According to the law on compulsory civil liability insurance, Article 15 of Law 40-FZ, in order to enter into an MTPL agreement in electronic form, an individual will be required to:

- insurance application,

- passport,

- vehicle registration certificate or PTS,

- driving licenses of drivers who will be allowed to drive under the policy,

- valid diagnostic card.

The list of documents for legal entities looks slightly different:

- insurance application,

- certificate of state registration of a legal entity,

- vehicle registration certificate or PTS,

- valid diagnostic card.

Since policies for legal entities are issued with the standard condition of an unlimited number of drivers, it is not necessary to provide a driver’s license.

Is it possible to apply for compulsory motor liability insurance online?

When trying to conclude an agreement with an insurance company in the usual way, a car owner may encounter many difficulties:

- loss of time in queues;

- lack of forms;

- forced registration of unnecessary services that are imposed additionally.

All this can be avoided if you apply for compulsory motor liability insurance online, just from home, via the Internet.

First, let's try to figure out what an electronic policy is and how it differs from a regular one. This opportunity has been available since October 2015. And from the beginning of January 2021, after changing the wording of Article 15, Clause 7.2 of Federal Law No. 40, all auto insurers are required to provide services for the electronic sale of policies.

In fact, to this day, not all insurance companies actually offer the option of purchasing electronic car insurance. Many companies, when trying to buy OSAGO online, have problems with the operation of their sites, for some this service is temporarily unavailable, other problems are possible. But, with a certain patience and perseverance, results can be achieved.

This may be due to both technical difficulties and sabotage of this process by insurance companies. In some regions, this type of insurance is considered unprofitable. In addition, with this form of registration, the insurer cannot impose all sorts of additional services on the client, which further significantly reduces the profitability of compulsory motor liability insurance for insurance companies.

It is also possible that the driver gets into accidents too often, and the car insurer’s losses for compensation for insured events increase.

But it should be noted that, if desired, it is quite possible to obtain car insurance online. It has the same strength and value as paper.

How to get an electronic policy online today?

OSAGO stands for a document on compulsory civil liability insurance for each vehicle owner. The first MTPL was issued on the territory of the Russian Federation in 2003 under the influence of Law No. 40 “on compulsory insurance”. Such a document protects citizens who were injured in a traffic accident.

An MTPL policy must be issued in electronic form in every organization that classifies itself as an insurance company. These organizations must have a license that will allow them to carry out civil liability insurance . If a company is given the opportunity to sell a compulsory motor liability insurance policy, it is obliged to submit its electronic type.

In accordance with the above statistical studies, as of January 1, 2021, there are 70 companies in the Russian Federation that are licensed to sell OSAGO policies. This means that they are all required to provide the ability to issue a policy online. You can find out more about the register of such insurers on the RSA website. And in this article you will find a list of the best companies where you can apply for compulsory motor insurance online.

What options are there for registering OSAGO online?

As already mentioned, the electronic version of compulsory motor liability insurance is no different from the usual one in terms of its effectiveness, only when registering it you do not need to visit the insurance organization, but you can do everything at home yourself using the Internet. Let's consider the order of such a purchase:

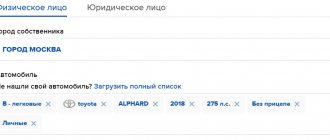

- decide on an insurance company and log into its online portal. When choosing a contractor, you need to take into account its pricing policy, reliability and the extent of payments for obligations, having analyzed the ratings of insurers. The difference in prices for the same machine in different organizations can vary by up to 25%, so you first need to calculate the cost of the services offered;

- register on the website and create a personal account. Personal information is indicated, including passport information, email address, etc. If registration is successful, you will receive a password to enter your personal account in the form of an email;

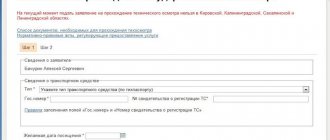

- A computer application form is filled out to obtain auto insurance. To do this, you will need to use data from your passport, driver’s license, document confirming the completion of a technical inspection, or car registration certificate. This statement is practically no different from the usual one when applying for a policy at the insurer’s office. The only difference is that there it is filled out by a representative of the insurance company, but in this case you have to enter the information yourself;

- insurance must be paid. Payment is possible through any bank card by non-cash transfer of funds. After this, a message with the purchased MTPL policy will be received by email;

- a printout of the policy so you can have it with you. Having this document in electronic form will help to avoid many problems, for example, if the electronic database of an inspecting traffic police officer malfunctions. In addition, the Traffic Rules in paragraph 2.1.1 of the second section require the driver of the car to have a compulsory motor liability insurance policy.

