Previously, legislation established the possibility of receiving monetary compensation through insurance instead of repairs. Now the insurance organization provides the car owner with a referral for repair work. The client no longer has the right to choose.

Under what circumstances does an insurance company client have the right to choose monetary compensation or repairs?

To understand how realistic it is to receive monetary compensation, the victim should pay attention to the policy of the person responsible for the traffic accident. If the policy was drawn up before the adoption of the law on the impossibility of cash payments, there is a possibility that the right to choose will remain with the victim.

Service station: direction and choice

Any insurance organization according to the rules is obliged to issue the client a referral to a service station. In most cases, the driver does not have the right to influence the choice of a service station; the company directs it to the institution with which it has a contract. The only exception is the situation if the accident was registered by the accident commissioner.

However, there is also a point here: on the official website of each insurance organization there is a complete list of service stations that cooperate with it, and the driver retains the formal right to choose exclusively from the list of services offered.

Refusal of repairs under compulsory insurance in favor of money

Why is it more profitable to refuse repairs under compulsory motor liability insurance? It’s no secret to anyone that insurance companies very often take advantage of clients’ lack of legal knowledge and, under fictitious pretexts, underestimate payments or refuse compensation for damage.

This may apply to both payments under compulsory motor liability insurance and repairs under compulsory motor liability insurance (we will talk about refusal of repairs below).

The service says: “We don’t know anything - the amount they gave us is the same amount they got.”

- What if the car was seriously damaged? Where is the guarantee that they will change the same bumper amplifier? Or the bumper will be assembled from pieces, and the missing elements will be puttied or soldered. You will pick up the car, everything seems to be beautiful, and then everything will fall off.

- You are directed to an unknown auto repair station, naturally not to an official dealer. And repairs are paid only in the amount taking into account wear and tear, i.e. You will pay extra for wear and tear out of your own pocket by buying new parts and spare parts.

How to get money under compulsory motor liability insurance instead of repairs: legal grounds

The possibility of compensation for damage as repairs appeared not so long ago. If the policy was issued after April 28, 2014, the company itself chooses which method of compensation is convenient for it. The new law provides for a lot of nuances that allow for some exceptions when compensation for damages in money takes place.

If repairs cannot be completed within 30 days

The law sets a period within which compensation must occur. Car repairs should not last longer than 30 days. The period is calculated from the moment the car arrives at the service station.

Often, in order to repair a car, parts are required, the delivery of which takes a long time. In this case, the insurer offers to extend the period of repair work.

If the driver does not agree, the company will have no choice, and it will pay the damages in money so as not to violate the provisions of the current legislation.

If the nearest partner’s car service is more than 50 km away

The repair service must be located no further than 50 km from the driver’s place of residence. If the service station is located further away, the citizen can refuse the service and demand monetary compensation.

There is one subtle point here - the insurance company has the right to offer delivery of the car to the selected service station, then payment will become impossible.

If there is no official dealer in the city

Those cars that are less than two years old are required by law to be serviced only by authorized dealers. If there is no such organization in the city, the insurer must offer car transportation or travel payment. Sometimes such services cost the insurance company a hefty sum, so the driver will have a loophole to demand monetary compensation.

If it's not your car that needs to be repaired

If, at the time of filing a request for compensation, the matter concerns not only damage to the car, but, for example, health, then payment in cash is guaranteed. These cases may also concern the citizen’s personal belongings that were damaged as a result of the collision: laptops, mobile phones, clothes, etc.

If after an accident the victim died or received moderate or severe harm

This situation provides for full monetary compensation. Insurers for medium and severe harm to the victim pay funds in accordance with established compensation standards.

Also, the victim has the right to demand monetary compensation for loss of ability to work, sick leave and disability in the appropriate case. In the event of the death of the victim, members of his family, young children, and dependents have the right to compensation for the period prescribed in the rules of compulsory motor liability insurance.

