New procedure for calculating the cost of an auto insurance policy

Car owners will be divided into categories based on age and driving experience. Several groups will receive the maximum coefficient, for example, the policy will become significantly more expensive for young drivers under the age of 24, if they have no more than 4 years of driving experience, as well as for drivers no older than 29, if they have just started driving. Drivers whose age has passed the 30-year mark will be able to receive a discount on compulsory motor liability insurance, provided that they have been driving for at least 4 years.

From these specific examples, the principle of changing the coefficients becomes clear. The older car owners are and the more experience they have driving a car, the lower the coefficient will be for them.

For owners of existing policies

Until April 28, all conditions of MTPL policies remain the same. When you need to enter into a new contract, try to choose an insurance company as carefully as possible. Previously, you could just take the money. Now you need to take into account which services the insurance company has contracts with.

The law requires each insurance company to post a list of its car services on its official website. In this list you will be able to see the addresses of services, brands of cars being repaired, and terms of work. You need to read all this before signing the contract in order to save yourself from inconvenience.

If you already have a reliable, proven service, find out which insurance companies it cooperates with.

You must keep receipts for all parts you replace yourself. They may be needed in court.

Even a small mistake can be grounds for denial of compensation. Therefore, make sure that after an accident all documents are completed correctly.

OSAGO coefficients 2017 by group

Now the coefficient is determined only by 4 group options. However, Bank of Russia analysts are confident that this gradation is not sufficient. In addition, experts have complaints about the coefficients themselves. Therefore, in the near future there will be an increase in the number of groups for people driving, as well as a change in the coefficient: the numerical multiplier will become fractional.

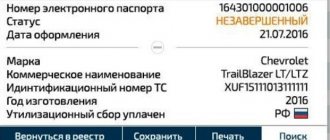

Dear OSAGO? Restore KBM now

and stop overpaying insurers!

The service will send an application to RSA. Recovery time for KBM: from 12 hours. Find out more

Repair under compulsory motor liability insurance instead of money - innovation in legislation No. 1

The main change is considered to be the one made by Federal Law No. 49-FZ of March 28, 2021 to the law on compulsory motor liability insurance. According to this document: the insurance company repairs the damaged car at its own expense at a service station, and does not pay money to the injured party.

Please note that until April 28, 2017. the situation was different: the victim had the right to choose a convenient option between carrying out restorative repairs and an insurance cash payment.

At the moment, money for repairs can be received in the following individual cases:

- A car cannot be restored after an accident;

- To repair a damaged car, an amount of more than 400,000 rubles will be required;

- The damage was caused to a property that is not related to the car;

- Insurance was obtained by the car owner within the framework of international insurance systems;

- The insurance company is not able to fulfill its obligations (under the insurance contract) to repair a car damaged in an accident in a way other than paying monetary compensation;

- A specific accident was registered without the participation of police officers, which is possible in cases where the damage does not exceed 100,000 rubles. However, the amount it will cost to repair the car exceeds the above and the victim refuses to pay extra with his own funds;

- The car owner is a disabled person of group I or II and submits an application in which he asks to pay monetary compensation for repairs.

More people will receive the discount than before

The topic of changes in the cost of compulsory motor liability insurance was studied by experts from several organizations: the National Union of Liability Insurers, the Russian Union of Auto Insurers, and the All-Russian Union of Insurers. They came to the conclusion that under the new changed tariffs, two-thirds of car owners will be able to get a discount on insurance - this is what gives a more flexible coefficient.

Insurers respond positively to the Bank of Russia’s decision because they have nothing to lose in this situation: the average premium will be the same. Car owners are also happy: insurance calculations promise to be fair, almost individual.

Grounds for a regressive claim - amendment to OSAGO No. 5

Regressive risk is a return claim from the insurance company to the culprit of the accident in order to recover from him the amount that was spent on restoring the damaged car of the injured party and previously paid to it.

According to the new amendments, the grounds for presenting such regressive risks include the following situations:

- Road accidents that occurred due to the intent of the culprit;

- The culprit at the time of the accident was in a state of alcohol or other type of intoxication and this is documented;

- The participant in the accident who was found to be at fault did not have the right to drive the vehicle;

- The driver found to be at fault for the accident is not included in the car owner's insurance policy;

- The culprit fled the scene of the accident;

- The accident occurred during a time period that is not covered by the insurance policy;

- The insurance company did not receive documents about the accident within the 5-day period established by law;

- The guilty party has already started repairing/disposing of the vehicle;

- At the time of the traffic accident, the validity of the maintenance coupon (diagnostic card) expired;

- At the time of concluding the insurance contract electronically, the policyholder provided false information to the insurer, which led to an unreasonable reduction in the amount of insurance compensation.

