What is total in CASCO insurance?

Total under CASCO is the complete or partial loss of a car due to an event covered by the insurance policy. A vehicle is considered unsuitable for restoration if more than 70% of its structural elements are damaged.

Important! The insurance amount is calculated according to the principle: for each month that has passed since the signing of the contract, a percentage of depreciation is deducted.

Total compensation will be paid if the car was damaged as a result of the event:

- fire;

- serious accident (collision with a pedestrian or obstacle, rollover, running off the road);

- natural disaster;

- unlawful actions of third parties (utility or technical services, criminals, etc.).

The extent of damage caused is determined through an independent assessment. The insurance company requests an inspection, then attaches the report to the contract.

What is included in CASCO insurance can be found here.

Total is beneficial for insurance companies because:

- after payment of compensation, the contract is terminated, and the unclaimed insurance premium remains with the company;

- the company can repair the car or sell it for parts, which will cover part of the costs;

- in some situations, an entire part of the vehicle turns out to be more expensive than was revealed during the assessment.

The driver, if in doubt about the difference, can send the insurer a request to recalculate the amount of compensation, attaching the conclusion of an independent appraiser to the case. If the company refuses to re-examine, the car owner has the right to file an application in court.

You can learn about the features of CASCO insurance for a car here.

What it is?

CASCO TOTAL is insurance of a car against its total loss as a result of an insured accident. Insurance companies understand that by total loss of a vehicle there is damage to the car, the restoration of which will cost the insurer more than the payment of the full insured value of the car.

To avoid disputes between the policyholder and the insurer about when a situation occurs in which the damage allows the car to be considered beyond repair, the insurance contract specifies a percentage of the stated price of the car.

Typically this limit ranges from 65 to 80 percent.

Typically, the risks associated with the complete loss of a car are already included in the cost of CASCO, but such full-fledged voluntary car insurance contracts are not suitable for all citizens. Some of them only need insurance against total loss of the car. Especially for this category of clients, insurers have developed a separate subtype of voluntary insurance: CASCO TOTAL.

Choose the CASCO insurance program that is right for you. We recommend reading the following material:

- CASCO Light.

- CASCO 50/50.

- “Boxed” CASCO insurance.

Options for paying under CASCO insurance in case of total loss of a car

Total loss of a car under CASCO is paid in three forms:

Full compensation

The insurer pays the entire amount for which the car was insured. The client signs an abandonment agreement - ownership of the vehicle is transferred to the company, for which he receives compensation. For example, if a car was insured for 1,000,000 rubles, then the owner will receive exactly that much (without any deductions). These are quite favorable terms of cooperation, but they are not so common.

Article on the topic: Rules and conditions for registration of the CASCO program “To the Ten”

Important! Insurers often try to take advantage of the situation: they deduct the amount of depreciation, reducing the amount of compensation, for example, to 900,000 rubles. If a similar calculation procedure is not specified in the agreement (there is no mention of deducting depreciation), then such actions are considered illegal. The driver must go to court to protect his rights.

Payments based on wear and tear

The amount of compensation taking into account wear and tear (usually equal to 1% for each month during which the policy was in force). In this case, the remains of the “lost” car also become the property of the company. For example, if the transport was insured for 1,000,000 rubles, the amount of damage was estimated at 700,000 rubles, and the accident occurred in the 12th month, then 12% (84,000) will be deducted from the compensation. The policyholder will receive 616,000 rubles.

If the incident happened closer to the time the policy was issued, and the insurer added a clause on calculating depreciation, then the client will receive the maximum benefit. The longer CASCO insurance is valid, the less money the policyholder will receive. Moreover, the company has the right to restore the “lost” car or sell it for parts, since it becomes its property. This does not happen often, since large companies try to maintain their reputation.

The client finds himself in an unpleasant situation if the car was purchased recently and on credit: compensation from the insurance company will be transferred directly to the bank. In such circumstances, it is advisable to try to keep the broken car so that you can sell the intact parts and make a profit.

Payments minus surviving parts

The company may pay compensation, from which the cost of the usable remains of the car will be excluded. Then the “lost” vehicle with all the vehicle equipment remains with the insured.

The insurer determines the amount of compensation taking into account wear and tear, subtracting the cost of serviceable remains (GOTS), which is why not much money will fall into the client’s hands, but he will retain ownership of the car. The main objective of the CASCO policy is to preserve material property at the original level will not be achieved. This form may be more profitable if the owner can sell the parts for real value. Sometimes the car can be repaired despite the appraiser's decision.

For example, a vehicle is insured for 1,000,000 rubles. The appraisers estimated the cost of the GOTS at 300,000 rubles, restoration will cost 700,000 rubles, from which depreciation is deducted (the event happened in the 12th month, which means the depreciation will be equal to 84,000 rubles). The client will be given 616,000 rubles and the remaining elements, which he can dispose of at his own discretion.

Article on the topic: Peculiarities of the activities of lawyers under CASCO

You cannot rely only on the value of the HOTS declared by the appraisers. Companies often inflate their value to save on compensation. This fact is difficult to prove, since there is no uniform regulation for accounting for HOTS in the legislation. It is easier to assess the damage to the entire vehicle and analyze proposals for the sale of vehicles with similar breakdowns.

Important! It is recommended to use the services of an independent appraiser to make the right choice. This will help to objectively assess the benefits of each option.

How are total payments made?

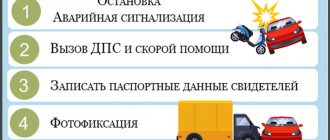

The insured event must be registered in accordance with the regulations. A representative of the company issues a memo to the client, which spells out the entire algorithm of actions in case of an accident.

You need to call the traffic police to the scene of the accident and record the insured event. If you don’t have time to wait for the traffic police and collect all the accompanying documents, you can contact the emergency commissioner. Their services cost about 1,500 rubles.

