Discount for accident-free driving under OSAGO

3.4 (67%) 20 vote[s]

The cost of compulsory motor liability insurance is calculated according to the formula approved by the Central Bank, which involves a number of coefficients. The value for each coefficient is selected taking into account the data of the driver and the car, which can directly both reduce the cost of insurance and, on the contrary, make it prohibitively high. Therefore, before you take out an MTPL insurance policy, check out the possible discounts for certain categories of drivers and find out who is entitled to benefits.

Is it possible to get a discount on car insurance?

The cost of compulsory motor liability insurance is formed according to a special formula, which is fixed by the regulations of the Central Bank. The cost calculation includes several coefficients that are applied to each driver individually. The coefficient table is also common for everyone and is regulated by law. The insurance company cannot apply a discount on its own and recalculate the coefficient. Therefore, the driver creates a reputation for himself, and the more “bonuses” he has accumulated for accident-free driving, the greater the discount will apply to the cost of the compulsory motor liability insurance policy.

As it was before

The cost of compulsory motor liability insurance depends on many factors:

- base rate in the region (determined by registration of the car owner);

- vehicle category and power;

- territory coefficient (CT) or, in other words, the region of registration of the car;

- driving experience and age of the driver (PIC) and all persons included in the insurance;

- bonus-malus coefficient (BMC) or discounts for accident-free driving. The basic BMR is 1 (you will have to pay 100% of the cost). The best coefficient is 0.5 (10 years without accidents, will give a 50% discount). And if the BMR is 2.45, it means that over the last year you had four accidents, and when calculated, the coefficient will be 1.45.

When calculating the cost of compulsory motor liability insurance, the size of the base rate was multiplied with all these coefficients. Where insurance companies wanted to increase market share, they lowered the rate in the region, but lowered it for everyone - both non-accident and accident drivers. Now everything will be individual.

Possible discounts on OSAGO

Federal Law No. 40 provides for different coefficient values that are used when calculating the final cost of compulsory motor liability insurance. You can influence some of them and thereby receive a discount when taking out a policy.

KBM

The most significant coefficient is the bonus-malus (MBM). KBM is a discount for accident-free driving. That is, the value of this indicator directly depends on the driver and his reputation on the road. The accident-free driving record contains 14 positions. Each position - taking into account the length of service and the absence/presence of an accident - is assigned its own coefficient, which affects the final price of compulsory motor liability insurance. Below is a table with values for KBM.

| Number of insured events (payments) that occurred during the period of validity of previous MTPL contracts | |||||||

| Increase in price | 0 | 1 | 2 | 3 | 4 | ||

| Class | KBM | Discount | Class to be assigned | ||||

| M | 2,45 | 145% | 0 | M | M | M | M |

| 0 | 2,3 | 130% | 1 | M | M | M | M |

| 1 | 1,55 | 55% | 2 | M | M | M | M |

| 2 | 1,4 | 40% | 3 | 1 | M | M | M |

| 3 | 1 | No | 4 | 1 | M | M | M |

| 4 | 0,95 | 5% | 5 | 2 | 1 | M | M |

| 5 | 0,9 | 10% | 6 | 3 | 1 | M | M |

| 6 | 0,85 | 15% | 7 | 4 | 2 | M | M |

| 7 | 0,8 | 20% | 8 | 4 | 2 | M | M |

| 8 | 0,75 | 25% | 9 | 5 | 2 | M | M |

| 9 | 0,7 | 30% | 10 | 5 | 2 | 1 | M |

| 10 | 0,65 | 35% | 11 | 6 | 3 | 1 | M |

| 11 | 0,6 | 40% | 12 | 6 | 3 | 1 | M |

| 12 | 0,55 | 45% | 13 | 6 | 3 | 1 | M |

| 13 | 0,5 | 50% | 13 | 7 | 3 | 1 | M |

As you can see, the maximum discount for accident-free driving is 50%, provided that for 10 years you have not been involved in an accident through your fault. That is, for every year of good driving, a 5% discount is awarded. But if the driver regularly causes accidents, then his insurance cost will increase by a maximum of 2.5 times (2.45), by 145%. As for beginners, they cannot count on a discount in the first year of driving, but there is no provision for an increase in the cost of compulsory motor insurance. Their coefficient is 1 and class 3 is assigned. All data for years of driving is stored in the RSA register. Anyone can access it.

Violation rate

In addition to discounts for accident-free driving, the violation rate is taken into account. He is responsible for enforcing traffic rules. In the absence of violations, the cost of compulsory motor liability insurance remains unchanged, that is, the coefficient is equal to 1, and in the presence of gross violations of traffic rules, it will be 1.5, that is, the increase in insurance costs will be 50%. Gross violations include:

- the driver caused the accident;

- alcohol or drug intoxication;

- fleeing the scene of an accident;

- the car is driven by a person not included in the insurance policy;

- lack of a driver's license;

- providing false information to the insurance company when applying for insurance or in the event of an accident;

- transport management after the expiration of the compulsory motor liability insurance policy;

- overestimation of the amount of damage to a car when assessing damage to calculate the amount of insurance payment.

If there were no violations over the past year, then the cost of the insurance policy remains at the same level, that is, a coefficient of 1 is assigned. Each driver has his own car history, which is reset to zero after the expiration of one year. Thus, you cannot count on a discount from the coefficient for violations, but you can maintain the same price level for compulsory motor insurance and not increase it.

Driver age and experience

A separate coefficient is assigned for the age and experience of the driver. Here, too, you cannot count on a discount, but you can keep it at level 1, that is, not increase the cost of the policy. So, the age and experience coefficient has 4 values (KVS):

- If the driver is under 23 years old and has less than three years of driving experience, then the coefficient is 1.8, that is, the cost of insurance increases by 80%.

