Application deadlines

What is the procedure for contacting an insurance company after an accident under compulsory motor insurance? When an accident occurs, the injured person must contact the insurance company immediately and report the incident. In other words, as soon as the opportunity arises, you need to make a call to the company with an appeal. To do this, you can use the phone, but it is best to clarify the conditions in the Insurance Contract. Some companies offer to use real-time insurance notification on the Internet.

Further appeal is carried out with prepared documents within 5 working days. There are some rules when the victim will need to submit documents directly to the insurance company for compensation under compulsory motor liability insurance.

The direct method is used in three cases:

- The accident involved 2 cars, possibly with a trailer.

- Only vehicles were damaged.

- Both parties have a valid MTPL policy.

You must submit documentation and an application after an accident as quickly as possible, but no later than 5 working days from the date of the accident. It is necessary to carefully read all prepared documents, and also look at what is being signed.

If the five-day period is violated, the insurance company has the right to refuse the claim for damages. In this case, the injured person needs to resolve the issue only through the court.

However, missing a five-day deadline is not a death sentence.

Driver's actions in case of an accident

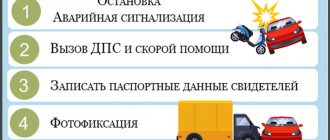

In the event of an accident, the driver must follow a number of steps:

- Stop the car and turn on the hazard lights.

- Invite the traffic police to the scene of the accident.

- Record the data of participants and witnesses of the incident (car numbers, telephone numbers of witnesses, insurance policy number of the participant in the accident).

- Check the correctness of the protocol drawn up by the traffic police representative.

- Notify the insurance company (abbreviation: SK) about the traffic accident. The insurance agent will conduct an additional examination to assess the condition of the vehicle.

It is drawn up if:

- the damage was caused only to the car;

- the accident involved two cars, each of which has an MTPL policy;

- There is no disagreement regarding the accident.

Additional nuances that drivers need to know about in the post-accident period:

- within 5 days, a representative of the insurance company must inspect the damaged car;

- car repairs can begin with the consent of the insurance agent after 15 days;

- in the presence of the Euro Protocol, the amount of the maximum payment cannot be higher than 50 thousand rubles (in populated areas of federal significance the amount of this limit may be different);

- if after the accident damage to health is identified, then a second application can be submitted to the insurance company for compensation to restore health;

- Photographs or video footage of the incident must be attached to the European Protocol.

Contact after 5 days

How long does it take to contact your insurance company after an accident? If an application for compensation for damage after an accident is submitted later than 5 working days, then it can be accepted for consideration. The only condition for this exception is the importance of the reason for the omission.

Such a reason may be the consideration of an incident in a civil or criminal case, the proceedings of which have not yet been completed. The logical consequence of an unfinished case is the inability of the participant in the road collision to present the documents appearing in the materials, as well as the court decision.

Therefore, the law does not establish a specific period for which the filing of an appeal to insurers can be extended.

The statute of limitations for claims for damages is 3 years. The injured person will need to apply to the court to receive compensation payments due to the accident.

If the injured party submits an application to the insurance company without attaching the required package of documents, then the insurer must send a notification to the addressee within 3 days with a list of missing documents.

If the applicant does not agree with the insurance decision, he has the right to go directly to the court. Typically, those involved in an accident who are dissatisfied with the insurance amount, independently and at their own expense, undergo an independent examination of the damage to their car, a copy of which they provide along with the claim. As a rule, such conclusions are used as the basis for decisions made by the court.

Current questions and answers

- Question: How often can compensation be made under compulsory motor liability insurance? Answer: Compensation under compulsory motor liability insurance, according to the law, can be provided no more than once during the year.

- Question: Based on what examination is insurance compensation approved? Answer: The priority is the damage assessment, which is carried out by a representative of the insurance company.

