Necessary documents and nuances of issuing a power of attorney

In order to issue a power of attorney for an MTPL policy, you will need to provide the notary with the following documents:

- certificate of ownership of the car;

- vehicle registration certificate;

- previous MTPL policy (if available);

- in the event of an insured event - a protocol from the traffic police;

- car diagnostic card.

The power of attorney is supported by copies of the identity card of the owner of the car and the authorized person.

At the time of drawing up the document, the principal has the opportunity to independently determine the permissible list of powers for the authorized person, which may include the right to receive insurance payments, participate in insurance procedures, and submit documentation on behalf of the principal.

To obtain a power of attorney at a notary's office or in the presence of insurance company employees, the presence of both parties is required: the authorized person and the principal with the following papers:

- A standard form of power of attorney completed by the principal for subsequent representation of interests in the insurance office.

- Documents confirming the identities of the parties - passports.

- For legal entities - registration documents that confirm the legality of the enterprise.

- An insurance policy on the basis of which the entrusted person will perform permitted and permissible legal actions.

- Papers for a vehicle.

Power of attorney for insurance from a legal entity

A power of attorney for insurance from a legal entity can be of several types :

The document must contain the following information:

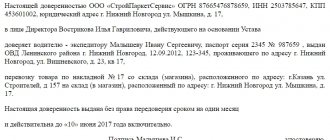

If this is not a general power of attorney, then this document does not need to be certified by a notary. A sample of a simple power of attorney is presented below.

Purpose of the power of attorney for registration of compulsory motor liability insurance

Many motorists are interested in why insurers ask for a power of attorney and why they cannot purchase a form without it. In fact, this requirement is enshrined in law. It is thanks to the power of attorney that the insurer can be sure that the applying motorist legally represents the interests of the owner.

The purpose of a power of attorney is to perform any actions on behalf of the owner of the vehicle legally.

Requirements for an attorney

To issue an MTPL policy, the authorized person must present documents to the insurance company specialist. Be prepared to prepare:

- passport to confirm identity;

- power of attorney (original);

- vehicle passport or state registration certificate.

If an employee of the company is involved in insurance issues, then the company’s statutory documents must additionally be presented.

As practice shows, in the insurance industry there are no clear requirements on how a power of attorney should be drawn up. That is why some insurers are ready to accept a regular handwritten document, while others are exclusively notarized. Unfortunately, the requirements are legal and the policyholder can only fulfill them or contact the office of another insurance company.

What information should be included

It doesn’t matter what kind of power of attorney is requested for an insurance company under compulsory motor liability insurance (handwritten or notarized), it must contain a number of mandatory requirements.

The power of attorney to receive the policy must contain:

- personal data of the car owner: full name, date of birth, passport details and registration address;

- personal information of the authorized representative (similar);

- characteristics of the vehicle: make and model, state registration plate, PTS data and identification number;

- powers of the trustee, for example: the right to issue compulsory motor liability insurance, make changes, receive payment in the event of an accident, etc.;

- date and place of issue;

- validity period (usually 3 years);

- notary's signature and seal.

Registration of a power of attorney for the right to insure a car

It is necessary to take into account that the power of attorney to issue an MTPL policy can be one-time or special. As for the one-time one, in this case the name speaks for itself. This document is required solely to perform one action, namely the purchase of compulsory motor liability insurance.

If a power of attorney is needed for several actions and for a long period, then in this case a special one is drawn up, which specifies all the rights of the trustee and the validity period of the document.

It is important to take into account that the special owner of the car can revoke the special license at any time, before the expiration date, if he loses confidence in his representative or he violates his obligations.

Validity periods

As for the validity period for an individual, it directly depends on the type of document.

| One-time | As already mentioned, this document is issued to carry out a specific action. That is why deadlines are not taken into account when compiling. |

| Special | The term of such a power of attorney is regulated by the parties to the legal relationship and in most cases does not exceed one to 3 years. |

| General | For this type of power of attorney, the term is negotiated by the parties to the agreement and must be written down in the text of the document. |

A power of attorney for insurance under compulsory motor liability insurance can be issued in the following options:

- one-time;

- special;

- general

A one-time power of attorney is intended to assign to another person the authority to perform a specific single action, therefore such a document is relevant exactly until the specified operation is fully implemented. For example, such a document can be issued by the owner of the car to the policyholder to purchase a policy. A sample form of a one-time power of attorney can be downloaded from the link.

