Do you need insurance when registering a car?

2.8 (56%) 10 vote[s]

OSAGO is a compulsory insurance policy, that is, every driver must have it. The essence of such insurance is to compensate the insurance company for damages to victims of a traffic accident that occurred through your fault, that is, through the fault of the policyholder. Car owners who have just bought or are planning to buy a car are wondering whether it is necessary to obtain an insurance policy when registering a vehicle? Let's figure out what the legislation says about this.

Is compulsory motor insurance required for registration in 2021?

If you are an experienced driver with experience, or are just starting to drive a car, you must know the rule that without a valid compulsory motor insurance policy, operating a vehicle on the territory of the Russian Federation is prohibited.

Due to the innovations, the car owner is no longer required to provide a paper insurance policy for registration. Now you can decide for yourself which type of policy suits you best, paper or electronic.

However, this fact does not change the rule that at the time the vehicle is registered, the compulsory insurance policy must be valid. In any case, its presence will be checked through the interdepartmental interaction database.

Also, please note that in order to avoid any delays and other technical problems when registering a car, it is, of course, better to provide a paper version of the compulsory motor insurance policy in 2019.

The procedure for registering a car

In order to easily register a vehicle in 2021, you will need the following documents:

— Diagnostic card. This document is evidence that the vehicle has passed a technical inspection. According to the law, a diagnostic card is just necessary in order to obtain a compulsory motor insurance policy. You can also read the process of passing the technical inspection in our other article on our website, where we explained in detail all the nuances of this procedure.

— A valid MTPL policy. Moreover, it does not matter whether you bought a new car or purchased it second-hand. The MTPL policy is a necessary document for registering a vehicle in 2021.

— Payment of the state fee for car registration

— Application for vehicle registration

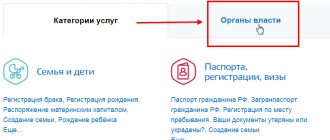

Registering a vehicle is also possible through the State Services portal.

In order to register a vehicle through State Services, you will first need to register on the website.

After this, you will need to select the appropriate service on the site and enter all the required data about the car and its owner.

At the end, you will be offered a time of your choice for which you can sign up directly to visit the traffic police.

Finally, you will need to come to the traffic police and provide all documents, including the compulsory insurance policy for registration in 2021.

Is it possible to register a car without insurance?

Any motor vehicle on the territory of the Russian Federation must be insured against the risk of damage to both the car and the life and health of its owner. Federal Law No. 40 “On Compulsory Motor Liability Insurance” talks about this.

Traffic police officers must be sure that they are registering a car that the owner has previously protected from possible road accidents. Therefore, the MTPL policy can be included in the list of necessary documents for the registration procedure.

But today, such a need is not strictly regulated and a car can be registered and re-registered to another owner with a certain list of documents.

If you are faced with the task of registering a car without having an issued MTPL insurance policy with you, then the traffic police officers will refuse you. Without having a policy form with them, only owners of electronic MTPL can register.

It is necessary to create a package of documents.- Attach the completed MTPL policy.

- Report to the traffic police department.

- A department employee will review your submitted package of documents.

- An application for vehicle registration is filled out.

- Traffic police officers inspect the vehicle.

- The inspector marks the inspection.

- State duty is paid.

- An MREO employee accepts documents. They can be submitted both through the government services portal and in person.

- You need to wait a certain amount of time.

- Receive the documents at the time appointed by the MREO employee.

- It is important to check the information on the forms to ensure that it is accurate.

Important! Before you become the owner of a car and take steps to register or re-register it, we recommend that you check for any fines on the car. It is likely that such fines may be inherited by you along with the car.

Registration in MREO traffic police

It is necessary to make an appointment with the traffic police in order to carry out the actions of submitting documents. If you are unable to appear in person, you can use the Public Services portal. Also, the State Services portal works not only as a way to submit documents, but also as a way to make an appointment.

If you prefer to come to the department, you will be placed on a waiting list. Upon arrival of your turn, you receive a special coupon, which indicates a specific time and day of appearance. If the queue is long and they won’t be able to accept you in the coming days, then instead of a coupon you will be given a special PIN code. It will need to be entered on the appointed day in order to receive a coupon and get an appointment.

Registration of a vehicle is a paid government service. You need to pay the fee using the details that apply specifically to your traffic police department. Payment can be made at any bank branch.

Also, in many traffic police departments there are terminals that provide assistance in paying state fees. When paying the fee through the terminal, the commission amount will be approximately 50 rubles.

