- List of main documents

- Additional documents

- If harm is caused to health

- In case of loss of a breadwinner

- Application Form

- Document submission deadline

- Deadlines for receiving payment

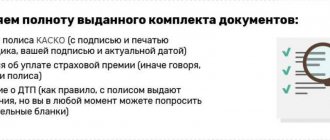

- Let's sum it up

Every driver should know about the procedure for receiving compensation under the “automobile civil law”, since no one is insured against accidents on the road. In this article we will provide a list of documents for payment under compulsory motor insurance and tell you when, how to submit them and how long to wait to receive the money.

List of main documents

One of the grounds for a legal refusal of compensation is an incomplete package of documentation provided by the driver who was involved in an accident. That is why the collection of papers must be taken carefully and seriously.

The list of documents required for insurance payment is as follows:

- application for compensation;

- a copy of the driver’s personal passport, certified by a notary;

- notification of an accident;

- a certificate of an accident (you must first obtain it from the traffic police);

- a copy of the protocol (you will also have to obtain it from the State Traffic Inspectorate);

- a copy of the resolution/refusal to bring to administrative liability;

- details of the account to which the compensation will be transferred.

In addition, you will need to submit payment documents confirming the expenses incurred (for restoration work, other material expenses).

Action plan: from an accident to receiving payment under compulsory motor liability insurance

Step 1: Registration of an accident

Recently, participants in road accidents do not have to call an inspector to document the incident. The Europrotocol allows drivers to independently prepare the necessary documents, which will be submitted to the insurance company. But this possibility is valid if:

- No casualties;

- The accident involved two cars colliding;

- Both vehicles have MTPL policies;

- The damage caused does not exceed 400 thousand rubles;

- There is no disagreement between the participants in the accident regarding the culprit of the accident.

When completing the paperwork, do not forget to make sure that your opponent’s compulsory motor liability insurance has not expired. Otherwise, you will not be able to receive compensation for damage through the insurance company.

If there are disagreements between drivers or the situation does not fit the above points, be sure to call the traffic police. This may also have to be done if one of the cars is insured under CASCO (requirement of the insurance company).

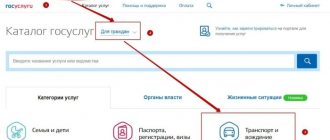

Step 2: Contact your insurance company

In different situations, you will need to contact different insurance companies.

You contact the insurance company where you took out your MTPL policy if there are no casualties in the accident.

And if your accident caused bodily harm to those involved, then you will need to contact the insurance company that issued the policy to the person at fault.

When should you contact your insurance company?

You must notify the insurance company of the occurrence of an insured event as soon as possible. We report the accident by phone call, and then within 5 days we bring the completed documents and an application for compensation.

Until recently, your insurer could recover the amount you paid if you caused an accident. This option was removed in 2019. But if this clause is specified in the insurance contract, the insurance company will have a legal basis for collecting compensation from you.

Within the first five days, you will need to present the car to your insurance company for inspection. If the car cannot be brought on its own wheels, the insurer will independently go to the site for inspection. But the company must be warned about this in advance.

Documents you will need to apply for compensation for car damage:

- Passport;

- Driver's license;

- Documents for the car: PTS and STS;

- OSAGO policy (e-OSAGO will need to be printed);

- Diagnostic card;

- Details for receiving compensation;

- Documents evidencing the accident;

- Documents evidencing the accident.

The set of documents will depend on how the accident was recorded. If you filed the accident yourself according to the European Protocol, then it will be enough to provide photographs from the accident site and a completed form.

If you called the traffic police officers, then the insurance company will need a certificate of the accident (on form No. 154), a copy of the initiation of the case and the investigation with the data of all participants, a copy of the receipt-resolution.

Documents that will be needed for compensation for health damage:

- A certificate from the ambulance that arrived at the scene of the accident;

- Medical report with a list of injuries sustained as a result of the incident;

- An extract indicating the necessary treatment;

- A certificate from the attending physician confirming that you are undergoing the prescribed treatment.

Compensation for damage caused to health does not occur immediately. First, the victim undergoes treatment, after which he undergoes a forensic medical examination, which assesses the condition and degree of harm received. The conclusion obtained during such an inspection will be the fundamental document for calculating the amount of compensation in the insurance company.

The law also provides for a second payment for those who need long-term treatment. In this case, you will need to provide all documents indicating serious harm to health and losses due to this.

This includes all checks, receipts and contracts for paid treatment, purchase of medicines, payment for nurse services, purchase of special food, prostheses, etc. If you have been assigned a disability, then you will need a certificate of receipt.

The income that you lost during treatment can also be reimbursed by the insurance company. To do this, you will need to provide a certificate from your place of work indicating your income.

If you have lost your profession forever (for example, your eyesight has deteriorated, which is why you had to leave your previous place of work), attach to your documents also an agreement with an educational institution, which will indicate your intention to change your profession due to the consequences of an accident.

