Fine for driving without insurance in someone else's car

2.4 (48.33%) 12 vote[s]

Having an MTPL insurance policy is a mandatory requirement for all motorists. The purpose of this insurance is to compensate third parties for losses resulting from an accident that was your fault. But very often, some drivers either forget to issue a car insurance policy in a timely manner, or even drive someone else’s car and believe that the owner’s insurance is sufficient. However, it is not. What does the legislation say about this, and what responsibility awaits the violator?

How to legally drive someone else's car in 2021?

So, the owner of the car entrusts his property to another person. At the same time, the legislation establishes that this other person owns the car on the basis of trust from the owner. That is, the owner and owner of the car can be different people.

At the same time, the transfer of a car can also be oral (although the Civil Code of the Russian Federation establishes exclusively a written form of power of attorney).

But the most important thing is that you, as a driver driving a car that is not your own, do not need to prove in any way the right to own this car, either during a routine stop by a traffic police officer, or if you are involved in an accident in someone else’s car. The main thing is that you have documents to be able to drive it.

In standard cases, the list of these documents includes only 3 (clause 2.1.1 of the traffic rules):

- registration certificate for someone else’s car (given to you by the owner),

- MTPL insurance transferred by him, where you must be entered as a driver allowed to drive (column No. 3 of the policy), or it must be unlimited,

- your driving license of the appropriate category.

The obligation to submit a written power of attorney from the owner to a road inspector for inspection was abolished 10 years ago.

Actually, the consequences of a traffic accident depend on the specified conditions for the legal ability to drive another person’s car, which we will discuss below.

How much will you need to pay if a person does not have a policy?

Every person driving a vehicle must have liability insurance. It happens that citizens neglect this rule. What liability does the person face in this case?

The MTPL policy insures the liability of drivers. According to legal requirements, such insurance is necessary for everyone who has driven at least once. The punishment for this offense is established by the Administrative Code and ranges from 500 to 800 rubles. The amount is small, but you will agree that there is nothing pleasant about it. In any case, these are unplanned expenses, and no one is happy about it.

It is quite possible to prevent all of the above if you notify the insurance company in advance that it is necessary to expand the circle of persons admitted to management. As a rule, most insurance companies require you to pay extra for the adjustments made, taking into account the prices for such services. If you do not do this in advance, you are guaranteed a fine. The best option is to plan your trip in advance, then you can prepare for it.

What to do if you have an accident but are recognized as the injured party?

In this case, the actions immediately after the accident are the same as if it were your car:

- stop and do not move the car and other objects related to the accident,

- put up an emergency sign,

- turn on the hazard warning lights,

- decide whether you can apply for a European protocol (you must be included in the current insurance) or call the traffic police,

- and other duties depending on the presence of injured or dead (clauses 2.5-2.6.1 of the Rules)

However, the difference in this case will be in the further settlement of losses caused as a result of such an accident. So, you will be the injured party in this accident in any case.

However, either only the owner or you together will apply for compensation for damage - both to the insurance company if the culprit has a valid compulsory motor liability insurance, and for a direct demand for compensation in the absence of insurance. It depends on the nature of the damage:

- if the damage was caused only to someone else’s car, which you were driving, then in this case the beneficiary is exclusively the owner, since damage was caused to his property,

- If, as a result of an accident, your health is damaged, then you are also a beneficiary (your health).

In the second case, you need to write 2 applications to the insurance company (you need to apply for compulsory motor liability insurance to the insurer of the culprit). Or, if the culprit did not have insurance, then the person causing the harm is presented with 2 demands: from you and the owner of the car.

The only time you have to pay!

There is still one situation when you will face civil liability even if you are not at fault in an accident committed in someone else’s car.

This is compensation for material and moral damage to these cars as a source of increased danger. Such liability arises when harm is caused to a pedestrian, passenger or cyclist. And the basis here is Article 1079 of the Civil Code of the Russian Federation, according to which the driver is obliged to compensate for damage as the owner of the source of increased danger on the road.

But even in this case, compulsory motor liability insurance applies: if the car in which, for example, a pedestrian was hit, had valid insurance, and you are included in it as an authorized driver, then the insurance company will compensate for the material damage. But the moral one is that you are still the owner of the car at the time of the accident (subparagraph “b” of paragraph 2 of Article 6 of the Law on Compulsory Motor Liability Insurance).

