Car owners or people who just want to buy a car should be vigilant and check the availability of an MTPL policy for the car. This action is very important because it allows you to identify fraudsters when selling a car, protect yourself from breaking the law, or correct incorrect information about the car. More details on how to perform the check are described below.

An advantageous offer from the partners of our portal - Terem Loan! Apply for a loan in the amount of up to 30 thousand rubles for a period of up to 30 days.

100% approval!

Get money

How to check if a car has compulsory motor liability insurance

There are three ways that allow you to check your current MTPL insurance policy for a car and find out its current status as of today:

- entering information about the contract number on the RSA website;

- entering information about the contract number on the RSA website indicating the period;

- entering information about the vehicle.

Entering information about the contract number on the RSA website

To check your policy using this option you must:

- Go to the website where the availability of car insurance is checked online in the RCA database.

- Go to the page to view the current OSAGO policy form.

- Check the contract number that you have and enter information about it in the appropriate fields.

- Select the series of the form in the field “Series of the MTPL policy form”.

- Indicate the form number in the field “Compulsory motor liability insurance policy form number”.

- Enter the captcha to confirm the security check.

- Click on the “Search” button.

After this, a database check will be performed, which will allow you to obtain information for the current year. It is performed for policies of different types (paper, electronic).

Statuses for found policies can be as follows:

- “Printed” - the document was produced, but was not even transferred to the insurance company yet - the document was given to the client. Information about such policies has been successfully entered into the RSA database;

- “Hosted by the insurer” - the document remains with the insurer or has already been purchased by the buyer, but this was quite recently and the information in the system has not had time to be updated;

- “No longer valid” - the document is expired, it is recommended to update the policy in the near future;

- “Lost” – applies to policies that have been reported missing.

This method allows you to quickly find out whether the car is insured. But it also has disadvantages :

- the need to connect to the Internet to access the database;

- there is no complete certainty that information about a fake policy was not entered into the database;

- overload and slow search for the necessary information in the database, since due to the large amount of data, the database periodically freezes. The duration of freezing and processing of information can reach more than one day.

Entering information about the contract number on the RSA website indicating the period

To check your policy using this option you must:

- Go to the website where the policy is checked.

- Enter policy information (series, number).

- Indicate the date for which you need to obtain information.

- Enter the captcha.

- Click on the “Search” button.

In the search results, in addition to general information about the policy, additional information will be provided. For example, you will be able to read about the exact reason why the insurance is not valid.

Entering information about the vehicle

This method is the reverse of the previous two. In order to check this way, you must:

- Go to the website where you enter information about the vehicle to check your MTPL policy.

- Provide information about the car:

- VIN number;

- GRZ;

- body number;

- chassis number.

- Select the date for which you are interested in information.

- Enter the captcha.

- Click on the “Search” button.

After this, information will be received about the insurance company that issued the policy. When choosing a date, you can find out the MTPL numbers for previous years and request that the information be corrected if an error was found in it.

Need car insurance? Try our free service to calculate the cost of insurance without additional charges!

What is required to fill out the policy?

To correctly fill out all insurance fields you will need:

- passport of the policyholder - the policyholder can be any legally capable person over the age of 18;

- vehicle owner's passport;

- documents for the car: PTS or registration certificate;

- driver's licenses of all drivers who will be allowed to drive;

- diagnostic card, if the car is more than 3 years old.

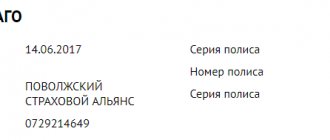

What does a completed OSAGO form look like?

Over the entire period of OSAGO's existence, the following series of policies have been issued: CCC, BBB and EEE. This is what an empty MTPL policy of the EEE series looks like, applicable from 2021:

The EEE series form itself includes the following fields:

- a ten-digit number located next to the series;

- insurance period, from the time and date of application until the expiration date of the contract;

- a mandatory field in which you must indicate during what period of the insurance contract the car will be used;

- When filling out clause 1, your full name is indicated for individuals, and their full name for legal entities. The owner of the vehicle is also indicated here. Based on data about its place of registration, a territorial correction coefficient is calculated;

- the next item contains information about the use or absence of a trailer for the vehicle;

- in three windows located under this field, the following data about the car is indicated sequentially: make;

- model;

- an identification number;

- state registration number;

- upper left corner;

As a result, the completed policy form should look like this:

How to find out the owner by OSAGO policy number

In order to avoid problems, you need to check who owns the policy. You can find out who the MTPL policy was issued to by using the policy verification methods given above. A website with a PCA database or contacting an insurance company will allow you to obtain all the necessary information about the user of the car.

