Possibility of importing non-customs cleared cars into Russia

All vehicles (VVs) crossing the customs border of the Russian Federation are required to undergo inspection at a customs point.

The person responsible for the import is given only 24 hours to deliver the car to this point. At customs, the car will be checked, registration fees will be deducted, and after payment they will issue documents confirming the legal crossing of the Russian border. Customs security must be paid before leaving abroad. After this, the vehicle is registered with the State Traffic Safety Inspectorate and can be in Russia legally. Such a car has passed customs clearance, has Russian state marks and is not classified as non-customs cleared.

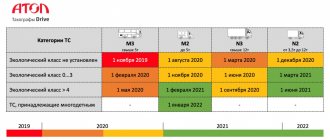

It should also be taken into account that the imported car must comply with the EURO-5 environmental standard, which significantly reduces the choice of used cars. Moreover, the requirement has now come into force that imported cars must be equipped with the ERA-GLONASS emergency call system, which must be provided by the manufacturer. In fact, fulfilling this requirement completely blocks the possibility of legally importing used cars from abroad into Russia.

But let's return to the question about uncleared cars. They are on the roads of the country, which means their import is possible. There are two legal ways of long-term operation in Russia of a vehicle with foreign license plates:

- The car was imported by a foreigner who has the right to legally stay in Russia for a long period. He can use a car in our country for no more than a year. It is prohibited to issue a general power of attorney for such a vehicle and sell it on Russian territory.

- The car crossed the border of the Russian Federation as a temporary import. This type of vehicle registration is not free. In this case, the maximum service life of the machine in Russia is 6 months. Theoretically, it is possible to extend the period of temporary import, but in practice this possibility cannot be realized. After 6 months, the car must be taken abroad, and for the next six months it must remain abroad. It is impossible to legally sell such a car in Russia.

But there are many advertisements on the Internet that a car that has not been cleared through customs can be bought at half price. The answer is simple - it's deception.

Is it worth buying a non-customs cleared car?

Purchasing a non-customs cleared car has its advantages and disadvantages. The positive aspects of the purchase include:

See also: Power of attorney for a car - how to issue it?

- Low cost of the vehicle due to the fact that customs clearance is not required.

- No transport tax is charged.

- Exemption from mandatory technical inspection.

- Problems with bringing to administrative responsibility for violation of traffic rules. The absence of foreign license plates in the Russian Federation database complicates the identification of the offender.

- Buying unique car models.

Flaws:

- Repeatedly crossing the border to renew a residence permit in Russia.

- The risk of numbers being stolen for ransom.

- Restoration of license plates and all documentation for cars at the place of registration.

- Border crossing and re-import costs.

- Bringing to criminal and administrative liability for violation of customs import rules.

- Confiscation of a non-customs-cleared vehicle when imported with violations.

Is it possible to purchase a non-customs cleared car?

Ownership of property provides the owner with the opportunity to dispose of it within the framework established by law. Property can be gifted, sold, or otherwise disposed of legally.

When it comes to buying a car that has not cleared customs, a substitution of concepts occurs. They promise to give you the opportunity to legally use a car with foreign registration in Russia for a certain fee. But since the sale of non-customs cleared cars is prohibited, you will not acquire ownership of the vehicle.

Deal Features

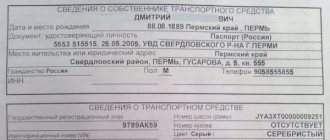

When concluding a purchase and sale agreement for a car, ownership rights are transferred to another person. This fact must be recorded in the traffic police within 10 days. The new owner will be entered into the vehicle’s passport and another vehicle registration certificate will be issued in his name. It is these documents that confirm ownership of the car.

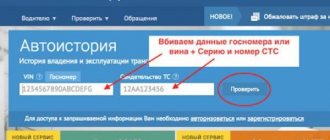

When “selling” a car without customs clearance, a purchase and sale agreement is most often not concluded; the scheme works differently. There is no actual purchase taking place. The client is offered to pay for the cost of the car abroad and, for an additional fee, certain services that will allow the car to be used in the Russian Federation without customs clearance.

Options for purchasing a car abroad

There is only one way to legally buy a car abroad, which initially involves its further customs clearance. Representatives of the intermediary company, at the client’s request, select a car abroad, purchase it, deliver it to Russia, carry out customs clearance in a legal way and transfer the car to the client. All expenses and cost of services are paid by the buyer. But the main purpose of driving with foreign license plates is to save on government payments for customs clearance of cars.

What do sellers of non-customs cleared cars offer? They will provide vehicle selection for a fee. Then there are 2 options:

- After making all payments, the client is given the car, foreign documents for it, keys and papers that supposedly allow the vehicle to be operated in Russia. The package obviously includes documents on the legal import of a car into the territory of the Russian Federation by a foreigner or Russian, a power of attorney for the use of the car and, possibly, for its sale. Today, a power of attorney also does not have to be certified by a notary, and when executed, you can write whatever you want on your knee. In addition, documents confirming legal border crossing may turn out to be fake.

- For an agreed fee, a car is selected for the client and offered to come to the country where it is located. Upon arrival, he is helped to prepare foreign documents confirming the right to use and dispose of the vehicle. Next, the buyer drives the car to Russia and arranges temporary importation in his name. After this, he can actually legally drive a car in the Russian Federation for six months, after which he must take it abroad and leave it there for six months. Theoretically, one can imagine purchasing two cars, which they then leave abroad in turn. You can only sell a car in the country where it is registered.