According to a special power of attorney, its recipient can perform the same action for a longer period specified in the document itself (maximum three years). If such a period is not indicated in the text, it is generally accepted that the document is issued for one year. For example, a car owner can authorize the policyholder to renew the contract with the company and purchase a policy every year for three years.

A general power of attorney is issued if the car owner plans to entrust another person to carry out a range of operations with his car: insure the object, leave it as collateral, sell it, etc. Such a document must be certified by a notary office. A general power of attorney, if necessary, may also provide for the right to delegate the implementation of certain actions to third parties. The form for filling out a general power of attorney can be downloaded from the link.

Every vehicle owner is required by law to insure the car, but if this is not possible, then an authorized person can carry out this operation. You can take out car insurance not only on the basis of a one-time targeted power of attorney with notarization, but also if you have a general power of attorney, which provides the right to perform any actions with the vehicle.

When drawing up a power of attorney for the right to insure a car, you must submit a standard set of documents and when drawing up the power of attorney form, indicate the following reliable data:

- The exact name of the document, place and date of its issue.

- Details of the principal and the trustee (passport data of individuals and registration data of legal institutions).

- The text of the power of attorney itself, which includes all the powers of the authorized representative - the right to insure a car.

- Validity period of the document.

- The clause on the existence of the right to formalize a transfer of trust.

- Signatures of the parties, seals.

Today, in many families, a car is purchased not only for one driver, but also for other family members.

Help: It is possible to register ownership in the name of only one person, but to drive this vehicle, other persons will need a special document called a power of attorney.

But how are such a document as a power of attorney and the insurance itself interconnected? In some situations, you simply cannot do without this document to obtain a motor vehicle license. These include:

- the situation when insurance is taken out by someone other than the owner of the vehicle;

- occurrence of insured events when representation of the car owner is necessary. Most often, in court you need to provide a certain package of documents and carry out certain actions confirming the insured event.

Power of attorney from an individual

To draw up an MTPL agreement, the legislation does not provide for the obligation to have a power of attorney from the owner of the vehicle, who is an individual. In Art. 15, Part 2 of the Federal Law (FZ) of the Russian Federation No. 40-FZ states that the agreement is concluded in relation to the owner of the vehicle and persons (the number of which may be limited or unlimited) allowed to drive this vehicle. In Art. 1 of the said Federal Law specifies that the owner of the vehicle is:

- car owner;

- a person who legally owns a vehicle: by lease;

- with the right to drive a vehicle on the basis of an issued power of attorney;

- on other grounds.

Thus, any person from the above can become the policyholder. In Art. 15, part 3 indicates what documents the policyholder must provide. A power of attorney for drawing up an insurance contract is not included in this list.

If the owner of the vehicle wants him to be listed as the policyholder in the insurance, but cannot be present during the registration procedure, then in this situation a notarized power of attorney from the owner is required for any citizen chosen as a proxy. In this case, the trustee acts as the legal representative of his principal, and the same person will be indicated in the “Owner” and “Insured” columns, namely the owner of the vehicle.

Sample power of attorney for car insurance

How to draw up a power of attorney on behalf of a legal entity

In the process of concluding a trust document for a car title or CASCO for a credit or regular car, the principal provides a standard list of papers and also supplements it with the following documents:

- internal passport, rights of a trusted person;

- vehicle registration documents;

- a valid diagnostic card (latest technical inspection coupon);

- a written statement from the owner of the vehicle regarding the desire to issue a power of attorney;

- copies of driver's licenses of persons who will be able to drive and operate a vehicle.

