Features of MTPL insurance

OSAGO is a document on financial protection of civil liability, which is mandatory issued to all vehicle owners for a period of 365 calendar days. Almost all insurance companies in Russia are involved in its registration (RESO Garantiya, Soglasie, SOGAZ, etc.).

For driving without a policy, the Code of Administrative Offenses provides for fines ranging from 500 to 800 rubles. Unlike CASCO, motor insurance is not able to ensure the financial security of a person’s life, as well as the integrity of his vehicle. The only area of his activity can be called compensation payments to third parties injured as a result of an accident due to the fault of an insurance company client.

It is important to know! Just like a comprehensive policy, OSAGO provides for the possibility of early cancellation. But it is only possible to carry out such a procedure due to a change in the owner of the vehicle or the theft/loss of the car. Is it possible to return money unused by the company for insurance if you sell the car? We’ll find out later.

Reasons for early termination of the contract

In accordance with the legislation of the Russian Federation, termination of any contract for the protection of civil liability can occur either at the initiative of the insured or at the request of the company. In the first case, the document will be canceled by:

- Withdrawal of accreditation from a certain insurance company (“RESO Garantiya”, “Consent”, “VTB”, etc.);

- Official change of owner of the vehicle (due to its sale, transfer by gift or inheritance);

- Loss of equipment (due to fire, accident or theft).

Representatives of the organization, in turn, also have the right to terminate the policy early. But only if the client, when filling out the form, intentionally provided false data or presented falsified papers (passport, PTS, etc.). In addition to the listed options, independent factors may also contribute to the termination of compulsory motor liability insurance, such as:

- Death of the owner;

- Complete liquidation of the insurance company by the state due to lack of a license.

Whether the return of compulsory motor liability insurance for the sale of a car, the death of its owner or other reasons provides for compensation for unspent premium, we will consider below.

Possibility of refund of cash bonus

Despite the wide list of circumstances under which the contract is canceled, the remaining funds from the insurance company account are reimbursed only in the following cases:

- Death of the owner of the vehicle (in this case, the relatives of the deceased or proxies can collect the money unused by the company);

- Loss of agency accreditation;

- Total loss of vehicle;

- Change of owner of the vehicle (according to the law, the current owner of the car can re-register the title to another person only when it is sold, transferred by gift or as an inheritance).

It is important to know! In other situations, it will not be possible to recover funds from car insurance even through court. After all, the legislation establishes only the above-mentioned series of criteria providing for the reimbursement of unspent premiums.

Who can receive

The return of compulsory motor liability insurance when selling a car cannot always be carried out by the owner of movable property. It is also possible to carry out this procedure:

- To the policyholder who is not the official owner of the car (if there is a general power of attorney);

- Direct heirs and relatives of the driver (in the event of the death of an insurance company client).

Moreover, the algorithm of actions when terminating a contract by third parties will be standard, and the only difference is the list of required documents.

Algorithm for receiving money

We found out that you can get your money back for compulsory motor liability insurance when selling a car, just like with early cancellation of a comprehensive CASCO insurance policy. But in order for the company to recalculate and pay compensation, it is necessary to act exclusively according to the following rules:

- Prepare the required package of papers and certificates;

- Make a written application for termination of the contract;

- Attach a receipt with bank details (VTB, Sberbank, Renaissance Credit, etc.), where the insurance company will return the unspent premium;

- Wait for funds to arrive within the time frame established by the state.

How much time is given to the agency to compensate the client’s money, and where to go with the collected package of documents, we will find out later in the article.

Required documents

Depending on the selected insurance company (Ingosstrakh, RESO-Garantiya, Tinkoff, etc.), the list of required amounts for the return of unspent funds may differ slightly. But the minimum list must necessarily contain:

- The original civil liability protection form (the copy in this case is considered invalid);

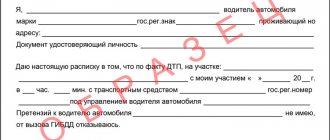

- A written statement drawn up according to a generally accepted template;

- Internal passport;

- Bank statements showing timely payment of insurance premiums.

Additionally employees

offices have the right to demand from a person a contract for the purchase/sale of a vehicle, a death certificate of the legal owner of the car, a general power of attorney or a protocol on the loss of a vehicle (due to a natural disaster, theft or accident). If representatives of the insurance company ask for a more extensive list of documents, then the client can calmly refuse to present them, since this is not prohibited by law.

Return deadlines

Having learned how to get your money back when canceling your car insurance, it would be a good idea to familiarize yourself with the acceptable deadlines for payment of the unused balance of the premium by the company. They are regulated by paragraph 116 of the “Rules on the provision of protection of civil liability”, which clearly states a period not exceeding 14 days.