In case of an accident:

- you cannot move the car from the scene of the accident;

- you need to take a photograph of the participants in the accident and record the damage;

- collect contacts of witnesses (they may be useful if proceedings arise).

What documents are needed

Payments under CASCO insurance in case of total loss of a car are assigned upon provision of documents:

- identification;

- confirmation of ownership (PTS, STS, etc.);

- driver license;

- a copy of the insurance policy;

- certificate from the traffic police (official proof of the occurrence of an insured event).

Important! The policyholder additionally fills out an application form - it is issued at the company’s office.

What to do with valid CASCO balances

You can try to sell the usable remains on the open market, make a profit, add compensation from the insurer and buy a new car. The sale of parts can begin only after receiving the appraiser's report and documentary agreement with the company.

Important! If, according to the expert’s assessment, the cost of the HOTS is too low, then it is more profitable to leave the parts to the insurer and receive compensation. The possibility of choosing the form of payment is provided for in Article 10, Clause 5 of the Law “On the Organization of Insurance Business”.

You cannot sell GOTS if a trial is planned (for example, the client does not agree with the decision or the insurer is delaying the transfer of compensation). Re-evaluation may be required. If GOTS are not available, then the court will be able to rely only on a previously conducted examination.

If suitable parts are transferred to the insurer, the client is obliged to ensure their safety. The policyholder, as the owner of the car, bears full responsibility for it. If the HOTS receive additional damage, the company may refuse to accept it and pay compensation.

Related article: Using a CASCO policy if your car is scratched

Damaged vehicles are sent to paid parking. The insurer undertakes to pay the client's expenses necessary to transfer the car into the ownership of the company, unless otherwise provided by the contract. In practice, the insurance company is in no hurry to take on expenses. The client must notify the company that, in order to preserve the property, the car was placed in a paid parking lot, and attach a copy of the invoice for services. If the insurer’s manager offers to bring the vehicle to the office, this cannot be done, since then the owner will have to pick it up at his own expense. Additional costs can only be challenged in court.

Important! The car ceases to be the property of the driver at the moment of signing the abandonment agreement. From now on, you can stop paying for parking if the policyholder paid for it.

How are payments made if the car is a credit car?

The following procedure applies to credit cars:

- The insurance company notifies the lender about the accident, since according to the contract, compensation is due to him, and not to the driver.

- The client fills out an application for payment, in which he indicates information about himself and the vehicle, and attaches an expert report.

- The insurance company sends a response to the policyholder and transfers money to the creditor. Part of the funds may be transferred to the borrower if the insurance amount exceeds the remaining debt. For example, if the loan was repaid ahead of schedule and was repaid by 80%, then the bank may allow all the money to be sent to the policyholder’s account.

With a total credit car, the driver loses part of the profit, but reduces the amount of debt to the bank.

Total credit car

Since many vehicles are purchased on credit, a completely logical question arises: how does the comprehensive insurance payment for credit cars occur if the car is recognized as total? When concluding a car loan, the bank obliges not only to purchase a voluntary protection form, but also to appoint a financial company as a beneficiary for the entire term of the loan agreement.

This means that the bank will be the first to receive all payments from the insurer. If the total is recognized, the insurer:

- makes an examination and official documents confirming the amount of loss;

- sends a written agreement to the bank asking where to transfer funds;

- receives an official response and makes a transfer of compensation payment.

If the loan debt is less than the amount of the insurance payment, then the compensation is divided between the bank and the policyholder. In the official response, the financial company indicates the borrower's account and states the exact amount of debt under the loan agreement, within which it is the beneficiary.

The insurer can also make a transfer in full to the bank’s account, when it, in turn, debits the required amount and invites the borrower to receive the remaining amount.

When you won't be able to get a refund

The insurance company has the right to refuse to pay compensation if the accident occurred due to the malicious intent of the owner or due to a vehicle malfunction.

For example, the policyholder will not receive money if a fire occurs due to a short circuit in the wiring. Also, compensation will not be paid if the driver was under the influence of alcohol or drugs.

Important! If the policyholder does not agree with the decision of the insurance company, he has the right to go to court. He will have to collect evidence of his innocence, otherwise the judge will side with the company.

Pitfalls of CASCO payments in case of total loss of a car

Litigation is the norm in the insurance industry. The limit of surviving elements of the car, required for recognition of the total, can play into the hands of the policyholder. If this point is not clearly stated in the contract, then it is permissible to use a comparative analysis of the conditions of other companies. In court, constructive loss of a car under CASCO can be recognized even with 50% of the damage.

Most often, insurance companies are willing to pay compensation only taking into account wear and tear. The owner needs to consider the age of the vehicle when deciding whether to keep the vehicle. If, due to the long service life, depreciation has accumulated, then it makes sense to sell off the HOTS yourself.

Determined by whom and how

The disadvantage is that there is currently no single method that allows one to determine the total loss of a car. There is also no single regulatory legal act for CASCO that would regulate this issue. The advantage is that previously there were more difficulties in declaring a vehicle unsuitable for restoration. Now everything goes according to a simplified algorithm.

Who can evaluate the car:

- employees of the insurer, but only if they have the appropriate permission to conduct the assessment;

- independent experts licensed to provide appraisal services.

The second option is popular in Russia. Insurers do not have independent experts on their staff, and company representatives themselves may be interested in a different outcome of the case. A cooperation agreement is signed between insurance companies and appraisers. In all situations, representatives of the insurance company send cars for evaluation to a specific organization. Are there risks for the policyholder? Of course, according to the expert's assessment, the amount of damage may be lower than the market value of the car. Therefore, if possible, you can simultaneously conduct an examination yourself and find out the cost of compensation.