- Question: What is the waiting period for the insurer to consider a claim about disagreement with the assigned payments? Answer: Based on the innovations of 2021, the period for consideration of claims, in comparison with previously existing norms, has increased from a 5-day period to a 10-day period.

By clicking on the button, you consent to the processing of your personal data and agree to the personal data processing policy.

What documents does the insurance company need?

A traffic accident is an extraordinary moment in our lives. As a rule, it is associated not only with equipment breakdown, but also with harm to the health of those involved in the accident. Funds for treatment and recovery are sometimes required by the culprit himself. That’s why it’s so important to apply for not only MTPL, but also CASCO insurance.

To receive compensation payments from the insurance company, you need to correctly follow a simple algorithm of actions. Thus, all participants in an accident must notify their insurance companies about the occurrence of an insured event. Each of them must personally contact their insurance company, where they submit the entire package of documents necessary to make the payment.

The list of documents, in addition to the application, for insurance payment under MTPL or CASCO includes:

- policy;

- passport;

- driver license;

- certificate of accident;

- road accident diagram;

- protocol and resolution on an administrative offense;

- vehicle registration certificate,

- statement with bank card details for transferring funds.

There is no need to give away the originals. It is enough to send easy-to-read photocopies. As you can see, the list for both insurance organizations is the same.

It is important to remember that the above list is not exhaustive. Depending on the specific case, it may be supplemented with other documents requested by the insurance company.

How to appeal yourself

You have received a certificate of an accident, but you do not agree with what is written there. There is no point in going to the employee who discharged her and banging your fist on the table, it will not help.

The most legitimate decision would be to appeal the certificate to a higher authority or in court.

To challenge a document, there must be some inaccuracies or unreliable facts that you can confirm, namely:

- the certificate contains inaccurate information about you or the car;

- important circumstances that occurred during the accident are not indicated;

- damage to the vehicle is not fully described, or possible hidden damage during an accident is not taken into account;

- there is no information about the victims who were actually present;

- there are no signatures or a seal has not been affixed.

You can appeal such a certificate by writing an application addressed to the employee who compiled it, or, if he refuses to correct inaccuracies, then to his immediate supervisor.

The statement states that the accident report was drawn up incorrectly, lists point by point what exactly is not true, as well as a requirement to correct the inaccuracies.

Approximate structure of a complaint about a certificate from the traffic police about an accident:

- Introductory part. This includes information about the addressee, to whom exactly the complaint is being submitted, about the applicant, and, if a representative of the applicant is present, then information about the legal representative is added. Also, the introductory part briefly contains the content of the circumstances under which the paper was compiled.

- Descriptive part. This includes data on the incorrectly drawn up protocol, its number, date of compilation, legal qualification of the incident and the name of the employee who compiled the document, and other necessary information according to the resolution number.

- Motivational part. It describes the applicant's position, the rationale for this position with arguments, facts, inspection data and references to witnesses, and then a list of requests and petitions.

- Final part. In this part, the applicant indicates the requirements that he addresses to the official; references to the laws according to which the applicant asks for a decision on the complaint are mandatory. The attached documents are also listed here, as well as the date of filing the complaint and the signature of the applicant.

Sample of appealing the decision of the traffic police:

It is necessary, before picking up the document, to read it very carefully in order to subsequently avoid the discovery of any inconsistencies that would enable the insurance company to refuse to pay insurance.

How to write an application to the insurance company

You can submit an application to one or another insurance company in handwritten or printed form.

The text should reflect in detail the most important points of what happened:

- At the top right is the name of the company where the applicant is applying.

- From the passport, personal data of the person is entered, as well as the names of witnesses, eyewitnesses with their contact numbers.

- The circumstances of the incident and the actions of each party are described in as much detail as possible.

- The list of damage sustained by the vehicle and the health of the victim is indicated at the time of the accident.

- The requirement for insurance payment is necessary to cover damage to the car and health.

You don't have to write the text yourself. Thematic sites contain samples with tips or already filled with approximate content. Therefore, in this situation, you just need to concentrate so as not to confuse the numbers in the numbers or not to forget to indicate an important detail.