The state fee for registering a vehicle will be 850 rubles, but only if you leave the previous numbers.

A traffic police officer must conduct a technical inspection of the car to make sure that the vehicle can participate in road traffic and does not pose a danger to other drivers.

A technical inspection is carried out after drawing up an application for registration. The inspector examines the car body, its engine, and checks information with technical documentation.

Traffic police officers pay close attention to the car, engine number, and also check the codes in their databases. If the condition of the car meets the requirements of the traffic police officers, a mark is placed on passing the inspection.

For individuals, there are regulations that provide not only the procedure for completing the procedure, but also the deadlines.

Thus, you will have to spend from one and a half to three hours on the registration procedure. This means that you can complete all the necessary actions in one day.

If the insurance is left over from the previous owner

Many motorists believe that if the compulsory motor insurance policy for registration remains old, that is, the old policy is still in force, then there is no need to conclude a new insurance contract. However, unfortunately, we have to disappoint you, as this is an erroneous opinion.

The fact is that the previous MTPL policy will be registered in the name of the previous owner of the vehicle, and since the owner of the car changes, the MTPL policy must be changed accordingly for registration in 2021.

With an old MTPL policy, registration of the car with the traffic police will be denied. The only reason why you can still keep it is the 10-day period during which the law allows you to drive a car after purchase until it is registered. The main thing is to also have the purchase and sale agreement with you.

It is important to remember that if you drive a car within 10 days after purchase with a previous policy, then you need to be included in it if the insurance is closed. Although, in principle, you can simply present the sales contract to the traffic police inspector, and there should be no questions for you.

There is also a dangerous side here. If you do not have a valid compulsory motor insurance policy for registration, then in a situation where a traffic accident occurs due to your fault, you will have to independently compensate for the damage caused to another road user, and this, you know, can sometimes be very unprofitable and take a huge amount of time.

Also, speaking about the remaining MTPL from the previous owner, you can replace the owner of the car in the insurance policy, however, unfortunately, it will not be possible to register the vehicle without the MTPL issued in your name.

This type of insurance is convenient only for a while until you can take out a new MTPL policy for registration. We also draw your attention to the fact that it is best to resort to such a decision only if the former owner is well known to you.

Thus, based on all of the above, we can conclude that it is simply impossible to register a vehicle without a valid compulsory insurance policy. If your vehicle reaches a speed of more than 20 km/h, then it must be insured, otherwise you will not be able to obtain a registration certificate.

Car registration procedure

Earlier, we said that in order to register a vehicle, you need to sign up in advance at the appropriate traffic police department. What should you have with you?

- Passport.

- Vehicle registration certificate.

- Contract of sale.

- OSAGO policy.

- Receipt with payment of state duty.

If another person, and not the owner, applies to the State Traffic Inspectorate, then in addition to the above documents, a power of attorney to carry out such actions should be attached.

On the spot, you will also draw up an application according to the established template and attach it to the package of documents. You can find out the details for paying the state duty on the State Services website. As for the size of the state duty, it is 2,000 rubles for new cars and 800 rubles for previously registered ones, that is, with mileage. When registering used cars, also take with you a valid certificate from the old owner.

So, we have answered the question of whether it is necessary to obtain insurance when registering a car. The main thing you should remember is the period of unpunished driving, namely 10 days, during which you must manage to obtain compulsory motor liability insurance and register the vehicle. Therefore, if you have all the required documents in your hands, do not waste time, but immediately start obtaining insurance.

Paper or electronic insurance for registration

As we mentioned above, currently the owner has the right to choose the type of compulsory insurance policy that is more convenient for him. Also in other articles we paid attention to the advantages and disadvantages of each type, you can also read this on our website.

Speaking about compulsory insurance for registration, it is worth saying the following. There are situations in which the new owner does not have any amount of time, and he urgently needs to register the vehicle.

In such a situation, it is better for him to issue a paper insurance policy, which specialists can prepare within one hour. Moreover, regardless of the type of vehicle and other factors, such as region.

Why is a paper insurance policy for urgent registration more profitable? It's simple. The fact is that an electronic MTPL policy can be entered into the database up to 4 days, while a paper policy will come into force as early as 00:00 the next day.

Moreover, some drivers may be faced with the fact that the traffic police themselves may require a paper policy, although this situation almost never occurs lately.

Thus, to register, as you might understand, it is better to issue a paper insurance policy. However, in other situations that do not require urgent insurance, an electronic policy is more convenient and practical.

When is an insurance policy renewed?