Contracts without limiting the number of vehicle managers will become more expensive

The Bank of Russia plans to increase the coefficient for “automobile license” contracts to 2.7 units, in which there is no limit on the number of persons entitled to drive a car. However, this rule should only apply to individuals. For companies that issue compulsory motor liability insurance for their cars, they plan to reduce this coefficient, on the contrary. It will be 1.68 units.

The KBM is also planning to change. It will be determined at the beginning of each year and remain unchanged during this period.

Renew OSAGO at the best price!

Innovations

After April 28, the insurance company only pays for repairs taking into account the wear and tear of the car, and does not issue money in hand. This applies to all passenger cars registered in the Russian Federation and owned by citizens of the country.

Compensation for damage

In the event of an accident, a representative of the insurance company goes to the scene. An examination of the car is carried out and the damage is determined. Then a referral for repairs is issued. By the way, all parts installed during repairs must be new. Costs for spare parts are determined taking into account wear and tear of the vehicle. If the compensation is not enough, the vehicle owner will have to pay extra himself.

Repair

A referral for repairs must be issued no later than 20 days from the date of receipt of the claim about the insured event. If the repair is carried out at a service center not included in the company’s list, 1 month is given for issuing a referral.

After the car arrives at the car service center, all repair work must be completed within 30 days. Deadlines are extended only in individual cases, if it is impossible to cope faster. The car owner should not be against prolonging the repair. If the work is not completed within the specified period, the insurance company undertakes to pay a penalty.

All body work comes with a 1 year warranty. For the rest of the repairs – 6 months.

Choosing a car service

Each insurer enters into contracts with certain services. There can be any number of them. But the car is sent to a service center located no further than 50 km from the place of residence of the car owner or the scene of the accident.

But if the company is willing to pay for transportation by a tow truck, then the vehicle can be sent to any service station, even if it is located several hundred kilometers from the accident site. Return delivery in this case is also carried out at the expense of the company.

If the car is still under warranty, the company must issue a referral to an authorized car service center that services cars of a certain brand. If there are none on the insurer’s list, the driver has the right to demand monetary compensation. Or you can agree to have the repairs done elsewhere, but this is no longer necessary.

This rule applies only to cars whose age does not exceed 2 years. After this time, even if the warranty is still valid, the insurer can choose any service from its list for repairs and refuse monetary compensation. Considering that the warranty is given for 3-5 years, this innovation is quite controversial. Most likely there will be some fixes here in the future.

When applying for a policy, the client of the insurance company can independently indicate the car service where he wants to have his car repaired. It is understood that you can choose a specific option from the company’s list. But you are allowed to choose another service if the company agrees to this. Such consent must be recorded in writing, otherwise the insurer will have the right to make a referral to the service at its discretion.

If for any reason the repair cannot be carried out at the selected service center, the car owner is provided with monetary compensation.

Poor quality repairs

If the repair was performed unsatisfactorily or the work deadlines were missed, the car owner may demand monetary compensation. In case of refusal, you must go to court.

Compensation for damage from the culprit of the accident - amendment to OSAGO No. 7

The maximum amount of insurance payments under compulsory motor liability insurance is accepted as follows:

- 400,000 rub. – for cars and other property;

- 500,000 rub. – for health and life insurance.

The adopted innovations do not resolve the issue of full compensation for damage from the culprit of an accident in the event that the insured amount for the restoration of the damaged vehicle is not enough.

Payments are calculated by insurers based on the unified methodology of the Central Bank. At the same time, payment for repairs/replacement of spare parts is carried out taking into account their wear and tear. As a rule, payments under compulsory motor liability insurance did not cover the cost of repairs 100%.

For example, a 3-year-old car’s bumper was damaged as a result of an accident. This part cannot be repaired and must be replaced. In such a case, the insurance company will pay the injured party only part of the cost of the bumper, and he will pay the difference himself. At the same time, the bumper looks like new, but the insurance company estimates it to be three years old.

According to the general rules, damages can be recovered from the culprit of an accident, even if he has a compulsory motor liability insurance policy. For example, if the car owner’s vehicle repair cost 70,000 rubles, but the insurance company paid only 40,000 rubles. (including wear and tear), then the remaining 30,000 rubles. can be recovered from the guilty party.

However, such arithmetic takes place only on paper, since the courts in fact refused to satisfy such claims by car owners, citing the methods of the Central Bank, and the Supreme Court supported this position.

At the beginning of 2021 Persons who suffered as a result of the accident appealed to the Constitutional Court of Russia. They tried to restore their rights and recover compensation from the insurance company under compulsory motor liability insurance, and the amount of damage from the party at fault for the accident. Before this, they had lost in all cases in court, which did not give them the right to recover compensation from the person responsible for the accident.

The Constitutional Court decided that the Central Bank's methodology should be used exclusively for calculating payments under compulsory motor liability insurance, and the injured party can demand the difference between the amount of the insurance payment and the amount of actual damage from the culprit of the accident.