Total car loss

Sometimes a car can no longer be repaired after an accident. Insurance companies have a concept - total loss of a vehicle. In this case, the injured driver has the right to receive monetary compensation under compulsory motor liability insurance in the amount of 400,000 rubles.

If the victim has a disability

If there are documents that confirm the fact of a citizen’s disability, monetary compensation is due from the organization that issued the policy. Here we are not talking about car repairs, but about paying compensation for health damage.

If the guilt is mutual

If guilt was found to be mutual, compensation depends on the degree of guilt and is calculated as a percentage.

The organization has the right to offer a referral for repairs for a small additional payment, because there is no need to pay off the damage in full. If this option is not suitable for the injured party, the company must pay him a certain amount.

If the vehicle is a truck

When a truck driver, who acts as a victim, was involved in an accident, he has the right to make his own decision on the method of compensation for damage.

Just offer to pay

This option is obvious, but not every organization agrees to the request of an injured citizen to pay him damages in money.

During the application process, you must indicate your desire to receive financial assistance or try to negotiate with the insurer.

Don't agree to extra payment

There are situations in which the insurance company refuses to pay, explaining its refusal by the fact that allegedly little money was transferred to the insurance company for repairs, and in order to receive payment in money, the victim needs to pay extra for something. Such actions by the insurance company are unlawful, therefore the client of the insurance company must be required to present the arguments for refusal exclusively in writing.

The victim should not agree to any “deals” with the insurance agent, manager or even director of the company. The company is obliged to fulfill its obligations, be it payment in money or a full repair of the car using new parts.

Where are car repairs carried out under compulsory motor liability insurance?

With the introduction of amendments to the regulations for repair work under MTPL, motorists are given the opportunity to choose between several options:

- Technical center of the official dealer.

- Service station cooperating with the insurer.

- Another service station.

Official dealer

The dealership auto center repairs cars that are less than 2 years old. Repairs are carried out under warranty and do not require payment from the car owner. All costs to the dealer are reimbursed by the insurance company.

At the insurance service

Restoration repairs under compulsory motor liability insurance at a service station working with the insurer is the most common option for in-kind compensation for damage. An official agreement is concluded between the vehicle owner, on the one hand, and the agency and service station, on the other. It specifies the timing, price and other nuances of the upcoming work. During repairs, the use of used or counterfeit parts is prohibited - all spare parts must be new and original. Upon completion of the repair, an acceptance certificate is drawn up, and the restored car is returned to the owner.

ONE HUNDRED

A car damaged in an accident can be repaired at an independent service station only if a number of conditions are met. You will need to obtain the insurer's written consent to carry out repairs at this service center. The application shall indicate the name, details and address of the service station. The insurance company is given a period of 30 days to consider the application and make its decision on it.

Is it necessary to pay a deficiency for repair work and will wear and tear on the machine be taken into account?

Expert opinion

Mironova Anna Sergeevna

Lawyer and lawyer for automobile law. Specializes in administrative and civil law, insurance.

Previously, wear and tear of parts was taken into account in the payment, while craftsmen could install used parts on the vehicle being repaired. Now car repairs under the MTPL policy involve replacing damaged parts with new high-quality analogues. The use of used spare parts is prohibited. In other words, the wear and tear of the car will not be taken into account during the repair work.

The culprit of the accident is obliged to make an additional payment if the policy was issued according to the old standards, and also when the insured amount does not fully cover all the damage to the victim.

Procedure for vehicle repair under insurance

Car repairs under OSAGO are carried out in compliance with certain standards and in the established sequence.

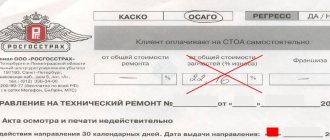

Referral for repairs

To receive a referral, the vehicle owner must notify his insurer about the accident by providing the established set of documentation:

- Insurance contract and valid policy.

- Vehicle registration certificate.

- Vehicle owner's passport.

- Copies of the protocol and resolution from the traffic police.

- Written notification of an accident.