What to expect if stopped by traffic police officers?

According to the requirements of the law, lack of insurance is punishable by a fine of 500 to 800 rubles. The minimum penalty applies only when it exists, but the policy is located elsewhere. To avoid a fine, you can confirm that you have a policy. For example, you can give the details of the insurance company, the telephone number of the insurance agent, or the contract number.

Starting from 2015, the existence of insurance can be determined using the information contained in the database. Traffic police officers can also check the validity period of the policy. State Traffic Inspectorate employees have the right not to issue you a fine; they can issue a warning. The decision is made by State Traffic Inspectorate employees at their discretion. What can the car owner expect in such a situation? Absolutely nothing.

Apart from this fine, no further actions will follow. Previously, employees of the State Traffic Inspectorate could apply other sanctions; in the absence of insurance, they had the right to take away the license plate or take the vehicle to a parking lot for a fine. Now this is excluded, at most they can only issue you a fine, given that you have all the necessary papers for the vehicle with you.

What happens if you get into an accident in a car that is not yours and become the culprit?

If you have an accident not in your own car and have met all the above conditions for having the right to drive it, then the liability, as well as the consequences for compensation for damage, are almost the same as if it were your personal car.

And these consequences can be of 2 types:

- administrative or criminal - a fine, deprivation of rights or other punishment directly for a violation that you committed in someone else’s car, which led to an accident (that is, we are talking about liability for corrective purposes),

- civil is a fair obligation to compensate for the damage caused if you were the culprit of such an accident not in your own transport.

Is there a fine or deprivation of rights for this?

There is no separate liability just because you were driving a car that was not your own. Of course, we are again talking about whether you have a driving license (w/w, STS and OSAGO), otherwise there will be fines regardless of the presence of an accident.

If you are involved in an accident in 2021 - regardless of whose car it is in, liability can only be:

- for a traffic violation that caused an accident (for example, you drove through a red traffic light and received a fine of 1,000 rubles),

- a fine or for the presence of victims in an accident (Article 12.24 of the Code of Administrative Offenses of the Russian Federation),

- or criminal liability for serious harm to health or death of people if you are guilty (Article 264 of the Criminal Code of the Russian Federation).

Important note!

- This article describes the basic principles of how legislation works. Meanwhile, in judicial practice everything depends on specific circumstances.

- In 96% of all cases there are subtleties that can affect the outcome of the entire case.

- Therefore, we recommend entrusting the matter to professionals who will study your business and select the right winning strategy.

The TonkostiDTP website employs professional road accident lawyers with experience in all major types of disputes (MTPL, guilt, administrative penalties).

Ask a lawyer

or get a free consultation by calling the hotline: 8.

Liability for damages

If you get into an accident in someone else’s car, in which you are found to be at fault, you will also be required to compensate for the damage caused. At the same time, this obligation is removed if your liability is insured under MTPL.

Here we will also not discuss another situation that was discussed in one of the previous articles - if you were involved in an accident in a company car.

However, it is removed conditionally or partially, taking into account 2 important circumstances of the 2021 legislation. We talked about the first above - this is compensation for moral damage, as well as in case of damage to property or under the conditions that are listed in paragraph 2 of Article 6 of the Federal Law-40 (if damage to someone else’s car was caused, for example, during a competition or caused to the environment ).

But let's talk a little more about the second one!

Fineness with compensation for the difference in wear

The point here is that insurance companies calculate damages under compulsory motor liability insurance taking into account the wear and tear of the car you were driving. The older the car, the higher the wear percentage when calculating. True, this wear and tear is considered when making payments - if the owner was sent for repairs, then everything should be calculated without him.

However, the Constitutional Court ruled several years ago that the right of the victim to full compensation for harm must be present regardless of the presence of wear and tear in the calculation. At the same time, the court indicated that in this case it is possible to claim the difference between the calculation with wear and tear and the real market cost of repairs from the tortfeasor - that is, from you as the driver who caused the accident in a vehicle other than his own.

But here there are a number of important subtleties.

- The victim must prove that the cost of actual repairs was higher. That is, simply calculating an independent examination in judicial practice in 2021 is not suitable for this. You will have to show real receipts and expense reports.