To obtain information about the owner through the insurance company, you need to visit the company’s office with a passport and information about the policy.

In order to find out who is registered with OSAGO by policy number, you will need to use the RSA website:

- Go to the website with the database.

- Enter the policy number. In the database, you can check when entering various data, for example, the owner's last name. But if it is incomplete or incorrect, then the search results may not yield anything. At the same time, searching for the owner by OSAGO policy number is very simple and comprehensive.

- View the information you need.

By looking at the results that the system will give after completing the search, you will find out who the policy is issued to.

Why do you need a policy check?

Each form is protected. Its falsification is considered a criminal offense. But cases of fraud are increasing. Therefore, RSA advises checking the OSAGO policy for authenticity as early as possible.

A counterfeit form entails a number of negative consequences for the policyholder, for example:

- In the event of an accident, payment will be denied;

- If representatives of the traffic police or insurers find out that the form is counterfeit, a criminal case will be initiated;

- The bonus for accident-free driving is canceled automatically (the discount disappears if there has been a break in insurance for more than a year);

- An insurer can sue for using a false company name;

- It is impossible to include drivers in such a policy;

- This agreement cannot be extended.

How to find out where your car is insured

To obtain such information, it is enough to use the RSA database. In order to find out which company insures the car by insurance contract number, you will need to enter the relevant information about the number in the required fields on the website, according to the instructions indicated above.

After this, all the key information about the insurance will be displayed, where you can also see who issued the insurance policy.

In addition to the method above, similar information can be obtained from the state. car number. You can specify information about it instead of the contract number.

How to avoid becoming a victim of scammers

- unfilled policy form;

- insurance at a price lower than the amount indicated on the policy form and in the receipt of payment (form No. 7);

- OSAGO, which lacks at least one of the visual signs indicating its authenticity.

Do not make any changes to the MTPL policy yourself.

- forgery and use of counterfeit OSAGO policies is prosecuted in accordance with Article 327 of the Criminal Code of Russia;

- Using a fake MTPL policy, you will have to pay the damage to the victims yourself.

When ordering online or by phone

- Ask for the name of the insurance company and the number of the form on which the contract will be concluded.

- Using the number, check whether the form belongs to the insurance company.

- Check that the insurance company’s license has not been revoked or limited in terms of concluding MTPL contracts.

- If you purchase a policy through an insurance intermediary, check that there is no incriminating information about it. To do this, enter the name of the intermediary into a search engine and look for the availability of such information in the official media.

- When renewing your policy online directly from the insurance company, make sure you are on the insurer’s official website.

When purchasing at an insurance company office

- Make sure that you come to the office of the insurance company, and not to an intermediary who uses logos and other attributes of the insurer under a special agreement. To do this, go to the official website of the insurance company and check the availability of an office at the address you have chosen.

- Find out the name and surname of the manager who will issue the policy.

When purchasing from an insurance agent

Ask him to present a power of attorney for the right to conclude MTPL contracts from a specific insurance company and an identification document - a passport or driver’s license. If this is an agent not of an insurance company, but of an insurance intermediary (broker, agency), then the power of attorney must be issued on behalf of this intermediary.

Is it possible to find out the car number using the MTPL policy?

You can get information about whether a car is insured or not if you know the contract number. When you enter information about it on the RSA website, all the key information will be displayed. It will also include vehicle license plate information.

This is basic information that every motorist should know in order to avoid problems with the law.

It is recommended to check car insurance information in a timely manner, because an expired or falsified policy is a direct violation of the law, often leading to criminal consequences. And even if the new owner of the car did not know about it, this ignorance will not free him from responsibility and fines.

How to get money from insurance

If the car owner was involved in an accident not intentionally in order to receive payments, then he can fully count on compensation within the insurance limit. To do this, he needs to collect the papers specified in the contract and, within 5 days, submit it along with the car to the company that insured the culprit. Compensation is made by paying for repairs, treatment or transferring the amount of damage. In the event that the amount of damage to material assets exceeds the limit, the missing amount is recovered from the perpetrator through the court, and he himself may be subject to recourse.

