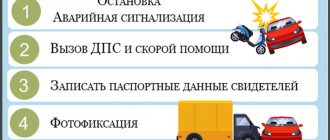

Almost every road user sooner or later encounters accidents of varying severity as a witness, victim or perpetrator. And in such a situation, knowledge of registration of a traffic accident will not be superfluous. In particular, it is necessary to have an understanding of what an accident report is and how to prepare it.

An accident report is a document confirming the innocence or guilt of the party involved in the accident. It is drawn up by the participants in the incident and is necessary to receive payment under compulsory motor liability insurance, because without it, the insurance company will not accept documents for payment of funds under insurance.

Where can I get a notification about an accident? Notification of the road accident report in 2 copies is attached to the insurance policy. You can also contact your insurance company for it or download it electronically below in this article on our website.

An advantageous offer from the partners of our portal - Terem Loan! Apply for a loan in the amount of up to 30 thousand rubles for a period of up to 30 days.

100% approval!

Get money

What is an accident notification?

The document, which is the basis for the settlement of traffic disputes, is drawn up by all participants in the traffic accident; a sample form can be found on any insurer website in the Russian Federation. The only case when its creation can be neglected is if the incident is not serious (there are no injuries or deaths, and less than 3 participants were injured in the accident) and the parties to the conflict decided not to contact insurance offices.

Each form has a special number, being a document of strict accountability.

This applies to holders of MTPL certificates. If motorists have taken out CASCO insurance, problems are resolved in a different manner.

In case of incorrectly filling out the notification of an accident, the driver will face a fine of 1 thousand rubles.

Sample of filling out a notification of an accident for compulsory motor liability insurance in 2021

A correctly completed accident notification allows you to receive insurance compensation without any problems or delays. It should be noted that there is a simplified procedure for processing compensation payments, but subject to the following conditions:

- no more than two cars were involved in the accident;

- the damage was caused exclusively to vehicles;

- absence of disagreement regarding the causes of the accident and the list of damages;

- both parties have a compulsory motor liability insurance policy.

The following rules for filling out this notice can be distinguished:

- the front part of the notice must be agreed upon by all participants in the road accident, since it is subsequently signed by them twice;

- if traffic police officers took part in the analysis of this incident, then the signature of the senior squad must be present, indicating his full name, position and rank;

- if there are witnesses, their last name, first name and patronymic, and residential address are indicated. If they are not there, then it is necessary to put a mark in paragraph 7 of this notice;

- when filling out paragraph 13 (place of initial impact), it is necessary to indicate a specific part of the vehicle, and not list all the damage;

- It is imperative to indicate all visible damage. Only those damages specified in this notice will be reimbursed.

Let's look at a specific example of how to correctly fill out a notification of an accident for an insurance company under compulsory motor liability insurance.

What is it for?

A completed form will be required to receive payment under the MTPL policy.

To avoid problems with the correct preparation of the document, it is better to familiarize yourself in advance with the procedure for entering data into it. Insurance companies provide special instructions for this purpose, which are recommended to be kept at hand.

Important! There are many known cases where victims failed to fill out a notification about an accident in accordance with the law. This leads to insurers either completely avoiding compensation payments or delaying resolution of the problem by initiating lengthy legal proceedings.

Payout limits under the European protocol

The SOGAZ insurance company operates in the legal field. The amount of compensation under compulsory motor liability insurance is determined by the state. For 2021, the legislation sets a limit on the European protocol of 100,000 rubles. The norm is prescribed in paragraph 4 of Art. 11.1 of Federal Law No. 40-FZ “On Compulsory Motor Liability Insurance”. However, in the spring of 2021, Law No. 88-FZ of 01.05.2019 was issued, according to which the injured party will be able to receive up to 400,000 rubles, even if the notification of an accident was drawn up without the traffic police. But IC "SOGAZ", like any other insurance company, will be able to transfer the amount within the maximum limit only under 2 conditions:

- The accident was registered in the “Road Accidents” application. Europrotocol".

