Procedure for calculating transport tax

Owning a car obliges the owner to pay a fee called transport tax to the regional treasury. This rule applies to both legal entities and individuals.

When calculating the amount of transport duty, special tariff rates are used, which vary depending on the following indicators:

- Engine power;

- Duration of operation in the reporting period;

- Regional increasing/decreasing coefficients (if a local regulation has been adopted).

The norms of environmental law in force in the Russian Federation provoke tax legislation to provide increasing coefficients for owners of vehicles whose car has been in operation for more than 10 years.

A bill is currently under consideration that plans to increase the tax on cars older than 10 years. However, the first steps in the described direction have already been taken and the transport burden has increased for owners of expensive cars, the price of which is at least 3 million rubles. The calculation of the fee within the new legal framework is based on the following indicators:

- Age of the unit;

- Level of environmental friendliness.

The older and more expensive the vehicle, the greater the burden falls on the shoulders of the owner of the unit. For example, if the car is more than 25 years old, the tax for the use of such a unit will be focused on technical inspection data and compliance with environmental standards.

Tax amount for individuals in 2019

In its modern form, the transport tax appeared in 2003. The fee is charged both to car owners and to water and air transport. The need to pay a fee is specified in Art. 356 of the Tax Code of the Russian Federation. Car owners often ask the question: “Do I need to pay transport tax on cars older than 25 years?” For the answer, we turn to the Tax Code of the Russian Federation.

For legal entities

The size and coefficient for organizations is calculated on a similar principle to individuals. The entire amount is paid to the budget by an accountant from the organization’s personal account.

Peculiarities

- Using an old car worth 10 million rubles or more can increase the transport fee threefold;

- If the car is subject to re-equipment or modification, as a result of which the environmental damage caused by its operation may become less, then the traffic police at the place of registration of the vehicle should be notified in a timely manner about such manipulations;

- Payment of a fee by an individual for any vehicle, regardless of the year of manufacture of the unit, is carried out on the basis of a receipt generated by the fiscal authority, and the absence (non-receipt) of such a document does not relieve the obligation to the Federal Tax Service.

The authorities have proposed increasing the transport tax on old cars

In Russia, the base rate of transport tax on cars of environmental class Euro-3 and below may be increased in the near future. This initiative was taken by the Ministry of Industry and Trade. RIA Novosti reports this with reference to the deputy head of the department, Alexander Morozov. We are talking about old buses and cars used in the commercial segment

The press service of the Ministry of Industry and Trade explained that such a measure will increase the attractiveness of new and more environmentally friendly cars. The department believes that such measures will have a positive impact on the environment, TASS reports.

In the near future, the Ministry of Industry and Trade will send documents with the corresponding proposal to the Ministry of Transport. It is expected that the innovation will work in Russia next year.

Articles January 17, 2021 Transport tax 2021: how and how much to pay motorists

Articles October 24, 2021 “Reform the entire system.” How will the transport tax be changed?

According to the analytical agency Autostat, as of January 1, 2021, a total of 8 million 186.5 thousand units of commercial vehicles were registered in the Russian Federation. The Ministry of Industry and Trade stated that such equipment daily causes irreparable damage to the environment and the health of citizens of the Russian Federation.

Earlier it became known that Moscow plans to ban the entry of old cars of low environmental class into some areas of the city. Also, environmentally friendly zones should appear in St. Petersburg. The corresponding document was prepared by the Ministry of Transport. At the first stage, restrictions are considered primarily for the movement of freight vehicles and buses, especially in residential areas and environmental zones.

According to the State Traffic Safety Inspectorate, of the 60.5 million vehicles registered in Russia, 20.9 million are over 15 years old, and another 10 million are over ten years old.

Car services Autonews

No need to search anymore. We guarantee quality of services. Always nearby.

Select service

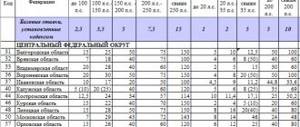

Let us recall that the basic methodology for calculating transport tax, in force since 2003, remains the same in 2021: the duty is calculated as the product of the regional tax base and a rate depending on the power of the vehicle’s power unit. For example, in Moscow for cars with engines weaker than 100 horsepower it is 12 rubles. for 1 l. pp., from 100 to 125 l. With. — 25 rubles, from 125 to 150 l. With. — 35 rub. and so on up to 150 rubles. for an engine with output over 250 horsepower. The most favorable tax conditions in Russia apply to low-power cars. For example, in the Kurgan region, owners of cars with engines no more powerful than 100 hp. With. they pay 10 rubles. for strength.

At the end of 2021, the State Duma in the first reading rejected the bill of the A Just Russia faction, which would abolish the transport tax on cars. The deputies explained their decision by saying that a complete waiver of the tax could lead to a shortfall in budget revenues of the constituent entities of the Russian Federation. This can negatively impact their financial situation and negatively impact their financial independence.

