In connection with numerous discussions on the topic of the financial burden borne by the owners of heavy vehicles, starting in November 2015, questions related to the abolition or change of the procedure for calculating transport tax on trucks are constantly being raised.

Next, we will look at how the duty on freight transport is calculated in 2021 and whether the transport tax for heavy trucks has been abolished.

An advantageous offer from the partners of our portal - Terem Loan! Apply for a loan in the amount of up to 30 thousand rubles for a period of up to 30 days.

100% approval!

Get money

Transport tax on trucks in 2021

Transport tax is paid according to the rules established by the Tax Code of the Russian Federation (Chapter 28, Article 356) on the basis of the basic (state) rate. In this case, the purpose of the payment is to replenish regional budgets. Consequently, the transport tax for each region is approved at the legislative level of the constituent entities of the Russian Federation and is a mandatory payment for each car owner ( Chapter 28, Article 357 of the Tax Code of the Russian Federation ).

The tax period is the reporting year. Tax rates, determined by laws at the regional level, can be increased or decreased in relation to the base (state) rate. Their size is influenced by:

- engine power , measured in horsepower.

- Gross tonnage.

- Vehicle category.

- Year of car manufacture.

Moreover, in each subject of the Russian Federation and cities of administrative significance, the authorities determine who can use transport benefits.

Vehicles belong to different groups according to category and type (this information is in the registration certificate).

Car categories are divided into five groups:

- Motor transport (“A”).

- Passenger cars with a weight of no more than 3.5 tons and a number of passenger seats of no more than 8 (“B”) .

- Vehicles weighing more than 3.5 tons (“C”).

- Vehicles with passenger seats (“D”) .

- Trailers designed to travel with a vehicle (“E”) .

Each category and type of vehicle has its own rates. Tariffs for freight and passenger transport may differ several times.

Transport tax and the Plato system (nuances)

Legal meaning of the simplified procedure for collecting fees in the Platon system

With the launch of the Platon system (in November 2015), a wave of criticism and negative comments began regarding the new mandatory payments. In addition, they tried to fight against the Platon system using legal methods.

One of the main complaints about the new fee was that the same object (heavy cargo) is subject to 2 payments simultaneously with approximately the same purpose:

- transport tax (Chapter 28 of the Tax Code of the Russian Federation), one of the main purposes of which is to maintain roads in an acceptable condition;

- toll on federal roads (Resolution of the Government of the Russian Federation dated June 14, 2013 No. 504), funds from the collection of which should also be used for road repairs.

The only difference between these “extortions” was that the transport tax is regional, and payments to Platon are federal. But for ordinary owners of heavy trucks, forced to pay both, in practice such a difference did not matter.

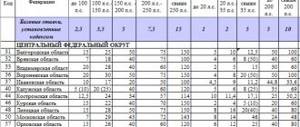

All-Russian base rates for transport taxes on heavy trucks

In 2021, the transport tax rate remains unchanged . The abolition of this category of payments is not envisaged, since it is one of the most significant sources of financial revenue to the state budget.

In each subject of the Russian Federation, the transport tax on trucks is calculated independently, however, there are all-Russian state rates (basic), which are based on engine power, which is measured in horsepower. At the same time, the amount of the transport tax, which is charged in 2021 in the regions, may differ from the state level (increasing or decreasing) by no more than 10 times (Chapter 28, Article 361 of the Tax Code of the Russian Federation) in relation to various categories of cars and their age , ecological class.

For each horsepower of trucks, the following base rate is established, measured in rubles ( Chapter 28, Article 361 of the Tax Code of the Russian Federation ):

- up to 100 hp - 2.5;

- from 100 to 150 hp - 4;

- 150-200 hp - 5;

- over 250 hp — 6.5 .

The tax amount established for each region can be viewed on the official website of the Federal Tax Service.

In order to find out the amount of tax on freight transport today, it is enough to know the engine power, measured in horsepower.

Calculation of the amount of TN

A transport tax calculator can be found on the website of the Federal Tax Service. However, you can calculate the amount to be paid using the following formula:

TN=MD×NS×(KPM/12), where:

- TN – transport tax;

- MD – engine power, measured in horsepower;

- NS – tax rate for a specific region;

- KPM – the number of full months during which the taxpayer owned the car.

For example, the transport tax on a KamAZ car with a capacity of 210 hp registered in the capital 8 months ago. s will be like this:

TN= 210×45×8/12= 6300 rubles

Read about how to calculate transport tax yourself.

Are all types of freight transport subject to taxation?

Transport tax is charged on all types of heavy equipment that is used to transport cargo : dump trucks , vans , platforms, tractors, multi-axle trucks, small vehicles and light-duty vehicles, pickups .