- Cars are equipped with the ERA-GLONNAS system.

In the first case, you need to install the application on your smartphone and transfer online data to RSA (with photographs of the location of the machines and the damage they received). After successful sending, an informative icon will appear in the program. Additional confirmation from RSA will be sent by email or SMS to your phone. If there is no network, the “DTP.Europrotocol” program will send data as soon as the smartphone is within Wi-Fi coverage. In the second case, SOGAZ employees will be able to understand the picture of the incident using ERA-GLONNAS satellite images.

Technical nuances

Even when using a smartphone to register an accident, car owners are required to fill out a paper accident report. It needs to be photographed. The user is given 60 minutes to send data to RSA.

Smartphone requirements to use the “Road Accident.Europrotocol” application:

- determining your own coordinates using GPS/GLONASS.

- camera expansion of at least 3 megapixels.

- Internet access for data transfer.

The application is available for installation in the App Store and Google Play.

Android - https://play.google.com/store/apps/details?id=com.ru.autoins&hl=ru

iOS - https://apps.apple.com/ru/app/dtp-europrotocol/id1009374752

Where to get the form

In accordance with paragraph 24 of Chapter IV of the OSAGO Rules, the insurance agent is obliged to provide the car owner with forms free of charge after concluding the contract. It is possible to obtain them by visiting the insurer’s website or on our website: download and be sure to print.

Correctly fill out the notification in case of an accident:

Advice! If the form was not found by the victim, he can ask another driver (of any car) for it. It's completely legal.

The form has a front part (where you need to write the circumstances of the accident), which, when filled out, is self-copied onto a second copy. As a result, each of the participants, the victim and the culprit, receives a separate document.

Compiled by whom and when

Each participant in an accident who is a victim must have a form filled out in his own hand after the incident. The person at fault also has the right to participate in the preparation of the notice. This is especially true for inventorying vehicle damage.

When analyzing an accident, traffic police officers will rely specifically on the documents provided by the drivers.

Drawing up a notice in a simplified manner is possible if there are only two participants and the damage was caused only to property. This is called settlement of an insured event according to the European protocol.

What is the unlimited European protocol “Consent”

Unlimited Euro Protocol is not the name of the document. This is a list of conditions, subject to which the injured party will receive maximum compensation for damage within the limit of 400,000 rubles. The insurance company will settle the claim using a simplified notice subject to the following rules:

- the European protocol form is filled out taking into account the general requirements;

- the participants in the accident agree with the circumstances of the damage to the vehicle;

- cars are equipped with ERA GLONASS complexes, and information about road accidents is recorded and transferred to the AIS OSAGO*;

- data about the incident is recorded and transferred to the AIS using a device that creates photographs of vehicles and their damage at the scene of an accident in an uncorrected form.

*AIS OSAGO - Automated information system for compulsory motor third party liability insurance.

Modern car navigation equipment records road accidents and provides the opportunity to see the vehicle collision pattern. Therefore, Soglasie Insurance Company specialists can consider the circumstances of the incident and establish the coordinates of each vehicle at the time of the accident.

If the picture of an accident is not confirmed by technical means of control, even in the absence of disagreements, the insurance compensation limit will be 100,000 rubles.

Instructions and nuances of filling out OSAGO

The fields must be filled out exclusively in blue ink and legible handwriting. If the victim has been injured and is unable to keep records, then one of the witnesses or relatives can draw up the document.

If an accident occurs within the city, you can call an insurance agent (or at least notify him in the case of a minor accident). In this case, he will take care of the registration himself.

Important! The form must not have any tears, stains or corrections.

Document structure:

- The front part of the notice - here they enter the time and date of the incident, personal data of the victims and culprits, information about insurance companies, a detailed list of damage caused to vehicles, additional information on items. Also on the main side is a diagram of the event that occurred;

- The reverse side - here you should indicate the features of the accident, a list of all the equipment involved in it, enter witness statements of third parties, notes about the video recording devices installed on the vehicle (if they comply with the requirements of the traffic rules), and make other notes.