Without properly completed insurance, the MREO inspector will refuse to re-register the car in your name. Therefore, before going to the registration office, you must either make changes to the current policy of the old car owner or take out new insurance.

In accordance with paragraph 2 of Article 4 of the law on compulsory motor liability insurance, a citizen who has purchased a car is allowed to drive it for no more than 10 days from the date of purchase of the car. This time is given to the new owner so that he can drive the car home and undergo a technical inspection, since without a diagnostic card, a compulsory motor liability insurance policy will not be issued and the vehicle will be refused registration at the traffic police department. However, you should not drive your car frequently until you obtain insurance. This is due to the fact that in the event of an accident, you will be compensated for the damage in full from your own pocket, and if detected, you will be fined 800 rubles.

In addition, some traffic police inspectors will try to scam you into paying a fine for driving without a policy. In this case, refer to the Resolution of the Supreme Court of the Russian Federation No. 12-AD13-3 dated January 21, 2014, which clearly states that within 10 days after purchasing a car you can operate it without a compulsory motor liability insurance policy. Therefore, take the purchase and sale agreement with you before re-registration of the car to prove that the vehicle was purchased within a period of no more than 10 days. If traffic police officers issue you a decree, you can appeal it in court.

Remember that if you do not re-register your car within 10 days, you will be issued a decree with a fine of 1,500-2,000 rubles.

If for some reason you did not meet the deadline for registering the purchased car, then the above fine can be avoided in 2 ways:

- Issue another DCT for a reliable person (spouse or friend) and then return with filling out the PTS.

- Carry out registration actions through an authorized person by issuing a power of attorney for him for the traffic police.

In addition to the execution of the contract, there is also the transfer of the car by proxy. In this case, there is no need to reissue insurance to the new owner, since the old owner of the vehicle remains the owner. Contact the insurance company to have its employees add an additional driver to your policy, then drive without fear of being stopped and having your documents checked on the road. If the policy is issued without restrictions on the right to drive, then there is no need to contact the insurance company.

OSAGO for registration for legal entities

As for all drivers operating or registering a vehicle on the territory of the Russian Federation, MTPL for registration is also necessary for legal entities.

Speaking about the registration of osgo for registration, it is worth saying that the procedure is practically no different from registration for individuals.

However, there are still some nuances here. Firstly, for legal entities, the MTPL policy for registration can only be open, that is, with access to management of an unlimited number of persons.

Also, as an organization planning to issue a compulsory motor insurance policy for registration, you may be faced with the fact that many insurance companies may refuse you. We also mention this in many articles. Everything usually comes down to the fact that it is not profitable for insurance companies to insure legal entities, since it may be unprofitable for them.

You will never face a refusal; we will issue you a compulsory insurance policy for registration of an unlimited number of cars owned by your company, regardless of the type of activity. And if you have a certain number of insured cars, we can even offer you a discount.

Other organizations

OSAGO for drivers with less than 3 years of experience

Young drivers with less than 3 years of experience experience difficulties when applying for an MTPL policy for their vehicle, so our company pays great attention to this issue.

OSAGO for the culprit of an accident

Almost all drivers get into an accident; after such an event, some perpetrators of accidents cannot take out a compulsory MTPL insurance policy. Our company can help such drivers restore justice and take out a policy.

OSAGO for a driver without experience

It is difficult for a young driver without experience to obtain MTPL insurance for his vehicle, since insurance companies flatly refuse to issue a policy to such drivers. However, our company has offers specifically for such drivers.

OSAGO for individuals and legal entities

Not all insurance companies and insurance brokers work with individuals and legal entities, and even those who do can process all categories of vehicles, but our company can handle everything.

OSAGO for Volkswagen Polo

For all owners of Volkswagen Polo, we are ready to provide unique offers for issuing compulsory motor third party liability insurance policies. Fully official design. We work with individuals and legal entities. Any purpose of use including taxi.

OSAGO for Finland

If you are going to travel to Finland with your car, then you will need a compulsory motor liability insurance policy, which is called a green card. With this policy you will safely cross the border with Finland.

OSAGO for individuals

Our company is ready to present a range of MTPL insurance services for individuals. We insure all categories of vehicles, apply all discounts and select the best offers for individuals.

OSAGO for Honda Accord

For Honda Accord owners, our company has special conditions for obtaining an MTPL policy. We issue compulsory motor liability insurance for any region for Honda owners. We have an additional discount on Honda Accord!