- If the driver is 23 years old or more, but does not have 3 years of driving experience, then the coefficient is 1.7, the price of the policy will be 70% higher.

- If the driver is less than 23 years old, but already has a driving experience of 3 years or more, then the price will increase by 60% (PIC = 1.6).

- If the driver has enough experience, that is, more than 3 years and age exceeds 23 years, then the cost of insurance will remain at the same level (PIC = 1).

If several drivers are included in the insurance policy, then the calculation will be made according to the highest indicators.

Territory coefficient

The calculation formula contains a territorial coefficient. It indicates the place of registration of the car. Its meaning depends on the region of residence, and to be more precise, on the locality of the Russian Federation. Its meaning is that if the city is large and developed with a high density of transport, then the probability of an accident is higher. Accordingly, the insurance organization sets the highest coefficient for large cities in order to justify the risks of an accident. For example, for Moscow, Tyumen and Perm the value will be at the level of 2.1, that is, the highest indicator, and for small cities - 0.6. You can familiarize yourself with all the coefficient values in a special table, which is easy to find on the Internet.

Special offers from the company

To attract new customers or retain old ones, most insurance companies come up with promotions or loyalty programs. With their help, you can count on an additional discount, in addition to the values assigned to each of the above coefficients. The discount amount can range from 3 to 10% and accumulate with each renewal of the MTPL policy.

Who is eligible for benefits?

For regular drivers, only the above discounts apply. As for benefits from the state, their size is 50% and certain categories of citizens can count on them, namely:

- disabled people of groups 1, 2 and 3;

- labor veterans;

- disabled children;

- legal representatives of disabled people.

As for pensioners, no benefits are provided for them, just like for war veterans. They can only count on a 5% discount, which applies to all drivers for accident-free driving.

There are special amendments to the law that apply to disabled beneficiaries. For them, a 50% discount is possible subject to the following conditions:

- For all categories of disabled people, the benefit applies only if they need a car for medical reasons.

- Disabled children under 18 years of age must have a legal representative, to whom the refund will be made.

- If a disabled person’s rehabilitation card states that the car must be specially equipped when moving (recommendations for people with disabilities), then such a condition must certainly be met.

It is also worth mentioning the 50% benefit for labor veterans. You can receive a discount of half the cost of compulsory motor insurance only as a refund of the difference by decision of the local authorities. Therefore, before you take out insurance, you first need to contact the appropriate authority with a complete package of documents and write an application for a refund. If your request is approved after consideration, half the cost of the insurance will be returned to the specified account.

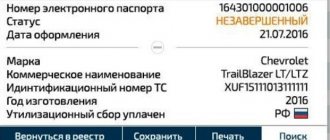

How to find out a possible discount

You can find out about the availability of discounts by personally contacting the office of the insurance company or independently, using the RSA (Russian Union of Motor Insurers) website. To do this, you need to fill out a special form on the website, where you indicate information about the policyholder:

- FULL NAME;

- Date of Birth;

- driver's license series and number.

The result will be the value of the bonus-malus coefficient, which will reduce the cost of the MTPL policy by a certain percentage. You can also find out about the price of insurance in advance using an online calculator on the insurance company’s website. To do this, just fill in all the required fields and click “Calculate”. The calculator will not only make the calculation taking into account all the coefficients, but will also apply a discount that depends on the value of the bonus malus.

The bonus-malus coefficient in OSAGO will be calculated on the basis of policies for two years

The new procedure for assigning the bonus-malus coefficient (BMC), reflecting the driver’s accident history, stipulates that in order to establish it, the values in contracts concluded over the last two years will be taken into account. As TASS reports, the executive director of the Russian Union of Auto Insurers (RUA) Evgeny Ufimtsev told reporters.

He explained that from April 1, a single KBM is assigned to each driver, and not to the driver in connection with the specific MTPL policy in which he is registered.

“From April 1, in order to calculate the new CBM, those contracts that were concluded over the last two years are taken into account - that is, those that began to operate in April 2017 . All agreements that have been in force over the past two years are taken as a basis. Of these, the smallest KBM . We say that this is an “amnesty” for the consumer : if within two years he, either as an owner or as a driver, has been included in one of the MTPL contracts, the smaller one is chosen,” said Evgeniy Ufimtsev. Thus, if over the last two years there were contracts with KBM 0.9 and 0.6, then the driver will be assigned KBM 0.9.

Moreover, if over the last year the driver had an accident (those for which there were insurance payments ), then an increasing coefficient is applied to him, added Evgeny Ufimtsev.

On April 1, the instructions of the Bank of Russia regarding the new system for assigning KBM . Now the KBM will be assigned to the driver once a year on April 1 and will not be recalculated during the year . If on April 1, 2019, a car owner has several bonus-malus coefficients listed in the automated information system RSA, then he will be assigned the lowest of them . A legal entity will be assigned a single KBM for all vehicles in its fleet .

In addition, the coefficient value will no longer be reset to zero during a break in driving , as was previously the case: it will be saved.

At the moment, the maximum BMC is 2.45 (increases the cost of the policy by 2.45 times), the minimum is 0.5 (corresponds to a 50% discount).

At the same time, the Central Bank previously announced its intention to reform the KBM settlement system. They have already prepared two reform options : according to the first, the maximum value of the coefficient should increase to 2.78 (a discount for a driver who has committed an accident cannot be given for 6 years), according to the second - to 3.85 (without a discount for 14-15 years ).

The need for reform, as noted in the Central Bank, is caused by the fact that now the average value of the BMR in the country is 0.81, and in a few years almost 70% of motorists in Russia will receive a maximum discount of 50%.