After amendments were introduced in the fall of 2021 to the legislation on insurance relations in case of road accidents, motorists received clearer regulations for actions in case of accidents with several participants. The innovations also brought a number of benefits to drivers. First of all, it is now possible to receive compensation from your own insurance company, and not from the company of the perpetrator. This means that the driver has the right to count on cooperation with the repair organization that was chosen when concluding the insurance contract.

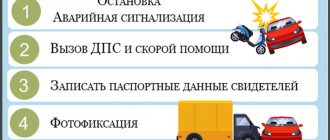

What to do as a motorist in the event of an accident

Most often, in accidents involving more than two cars, it is quite difficult to determine the instigator and the victim. The insurance company is dealing with this problem.

The only thing that depends on the driver is correct behavior when an atypical situation arises on the road. Due to violation of the rules, additional penalties may be applied against the motorist.

The main nuances of behavior in emergency situations are:

- If an accident occurs, in order to maintain the integrity of the picture, it is prohibited to change the location of the car until the traffic police officers and the insurer arrive (if his presence is necessary).

- The driver’s actions after an accident must comply with traffic regulations: the emergency lights must be turned on and the corresponding sign must be placed on the roadway.

- You cannot change the position of not only your car, but also other objects in an emergency situation.

It is important to determine whether other people caught up in the traffic situation require assistance and, if necessary, provide it. Violation of this rule may result in additional penalties.

If there is an injured party

If one or more people are injured due to an accident, according to the traffic rules, the motorist must provide all possible support. It is important to ensure that emergency specialists are called. If quick action is necessary, it is possible to independently transport the victim to a nearby medical center.

In the event of a serious health condition of the victim, it is necessary to act in the direction of maintaining his maximum safety until the arrival of emergency personnel: ensure peace, the most possible comfort in this situation and, if necessary, protection from other participants in the accident.

In the absence of victims

If there is no injured party, and the damage to the property of motorists is insignificant, the law allows the conclusion of an agreement between the parties to the accident. Then all participants in the road accident have the right to leave the scene of the accident.

If the participants are unable to reach an agreement and the damage to the cars is significant, it becomes necessary to call state inspectors and the insurance company. With the help of specialists, the facts of an emergency situation are identified, possible culprits and the procedure for insurance actions are determined.

How to file a mass accident

Already from September 25, 2021, according to the amendments made to the law, new rules are in force that must be followed in case of group accidents. Thanks to the innovations, participants in a road accident, even if there are 3 or more of them, have the right to count on direct compensation for losses from insurers under compulsory motor liability insurance in the event of a mass road accident. But only under two conditions:

- the presence of valid policies, including those concluded earlier than the specified period;

- no casualties.

If there are 3 or more participants in an accident, you cannot do without calling traffic police officers to the scene. Moreover, it is often difficult, and sometimes impossible, for drivers to determine who is responsible for the accident, as well as to reach agreement on its mechanism. Independent registration of an accident is possible only when it comes to an accident involving two vehicles (i.e., no more than 2 participants). Only in such a situation can we talk about registration under the European Protocol.

No injuries

What sequential actions should be taken by drivers of cars involved in an accident if there are no casualties, what to do in cases of this kind? They need:

- Bring your vehicle to a complete stop, turning off all vehicle electronics.

- Leave the vehicle in place if it does not obstruct the movement of other vehicles or is not on tram tracks. And if it interferes, then remove it from the road, having previously taken a general and close-up photo or video of the surrounding area and all damage to your car.

- Turn on the emergency lights and place an appropriate sign on the road indicating an emergency stop.

- Find out from other participants in the incident whether they have valid MTPL policies, etc.

The mentioned rules of action are provided for in cases in which there is no question of harm to the health/life of people or damage to the property of third parties who were not involved in the accident.

There are people injured

If road accidents in which several vehicles were involved do not result in casualties, then actions similar to those already mentioned above are carried out, but the range of responsibilities for car owners expands.

In case of any accident with injuries, drivers are additionally expected to:

- determining the severity of harm caused to the health of the victim/victims based on a visual assessment of his/their condition;

- calling an ambulance, providing first aid, sending victims by passing transport to the nearest medical institution or their independent delivery to one with subsequent return to the scene of the accident (all of the above is done if necessary);

- collecting evidence (optional);

- preparation of documents necessary for registration of a traffic accident, including a policy, if the car owner is expected to be paid under compulsory motor liability insurance;

- providing all possible assistance in registering the incident to the traffic police officers who arrived at the scene (giving full explanations of what happened with clarification of all the details, comprehensive assistance in drawing up a diagram of the accident);

- following the instructions of traffic inspectors, receiving from them the documents required for insurance payments, provided that the right to such arises.

If there are three participants in an emergency

Such circumstances make it extremely difficult for traffic police officers and insurers to assess the situation, and often lead to the need to resolve the conflict in court.

Participants in such an accident are usually at a loss regarding insurance payments for vehicle repairs. These doubts are understandable: when concluding an insurance contract, the condition for the occurrence of an insured event is the participation of 2 vehicles in an accident. Based on this, the agent considers it possible to refuse to compensate the motorist for damage received in the accident.

Therefore, it is important for a vehicle driver to know his rights when concluding an agreement with an insurance company and a similar situation arises.