Odds sizes

The majority of vehicles traveling on Russian roads have been in operation for decades, which is why the use of an increasing coefficient promises significant increases in the volume of regional budgets.

The new transport taxation provides for an increase in the tax rate not only for old, but also for new cars, in particular (only expensive vehicles become objects of the conditional tax rate):

- By 0.5 - if the car has been in use for 1 to 3 years;

- At 1.75 – operation from 5 to 10 years;

- 2 times – the car has been used for at least 10 and no more than 15 years;

- 3 times - the car is more than 15 years old.

Do not forget that the final amount of the duty will be influenced not only by the year of manufacture, but also by the engine power, so vehicles put into operation in the same period, but with different units of engine power, will be assessed by tax officials in different equivalents.

Explanations

In some cases, the description of the model (version) of a passenger car in the List is presented in an abbreviated version and does not completely coincide with the information about the specified car in the title or received from the traffic police.

For example, the model (version) of “Bentley GT” from the List for 2014 in the PTS and information from the traffic police is called “Bentley Continental GT”, in the List for 2015 the model “Ferrari California” is indicated, and in the PTS – “Ferrari F 149 California." As the Ministry of Finance of the Russian Federation explained in letter No. 03-05-04-04/44504 dated July 12, 2017, in the cases under consideration, an increasing coefficient should be applied when calculating transport tax.

The Federal Tax Service, in turn, issued letter No. BS-4-21/ [email protected] dated July 18, 2017, by which it communicated these clarifications to the Federal Tax Service Inspectorate locally and recommended that they conduct an analysis of the correctness of the calculation of transport tax, taking into account the application of an increasing factor for expensive cars and if necessary, recalculate transport tax.

Meanwhile, the Federal Tax Service previously gave the opposite explanation. The letter of the Federal Tax Service No. BS-4-21/ [email protected] dated 06/01/2017 states that the List is exhaustive and the transport tax is calculated taking into account the increasing coefficient only in relation to those cars that are indicated in the List.

Thus, in the opinion of the Federal Tax Service of Russia, set out in this letter, if information about a passenger car is not in the List (model, make, version, specialization and other parameters differ from those indicated in the List), the transport tax on this car should be calculated without taking into account the increasing factor .

Payment of TN by individuals and legal entities

According to the regulations of tax legislation, car owners who are individuals pay the fee based on a receipt generated by the fiscal authority. This category of taxpayers is exempt from the need to independently calculate the costs of the transportation burden and reflect it in the declaration.

Representatives of the tax service send to the taxpayer (no later than 1 month in advance) a receipt reflecting:

- The amount of the fee;

- Recipient details;

- Tariffs applied in calculation;

- Technical characteristics of the unit.

If the taxpayer has an authorized account on the official website of the Federal Tax Service, he will be notified of the timing and amount of the tax at least 90 days in advance.

Owning a car that has been in use for at least 10 years does not in any way affect the procedure for notifying the owner of upcoming costs for the specified movable property.

Legal entities, unlike individuals, are required to independently calculate the amount of the transport fee and reflect the resulting data in a special report (declaration).

Calculation of transport tax on cars older than 10 years

The size, time period for depositing funds, procedure and preferential categories of citizens are regulated by legislation, namely the Tax Code of the Russian Federation. Money is deposited by the payer at the location of the transport within the time limits established by the regulations of the constituent entity of Russia. The calculation process uses a special formula that looks like this:

In certain cases, increasing factors are added to this formula. They apply to passenger cars costing more than 3 million rubles, a list of which is compiled and updated annually by the Ministry of Industry and Trade. Lists for the current and previous years can be found on the ministry’s website or downloaded from our website (links to 2018 and 2021 ).

Reasons for payment

The amount of the tax payment directly depends on the region where the vehicle was registered, its cost, engine size and production date.

The more mature the transport, the higher the calculated rate. The same goes for a car with a production date over 25 years old. For such a vehicle, the owner must pay increased tax due to the introduction of environmental and age restrictions. If you are “mature” and do not meet environmental standards, you pay more for such a car. IMPORTANT! To find out whether you are required to pay transport tax for an old car, you should contact the regional branch of the Federal Migration Service or carefully study the resolution of your own region.

Tax on a car over 30 years old

Local legislators work very heterogeneously, and sometimes show excessive severity, imposing a transport tax on everyone and everything. The corresponding norms must be sought in regional regulatory documents, in particular, the “Law on Transport”, and they practically cannot be generalized.

The evaluation system will not be simple. Judging by the data published by the Kommersant newspaper, the machine will be checked for compliance with GOST by experts accredited by the sports federation. The originality of the parts and the level of restoration will be assessed. Moreover, they plan to award penalty points for each non-original part.

May 04, 2021 klasterlaw 158

Share this post

- Related Posts

- Ufsin after 44 years you can get a job

- According to what law do pensioners not pay tax on transport in Kemerovo?

- How much do extra bus rides cost for pensioners?

- What do they give for 3 children in 2021 in the Sverdlovsk region