate each step, as well as to reduce the price below the market average in order to convince the buyer of the profitability of the deal.

PTS in the bank

One of the conditions for obtaining a car loan is the transfer of the original title to the bank for storage. The absence of the main document for the vehicle significantly complicates the approval process, if not makes the transaction impossible. No buyer will take a risk by purchasing a car without a title, and if it is kept by a lender, they will have to contact the bank in any case.

In order to sell a credit car, having received the bank’s approval, they submit an application and agree on a scheme for re-registering the vehicle to the new owner - through the buyer depositing the amount into the credit account or changing the borrower.

In the first case, you need to involve a notary:

- The buyer and the seller enter into an agreement and have it certified by a notary.

- The new owner deposits into the account the amount missing to close the car loan.

- The remainder (if the purchase price exceeds the amount of debt) is given to the former owner.

- The further procedure for re-registering a vehicle with the State Traffic Safety Inspectorate and purchasing a policy no longer requires the participation of the seller.

Due to the fact that the contract is signed before the actual transfer of the amount, there is a risk of encountering scammers who “forget” to pay the motorist.

In the second case, the transaction takes place with the direct participation of the bank:

- The buyer submits a request to re-register car loan obligations.

- The bank, having transferred the loan debt to the new owner, readily agrees on the purchase and sale, while maintaining the same amount of collateral. The main difficulty of such execution is finding a buyer willing to take out a loan from the same bank as the previous car owner.

- After transferring the debt to another person, the bank will issue a new repayment schedule, exempting the current owner from further payments. He will be given the remainder of the amount remaining after deducting the amount of the unpaid loan from the cost of the car.

The bank itself does not like to sell a credit car. This requires additional resources from the bank related to organizing the sale of the collateral object. The bank prefers to transfer the authority to find a buyer to the borrower, watching as the new owner buys the vehicle on legal terms and transfers money to eliminate the debt.

Car sales algorithm

A vehicle technical passport is a document that contains detailed characteristics of the vehicle and personal data of the owner. Financial institutions have the right to take away the title when issuing a car loan.

Attention! The document is sent to the bank for storage within 15 days after the loan is issued. A technical equipment passport is issued to a citizen only for registration of a vehicle with the traffic police.

If PTS is in hand

Banks have the right to issue a technical passport to the borrower after purchasing a vehicle. Keeping the document with the buyer is a risk for the financial institution, which may face fraud by unruly citizens.

The procedure for selling a credit car if you have a PTS:

- Submitting an application to the bank.

- Waiting for a decision to be made.

- Choosing a way to sell a vehicle.

- Make a deal.

The borrower is required to write an application in free form. Up to two weeks are allotted for consideration of the application. Upon receiving a positive answer, the citizen must choose an option for selling the car: re-issuing a loan, searching for a buyer independently, selling the car through a dealership, or at an auction. The conclusion of the transaction must be carried out with the permission of the financial institution.

If PTS is in the bank

The technical passport of the collateral vehicle is a guarantee of regular payments by the borrower. This is not a reason for the impossibility of selling movable property. When applying for a loan, drivers have the right to find out how to sell a credit car if the title is in the bank. The client must write an application and wait for a response from the financial institution. There are two ways to sell a vehicle if you don’t have a technical passport: signing an agreement to another buyer, changing the owner of the car. The borrower independently chooses the option of selling the car.

Buying a car mortgaged to the bank: how to do it right?

Buying a car is a serious and expensive matter. In order not to get into trouble when faced with fraud or due to ignorance of legal subtleties, it is enough to follow only a few simple rules, which, surprisingly, many neglect. Let's consider a standard situation: you have finally decided to buy the car of your dreams. But you don’t have enough money for a new car, or you think it’s unprofitable. One way or another, you decide to buy a car second-hand. You find an advertisement for the sale of the car you want, meet the owner, and you are completely satisfied with the condition of the car. But the car is pledged to the bank. Is it possible to buy such a car? What are the risks of such an acquisition? And how to protect yourself from unforeseen troubles?