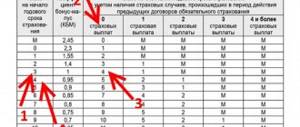

How is damage distributed if there is more than one victim?

Many motorists still remember the times when the compulsory motor liability insurance limit required the payment of a certain amount per accident, while the number of participants was not important and the payment within the limit could be divided among the victims and often turned out very unfairly.

Now we turn to the current version of the law “On Compulsory Motor Liability Insurance” and see the following in Art. 7:

- in terms of compensation for harm caused to the life or health of each victim, 500 thousand rubles;

- in terms of compensation for damage caused to the property each victim, 400 thousand rubles.

This means that, regardless of the number of victims, the amount of maximum compensation is not divided “for everyone” but is calculated for each individual. Also, in connection with the new MTPL rules, many are interested in whether they will be able to get the money or whether repairs will be made (compensation in kind). In this regard, everything is the same as in a regular road accident; the conditions for receiving monetary compensation are the same:

- death of the vehicle;

- death or serious injury of the beneficiary (motorist);

- the beneficiary was disabled;

- mutual guilt;

- lack of a service station that meets the requirements and distance;

- agreement between the victim and the insurer;

- terms and conditions of the MTPL policy (old policy).

Is direct compensation always possible?

Direct compensation is compensation for damages from an accident provided by the insurance company with which the driver has a contract.

It is worth noting that this is only possible if two conditions are met:

- The emergency situation only affected the condition of the vehicle, but did not lead to damage to the health or life of the participants.

- All motorists involved in an accident have compulsory motor liability insurance policies. If one or more participants do not have a compulsory motor liability insurance policy, the issue of compensation for damage is resolved through the court.

Currently, for this type of compensation there are no restrictions on the number of participants in the accident.

Direct insurance payments in case of a triple accident: what changes

From September 25, 2021, 49-FZ “On Amendments to the Federal Law “On Compulsory Insurance...”” comes into force.

Now drivers – holders of a compulsory motor liability insurance policy – who are involved in an accident with three cars have the right to receive direct insurance payments. Back in the middle of summer, the Central Bank of the Russian Federation came up with an initiative to expand the conditions for PES - and it was ultimately supported at the legislative level.

Until September 25, 2021, a car owner could apply to his own insurer for payment under OSAGO only if the number of participants in the accident did not exceed two, both participants had OSAGO policies in hand, and the damage was sustained only by cars (and only by those involved in the accident). If the number of cars was greater, the car owner had to apply for compensation to the opponent’s insurance company. From the point of view of the policyholder, this is not just inconvenient: the chances of receiving even that small amount of money become less.

Now the “acceptable” number of cars injured in an accident is three. However, other conditions for obtaining a PES have not changed:

- owners of damaged cars must have the status of insurers, that is, have a compulsory motor liability insurance policy valid at the time of the accident;

- Damage as a result of the accident was caused only to vehicles.

The changes will “work” only in relation to accidents that occurred from September 25, 2021. The date of purchase of the policy is not important.

- What about the priority of repairs under compulsory motor liability insurance?

- What do car owners think?

- What do insurance companies think?

What about the priority of repairs under compulsory motor liability insurance?

The rules regarding the possibility of replacing monetary compensation with repairs also remain the same. If a compulsory auto liability insurance policy was purchased by a car owner before April 27, 2021, he will most likely receive monetary compensation. If the insurance contract is concluded after this date, then the insurance company will prefer - and will, by law, have the right - to replace the money with services from authorized or own services, that is, repairs.

What do car owners think?

The reaction to the changes in the key law from the car owner community was surprisingly restrained. And the Federation of Car Owners of Russia even sees a certain trap in some relaxation of the conditions for obtaining a PPV. According to FAR representatives, liberalization of conditions will lead to liberalization (read: reduction) of tariffs for compulsory motor liability insurance.

What do insurance companies think?

For motor third party liability insurers, the changes from 48-FZ also do not seem to be a very good solution. Representatives of the Russian Union of Auto Insurers believe that an increase in the number of participants in road accidents will only lead to an increase in the number of claims against the work of insurance companies from car owners and, of course, an increase in the insurance company’s expenses for payments, albeit in “natural” (repair) form.

Which insurance company is best to contact after an accident?

According to the legislative amendment, compensation in almost all cases occurs in the form of repair work. The likelihood of receiving monetary compensation is extremely low.

When concluding an insurance contract, the driver is guided, among other things, by the choice of a car service that suits him according to a number of parameters. For this reason, when contacting his insurance company, a motorist can count on the provision of services by the chosen car service center. If he applies to another insurance company, he will not have this opportunity.

Mutual guilt

As in the case of an accident with two participants, in a multiple accident, the degree of guilt of the participants matters; it may turn out that one of the participants in the accident also turns out to be guilty, in this case, compulsory motor liability insurance compensation will be proportional to the degree of innocence of each participant. Those. if the participant is not guilty, then he can count on full compensation for damage; 50% of guilt leaves a chance to hope for compensation for half of the actual damage.

The payments themselves in favor of the victims will also be made from the perpetrators or their insurance companies (if there is compulsory motor liability insurance) in an amount proportional to the degree of guilt and within the limit of payments under the policy. Those. If you are found to be 30% at fault in an accident and another participant is found to be 70% at fault, then you or your insurance company will be charged 30% in favor of the victims due to your fault.