In legal practice, it is possible to execute trust documents on behalf of an individual. With this procedure, the applicant must collect a list of required documents and visit the insurance company or notary to fill out the appropriate form. The document must indicate the following information:

- place and date of execution of the power of attorney;

- your passport details: full name, date of birth, gender, series and number, date of receipt and organization that issued the passport;

- similar data must be indicated by the party of the trusted person;

- a list of powers that a trusted person can perform.

The procedure for issuing a power of attorney for the right to represent interests in an insurance company from a legal entity provides for a standard registration procedure. The applicant indicates the place and date of the manipulation, the name of the organizations in which representation is required and a list of powers. The following data is entered in the applicant's side column:

- Name of the organization;

- individual tax code;

- registration number of the commercial enterprise, the date of registration and the responsible person who recorded it;

- company address;

- passport details (full name, date of birth, number, series, date of receipt of passport, registration).

In accordance with current legislative acts, a power of attorney for the right to represent the interests of the principal in an insurance company, issued on behalf of a legal organization, must be certified by the company’s seal and the signature of the following persons:

- head of the institution;

- a person authorized to sign the relevant constituent documents.

Is it possible to apply for compulsory motor liability insurance without the owner of the car?

Having a power of attorney makes it unnecessary for the car owner to be present when purchasing the policy. The document is drawn up in two ways: by the principal or through the services of a notary.

The need for powers of attorney fell after the opening of online sales of compulsory motor insurance. Drivers now have the opportunity to contact any insurance company without visiting an office.

The DocAuto service will help you get acquainted with the best insurance products. Here are solutions for private and commercial vehicles, motorcycles and cars. Along with compulsory motor liability insurance, proposals for CASCO and Green Cards have been collected.

You can quickly insure your car from anywhere in the world, spending no more than 15 minutes!

Registration procedure

To formalize a power of attorney, to purchase compulsory motor liability insurance, you must contact a notary. In this case, the document is drawn up exclusively in the presence of the car owner, an authorized representative and a notary.

Before drawing up a power of attorney, the notary is obliged not only to check the documents, but also to make sure that both parties are legally capable. If everything meets generally accepted requirements, then the text of the document is compiled. As a rule, each notary has special templates.

After the text has been agreed upon, a document is prepared on a special form with watermarks and certified with a signature and seal. It is important to take into account that the document is always drawn up in two copies, which have equal legal force. One copy will be kept by the notary, the second will be handed over to the owner of the car. In addition to the paper copy, the number is entered in a special notary book and the unified state register.

Required documents

To issue a power of attorney for car insurance, you need to prepare a small package of documents.

Be prepared to provide:

- passport of the principal, in this case the one in whose name the vehicle is registered;

- passport of the representative who receives the license for the car;

- document confirming ownership of the car: PTS or STS.

All documents are accepted only in originals. It should be borne in mind that the notary does not have the right to demand other documents.

If the power of attorney does not require notarization, the car owner has the right to write it out in his own hand or prepare a printed version. To do this, you can compose the text yourself according to the rules of office work, using a ready-made form, or online, using the document designer.

A power of attorney that needs to be certified must be drawn up directly at a notary’s office and always in the presence of the principal. If necessary, the second party in whose name the power of attorney is drawn up can also be invited. Before going to the notary, you should prepare the required package of documents.

The list of documents required to issue a power of attorney includes:

- driver's license and car owner's passport;

- driver's license and passport of the person in whose name the document will be issued;

- documents for the car (technical passport, certificate of registration with the traffic police).

If the principal or trustee is a legal entity, then for registration you will need the registration documents of the organization and the passport of the official representative authorized to represent the interests of his company. Powers of attorney issued on behalf of an individual and a legal entity differ in the set of data specified in the text. Organizations can use their own letterhead as the basis for the paper.

The completed power of attorney must contain the following information:

- date of issue of the document and its validity period;

- Full name, date of birth, address, passport details of the owner of the car (for legal entities - organization details);

- Full name, date of birth, full address, passport details of the person in whose name the document is issued (for legal entities - details of the organization);

- a detailed description of the car indicating the make, model, VIN number, year of manufacture, body and chassis numbers, license plate, details of the state registration certificate;

- a list of operations that the authorized person is allowed to carry out;

- visa of the principal (for legal entities - and seal of the organization);

- visa and notary stamp (if necessary).