If the transport is used to perform agricultural or other specialized work, then the transport tax is not charged. Such vehicles include milk tankers , vehicles for transporting fertilizers , poultry , livestock , special vehicles for veterinary services , self-propelled vehicles , tractors , combines , etc. ( Chapter 28, Article 358 of the Tax Code of the Russian Federation ).

Transport duty is not charged on these types of machines only if the owner is a registered manufacturer of agricultural products.

Nuances of calculating tax on freight transport category “B”

The greatest uncertainty for car owners is the tax on flatbed cargo vehicles of category “B” (pick-ups) and on vehicles of the “ van ” vehicle type ( minibuses ), also belonging to category “B”.

Assuming that the letter “ B ” indicated in the PTS in the line “ Vehicle Category ” indicates that the car belongs to the category of passenger vehicles, the owner of such a car is surprised to receive a notification from the Federal Tax Service, in which the transport tax rate is calculated as for freight transport. As a rule, this rate is several times higher than for a passenger car. And this is not a mistake of the tax authorities, since the transport tax is calculated based on the rate, which is determined not by category “ B ”, but by the type of vehicle.

Category “ B ” only indicates that the following vehicles are permitted:

- maximum vehicle weight – no more than 3.5 tons;

- number of passenger seats – no more than 8 .

These restrictions precisely indicate category “ B ” in accordance with the Regulations on vehicle passports and vehicle chassis passports, approved. Order of the Ministry of Internal Affairs of Russia N 496, Ministry of Industry and Energy of Russia N 192 , Ministry of Economic Development of Russia N 134 of June 23, 2005 (clause 28) and Appendix 6 to the Convention on Road Traffic (clause 5) .

Thus, we can conclude:

- Category “B” is not always a passenger car . Trucks that fall under the specified criteria may also be included in this category.

- When it comes to determining the type of car, you cannot focus on category “B” .

Transport classification

Road transport is classified according to the following parameters:

- appointment;

- engine type and size;

- type of car body;

- its passability.

Depending on the parameters of the car, they are divided into 5 groups:

- “A” – motor transport;

- “B” – vehicles weighing up to 3.5 tons and with a capacity of no more than 8 passengers;

- “C” – vehicles weighing more than 3.5 tons;

- “D” – car with more than 8 seats for passengers;

- “E” – trailers.

Each group of vehicles has its own tariff rate for taxation. All vehicles weighing more than 3.5 tons are subject to the payment of a tax for trucks.

Attention! All heavy equipment used for transporting and moving goods is also subject to the transport tax for freight vehicles. It doesn’t matter whether it’s a tractor, a flatbed truck, a pickup truck or a KAMAZ truck crane.

Sometimes a car owner may not understand why his vehicle belongs to category “B”, and the tax is calculated as for a truck. This is explained by the fact that the car may belong to the category of trucks, in accordance with the Regulations on PTS and vehicle chassis, although it has characteristics corresponding to category “B”.

Benefits for participants of the Platon system

Platon system was introduced in Russia ( Federal Law No. 68-FZ of 04/06/2011 ), which provides for the obligation to pay a toll when driving on federal roads of vehicles with a permissible maximum weight of over 12 tons . Truck owners are faced with a significant financial burden in the form of two mandatory payments with the same purpose: financing roads intended for public use.

Subsequently, in order to reduce this burden, Federal Law No. 249-FZ dated July 3, 2016 amended the second part of the Tax Code of the Russian Federation. The amendments provide for adjustments to the taxation system for owners of freight vehicles with a permissible maximum weight of more than 12 tons.

In accordance with Article 1 of Federal Law No. 249-FZ dated July 3, 2016 “On Amendments to Part Two of the Tax Code of the Russian Federation,” Platon toll collection system :

- If the amount of payment made under the “ Platon ” system is equal to or exceeds the amount of the accrued tax on a cargo vehicle, then the owner is exempt from paying this tax .

- If the amount of payment under the “ Plato ” system is less than the amount of tax, then the car owner is entitled to a tax deduction equal to the amount of payment made.

It is important that the transport tax benefit is provided to the owner of a freight transport - a participant in the Platon , regardless of who owns the truck: an individual or an individual entrepreneur. This is explained by the fact that when calculating transport tax, individual entrepreneurs are equated to individuals ( Chapter 28, Article 362 of the Tax Code of the Russian Federation ), since there is no special procedure for paying transport tax for taxpayers who are individual entrepreneurs.