OSAGO for Hyundai Solaris

Registration of an MTPL policy for a Hyundai Solaris car. We even process taxi registrations for owners from other regions. We make a paper policy on a pink form. We will select the best offers for you.

OSAGO for those registered in another region

Compulsory motor liability insurance for those registered in another region is always a problem. You will be sent for a car inspection, which lasts more than a month, and it’s not a fact that they will give consent!

OSAGO for ZIL

All owners of ZIL cars are faced with the problem of obtaining compulsory motor liability insurance. There are several reasons for this - firstly, these are trucks, and secondly, most often these are old cars. Therefore, all insurance companies refuse such vehicles, but not us!

OSAGO for foreign cars

If you come from abroad and you need to take out a compulsory motor liability insurance policy in Russia, then we are ready to do this for you. We are insurance brokers and work with the largest insurance companies.

OSAGO for abroad

If you travel abroad in a personal car, then you will need to take out a special MTPL policy for traveling abroad, called a green card. The cost of this policy is low.

OSAGO for school bus

The bus is a non-segment for insurance companies and school buses are no exception, many people face big problems when insuring a bus. We specialize in non-segmented vehicles and registration of compulsory motor liability insurance for them.

OSAGO for Chevrolet Niva

Taking out an MTPL policy for a Chevrolet Niva can create a lot of problems for car owners, but we are ready to offer special conditions for obtaining insurance for this popular car.

OSAGO for Skoda Kodiak

For Skoda Kodiak owners, our company has special conditions for issuing MTPL insurance policies with an additional discount. We will provide more than 5 insurance companies to choose from.

OSAGO for Chevrolet Cruze

If you are the owner of a Chevrolet Cruze car and do not know where to apply for an MTPL policy, then this article is especially for you. In our company, you will not only be able to take out a policy for this car, but also do it on the most favorable terms.

OSAGO for Schengen

If you are going to travel to the Schengen zone in your own car, then you will need to apply for a special type of compulsory motor liability insurance, you can do this in our company. This type of MTPL is called a green card.

OSAGO for Georgia

If you are going to travel to Georgia by car, then you will need compulsory motor liability insurance, which is valid on the territory of Georgia. You can obtain this OSAGO form from our company.

OSAGO for traffic police

One of the mandatory documents required by the traffic police to register a car in Russia is an MTPL insurance policy. You should think about issuing a policy for the traffic police in advance, otherwise registration will be denied to you.

OSAGO for trucks for individuals

Trucks are a non-segment for insurance companies, both for individuals and legal entities. However, there is no need to despair, because our insurance center will help you in obtaining an MTPL policy for a truck if the owner is an individual.

OSAGO for a new car

Have you bought a car? - Fine. After purchasing a new car, the first thing you need to do is take out an MTPL policy. In our company, you can always take out an MTPL policy for a new car from a showroom or a used car.

OSAGO for beginners

It is not so easy for young drivers to take out a compulsory motor liability insurance policy and insure their car. Many insurance companies are turning away young drivers. However, we have a few suggestions for those new to the road.

OSAGO for driving with a trailer

One of the points that the insurer must ask the client when applying for compulsory motor liability insurance is whether the vehicle will be operated with a trailer. Many vehicles are not used at all without a trailer. Driving with a trailer on a policy that does not have the trailer ticked is an offence.

OSAGO for Europe

For cars that travel to Europe, you also need a compulsory motor liability insurance policy; most often, a green card is sufficient. In our company you can apply for any type of MTPL for Europe.

OSAGO for Crimea

The MTPL policy is mandatory throughout the Russian Federation, including for residents of Crimea. However, many insurance companies refuse to provide insurance as soon as they see the region of registration of the owner - CRIMEA.

OSAGO for apartments

An apartment is one of the best investments, so you need to insure it so that your investment does not go nowhere. Few people know that there is an analogue of OSAGO for an apartment.

OSAGO for accounting

It's no secret that without compulsory motor insurance it is impossible to register a car with the traffic police. However, many do not know where to apply for compulsory motor liability insurance for registration. Our company is ready to take on all obligations for obtaining insurance for your car. With our insurance, you are 100% guaranteed to register your vehicle with the traffic police.

OSAGO for Ukrainians

If you come from Ukraine, then in Moscow it will be difficult for you to obtain an MTPL policy for your car, so our company specializes in issuing MTPL policies for citizens with foreign rights, including Ukrainians.

OSAGO for educational vehicles

Training cars are associated with increased danger on the roads, so not every insurance company is ready to accept such cars, but we will select for you the best offers for compulsory motor vehicle liability insurance for training cars.