When the information is entered, it is reconciled by the insurer with that presented in the electronic PCA database. If any discrepancies are identified, the client will be asked to provide scanned copies of documents confirming the right of the car owner.

If an insured event occurs, the owner of the car may be subject to additional compensation if there are errors in the system. Therefore, it is necessary to carefully check the data entered into the electronic database with the actual data to eliminate possible errors, which could be costly in the future.

Step-by-step instruction

Let's pay attention to considering several payment methods at once.

Using a bank card

- Log in to your personal account.

- At the order point, go to the application page for issuing an electronic MTPL policy.

- Click on the "pay" button. The site will redirect you to a page where you need to enter your card details. Details include the card number, expiration date, and code. Additionally, you can indicate the initials of the card holder.

- Click on the "send" button.

- The data will be processed, as a result of which an SMS message will be sent to your phone number.

- It will contain a code that must be entered into an empty field. If the correct code was entered, funds, if any, will be debited from the account.

But not all citizens pay using a bank card. If you have funds credited to an electronic account, you can use a similar method.

- To do this, you should also go to your personal account and open the page with the completed application.

- Find payment systems among the available payment methods. The most common of them are Qiwi, WebMoney, Rapida and so on.

- Select the payment system in whose account your funds are located. Depending on the chosen system, you will be asked to indicate the debit account.

- If the payment system is linked to a phone number, you must specify it.

- An SMS message with a code will be sent to your phone number, which you will need to enter in the empty field. A correctly entered code will give permission to write off funds.

Procedure for registration of compulsory motor liability insurance for the car owner

In order to obtain car insurance online, you must submit the following documents:

- First, the owner of the vehicle must register on one of the websites of the company that deals with insurance.

- Next will be a request to enter data regarding yourself and your car, which is requested by the company management.

- After this, the system will determine what the final cost of the purchased policy will be. In this case, all coefficients are taken into account, such as region, etc.

- After the completed actions, the most difficult and crucial moment comes - the data entered on the site is verified with those available in the RSA database. This stage is considered the most problematic, since the information provided on the RSA website is not always true.

- If all the above steps are successfully completed and the reconciliation is successful, the future owner of the insurance policy will need to make a payment. This can be done in different ways, for example, using a bank card or the payment system webmoney, qiwi, yandex and others.

- After the specified amount has been paid, the company management will send an insurance policy form to the registered person’s email address or personal account. And to become the full owner of the document, you just need to print it.

How to deposit funds for e-OSAGO?

- To pay for your e-OSAG policy, you need to go to your personal account.

- You will see an order to receive an insurance product. Hover over it and go.

- You will be taken to a secure payment page.

- You can deposit funds through a bank account or by paying electronically.

- Before depositing funds, carefully check the information you provided in the payment system.

- You will receive a code in the form of an SMS message, which you must enter in the empty field.

- The funds will be withdrawn from your account and applied to the transaction.

- The payment will be processed within a few hours.

- In some situations, payment may be credited within one business week.

- The fact of payment for the electronic MTPL policy will be confirmed in an SMS notification.

Necessary documents for obtaining MTPL insurance

In order to correctly fill out the insurance form, the car owner needs to prepare the following documents (Clause 3, Article 15 No. 40-FZ):

- Passport of the owner of the vehicle and passport of the policyholder if it is more than one individual.

- A certificate confirming the registration of the car or car passport.

- Driver's licenses of those persons who have the right to drive a vehicle (this is necessary if the insurance is limited).

- Valid diagnostic card.

Important! The need for a signature on the received document must be taken into account. An alternative signature option is an electronic key, which can be ordered from specialized organizations.