It is not always possible for participants in a collision to collect and submit a package of documents on their own. But the law is inexorable, and you need to do it within 5 days. In this case, it is possible to apply not in person, but through a representative. However, in this case, you will have to incur additional costs for registering a power of attorney with a notary.

Notification of an accident

Notification of a traffic accident is a mandatory document for consideration of a case in court or in an insurance company. Its peculiarity is that it is filled out by the participants in the accident and certified by their signatures.

However, a notification of an accident can be filled out by each participant individually.

But for this you need to meet several conditions:

- disagreements about the circumstances of the incident;

- multiple parties to the conflict;

- other circumstances that prevent everyone from filling out one form together.

The injured party has the right to file a claim not only for damages for the damaged car, but also for other damaged property. Almost always, the claim also contains demands for compensation for moral damage. In these cases, the notification of an accident is a rich source of evidence.

An accident notification does not apply to a claim for benefits. Such a document is a simple notification of insurance about the fact of an accident. The notice is given to the victims, and only this document gives the right to file an application for compensation for damages.

What to do if the driver is not satisfied with the insurance payment?

If the driver is not satisfied with the amount of the insurance payment, he can first receive a payment, the amount of which is determined by the insurance company, and then try to get the rest of the money.

In practice, it happens that the payment to the insurance company is several times less than the amount required to repair the damaged vehicle. In this case, I recommend contacting a competent lawyer who deals with traffic accidents. If the case is won, the costs of the lawyer will subsequently be reimbursed by the insurance company, so you will not lose anything.

In conclusion, I would like to note that the receipt of payments under compulsory motor liability insurance is regulated by Chapter 3 and Chapter 4 of the rules of compulsory insurance of civil liability of vehicle owners. So if you still have any questions, please refer to this document.

Good luck on the roads!

Europrotocol

This document has become a mandatory condition for registering an accident without the participation of traffic police officers. since 2009. The term has Western roots, hence its name.

This procedure for considering the issue by mutual agreement of the parties is possible in a limited number of cases.

- There is a collision of no more than two cars.

- The driver of each car has an MTPL policy.

- Damage was caused only to the vehicles of the participants in the conflict;

- All parties have the same understanding of the reasons and circumstances of what happened.

If all conditions are met, the parties fill out the Euro Protocol form. It is issued together with the MTPL policy, so every insured person has it. The completed form must be certified by the signatures of both parties in order to eliminate the possibility of violations in the future.

The completed document is sent to the insurance company within 5 days from the date of the accident. It must be filed by the injured party who wishes to receive compensation. Sending is done by registered mail to the address of the insurance company branch. The receipt for payment for sending the postal item must be kept.

The Europrotocol can also be sent by email. The address can be specified directly in the MTPL agreement. Confirmation of receipt comes 3 days after sending the letter. In the response message, the insurance company often indicates a list of documents it needs.

Sending by email does not relieve the applicant from the need to duplicate the entire package by regular registered mail.

You should not always and in all cases be satisfied with the decision made by the insurer. In case of unclear or controversial issues, it is necessary to obtain legal advice, and even go to court.

Conducting an inspection or independent technical examination

To determine the amount of insurance payment, the insurance company must conduct an inspection, an independent technical examination or an independent assessment within 5 business days from the date of submission of documents.

In this case, the insurer agrees with the driver on the time and place of the inspection or examination. The driver must deliver the car to the specified location by the specified time. If the driver does not come for the examination, it will be postponed, and along with it, insurance payments will be postponed.

If the car cannot participate in road traffic, then it is inspected at its location.

If the insurer does not inspect the vehicle or examine it within 5 days, the victim may conduct an examination at his own expense. Subsequently, the cost of the examination will be reimbursed, i.e. included in the MTPL payment.

Attention! From August 24, 2020, the driver is required to notify the insurance company 3 days in advance of the date and time of the independent examination.