The need for customs clearance of goods

Regardless of the type or volume, any cargo when crossing the border undergoes customs clearance. This is a mandatory requirement in international trade.

Processing time depends on several factors:

- The degree of danger of the cargo.

- Volume and list of goods transported.

- Quality of paperwork for cargo and transport.

- The need for examinations to confirm the specified codes.

- Image of the exporter or importer.

Customs clearance, as a mandatory procedure, confirms the legality of the movement of goods across the border: the recipient will be able to legally sell or use the received cargo on its territory.

Making a deal

The second way to buy a car, described in the previous section, is to complete the transaction according to the procedure provided for by the legislation of the country where the car is registered. But this has nothing to do with the legal stay of the vehicle on the territory of the Russian Federation. Legality in this case is ensured by temporary import.

A general power of attorney or a purchase and sale agreement will not help either - these documents will initially be illegal.

Preparation of documents for customs clearance

The list of documents that are provided for each shipment of goods being transported may depend on the individual properties of the cargo: additional documents may be required for the main package.

The preparation of documents is almost always carried out by the owner of the cargo: sometimes this work is undertaken by the recipient or the documentation is prepared jointly. Organizations that are subjects of foreign trade activities either have declarants on their staff or turn to customs brokers for help.

In the first case, this is beneficial if customs documents are processed on an ongoing basis (weekly or daily); the services of specialized specialists are needed for irregular import or export processing.

Responsibility for purchasing a vehicle that has not been cleared through customs

According to Chapter 16 of the Code of Administrative Offenses of the Russian Federation, a fine is imposed for the following violations:

- Failure to comply with the deadlines for transferring payments to customs – 50-2.5 thousand rubles.

- Failure to submit a customs declaration on time – 1-2.5 thousand rubles.

- Violation of established import bans – 1-2 thousand rubles. In some cases, the vehicle may be confiscated.

- Failure to pick up a car on time – 1.5-2.5 thousand rubles. The car may be confiscated.

Criminal liability arises for citizens if evasion of customs duties has reached large (1 million rubles) or especially large (3 million rubles) proportions.

If there is a large debt to customs, the following types of penalties are possible:

- A fine of 100-500 thousand rubles or in the amount of income for 1-3 years.

- Mandatory work. The maximum period is 480 hours.

- Forced labor – up to 2 years.

- Imprisonment for up to 2 years.

If the debt to the state has reached particularly large sizes, liability becomes stricter:

- Fine 300-500 thousand rubles or the amount of income for 1-3 years.

- Forced labor – up to 5 years.

- Imprisonment for up to 5 years.

Calculation and payment of customs duties

The calculation is carried out using a special formula, and determining the amount of customs duties is within the power of an ordinary accountant. True, there is a peculiarity: the calculation is made taking into account the rate of customs duties and the exchange rate of foreign currencies to the US dollar on the day of cargo clearance (acceptance of the cargo customs declaration). Payments are made only in rubles at the exchange rate of foreign currencies on the day of payment of customs duties.

The main method of making payments remains the deposit of funds into the account of the customs office (the regional office where the cargo is processed). But the legislation provides for several additional methods - a bank guarantee, a guarantee or in the form of a property pledge.

Legal requirements in the field of customs clearance of cars

According to Russian laws, any vehicle (VV) imported from abroad must be presented to a customs point within one day for its inspection , payment of duties and taxes (if necessary) and registration of the necessary permits. Only after this can the car legally move on Russian roads. Otherwise - if these procedures are ignored - the very first meeting with a traffic police officer will turn into a very unpleasant surprise, since the car will be considered a contraband item.

Domestic legislation allows the operation of a non-customs-cleared car on the territory of Russia with some temporary restrictions (“how long can you drive a non-customs-cleared car”) for only two categories of persons:

- Foreign citizens who have registered a temporary stay in the Russian Federation. A foreigner registers at a customs post for the temporary import of a car that is registered in another state, without paying any customs duties and taxes. After this, he can use the car for the entire period of his stay in Russia, but no more than 1 year ;

- Russians who bought a car registered in another country and drove it into the territory of the Russian Federation with temporary import registration. The period of stay of such a car in Russia is limited to 6 months per 1 year , and its owner is obliged to pay a number of customs duties and taxes for the imported car.

This procedure for the import of cars into the Russian Federation is called “temporary import” and is regulated by separate provisions of customs legislation (“Agreement on the procedure for moving ...” and “Instructions on the procedure for performing customs operations ...” No. 311 of June 18, 2010), agreed and adopted by the states -members of the Customs Union.

Customs inspection of cargo

Inspection is one of the forms of customs control of goods (cargo). It is carried out both in relation to cargo (packaging is opened, goods are taken out) and in relation to transport (search for hiding places).

Reasons for conducting an inspection may be:

- There is information about a violation of customs legislation by the importer or exporter: violations either occurred previously, or in relation to the cargo being moved.

- The integrity of the awning or walls (for vehicles), container or tank (for sea or railway transport) is damaged.

- The integrity of the seals installed at the border has been compromised.

- Automated customs system solution: the operation of the algorithm is understandable only to a narrow circle of specialists, and your cargo is selected at random.

Before customs inspection, the sender (for export) or recipient (for import) receives notification of the procedure. Inspection of cargo (selective, complete) or identification of goods, recalculation of cargo packages (or items in them) or weighing may be carried out; taking samples and samples, or disassembling a product - to determine its characteristics.

The inspection is carried out only in the presence of the sender or recipient (or their representative), and ends with the drawing up of an inspection report.