Consequently, the victim of an accident as a result of compulsory motor liability insurance is paid an amount taking into account the wear and tear of damaged parts, but he has the right to count on compensation for property damage in full. To do this, he will be required to prove that the actual amount of damage is greater than what he received under insurance. In turn, the guilty party has the right to insist on an additional examination, which may become the basis for reducing the total amount of compensation for damage to the injured party.

Update of MTPL insurance policies from January 1, 2021

Lada XRay 2021 model year will receive all-wheel drive

Now all victims will be able to contact their insurance company. Insurers are unhappy with this decision, as it could significantly increase the size of their losses. Good news also includes the fact that the amount according to the European protocol will be increased to 100 thousand rubles.

Each change concerning the regulation of articles and paragraphs of this provision is published by the Government of the Russian Federation in the form of a separately published legislative provision.

From January 9, 2021, insurers have already begun calculating the cost of an MTPL insurance policy using new coefficients. Their number increased to 58, as additional clarifying positions were introduced. But there is also a plus, since at the same time reducing coefficients have been introduced, thanks to which a number of drivers will still be able to save money by taking out a policy.

This practice caused enormous damage to the entire insurance market. The adopted amendments affect the interests of not only insurance companies. Innovations under compulsory motor liability insurance directly affect all car owners without exception, including those who have not been and do not plan to get into an accident.

Important! such changes will become a fair reward for exemplary drivers and a restriction for reckless drivers, this is the first thread towards the use of individual prices and the Ministry of Finance is already working on the project. Now the owner has the opportunity to independently determine how to insure the car:

Now the owner has the opportunity to independently determine how to insure the car:

- Two million rubles for material damage + health damage;

- One million rubles for material damage + health damage;

- Four thousand rubles for material damage + 5 thousand rubles for health.

Let's start with the most important thing - with what you expect from us - yes, insurance will become more expensive. But at the same time, we should expect an increase in the tariff corridor of base rates.

The provisions of this article regulate the rules for conducting professional activities under a motor vehicle liability insurance contract. Namely, it contains the following provisions:

- conditions for consideration of claims made by the injured party in the event of a traffic accident;

- procedure for payment of compensation;

- direct compensation rules;

- nuances of joining a professional association of insurance companies;

- criteria and amounts of contributions to the reserve fund;

- other provisions.

Law office "Efremov and partners" Rostov-on-Don, per. Dolomanovsky 63, of. Where exactly to carry out repair and restoration work will be decided by the owner of the car. The driver also received the right to agree on car repairs at a service station that is not on the insurer’s list.

The grounds for refusal to satisfy a claim are:

- filing a claim by a person who is not a victim and has not provided a document confirming his authority (for example, a power of attorney);

- failure to provide originals (duly certified copies) of documents substantiating the claims of the victim;

- in case of receipt of payment by bank transfer, the claim does not contain an indication of the bank details of the victim (or other beneficiary);

- failure to present the vehicle for inspection in accordance with paragraph three of clause 5.3 of these Rules;

- other grounds provided for by the legislation of the Russian Federation.

Everything about benefits, allowances, subsidies, compensation, pensions, maternity capital and other cash payments for preferential categories of citizens.

The claim, at the choice of the policyholder, is handed over to the insurer against signature or sent to the insurer at the address of the location of the insurer or the insurer's representative by registered mail with a list of attachments, or transmitted in another way (including the exchange of information in electronic form and e-mail, the address of which is indicated on the official website of the insurer in Internet), indicating the date of its receipt.

5.2. Based on the results of consideration of the claim, the insurer is obliged to take one of the following actions:

- make a payment to the victim (or other beneficiary) according to the details specified in the claim;

- send a refusal to satisfy the claim.

CT, or the coefficient of the territory of primary use of the vehicle, has also undergone changes. Every year the CT is adjusted depending on accident statistics in the regions of the Russian Federation. The more accidents in the region, the more expensive compulsory motor liability insurance will cost all drivers.

According to statistics:

- The number of responsible drivers is 80%.

- Violators – 14%.

- Pernicious violators – 6%.

Why is it important for a motorist to know about the Law?

The legislation places responsibility for compensation for damage caused as a result of an accident on the person responsible for the accident. If the last policy has compulsory motor liability insurance, the obligation to pay compensation passes to the company with which the insurance agreement was concluded. But the selected company transfers monetary cases only if a certain procedure for registering an accident is observed.

This is where Federal Law No. 40-FZ comes into effect. Only if the rules specified therein are followed and the established deadlines are met, the motorist can count on the assistance of the insurance company. Ignorance of the provisions of the Law “On Compulsory Motor Liability Insurance” may result in the company’s refusal to pay compensation, as in case No. 2-9/2016, considered by the Yuzhno-Sakhalinsk Court.

Failure to comply with the deadlines established in the said normative act led to the entry into force of Article 14, establishing the possibility of claiming recourse. That is, in fact, money had to be paid to the client of the insurance company involved in the accident.