All items on the main side must be filled out by the owner of the damaged equipment (except for item 18 of the “general information” and item 17 “Road accident diagram” - here the information is recorded by the other driver).

Expert opinion

Artemyev Dmitry

Experience as a forensic expert in the field of automotive technical examination for more than 2 years, more than 3 years of work in the field of insurance disputes, appealing guilt in road accidents.

Ask a Question

The main side of the document must be signed twice by all participants in the event, so all entered data must be agreed upon with each of them. And if at the time of the analysis there are police officers on site, then the senior officer must also apply for a visa; information about the position, rank, personal data (last name, first name and patronymic) and badge number must be available.

Notes about the witnesses present may also be helpful:

- FULL NAME;

- Addresses and contact information.

Important! Only damage to vehicles indicated on the form will be compensated by the insurance company.

If one of the cars is insured under the CASCO program, then this is noted in a special column “The car is insured against damage” - a check mark in the “Yes” box, if there is only a compulsory motor liability insurance certificate, then o.

The incident diagram should be drawn up jointly, following the design rules. The correctness of the analysis of the event by police officers depends on this. It is important to indicate which part of the car the first impact occurred (arrow).

Note the nature of visible damage (dents, cracks), list broken parts and body elements.

It is important to clearly determine the position of the vehicle at the time of the accident relative to local streets, buildings, and nearby trees. Draw road markings and traffic lights in the drawing. If there are tire marks on the road surface (left during braking), then show them too.

Reference! If, during the analysis, traffic police officers identify serious disagreements between drivers, then the information contained in paragraph 16 of the document will be considered priority information.

When assessing the actions of road users, police officers will evaluate all maneuvers that could have helped to avoid an accident or, conversely, led to aggravation of the situation. Therefore, the driver needs to clearly indicate what he was doing at the time of the collision, before and after it.

Expert opinion

Artemyev Dmitry

Experience as a forensic expert in the field of automotive technical examination for more than 2 years, more than 3 years of work in the field of insurance disputes, appealing guilt in road accidents.

Ask a Question

After affixing the signatures, the form is divided into parts: the main one, filled in with a writing pen, and a copied copy. Both fragments have equal meaning. The reverse side is also filled out by each participant.

An example of filling out the first section of the notice of the secondary part:

“The circumstances of the accident - at 22.00 I was moving along Utochkina Street in the direction of Eastern Avenue in the left lane. When changing lanes to the right lane, a collision occurred with a Volvo... under the following circumstances..."

Other graphs:

- Data on all vehicles that took part in the incident;

- Is there any damage?

- Can this vehicle move independently?

- Was there a video recording of the accident? If yes, then what device (type of model, on which vehicle it is installed).

Important! To avoid misunderstandings, free fields (without text) should be carefully crossed out after filling.

Video recordings can be added to the accident report only in one case: they have GPS or GLONASS sensors.

How to correctly fill out a notice for an insurance company

General information is indicated on the front page, and detailed circumstances of the incident are indicated on the reverse side. The outer side consists of points where you need to enter information or check boxes. Here is a step-by-step example of filling out an accident notification form under compulsory motor liability insurance.

On the front page in “General Information” the following is indicated:

- accident location;

- date and time of the accident;

- number of damaged vehicles;

- number of injured or killed;

- examination of the state of intoxication (with the participation of traffic police officers);

- presence of material damage;

- information about witnesses: full name, addresses, telephone numbers;

- police officer number.

Also on the front side it is necessary to indicate information about drivers and vehicles. The Notice indicates the make and model of the vehicle and other data from the title, as well as information about the owner of the vehicle. Information about the driver must contain full name, date of birth, telephone number, address, driver's license.