OSAGO for a leased car

If you have a leased car, then you understand how difficult it is to issue an MTPL policy for such a vehicle. However, our company is ready to help you with this.

Accident in the parking lot

Often, an accident does not happen on the road, but when the car is parked, what to do in this situation, because the second participant in the accident most often has already left the scene of the accident, and the damage to the car has been caused, is it possible to receive payment under compulsory motor liability insurance in this case?

Duplicate diagnostic card

Creating a duplicate of a valid diagnostic card has become a real problem. However, this article describes the solution. Read on to find out how to get a duplicate of the technical certificate.

Left OSAGO

Recently, fraud schemes involving fraudulent MTPL policies have become more frequent, and both paper policies and electronic ones are counterfeited; read the article on how to avoid becoming a victim of fraudsters.

Road accident without compulsory motor liability insurance

Almost every driver gets into an accident, but it is possible that one of the participants in the accident does not have a compulsory motor liability insurance policy. What should you do in this case? options for solving the problem.

Working as an insurance agent under compulsory motor liability insurance

To become an insurance agent for issuing MTPL policies for all categories and regions, you need to leave an application and our specialists will provide you with all the necessary access to a whole range of services!

OSAGO for a tractor

One of the types of special equipment that require registration of compulsory motor liability insurance is tractors. However, many tractors are not a segment of the insurance company, so the owners of such vehicles hear refusals from insurance companies. Read the article about how to get a policy for a tractor.

OSAGO for a combine harvester

Agricultural combines require a compulsory motor liability insurance policy during their operation, but where are they issued and how to do this? If everything is clear with passenger cars, then it is difficult to insure a combine harvester.

OSAGO for a scooter

Official registration of a compulsory motor liability insurance policy for a scooter, as well as other small motorcycles, has become a big problem lately, so our company is opening special offers for compulsory motor liability insurance for scooters.

OSAGO for ATV

One of the most common types of special equipment is an ATV, and it is a full-fledged participant in the movement, so it is necessary to take out a compulsory motor liability insurance policy for it.

OSAGO with delivery

OSAGO with delivery to AutoPlus is the most convenient way to get insurance without leaving your home. The courier will deliver the policy to any place you want and at a time convenient for you - quickly and without any problems.

OSAGO for a dump truck

A dump truck is not a very common type of special equipment, so it may have problems with insurance under MTPL, but you need to get insurance. Read the article about how to make a policy for a dump truck and what difficulties may await you when applying for it.

OSAGO for an excavator

One of the types of special equipment that you can order from our company is excavators. In many insurance companies you will hear a refusal, since an excavator is not a segment, but not with us. We have been issuing compulsory motor liability insurance for excavators for more than 5 years, working with both legal entities and individuals.

OSAGO for a truck

One of the riskiest businesses is the transportation of goods. It is important that the trucks used for transportation are officially insured, but many do not know where and how to do this.

OSAGO for a snowmobile

Not all insurance companies insure such a unique type of equipment as a snowmobile, but situations often arise when the vehicle needs to be transported to another location and a compulsory motor liability insurance policy is required for the move. Taking out insurance for a snowmobile.

OSAGO for tractor

Registration of an MTPL policy for special equipment is a big problem for both individuals and legal entities. One of the problematic types of special equipment is the tractor. Read the article on how to apply for insurance for a tractor.

OSAGO for special equipment

Registration of compulsory insurance policies for various types of special equipment is a very difficult task, as it turned out. Many insurance companies prohibit insuring various types of special equipment.

OSAGO for registration

Is it necessary to take out a compulsory MTPL insurance policy in order to register a car and how to do this, read the article. Many drivers wonder whether insurance is needed to register.

OSAGO for the haul

There are situations in which it is necessary to take out a compulsory motor liability insurance policy for a short period of time to move a vehicle and one place to another; read the article on how to do this.

OSAGO category C

Recently, it has become a problem to issue an MTPL policy for category C vehicles; many insurance companies refuse to insure trucks, since they do not fall under the insurance segment. Read the article about how to apply for a policy.

CASCO for taxi

One of the specializations of our company is issuing CASCO policies for taxis. Taxi is one of the riskiest businesses for a car, so it is important to apply for CASCO insurance to be sure that you will not be left with nothing if the taxi gets into an accident. Read more about registering CASCO insurance for a taxi in the article.

OSAGO category D

Category D is one of the problematic categories when applying for an MTPL policy, but our company is ready to help you and obtain insurance for a category D vehicle without any problems. Read more about the design of category D in the article.