Insurance payment procedure

According to current legislation, the insurance company, having recognized the incident as an insured event, fully or partially compensates for the costs of repairing the car:

- up to 400 thousand rubles - harm to health;

- up to 500 thousand rubles - damage to a car and other property.

The insurer is given 20 days to check the entire package of documents, excluding holidays and weekends. As a result, the amount of compensation and a special document for repairing the car at a service station are transferred to the victim’s account.

If this deadline is not met, the applicant has the right to also receive a penalty at the rate of 1% of the payment amount. To do this, you need to submit a corresponding application to the insurance company.

Useful tips

None of us want to get into an accident. But still, this happens to some drivers. To minimize damage, you need to act clearly and quickly. There are several “golden” rules that any car enthusiast should know.

We suggest you read: Reviews: CASCO prolongation – Association of Russian Banks

The insurance company cannot refuse to accept an application based on the fact that the owner of the car submitted documents not a day later, but only 2-3 days after the accident.

Before submitting all documents, you need to make copies of them, and hand over the originals only for inspection or according to the acceptance certificate against signature.

Payments must be made in full within 20 days from the date of submission of all documents. If the deadline is violated, a penalty is charged for each day of delay.

In case of any disagreement, one must strive to bear responsibility in a pre-trial manner. But you shouldn’t avoid litigation either. With the right approach, this will solve the problem in your favor.

When the insurance company refuses compensation

In some cases, the insurance company may refuse to pay. the list is quite extensive.

- The vehicle involved in the accident was not the one listed on the policy of the person responsible for the accident.

- The circumstances of the accident are related to driving training, competitions or vehicle testing.

- The damage was caused by the transported cargo.

- The damage occurred as a result of work activities.

- Antiques or unique items have been damaged.

- The requested list of documents has not been provided in full.

- The terms of application specified in the insurance contract have been violated.

- The insurance company has been declared bankrupt.

- The policy form is fake.

- Fraud.

As a rule, the amount of compensation is always lower than what is needed for a good repair. Therefore, if payments are not made in full, experts advise receiving the offered compensation. The rest of it should be disputed in court.

What to do in case of refusal?

In some cases, the insurance company may refuse to pay. the list is quite extensive.

- The vehicle involved in the accident was not the one listed on the policy of the person responsible for the accident.

- The circumstances of the accident are related to driving training, competitions or vehicle testing.

- The damage was caused by the transported cargo.

- The damage occurred as a result of work activities.

- Antiques or unique items have been damaged.

- The requested list of documents has not been provided in full.

- The terms of application specified in the insurance contract have been violated.

- The insurance company has been declared bankrupt.

- The policy form is fake.

- Fraud.

What do insurers expect? The fact that law-abiding citizens, having delayed filing an application, will not seek payment of insurance compensation. However, by paying for a CASCO policy, you insure your car, and not the responsibility for meeting the deadlines specified in the Rules. Moreover, often their failure occurs due to the fault of a third party, and not the insured (for example, the traffic police delays the execution of the protocol.

The main reason for refusal of compensation is the driver’s guilt in road accidents. This fact is noted in the European Protocol with the mutual consent of the participants in the incident or established by road service employees. Other cases of refusal, provided that all MTPL requirements have been met, are illegal.

However, in practice, drivers often violate the rules of the insurance company. Let's look at the most common of them:

- not all documentation is submitted to the Investigative Committee;

- the time limit for submitting documents to the insurance company after an accident has expired;

- the deadline for submitting the damaged car to the Investigative Committee for examination has expired;

- impossibility of establishing the circumstances of road accidents (insurance agents may assume that the accident occurred due to the driver’s fault, but such controversial issues are resolved in court with the participation of an independent expert).

If the submission of documentation was rejected due to the lack of a technical card or inspection certificate (these documents are not included in the mandatory list of documents), then the driver should boldly resolve the problematic issue in court.