If he is not the owner of the car, additionally indicate the details of the document (waybill or notarized power of attorney) on the basis of which he was allowed to drive the vehicle. These paragraphs also indicate the circumstances of the incident, data on damage to the vehicle and signatures of the drivers.

What to write in the circumstances? In the “Circumstances of the accident” field, the motorist must indicate the situations in which the incident occurred:

- overtaking;

- keeping the machine stationary;

- the car changed lanes from one lane to another.

Paragraph 16 should reflect the maneuvers of your car, taking into account the following nuances:

- Parking does not apply to stops. An example of the circumstances of an accident: if the vehicle stopped at a red light, then in position No. 1 you should not write: “The car was in a parking lot or stationary.” It is necessary to indicate: “Stopped at a prohibitory traffic light.”

- If the car left the lane without entering the lane intended for oncoming traffic, it should be o.

- If the car was overtaking another vehicle, entering the oncoming lane and then returning back, then the position is indicated: “Overtaking”.

The driver of the vehicle is selected, fills out the back of the document and briefly describes the circumstances of the accident: street names, position of the vehicle, direction of movement of the vehicles.

Who should fill it out? The front side in relation to their vehicle is filled out independently by each driver, except for points 1–8 from the “General Information” and “Road Accident Scheme” under point No. 17, which can be filled out by the driver by agreement.

After filling out, the participants in the accident sign the document. It is necessary that both sheets of the Notice be signed by each driver, and not just one copy left with him. Once the forms have been separated, no corrections, changes or additions are allowed. It doesn’t matter which motorist takes the main or tear-off copy of the completed accident notice, or chooses column A or B, these forms have the same legal force.

You should only use a ballpoint pen, since ink or writing with gel paste can be smeared when exposed to moisture, and marks made with a pencil lead can be easily erased and faked.

The reverse side contains paragraphs with additional information about accidents and vehicles. Each driver must fill out this side independently and describe the circumstances in detail. If there is not enough space on it, then the additions are presented on a blank sheet of paper, which should be attached to the main form with the statement. If the form is damaged, it should be rewritten.

List of reverse side items:

- information about the driver (owner or not);

- section describing the circumstances;

- information about other vehicles, if more than two of them participated;

- information about property damage;

- the ability to move the vehicle under its own power;

- notes (availability of a DVR).

In the text of the Notice, the fields “Vehicle A and B” are filled in by each motorist separately, indicating the following information:

- about the owner;

- about insurance companies;

- vehicle model.

In the road accident diagram, you should clearly indicate with an arrow the location of the initial impact, that is, not damaged parts, but which part of the vehicle was struck first. The list of visible damage (crack, chip, dent, scratch) is also briefly and accurately listed. In the absence of this description, the insurance company has the right to refuse compensation for damage, since this part could have been damaged not in this accident, but under other circumstances.

The accident diagram must be drawn carefully, indicating the streets, the location of road signs and traffic lights, the direction of movement of cars, skid marks and braking marks. Contradictions between the information in the accident diagram and the Notice should be avoided, since the information specified in the Notice is taken into account first.

Download standard diagrams

If the vehicle has a voluntary insurance policy (CASCO), then “yes” is entered in the “Vehicle is insured against damage” item.

So, the completed notification of a traffic accident must meet the following requirements:

- The front side must be signed twice by the participants in the accident.

- The Notice must indicate visible damage. Damages will only be reimbursed for damages specified in this document.

- The act indicates the full name and residential address of the witnesses. If they are missing, then a check mark must be placed in paragraph 7.

- If traffic police officers took part in the inspection of the scene of the incident, then their data must be present: full name, rank, position and signatures.

- When filling out paragraph 13, you should indicate a specific part of the vehicle, and not all damage.

Where to apply and when?

The completed form is sent to the victims to the insurance office, but no later than 5 days after the incident.

In addition to the notice, you should have with you all the papers issued by the traffic police officers. You must arrive at the company that issued the MTPL policy.

If the institution does not work for some objective reason, then the victims must go to the company responsible for the accident and notify its employees.