Detailed step-by-step instructions

Sample of filling out a power of attorney. To issue an MTPL policy under a power of attorney, you must select a suitable insurance company. After choosing an insurance company, a package of necessary documents is collected, consisting of:

- car owner's passports;

- a power of attorney issued by the owner of the car in the name of the attorney;

- PTS and STS of the vehicle;

- the rights of a person who is allowed to drive a car;

- technical inspection certificate.

To issue compulsory motor vehicle liability insurance, a technical inspection of the car for which the policy is issued must be carried out.

After all the necessary papers have been collected, you can go to the office of the insurance organization and purchase insurance (read what to do if the insurance company imposes additional services here, and here we told you how to apply for compulsory motor third party liability insurance online without additional services from the insurer).

It should be noted that before you sign for an insurance policy, you need to check it carefully. If errors or corrections are found in the compulsory motor liability insurance policy, then the insurance agent must be informed about this so that all corrections can be made.

A car insurance policy is a strict reporting form, so making changes to it manually or in any other similar way is strictly prohibited. To change the information in the form, the damaged policy is canceled, and the client is given another form, filled out without errors or corrections.

This action must be carried out without fail, because driving a vehicle without documents or with incorrectly filled out documents entails a fine.

At the end of the insurance registration procedure, the client is returned the originals of his documents, and is also given the original auto insurance policy and a check confirming payment of the insurance premium.

Any document must be drawn up correctly. If the company agrees to accept a power of attorney in handwritten form, then we will consider in more detail how to draw it up correctly and what should be indicated.

You will need:

- Take a blank sheet of paper, A4 size and on top.

- Just below in the upper right corner you must indicate the city in which registration takes place and the date.

- Next will be the text of the document itself. In this section you must indicate all the details of the principal, authorized person and powers.

- Finally, you must indicate for what period the document was issued.

- Submit the signature and transcript of the principal and authorized representative.

A power of attorney drawn up by hand is accepted in most cases:

- to make changes to the contract form;

- in order to receive payment in the event of an insured event;

- to represent interests in an insurance company;

To make changes to the policy

If a power of attorney is needed only to make changes, then in the powers section you should write down: the authorized person, during the validity period of agreement No. “Specify number,” can make changes, namely:

- register a driver or do compulsory motor liability insurance without restrictions;

- extend the period of use;

- change data: full name of the owner, PTS data or state registration plate.

To receive insurance payment

In the event that the owner cannot personally contact the insurer’s office in order to receive payment, a document is prepared indicating: an authorized person, during the term of the contract, can contact the insurance company’s office in order to provide documents on the accident and receive compensation payment.

To represent interests in an insurance company

Such a power of attorney is drawn up so that the trusted person can contact the insurer’s office to resolve any issues. To do this, all powers should be clearly stated in the body of the document. Eg:

- driver registration;

- extension of validity period;

- termination.

Instructions for concluding a contract

When preparing a document yourself, you should follow a few simple rules:

- Download the power of attorney template for MTPL.

- Fill out a power of attorney only if you have the passports of the principal and the authorized person.

- After drawing up, give the document to the authorized person confirming ownership of the car.

When is such a document needed?

In clause 8, clause 15 of the Federal Law “on compulsory motor liability insurance”, the policyholder is obliged to notify the insurer in writing of any changes in the submitted data when concluding a contract . Often, changes mean adding or removing drivers from the list of those allowed to drive a vehicle.

Changes are made solely with the knowledge of the insurance policy owner. To do this, he must contact the insurance company in person. However, insurers allow changes to be made at the request of other persons if they can provide a valid power of attorney.

The need to make amendments is not directly stated in the law, since the period for notification of changes and sanctions for ignoring this obligation are not specified. However, the addition of a new driver to the MTPL agreement since 2012 eliminates the need to obtain a power of attorney to drive a car, replacing this document with participation in the insurance agreement.