- If the damaged car was sent for repairs, then the calculation should have been without wear and tear - that is, there can be no difference then, and there is nothing to collect from you.

- There is a recent ruling by the Supreme Court of the Russian Federation regarding the case when depreciation should not be taken into account in the calculation when paying. This is when a payment in money is made without justification.

Penalty for driving without insurance in someone else's car

Driving without MTPL insurance in someone else's car, according to the current legislation of Russia, threatens with a fine of 500-800 rubles. It is issued in the name of the “caught red-handed” driver. The minimum amount is assigned if the driver was driving without a policy, but he had a compulsory motor insurance policy (he was simply left at home or at work, or lost). To avoid sanctions, prove to traffic police officers that you have completed the insurance procedure by providing the insurer’s details, insurance agent’s phone number, contract number, etc. The maximum amount is provided in the absence of a document.

Since 2015, the availability of a policy is determined by police using an electronic database. It also allows you to determine what kind of insurance is provided to traffic police officers - closed, that is, expired, or valid.

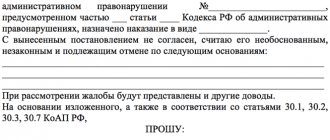

The law also provides for such a sanction as a warning (Article 12.3 of the Administrative Code). The punishment is determined by the traffic police officer on the spot, depending on the circumstances. For the first time, the driver can “get off” with a warning. The police officer's decision included in the resolution can be appealed in court.

What sanctions are provided by law for the owner of a vehicle who has not issued compulsory motor liability insurance if another person is driving his car? A fine for driving without insurance is issued only in the name of the driver whom traffic police officers caught driving someone else’s car.

Apart from a fine, the police cannot impose any sanctions against him. Although even before 2014, traffic police officers were given broad powers: for driving without compulsory motor insurance in someone else’s car, they could remove license plates, tow the car and apply other enforcement measures. In 2021, police officers no longer have the ability to restrict the use of someone else’s vehicle. If you have two other mandatory documents (license and registration certificate), then a fine is the maximum penalty.

If you have an accident with your own car without insurance - what is the penalty?

This situation should be considered in 2 different situations, the consequences of which differ in nature:

- if you were not included in the insurance policy of someone else’s car, but the insurance was still valid,

- if there was no compulsory motor liability insurance on the car at all.

If not included in the policy

In this case, you will face 2 measures of responsibility:

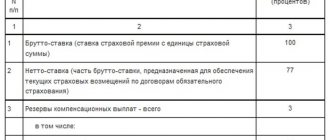

- administrative in the form of a fine of 500 rubles from the visiting traffic police officers for an unregistered driver (part 1 of article 12.37 of the Administrative Code),

- recourse claim from the insurance company.

Regress for a driver not registered in the compulsory motor liability insurance becomes possible due to subparagraph “d” of paragraph 1 of Article 14 of the Federal Law on Compulsory Motor Liability Insurance. That is, the insurance company in this case compensates the damage to the injured persons in full, and then demands the entire amount from the driver who is not driving his own car and is not included in the policy.

We also recommend that you read the other subparagraphs - the grounds for recourse from this provision of the law, because recourse is most often the most significant amount of possible costs in the event of an accident. Moreover, please note that even if the owner himself drives his own car, he may also not be included in the insurance.

If there was no insurance at all

In this case, the consequences are the same, but their size may be slightly different:

- the fine will no longer be 500, but 800 rubles – under Part 2 of Article 12.37 of the Administrative Code,

- and you will have to compensate for the damage yourself from your own pocket - MTPL insurance does not work here, even if the victim had it (after all, with this type of insurance, the risk is not personal property, but the driver’s liability).

But in the latter case there may be options. So, if the victim’s car is insured under Casco, then he can already contact the insurance company. She will compensate him for the damage, and then, in the procedure of so-called subrogation, will recover the amount paid from you.

In addition, a kind of extension of the MTPL policy has recently become popular - when additional insurance is purchased to the standard policy, which protects against situations where the person at fault for the accident does not have valid insurance. In this case, the insurer also compensates for the damage to the beneficiary, but then claims it from you.