Reference! In case of refusal to compensate for damage, applicants for payment of compensation have the right to contact RSA (Russian Union of Auto Insurers).

If the deadlines for submitting documentation are violated, the insurance company has the right not to pay the amount of damage.

To fill out or not to fill out the Notice?

As you know, there are two options for registering a traffic accident: a standard one, in which the participants call the police, and they draw up reports, certificates, as well as a simplified or Europrotocol.

There are several circumstances in which drivers may not call the traffic police, but draw up all the documents for the insurance company themselves.

What were the circumstances of the accident?

The European protocol is drawn up when:

- two vehicles are involved in an accident, the drivers have compulsory motor liability insurance policies;

- damage was caused only to the participants' cars, with minor damage;

- the culprit of the accident is clearly identified, and the participants themselves agree with all the circumstances of the incident.

In all other cases, participants in an accident must call the police.

However, even after calling the police, the MTPL rules oblige drivers to fill out an Accident Notice. Clause 41 of the contract rules states that drivers whose cars were involved in a traffic accident are required to fill out a notification form, regardless of which registration method was chosen. All circumstances must be described carefully and in detail.

In addition, paragraph 44 states that the victim should contact his or the culprit’s insurance company, and the list of documents includes a document called Notification of an Accident.

Considering that the insurance company has the right to refuse payment on the basis that any documents are missing from your set of papers and certificates, it is better if you fill out this Notice at the scene of the traffic accident.

On many forums, car owners have heated debates about whether this should be done or not, provided that the drivers called the traffic police. It would be better if this document exists.

If the second participant in the accident does not want to fill it out, then you can fill out your half yourself and make an explanatory note that the driver of such and such a vehicle refused to fill out the notification form.

These circumstances will not affect your payment, since the form filled out by the injured party will be attached to the list of documents.

What to do if you didn’t fill it out at the scene of the incident

A situation may arise that one of the participants in the accident did not fill out the notification:

- Refused this procedure;

- Fled from the scene;

- Killed in an accident;

- There were no extra forms.

Clause 41 of the OSAGO Rules states that it is allowed to fill out a notice unilaterally if for some reason other participants (or a participant) did not do so.

The statement is written by the victims within 15 days from the moment of the accident.

Be sure to indicate in the form:

- The model, type and color of the cars of those drivers who did not submit notices;

- It is recommended to find witnesses to the accident and record their information in a document.

How to receive payment under the SOGAZ European protocol

To compensate for damage under compulsory motor liability insurance in Sogaz Insurance Company, you must draw up an application to which you will need to attach the following documents:

- OSAGO policy.

- Passport.

- Notification of an accident.

- PTS or STS (SOR).

- Driver's license.

- Bank details.

- Expert conclusion (if the owner ordered an assessment from independent experts).

Then the representative of IC "SOGAZ" schedules an inspection and assessment of the vehicle, which must take place in the next 5 days. Then (within 15 days) the policyholder will receive a referral for repairs to an accredited car service center. If there are no professional workshops in the area, then SOGAZ transfers money to the victim’s bank card. The law gives 20 days for the entire procedure.

In case of a minor accident, you don’t have to call the traffic police, but file an accident using a simplified form. Car owners can use the European protocol on the SOGAZ website. To do this, you have to make only 5 transitions. In other cases, the client has the right to receive the document at one of the company’s offices. The notice must be filled out at the scene of the accident and submitted to the insurer within 5 days. The maximum payment amount is 400,000 rubles. Money is transferred in exceptional cases, since the state recommends that insurers prioritize repairs.

What to do after filling

After an accident, traffic police officers (when called) will set a day for analyzing the incident. As a result, the perpetrators and victims will be identified.

The injured party, along with a notification form and documents confirming his innocence, arrives at the insurance company’s branch.

Employees are required to accept a citizen’s application requesting compensation for losses.

Reference! The injured party has the right to go to court if it is sure that insurance payments are not enough to pay off the damage.