It is possible to add new persons to the insurance before the expiration of the contract , but only at the request of its owner. If the policyholder is not comfortable contacting the company personally, he can entrust the drawing up of the appeal to a trusted person.

Is it required if the driver is included in the insurance?

Since November 2012, at the legislative level, drivers are allowed to drive a vehicle without a power of attorney, provided that they are included in the compulsory MTPL insurance policy. When stopping, a traffic police officer cannot demand permission to drive a car, since it is not included in the list of mandatory documents, unlike insurance and driving license. Drivers are included in the insurance when it is taken out or while it is valid.

Do you need a power of attorney to drive a car if you are registered with OSAGO? This document is still required in cases where the driver wants to perform the following actions with a vehicle that does not belong to him:

- cross the state border;

- conduct a technical inspection and obtain a diagnostic card;

- take out a CASCO or OSAGO policy;

- sell a car;

- deregister the vehicle.

The power of attorney must indicate the actions permitted by the owner with the car or indicate the full right of disposal. To drive any vehicle, you do not need the owner's permission ; it is enough to be included in the policy.

You may find other articles from our experts on the topic of MTPL insurance useful. Read about what the fine is if the driver is not included in the MTPL policy, how to correct an error in the document and when it needs to be replaced, as well as how changes are made and whether the policy will have to be changed when changing the driver's license.

If the driver is not included in the “motor citizen”

The question of whether a power of attorney is needed if it is not included in the MTPL can be answered in the negative, since a power of attorney to drive a car is excluded from the list of mandatory documents and its execution is not necessary. On the other hand, a driver who has such a power of attorney still does not have the right to operate a car on public roads without being included in the MTPL insurance policy. Only the policyholder who has the appropriate right to dispose of the car has the right to include the driver in the insurance contract. The applicant is required to provide a passport, driver's license and sign an agreement with the insurance company.

To add a new driver to the insurance policy, you do not need to renew it, since there is a procedure for making changes to the compulsory motor liability insurance policy. To do this, you need to provide a copy of the new driver’s passport and driver’s license. It should be noted that the insurer must contact the insurance company.

Other persons, even car owners, must provide a power of attorney to make changes to the MTPL from the policyholder . Most insurance agents ask for a notarized power of attorney or a general power of attorney with signing authority, rather than accepting handwritten authorizations. In this case, it is possible to prove the validity of a handwritten document only through the court, so the best solution is to contact a notary.

Attention! When adding a driver to the insurance policy, the overall MTPL ratio will be recalculated. An additional fee will be required based on the new driver's insurance ratio.

You will learn all the details of the procedure for adding a new driver to the policy in this material, and how many drivers can be added to the policy for free can be found here.

Certification methods

When drawing up a contract, insurers ask to present a certified power of attorney form to the office of the insurance company. In this case, as already mentioned, you can certify the document:

- personally, by signing the document on the part of the principal;

- notarized.

Often, companies only require a notarized power of attorney to enter into an MTPL agreement. This requirement can be explained very simply; insurers are trying to avoid the fact of fraud and issue or extend the contract “cleanly”, from a legal point of view.

Is it possible to issue compulsory motor liability insurance not for the owner?

You can save time and money by using the OSAGO online calculation and registration form on our website, which provides separate fields for the car owner and the one who insures the car (the policyholder ) . In this case, you do not need a power of attorney and you can choose a profitable option from the offers of several insurance companies.

There is still an opinion among drivers that a car insurance policy is always issued only to the formal owner of the car. However, this opinion is wrong. The presence of the owner when registering compulsory motor liability insurance is not at all mandatory. However, his name fits into the auto insurance policy. The policyholder is the person who entered into the MTPL agreement and, accordingly, made the payment. He automatically becomes a driver included in the motor vehicle policy, that is, he is covered by insurance. For the owner of a car, when applying for compulsory motor liability insurance not in the name of the owner, it is not necessary to enter the policy as a driver.