Article on the topic: Features of liability limits under compulsory motor liability insurance

Thus, if the PCA website writes that the policy is with the policyholder, this means that everything is in order with him. The document is genuine, you just need to figure out where it is.

How to avoid becoming a victim of scammers

- unfilled policy form;

- insurance at a price lower than the amount indicated on the policy form and in the receipt of payment (form No. 7);

- OSAGO, which lacks at least one of the visual signs indicating its authenticity.

Do not make any changes to the MTPL policy yourself.

- forgery and use of counterfeit OSAGO policies is prosecuted in accordance with Article 327 of the Criminal Code of Russia;

- Using a fake MTPL policy, you will have to pay the damage to the victims yourself.

When ordering online or by phone

- Ask for the name of the insurance company and the number of the form on which the contract will be concluded.

- Using the number, check whether the form belongs to the insurance company.

- Check that the insurance company’s license has not been revoked or limited in terms of concluding MTPL contracts.

- If you purchase a policy through an insurance intermediary, check that there is no incriminating information about it. To do this, enter the name of the intermediary into a search engine and look for the availability of such information in the official media.

- When renewing your policy online directly from the insurance company, make sure you are on the insurer’s official website.

When purchasing at an insurance company office

- Make sure that you come to the office of the insurance company, and not to an intermediary who uses logos and other attributes of the insurer under a special agreement. To do this, go to the official website of the insurance company and check the availability of an office at the address you have chosen.

- Find out the name and surname of the manager who will issue the policy.

When purchasing from an insurance agent

Ask him to present a power of attorney for the right to conclude MTPL contracts from a specific insurance company and an identification document - a passport or driver’s license. If this is an agent not of an insurance company, but of an insurance intermediary (broker, agency), then the power of attorney must be issued on behalf of this intermediary.

General recommendations

- After completing the contract, make sure that the correct information is indicated in the policy, application for insurance and receipt. Check that the information matches the copies of the documents.

- Be careful not to purchase insurance policies at a price lower than the officially established price and at the same time as purchasing a car: when buying a car, there is a high probability of not paying attention to important points of the contract.

How to avoid becoming a victim of scammers

Don't buy:

- unfilled policy form;

- insurance at a price lower than the amount indicated on the policy form and in the receipt of payment (form No. 7);

- OSAGO, which lacks at least one of the visual signs indicating its authenticity.

Do not make any changes to the MTPL policy yourself.

Remember:

- forgery and use of counterfeit OSAGO policies is prosecuted in accordance with Article 327 of the Criminal Code of Russia;

- Using a fake MTPL policy, you will have to pay the damage to the victims yourself.

When ordering online or by phone

- Ask for the name of the insurance company and the number of the form on which the contract will be concluded.

- Using the number, check whether the form belongs to the insurance company.

- Check that the insurance company’s license has not been revoked or limited in terms of concluding MTPL contracts.

- If you purchase a policy through an insurance intermediary, check that there is no incriminating information about it. To do this, enter the name of the intermediary into a search engine and look for the availability of such information in the official media.

- When renewing your policy online directly from the insurance company, make sure you are on the insurer’s official website.

When purchasing at an insurance company office

- Make sure that you come to the office of the insurance company, and not to an intermediary who uses logos and other attributes of the insurer under a special agreement. To do this, go to the official website of the insurance company and check the availability of an office at the address you have chosen.

- Find out the name and surname of the manager who will issue the policy.

When purchasing from an insurance agent

Ask him to present a power of attorney for the right to conclude MTPL contracts from a specific insurance company and an identification document - a passport or driver’s license. If this is an agent not of an insurance company, but of an insurance intermediary (broker, agency), then the power of attorney must be issued on behalf of this intermediary.

General recommendations

- After completing the contract, make sure that the correct information is indicated in the policy, application for insurance and receipt. Check that the information matches the copies of the documents.

- Be careful not to purchase insurance policies at a price lower than the officially established price and at the same time as purchasing a car: when buying a car, there is a high probability of not paying attention to important points of the contract.

What to do if your policy is fake