There are cases when victims of an accident end up in medical institutions, then the relatives or friends of the injured citizen will have to take care of drawing up a notice.

Sample of filling out the European protocol

Along with the package of MTPL documents, the client receives a memo with instructions on how to fill out the document in the event of an insured event. According to the instructions, when entering data into the notice, you must adhere to the following 7 rules:

- Use a ballpoint pen to fill out the form to avoid the risk of smearing the ink.

- Enter information in legible block letters to make the text readable.

- Accurately describe the damage to the vehicle so that Soglasie Insurance Company employees have a complete understanding of the nature of the damage. It is correct to indicate where there is a scratch and dent, and where there is deformation, crack or rupture.

- If the driver made a mistake, it is possible to make changes. They just need to be certified by the signatures of both parties.

- Each European protocol must have the signatures of two drivers.

- Those involved in accidents send forms to their insurance companies.

- The vehicle cannot be repaired until it is assessed by an insurer or an independent expert.

There are 2 sections on the European protocol form (for both the culprit and the victim). Each one is filled out by one of the drivers (example screenshot EP1).

Common questions that arise when filing a notice

Problems arising at the time of writing:

- The document does not establish the guilt of any of the participants. It is intended to give the most objective assessment of the situation that has arisen. The initiator of the accident is determined by police officers as a result of analysis and necessary examinations, after which the participants in the accident are notified;

- The notice should always be filled out (if it is necessary to contact insurers); the presence or absence of traffic police inspectors does not matter;

- If there are 3 or more participants in the accident, then each of them writes a notice;

- In the event of a collision with an obstacle, there is no need to fill out a document, the owner of the MTPL policy will not receive compensation, and the citizen who purchased the CASCO certificate will be able to assess the damage based on the actual damage to the car;

- Signatures are not required on the back of the notice.

Expert opinion

Artemyev Dmitry

Experience as a forensic expert in the field of automotive technical examination for more than 2 years, more than 3 years of work in the field of insurance disputes, appealing guilt in road accidents.

Ask a Question

In the event of a collision with animals, structures or pedestrians, insurance companies should write a regular statement asking them to evaluate and pay for the damage.

Reference! It should be taken into account that sometimes the emergency commissioner from the insurance service can meet halfway; with the mutual consent of all participants, notices can be rewritten.

Common mistakes

- If the vehicle was not insured, the culprit will pay for the damage from his own funds. If the victim does not have compulsory motor insurance, he will receive nothing;

- The victim forgot to notify the insurance company about the accident and lost the opportunity to receive money as compensation;

- Errors in the preparation of notices;

- Sometimes all the forms are filled out by the same person (in the same handwriting as the rest of the documents). Insurers may find this suspicious, since there are many cases of fraud in this area;

- Corrections to the main text were made with different ink - another reason for refusing to pay compensation;

- There is no consistency: the culprit writes one thing, and the victims write something completely different.

What to do in case of refusal:

- Request a written document indicating the reason for the refusal;

- Conduct an independent examination to assess the damage to the vehicle;

- Collect all available documents, including receipts indicating additional expenses;

- Write a statement to the court.

Expert opinion

Artemyev Dmitry

Experience as a forensic expert in the field of automotive technical examination for more than 2 years, more than 3 years of work in the field of insurance disputes, appealing guilt in road accidents.

Ask a Question

You need to understand that a dispute with a structure that has dozens of experienced lawyers on its staff is a long story. Therefore, already at the stage of searching for an insurance company, it is recommended to carefully study the local market for services and choose a large organization with a minimum percentage of refusals.

Advice! Most often, difficulties arise when participants in an accident decide not to call either the police or emergency commissioners. One small mistake results in non-payment of compensation.

Quite often, an accident diagram and a description of the first impact are drawn up with errors (the list of damages is indicated, not the nature of the collision). The police find it difficult to determine the culprit and draw up a report of mutual violation.