If a car is pledged to a bank, this does not mean that it cannot be bought or sold. Schemes for transactions with pledged cars have existed for quite a long time, and citizens have successfully used them. The main thing you need to understand when agreeing to a deal with a mortgaged car is that it is on the bank’s credit balance. That is, the car seller, if he does not fully repay the loan during the transaction, through the same transaction transfers his obligations to the bank to the buyer, if the bank gives its consent to such an operation.

If you agree to the transaction, then it is better to carry it out at the bank branch that holds the car as collateral. In the first option, the seller must inform the bank that he is going to pay off his car loan early. To ensure that the car purchase is completed in accordance with all the rules, it is advisable to invite a notary to the transaction. The owner of the pledged car agrees with the credit institution (bank) and the notary on all issues related to documenting the transaction.

The procedure for repurchasing a pledged car from a bank is as follows: the parties sign a purchase and sale agreement, certified by a notary, then the buyer pays for the purchase, after which the seller fully repays the loan by depositing the required amount into the bank’s cash desk. The bank must release all liens on the car by filing a notice with the registry of notices of liens on movable property.

In the second option, the bank first approves the assignment of rights of claim in the amount of the remaining amount of the seller's debt to the bank for this car. The buyer and seller then sign a purchase and sale agreement, certified by a notary. If the cost of the car exceeds the amount owed to the bank, the buyer pays the difference to the seller. After completing all the documents, the bank submits a notification to the register of notifications on the pledge of movable property about the removal of the pledge from the seller and about the emergence of a new pledge on the same car, but on the buyer.

However, it may turn out that you buy a car that is pledged without even knowing it, and after a while you find out that you must either find the previous owner or pay off someone else's loan.

If the owner kept silent during the transaction that the car was pledged, it is most often impossible to find it. And you, having spent money on the purchase, will either lose the car or will have to pay the bank money, essentially buying the same car for the second time. A notary can also help you avoid such an unpleasant situation. It is enough to come to him, having the VIN of the car you want to buy, and the notary will check in the register of notices of pledges of movable property, whether the car is pledged or not, and will issue you a document which will indicate that on a certain date and time the car was not listed in the pledge registry. This guarantees you that the bank will no longer be able to challenge your right to own this car, even if the car was pledged, the bank simply for some reason did not enter information about this into the register. You can check the register data yourself, on the website of the Federal Notary Chamber, but only thanks to a document from a notary, even if the car is still pledged, but the information has not been entered into the register, the bank will not be able to force you to pay someone else’s debt or take the car. a document granting a person the right to perform a certain action by a person whose consent is required to complete a particular transaction in accordance with the law. Notarized consents include: consent of the spouse to complete a transaction (both for the acquisition and alienation of property), consent to refuse privatization, consent to travel abroad of a minor child, consent of the owners (tenants) of housing for temporary registration. legal and individuals who enter into or have entered into an agreement with each other. A party to the agreement may be the state (the Russian Federation, its subjects), which act on an equal footing with other participants in civil law relations. an agreement of two or more persons on the establishment, modification or termination of civil rights and obligations. an official authorized by the state who has the right to commit notarial actions on behalf of the Russian Federation in the interests of Russian citizens and organizations (legal entities). loans, commodity and commercial loans, loans, bank deposits, bank accounts or other borrowings, regardless of the method of their execution.

Responsibility for illegal sales methods

Wrongful sale of a loan vehicle is the basis for the application of punishment under the Civil Code of the Russian Federation: recognition of the completed transaction as invalid, seizure of the car, return of funds. Acquisition of property by illegal means is subject to a fine of up to 120 thousand rubles, compulsory labor for up to 360 hours, or imprisonment for up to two years in accordance with Art. 159 of the Criminal Code of the Russian Federation.

After applying for a car loan, the borrower has the right to sell the pledged car before making the last payment. The implementation procedure must be approved by the financial institution that issued the loan. Unlawful actions to re-register a vehicle are a violation of Russian legislation.