The benefit is provided to owners of large cargo for each truck that has been registered in the Platon system

It should be borne in mind that this benefit is provided for legal relations established from January 1, 2021 - for organizations, from January 1, 2015 - for individuals. The law extends its effect until January 1, 2021 .

You can apply for a transport tax benefit in one of the following ways:

- Contact the tax office in person.

- Use the services of Russian Post .

- Leave an application on the Federal Tax Service website in the taxpayer’s personal account.

Plato system and transport tax in 2021

Author: Ekaterina Solovyova Accountant-consultant

The beginning of 2021 was marked not only by an increase in the VAT rate, changes also affected the Platon system. Among the innovations is the abolition of the transport tax deduction for the amount of payments into the system. We tell you how owners of heavy trucks can avoid mistakes when calculating the necessary contributions to the budget and how to return the overpayment, if any.

What tax collection procedure was in place for heavy trucks before 2020?

Until December 31, 2018, two types of payments were “assigned” to owners of heavy-duty transport:

- contributions to the Platon system, through which roads are repaired;

- regional transport tax allocated for road maintenance.

In addition, owners of cars with a maximum permitted weight of more than 12 tons had the opportunity to reduce the fuel charge by the amount listed in Plato.

It is important that only owners of heavy trucks registered in the system as tax payers for this vehicle could take advantage of this right (letter of the tax service dated July 11, 2021 No. BS-4-21/13355).

Tax calculation was based on the following rules:

- Records were kept for each vehicle separately. It was not possible to reduce the tax amount for one truck by the amount of contributions paid for another vehicle.

- A reduction in budget payments was allowed only in the case when in the reporting year the car “traveled” advance contributions to the system.

- If payments to Platon exceeded the accrued tax, the payer was completely released from the obligation. The difference between the amount of contributions and the transport tax was allowed to be taken into account in the tax base for profits.

- If the payment for damage to roads was less than the tax, the amount not covered by the funds spent on Platon was paid to the budget.

From January 1, 2021, the benefit with which car owners reduced the amount of transport tax was cancelled. In addition, innovations have complicated the accounting of expenses according to Plato. To be able to include them in total costs, you will need to separately account for payments into the system.

Cancellation of transport tax benefits: prospects for innovation

From 2021, the amount of payments paid to the Platon system does not matter for the purposes of calculating TN. According to the new rules, payers are required to pay taxes for all existing vehicles in full (letter of the Federal Tax Service No. BS-4-21 / [email protected] dated March 22, 2019).

Thus, all owners of heavy trucks are simultaneously responsible for calculating and paying advance payments of transport tax, as well as payment for travel on federal highways to the Platon system.

Article 12.21.3 of the Code of Administrative Offenses establishes a number of fines for failure to use the on-board device or for fraud with it.

Rules and procedure for paying transport tax

The payer of transport tax on freight transport, as in the case of passenger cars, is the owner in whose name the vehicle is registered.

A truck can be registered to an individual or a company (organization, institution).

Payment of transport tax is made by the car owner after receiving the appropriate notification sent by the tax office 30 days before the date of payment to the address that the car owner indicated when registering the vehicle.

The absence of a postal tax notice is not grounds for exemption from payment of the transport tax. If there is no such notice, you should contact the tax office to find out the reasons and receive a tax receipt in person.

If payment of transport tax is not made within the deadlines established by law, then this may be considered a tax, administrative offense or even a criminal offense . In case of tax evasion (including transport tax), enforcement measures are provided.

In accordance with Art. 45 Part 2 of the Tax Code of the Russian Federation, debt is collected in the manner prescribed by Articles 46,47,48 of the Tax Code of the Russian Federation :

- The car owner-taxpayer is notified of the need to pay the debt and penalties for each overdue day.

- Tax authorities file a claim in court , which may decide to collect transport tax by:

- writing off funds (electronic or from bank accounts);

- seizure of property.

For physical individuals, tax can be collected by deducting the required amount from wages. In addition, the defaulter’s travel outside the Russian Federation may be limited.

Article 15.5 of the Code of Administrative Offenses of the Russian Federation provides for administrative punishment for late provision of tax information (declarations, calculations of insurance premiums): a warning or a fine for officials.

If the car owner, evading paying tax, did not report the purchased vehicle to the Federal Tax Service (hid tax information), then the measures provided for in Art. 198 of the Criminal Code of the Russian Federation : fine, forced labor, arrest, imprisonment. For organizations, such measures are provided for in Art. 199 of the Criminal Code of the Russian Federation .

In this regard, car owners (individual, individual entrepreneur or organization) must be personally interested in promptly reporting information about the vehicle to the Federal Tax Service and paying the transport tax on a car (including a truck) on time and in full.