It may also happen that you cannot buy OSAGO car insurance online due to the fact that there are discrepancies with the RSA data. In this case, site representatives have the right to request a scanned version of the above documents.

How to correctly fill out a paper OSAGO policy

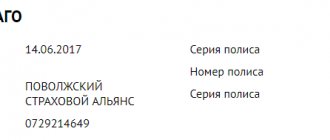

- Field "Series and number". The series is already printed on the original OSAGO form; it consists of three letters, as well as a unique number of ten digits. Today, all OSAGO paper forms use a special series.

- "Insurance period". The period must be specified here. It starts either on the day of application or from the date the client needs. But not earlier than the date the buyer contacts the office. Validity period – 1 year.

- “Period of use of the car.” In this field, you must indicate the time of operation of the machine when compulsory motor vehicle liability insurance is in effect. Typically 12 months is specified. But if the driver does not intend to drive continuously all year, then it is necessary to indicate only those periods when the vehicle will be used. For example, the car will be used 9 months a year, except for the three winter months. This means you can get insurance for summer, autumn, spring. You can choose any period for car insurance, but not less than 3 months.

- Policyholder. If he is an individual, his full name is indicated.

- "Vehicle owner." The full name of the car owner or the name of the company for legal entities is also indicated here.

- "Vehicle". Here you need to indicate all the data relating to the car: make, model, VIN, state number, series number of STS or PTS. Specify the purpose of operation; all this information has an impact on the calculation of the price of the MTPL policy. When filling out this field, you must be extremely careful, since you need to specify a lot of numbers in the section. It’s quite easy to get confused, make typos and make mistakes.

- List of drivers. Information about all drivers who can drive the vehicle is indicated: fill in the full name, number and series of its driver’s license, KBM. You can select the “No restrictions” option, then the data is not filled in, but such a policy costs more.

- "Amount of insurance premium." – the price of the MTPL policy is indicated.

- "Date of conclusion of the contract." The date of registration of the contract and issuance of the insurance policy is indicated here.

The signatures of the parties are placed below, the signature on the part of the insurance company is certified by a seal.

Pros and cons of electronic insurance

Electronic insurance has both its pros and cons.

The main advantages include:

- the ability to purchase without leaving home, no need to waste time visiting an insurance company;

- lower cost because it does not offer additional features that are not always needed.

The disadvantages are problems with the operation of insurers' services for purchasing compulsory motor insurance online, and the presence of errors in the electronic database.

Considering that time does not stand still, this form of purchasing is the future. The electronic service will be improved, and these requirements are also imposed on auto insurers by the state.

Positive and negative aspects of purchasing MTPL

The very presence of an insurance policy is a mandatory condition for all car owners, and the desire or unwillingness to obtain it is not discussed, but the method of obtaining it can be chosen at your own discretion. By law, any car owner can obtain an MTPL policy via the Internet. To make a decision on purchasing e-OSAGO, you need to evaluate the advantages and disadvantages of this method of acquisition.

So, the undeniable advantages of electronic registration of an MTPL policy are:

- remote purchase, that is, the buyer can complete the registration and purchase from anywhere in the world, at any time of the day, without a personal visit and the assistance of insurance company employees;

- saving personal time - searching for an insurer, making an appointment or a suitable time to visit the office, waiting in line, etc.;

- safety of the policy – confirmation is the availability of information in the OSAGO and RSA database; You can print the policy an unlimited number of times; if necessary, you can do without a paper document; to do this, just display the form on the gadget screen;

- transparency of pricing. The buyer has the opportunity to independently calculate the price of the policy and see its components using an online calculator. At the same time, additional costs for intermediary services and imposed additional insurance are completely eliminated;

- convenience of cashless payment. Sites offer payment in different ways: cards (debit, credit), electronic wallets, bank transfer from a personal account, etc.