The countdown of this time period starts from different dates, depending on the circumstances of termination of the contract:

- If the compulsory motor liability insurance expires early for reasons beyond the control of both parties (death of the owner or complete liquidation of the insurance company), the countdown begins from the moment the incident occurred;

- When canceling a policy at the initiative of a citizen or agency, the two-week period will be counted from the date the application is signed.

It is important to know! If the vehicle owner does not have time to submit an application for repayment of the unused premium, the company reserves the right to refuse compensation. And from the side of the law, such an act will be regarded as completely legal.

Refund amount

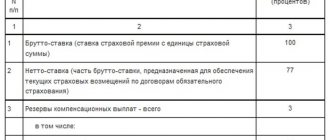

We found out how to get your insurance money back if you sell your car. Now is the time to calculate the stipulated payment amount based on the following formula: D = (P-23%) X (N/12), where:

- D – size of unspent balance;

- P – cost of the initial payment under the MTPL agreement;

- N – the number of months remaining before the timely cancellation of the policy.

There are no other ways to calculate the unspent bonus. For convenience, clients can use electronic versions of calculators, where they only need to enter the last two indicators, and the result will be calculated automatically (similar programs are available on the websites of many insurance companies, such as Renaissance Credit, Tinkoff, Rosgosstrakh, etc. ).

How to terminate the VSK OSAGO contract

You can cancel your MTPL policy and receive compensation for unused days at any office of the insurance company. To do this, an application is drawn up, the reason is indicated (for example, return of insurance when selling a car), and the documents necessary in a particular case are attached.

The submitted documents are checked and, if there are grounds provided for by law, the MTPL agreement is terminated and the insured is paid compensation. Since the amount depends on the number of unused days, the calculation is carried out from the moment the application is submitted, except in cases of death of the policyholder or destruction of the vehicle.

Compiling and submitting an application

There is no need to draw up an application yourself, it is a standard one, and the form will be issued at the company’s office upon application. The form contains information about the applicant, policyholder, owner and vehicle. The application can also be submitted online on the official website of the insurer.

The following documents are attached to the application:

- original insurance, payment receipt;

- a copy of the passport of the policyholder and his representative, if necessary;

- a copy of the purchase and sale agreement, disposal certificate, death certificate or other document confirming the right to early termination of compulsory motor liability insurance with payment of compensation.

If all established rules and requirements have been met, the insurance company does not have the right to refuse to terminate the contract.

In what case will the money not be returned?

Knowing how to get your insurance money back is not enough. After all, the legislation of the Russian Federation provides for a number of cases in which a citizen will be refused a given request. Most often this happens in the following situations:

- Entering incorrect information about yourself or your vehicle when filling out the IC form;

- The desire to terminate the contract with the company without any valid reasons;

- The owner of the movable property did not have time to submit an application for the return of unused premiums for the allotted period;

- Refusal to present additional documents to insurance office employees.

Any other circumstance does not give the company the right to ignore compensation for unspent money under compulsory motor liability insurance.

Under what circumstances can you return your MTPL policy?

Federal Law on Compulsory Motor Liability Insurance No. 40-FZ dated April 25, 2002 has a provision that it is possible to return motor insurance or, as it is written in the law: to terminate the insurance contract ahead of schedule, only in cases provided for by the Rules of Compulsory Insurance. Can I get my money back for car insurance?

A complete list of cases in which early termination of a compulsory insurance contract with the receipt of money for the unused period is possible is specified in clause 33 and clause 33.1 of the OSAGO Rules.

Let's take a look at all the cases:

- change of ownership of the car, formalized only by a purchase and sale agreement;

- death of the driver who bought the policy;

- loss or destruction of the vehicle specified in the insurance policy;

- the insurance company's license to provide insurance under the MTPL system was revoked;

- other cases provided for by law.

Thus, in almost all the cases considered, either the policyholder changes, or the car specified in the contract no longer exists.

A separate topic is the deprivation of an insurance company's license under compulsory motor liability insurance. Experts believe that such actions are carried out before the possible bankruptcy of the company. They advise you to immediately terminate the contract and return your money. Once the insurance company is declared bankrupt, it will not be possible to return your money.

What to do if the insurance company illegally refuses to return the money

If a citizen terminates the contract with the insurance company for legal reasons, and payment of funds for the remaining period of the policy has not been received, then he can turn to the central bank or local judicial authority for help. Moreover, it is better to initially try to resolve the problem through the Central Bank, since when filing a claim in court, additional costs are charged from a person.

We learned what documents are needed to return money in case of early cancellation of compulsory motor insurance and how to calculate the exact amount to be paid. In conclusion, it is worth adding that legislation tends to change. Therefore, before terminating the contract, it is better to familiarize yourself with the current regulations in advance, so that there are no unpleasant surprises in the future.