Various situations when the driver does not have insurance

- The insurance contract was concluded, but the driver did not take the policy with him

In the event that the driver simply forgot or lost his MTPL policy, he is issued the minimum fine, provided that he has not committed any other violations.

The driver must provide the inspector with evidence that the contract with the insurance company was actually concluded by him. He can call the insurance agent or give the contract number. If he does not do this, then the inspector has the right to draw up a protocol of an administrative offense due to the lack of a compulsory motor liability insurance policy.

You have the right to challenge it in court. A copy of the MTPL policy is attached to the application. Then the amount of the fine for driving without insurance in someone else’s car can be reduced from 800 rubles to 500. Today, every inspector in a matter of minutes can check information about the presence or absence of a valid MTPL policy through a special program based on the RSA database.

In order to avoid problems, it is not difficult to put a copy or original of the MTPL insurance policy in the glove compartment of the car. If you applied for insurance online, then you should print it out.

- The vehicle is driven by a driver whose insurance has expired

The standard MTPL policy term is one year. But if you are sure that you will drive your car exclusively to the country in the summer, then it is more advisable to take out insurance only for these months. Of course, this way you will save your budget, but remember that you will only be able to use the vehicle for a certain time, limited by the insurance period.

If you see that the insurance period is about to expire, then immediately apply for a new one. Moreover, now many insurance companies remind about this in advance, thereby protecting their regular customers from negative consequences.

Of course, there are also drivers who deliberately do not insure their auto liability. It is not clear what goals they are pursuing. Maybe they want to save money? But the issue is quite controversial, because if such a driver becomes the culprit of an accident or suffers in an accident, then he will have to pay all the expenses from his own pocket.

- The owner of the car is next to the offending driver

It does not matter at all whether the owner of the vehicle is sitting in the passenger seat at the moment when a driver without insurance is driving his car - the fine will still be 500 rubles.

In this case, traffic police officers draw up two reports: against the driver and against the owner of the car for the fact that the first is not included in the insurance, and the second entrusted the right to drive a car to a person without insurance.

If you were without a driver's license?

This does not matter in terms of compensation consequences. With the only subtlety that if you do not have the right to manage, then there will be recourse from the insurer on the basis of subparagraph “c” of paragraph 1 of Article 14 of the Law on Compulsory Motor Liability Insurance.

But for driving someone else’s car without a driver’s license, you also face administrative liability. And it depends on the specific reason for your lack of rights:

- if you have never received them or do not have the required category to drive someone else’s car, then the fine will be from 5 to 15 thousand rubles under Article 12.7 of the Code of Administrative Offenses of the Russian Federation,

- if you are deprived of your license, then the traffic police fine increases to 30 thousand (part 2 of the same norm of the Code of Administrative Offenses),

- if you simply forgot them at home, then there will be a “symbolic” 500 rubles under Article 12.3 (and recourse here will be illegal).

But another fine threatens the owner who allowed a person without a driving license or deprived of such a right to drive his car. He will be charged 30,000 rubles for the transfer of control (Part 3 of Article 12.7).

How is civil liability insured?

Civil liability is insured in two ways:

- Registration of a motor vehicle license for a limited number of persons , where potential drivers fit in. For example, family members, friends, colleagues.

- Registration of “open insurance” for an unlimited number of persons. Any person can drive the vehicle. An open car license is usually issued when carrying out business activities - for example, when renting out a car.

The Federal Law “On Compulsory Motor Liability Insurance” does not contain any exceptions regarding driving without a policy if the owner is nearby. It makes no difference how the car is operated - with or without an owner; the person driving is required to have an MTPL policy. Therefore, driving without insurance, even with the owner of the car, is illegal.

If you fled the scene of an accident in someone else's car?

In this case, the judicial practice of 2021 works in such a way that if the person who caused the harm is unknown, due to the fact that he left the scene of the accident, the owner of the car is responsible. This practice has been established thanks to the same article 1079 of the Civil Code of the Russian Federation.

And please note again that this is only in the case when the culprit - the driver of the wrong car - is not clear. At the same time, the materials of the accident case must contain evidence of the involvement of this car itself in this accident.

What responsibilities are provided?

The penalty for an accident depends on the following factors:

- The driver is included in the insurance policy; another participant is recognized as the culprit. There is nothing to fear here. The insurer is obliged to compensate the damage to the owner of the car. If the company doesn't pay enough, the owner can sue. But not to the person who drove the vehicle, but to the company that issued the policy.