Negative points in issuing an electronic policy may be:

- impossibility of obtaining insurance for new cars and novice drivers, since there is no information in the RSA database;

- “program failure” in regions with large unprofitability. Insurers call such regions toxic, and they set up the website in such a way that the page freezes and does not load for car owners in such regions;

- any error or typo can lead to non-payment in the event of an accident or recourse on the part of the insurance company. Correcting errors electronically is extremely difficult, and policyholders with errors must contact the offices of the insurer or its representative. If the error was not corrected and a traffic accident occurs, the insurance company will try to present the typo as deliberately false information, as a result of which they will refuse to pay or issue an invoice - recourse;

- Difficulty checking the policy by State Traffic Inspectorate inspectors. Despite the fact that more than two years have passed since the introduction of e-OSAGO, employees in uniform who check documents have an extremely negative attitude towards the electronic form of insurance. This is explained by the time and energy costs of reconciling information against internal databases, in other words, they have to “work” to check it;

- fraud in this area of activity. Approximately a little more than 10% of all MTPL policies sold turn out to be fake and invalid. There are a lot of scenarios that scammers use, from fake websites that are exactly like the official websites of the most famous insurance companies, to fake policies in Photoshop.

As they say, “don’t chase cheapness, priest.” Searches for the lowest OSAGO price on the Internet, as a rule, lead precisely to scammers and swindlers. You need to understand that the cost of insurance consists of certain components established by law. The discount can only be applied to the driver's accident-free rate (FMR). Insurers do not give any other discounts to their clients.

If you are offered a policy at a reduced price, remember Russian proverbs and sayings on this topic. The most common scam scenario is now considered to be this: you order a policy at a price that compares favorably with the market price from an intermediary who allegedly works for free. They issue a policy, distorting your data (information that affects the price reduction is entered - a region with a reduced rate, a motorcycle instead of a car, the optimal age), receive a policy from the insurance company and correct it in graphic editors, indicating the correct data. The difference in cost is their earnings. The buyer receives a policy that has no value and provides no protection.

Do you need MTPL for a motorcycle? Read on our website.

How to fix it instructions for making changes

The procedure for making changes to the electronic MTPL insurance policy is not complicated and should not cause difficulties for the policyholder. Below are step-by-step instructions on how to make the required changes:

- Contact the local office of the insurance company.

The policyholder can contact any official representative office of the insurer, without being tied to the geographical location of registration. - Submit an application to make changes to the MTPL online.

In order for the insurer to make changes, you must submit an application that must contain:- The full legal name of the insurance company with which it is being filed.

Last name, first name and patronymic of the applicant.

- Information about what information in the policy is unreliable and what it needs to be replaced with.

- List of documents that are attached to the application.

- Date of application.

- Signature and transcript of the applicant's signature.

- Submit the required package of documents.

The required package of documents includes the applicant’s passport and driver’s license, from which an employee of the insurance company will make copies and attach them to the application.Situational documents are:

- Notarised power of attorney. If the application is submitted not by the holder of the electronic insurance policy, but by a third party, then this citizen must present to the company employee a notarized power of attorney, according to which he has the right to represent the interests of the policyholder on these issues.

A document confirming the legality of the changes. If the errors are related to data about drivers, then copies of identification documents will be required, but if the data relates to a car, then an insurance company employee may ask to see the PTS and STS, and in rare cases, a diagnostic card.

- Pay the difference in the cost of electronic policies before and after the changes.

In cases where changes are made to the vehicle information, a situation may arise where the cost of the vehicle title increases. In this situation, the applicant will need to pay the difference in cost to the insurer's cash desk. - Get a new insurance policy.

By making changes to E-OSAGO, the policyholder actually transfers it to the form of a traditional insurance policy. Within two working days from the date of submitting the application and paying the difference in cost, the insurer is obliged to issue or mail to the policyholder a new corrected OSAGO policy on a strict reporting form.

We also invite you to learn more about the features and rules for registering E-OSAGO:

- How to quickly and easily apply for E-OSAGO?

- How to register E-OSAGO for legal entities?

- Features of registration of compulsory motor liability insurance through State Services.

In general, errors in electronic “vehicle certificates” do not have serious consequences for the policyholder. But in order to avoid problems associated with payments in case of an accident and fines from traffic police officers, when errors are first discovered in the policy, it is better to immediately contact the insurance company and correct them, especially since the procedure is not at all complicated and will require a minimum of time. and will require a minimum of time.