Osago for taxi 2019

Taxi is one of the most popular vehicle segments, millions of drivers are employed in the taxi industry and therefore changes in taxi insurance will affect a large number of people in 2021.

Number plates of Russian regions on cars 2019

Region codes in Russia are written on state license plates. Each region corresponds to a specific code, but sometimes it is necessary to identify a particular region by its code or, conversely, by its region code. Regions of Russia in 2021.

Registering a car with the traffic police 2019

All vehicles in the Russian Federation are subject to mandatory registration. How to register a car in 2021, what’s new in the process of registering a car with the traffic police.

Driving license categories 2019

There are a large number of different categories of driver's licenses and not everyone knows what this or that category means. The article provides a convenient table of categories, with which you can always find out all the necessary information.

Access to registration of E-OSAGO

Now there are a large number of platforms for issuing E-OSAGO policies, to which we can give you access so that you can independently issue an OSAGO policy and receive a commission.

OSAGO without inspection

If you want to take out a MTPL insurance policy, but you are sent to have your vehicle inspected, then we can help you and issue a policy without inspecting your car.

How much does it cost to get your license in 2021?

Every year, thousands of people want to take the driving test at the traffic police and get a driver's license. If you have already attended a driving school, then you will be interested in the cost of passing the exam at the traffic police.

Car re-registration in 2019

How to re-register a car to a new owner in 2021, as well as what reasons exist for re-registration, all these issues are discussed in the article.

Do I need to take an exam when replacing a license 2019

Many drivers are interested in the question of whether they will need to retake the exam when replacing their license in 2021. Let's answer this question, because many drivers have already failed, for example, the theoretical part of the exam.

Replacement of rights in 2021

Since licenses are issued for a certain period, there comes a time for every driver when he needs to change his license, but not everyone knows where and how to do this. Read about the process of replacing rights in the article.

OSAGO day to day

Today, electronic MTPL policies are valid only after three days, but what to do if you urgently need a MTPL policy and you don’t have time to wait 3-4 days. In this case, you can contact Our company and we will issue you a paper policy on the day of your application!

OSAGO for pensioners

Such a group of the population as pensioners in our country is not particularly wealthy, so issuing a compulsory motor liability insurance policy is a very difficult task for them, as it hits their wallets hard. However, in our company, all pensioners receive an additional discount when applying for compulsory motor liability insurance. Special MTPL program for pensioners.

OSAGO in 2021

OSAGO is a type of insurance that concerns all car owners, therefore changes in the process of registration and calculation of insurance for a vehicle concern almost every citizen of our country. Read about changes in the field of auto insurance and compulsory motor liability insurance in particular in 2021 in the article.

Inspection in 2021

Changes are inevitable, if you want to know what will happen to car inspection in 2021, then read the article. The article provides comprehensive information about diagnostic cards and technical inspection in general. VET and OTO registers in 2021.

OSAGO for foreign citizens

Every day a huge number of foreign citizens from near and far abroad come to Russia. Naturally, foreigners may sometimes need a compulsory motor liability insurance policy in order to move around the territory of the Russian Federation by car. About how to apply for compulsory motor liability insurance for foreign citizens.

Electronic PTS in 2021

It's no secret that one of the main trends in our state is the transfer of all document flow to electronic form. This trend also affected vehicles. Electronic PTS will be introduced in 2021. About the pros and cons of a new type of documents.

OSAGO for old cars

If you are the owner of an old car, then you have already understood or will understand that getting compulsory motor liability insurance for it is not such an easy task and not all insurance companies undertake to insure such vehicles; read the article on how to insure an old car.

OSAGO-rural and village registration

Many people who come to large cities have a rural or rural residence permit (registration) and it is not at all easy for them to get an MTPL policy in the city, since insurance companies begin to put spokes in the wheels and do not issue the policy. What to do if you still need to take out a policy.

OSAGO with temporary registration

Often people who have a temporary registration wonder whether they will be able to get car insurance. Temporary registration itself does not limit the issuance of a policy, however, there are some nuances that you should know...

OSAGO with registration in the region

Recently, people who are registered in the regions of Russia are faced with the problem of applying for a car insurance policy in Moscow. Read the article about why this happens and how to apply for a policy with registration in the region.

OSAGO for Daewoo Matiz

One of the problems faced by owners of low-power cars such as Daewoo Matiz is obtaining an MTPL insurance policy. Read about why it is difficult to get insurance for a Matiz and how to do it in general.