- Additional papers, if available - receipts for payment for tow truck services, emergency parking, independent experts.

Then the damaged car is provided to the insurer for inspection within five days. As a result of the examination, the final price of repair work is determined. After this, within 20 days, the insurer is obliged to issue the client a referral for repairs under OSAGO.

Service call period

Legislative acts do not establish specific deadlines during which the owner of a vehicle must contact a service station for repairs. As a rule, they are prescribed in the direction itself, and can take from 1 to 3 weeks . If the specified deadline is missed, the car owner will have to contact the agency for a new referral. The insurer has no right to refuse to issue it, nor does it have the right to demand any payment for it.

Calculating the cost of transport restoration

The cost of repair work is determined by insurance agency experts, based on generally accepted methods. They include current prices for repair work and the cost of replacement units and parts. When the total amount of restoration exceeds the limit of payments under compulsory motor liability insurance (400 thousand rubles), the difference will have to be made up by the owner of the vehicle.

After this, in a regressive manner, he will be able to make claims for compensation of these expenses to the culprit of the accident. When the car owner does not agree with the conclusions of the insurance company appraisers, he can order an independent examination. Based on the conclusion received, it is possible to put forward demands to revise the price of repair work.

Do I need to pay for repairs?

According to paragraph “b” of Part 18 of Article 12 of the Federal Law “On Compulsory Motor Liability Insurance”, the insurer is obliged to pay all costs associated with repair work. After providing such a service at a service station, the car must return to its condition at the time of the insured event. These expenses include (Part 1, Article 12 of Federal Law No. 40):

- Spare parts and consumables.

- Payment for the service.

Payment by the policyholder is possible only in one case - the cost of restoration work exceeds 400 thousand rubles (Part 17, Article 12 of Federal Law No. 40). The insurer is obliged to notify its client of this in writing. If the policyholder does not agree to pay the difference at his own expense, he has the right to receive compensation in money.

What to do if the insurer does not cover the full cost of repairs under MTPL

Sometimes the insurer does not satisfy the requirements for payment under auto insurance. Cases of refusal of compensation vary. As soon as the car service center learns that a referral for restoration work has been received and notifies the client that the amount set by the appraiser for repairs will not be enough, the injured motorist must immediately contact an independent expert. In accordance with the results obtained, the insurer is obliged to revise the amount of compensation so that it fully covers the costs of restoration.

The insurance company is not always willing to change the results of determining the amount of damage established by its expert. In this case, the owner of the damaged car can file a pre-trial claim and not rush to carry out the repairs themselves.

If the insurer denies the claim, you can take legal action. In this case, the car should be submitted for inspection to an expert appraiser provided by the court. When damage to health and life is caused in an accident, the payment can reach half a million rubles. If damage is caused exclusively to property, the maximum compensation is limited to 400 thousand rubles. If this money is not enough, the motorist will have to cover the difference.

If possible, what to choose: money or repairs under MTPL?

Experts recommend that for cars that have a warranty after being purchased at a car dealership or when purchased through a car loan: it is better to try to get a financial refund than not to have the vehicle repaired.

It is preferable to take compensation in cash in the following situations:

- The new car still has a manufacturer's warranty.

- The mechanics at the service station reported that they were not able to carry out repair work for the amount indicated by the insurer, so the motorist would have to pay the difference.

- Auto repair shops designated in the MTPL terms and conditions do not provide the necessary repair services.

- When a service station regularly receives negative reviews from motorists due to the unsatisfactory quality of repair work.

Customer complaints regarding service station services should be given special attention. After the repair is completed, the insurance claim will be closed; it will not be easy to complain in this situation. A circumstance will arise in which the insurer will say that the car service is to blame, and the workshop, in turn, will blame the insurance company. Sometimes only a court decision will resolve the conflict.

Remember! The motorist has the right not to sign a certificate of work performed, not to pick up the vehicle and not to wait for alterations if the repairs were not performed properly.