- The motorist is included in the insurance, and he is also named as the culprit. Punishment will follow according to the article of the Code of Administrative Offenses, which is violated. In addition, the at-fault party's insurance will have to pay for damage caused to other participants in the accident. If she doesn’t pay enough, in the opinion of the victims, they can file a claim against her and the person driving someone else’s car, and not the owner of the car.

- The person driving was deprived of his license, but his name is included in the insurance and he is recognized as the injured party. Here the motorist will pay a fine of 30,000 rubles. according to Part 2 of Art. 12.7 of the Code of Administrative Offences, may also be sent to forced labor for 100 - 200 hours or put under arrest for 15 days. The damage will be paid by the insurance company of the other participant. But she then has the right to sue the driver of the car so that he returns this money to her from his own pocket.

- The driver of the car was deprived of his license and is included in the insurance, but is the culprit. In this case, he will be punished for the lack of a document under Part 2 of Article 12.7. The insurer of the perpetrator will compensate the damage to the victim. But then the company will demand that the client return the money, and the court will most likely agree with this. After all, there is paragraph B of Article 14 of the Law on Compulsory Motor Liability Insurance:

The insurer who provided the insurance compensation passes on the right of claim of the victim to the person who caused the harm in the amount of the insurance compensation provided to the victim, if... the said person did not have the right to drive the vehicle during the use of which the harm was caused to him...

The owner of the car can also enter into a conflict in order to restore the vehicle at the expense of the person driving the car. And he will file a lawsuit, claiming that he hid the lack of a driver's license from him. But here you cannot be sure that the decision will necessarily be in favor of the owner.

- The motorist was drunk. He will be punished for driving a vehicle while drunk; this is a fine of 30,000 rubles. and deprivation of driver's license for 1.5 - 2 years. You will also have to pay damages to the insurer if you have a written policy. Most likely it will be the victim's company. Because a drunk driver is more likely to be found guilty. The company will demand a refund based on paragraph B of Article 14 of the OSAGO law:

The insurer who provided the insurance compensation transfers the right of claim of the victim to the person who caused the harm in the amount of the insurance compensation provided to the victim, if... the harm was caused by the specified person while driving a vehicle while intoxicated (alcohol, drugs or other)...

A drunk driver who is not included in the insurance will pay everything himself voluntarily or by court decision.

Details

For driving without insurance, the police only have the right to fine you - the law prohibits taking away your license or sending the car to a penalty area. Since 2021, there are no restrictions on using someone else’s car if the driver has a license and documents for the car. If, after issuing a fine, the violation is not eliminated, then at the next inspection, traffic police officers will impose a penalty again.

According to the Code of Administrative Offenses of the Russian Federation, art. 12.3, taking into account the circumstances, the driver may receive a warning from the traffic police officer, for example, if he has insurance, but left it at home.

If the policy is expired, then the punishment will be more serious and penalties in this case will amount to 800 rubles.

Why is it better to travel with a power of attorney?

So do you ultimately need a power of attorney or can you do without it? The thing is that the owner may have serious problems if another person in his car gets into an accident. Even if it is a friend or close relative, he may simply flee the scene. Because of this, the owner may have difficulty proving that he was not driving the car. And there is a high probability that he will have to pay for the damage to the victim in the accident.

In addition, if there is neither a power of attorney nor a compulsory motor liability insurance policy in which several people are registered, then a traffic police inspector can stop the car to make sure that it is not stolen. After all, if the driver is not included in the insurance and there is no power of attorney, then it is difficult to prove on the spot the fact of transfer of the car for temporary use. And the verification may take several hours. It is much easier and faster to write a power of attorney and not have problems in the future.

Do I need to show a power of attorney to drive a car to a traffic police inspector?

Previously, the list of documents that the driver was required to present at the request of traffic police officers included a power of attorney. However, the Government of the Russian Federation abolished the need for its provision by issuing Resolution No. 1156. In 2021, the driver cannot be held accountable due to the lack of a power of attorney to drive the car.

There is no need to issue a power of attorney to drive a car in 2021 if you only drive a car. When you plan to carry out legal actions with another person’s vehicle, paper will be required.