Documents for payment to relatives of the deceased:

- A copy of the deceased's passport;

- A certificate confirming that death occurred as a result of the consequences of an accident;

- A document confirming your relationship.

Additional documents

In addition to the mandatory ones, depending on the specific circumstances of the case, additional documents may be required. Thus, the insurance company in some cases requests:

- original documents for the car (PTS or STS);

- title documents for cars;

- documentary evidence of the right to receive compensation if property belonging to third parties was damaged in an accident (for example, a car leasing/rental agreement or a loan agreement with a bank);

- receipt for payment for tow truck services;

- receipt for payment for car security services prior to the examination;

- other documents confirming the right to compensation and its amount.

Also, depending on the nature and extent of the damage suffered, an additional package of documents may be required to receive payment.

If harm is caused to health

If, due to injuries received as a result of an accident, the victim has lost his ability to work and his source of income, he must submit to the insurance company:

- a certificate from a medical institution indicating the diagnosis, the nature of the injuries received and the period for which the insured is disabled;

- conclusion on the degree and type of disability (general or professional);

- a certificate of average monthly income indicating the source (salary, pension, etc.);

- other documents confirming loss of ability to work (if available).

Note! In case of harm to health, the maximum amount of payment increases from 400 thousand to 500 thousand rubles.

In case of loss of a breadwinner

If there are deaths as a result of the accident, persons entitled to receive insurance payment must submit:

- a statement which, in addition to the request for payment, contains information about family members of the deceased, as well as persons who were dependent on him;

- birth certificates of young children;

- passports of minors over 14 years of age;

- certificate of disability (if the deceased was supported by persons with disabilities);

- a certificate from an educational institution (if dependent students);

- a certificate of the need for continuous medical care (if such categories of persons were supported).

If the list received does not contain a document required to be submitted, the insurer is obliged to notify the applicant of the need to attach it by mail or by personal visit within 3 days from the date of receipt of the rest of the list.

Algorithm of actions for a victim after an accident

If you are the injured party in an accident that just happened, then, therefore, you are entitled to insurance compensation for an accident from the insurance company. But to get it, you need to know how to properly file an accident so that the insurer does not refuse to pay you.

If only property was damaged as a result of the accident, then the following actions must be taken:

- If your car does not stop due to a collision, then the driver himself is obliged to stop driving and stop the car. It is important to stay exactly at the scene of the collision.

- Turn on the hazard warning lights. It will tell other road users that you cannot continue driving.

- Get out of the car and inspect the damage.

- Obtain and install the emergency sign. Together with the hazard warning light, it will help draw the attention of all other drivers and tell them that you have had an accident and cannot continue driving.

- After these steps, you need to start registering the accident, first write down the numbers and full name of the guilty party to the accident, as well as witnesses.

- Call the police and let them know about the accident.

- After the police officer registers the accident and issues the necessary documents, you can collect a complete package of documents and go to the insurance company to write an application for payments.

Additionally, we recommend that you learn about compensation for damages under compulsory motor liability insurance.

If the collision results in harm to the life or health of people, then your actions will change slightly:

- After an accident, you are required to stop the car and remain at the scene of the collision.

- Turn on the emergency system and assess the extent of damage caused to the passengers of your car (if any). If damage is caused to a pedestrian, then he also needs to be inspected.

- Even with the slightest injury, call an ambulance, and then the police.

- Write down the name and cell numbers of the party at fault in the accident, as well as witnesses.

- Wait for the police to register the accident.

- Collect the necessary documents and go to the insurance company to write an application for payment of insurance compensation.

Once law enforcement officers arrive at the scene, they will take the following actions:

- will take testimony from parties to the accident, as well as from witnesses;

- Make a schematic drawing of the accident scene. This figure will show the main landmarks in the area, the street name, markings, road signs and traffic lights, measure the point of collision, and how the cars are located after the accident, as well as the distance from the cars to the landmarks;

- will conduct an inspection of the scene of the incident;

- will inspect the damage to cars that were involved in the accident;

- will draw up a report on the traffic accident. It indicates all damage to vehicles after an accident;

- fill out a traffic violation protocol.

As soon as the entire process of registering a traffic accident is completed, the main thing is to meet the deadline for applying for insurance payment and have time to collect all the necessary documents for payment under compulsory motor liability insurance.

If you are interested in the question of what is the maximum payment under compulsory motor liability insurance, then you will find the answer in the article of our specialist.

If you understand that the injured person may not wait for help, then arrange for his delivery to the nearest medical center by asking other drivers about this, or, as a last resort, take him yourself. When you arrive at the hospital or clinic, leave your phone number, full name and license plate number there. This will help you prove to the police that you left the scene of the accident for a reason. After this, return to the scene of the accident.

Application Form

The legislation does not establish a special application form. If the insurance company does not have its own approved form, the application for payment is processed in a random manner.

Despite the absence of legislative norms, there are requirements for the content of the document. The application must indicate:

- personal, passport and contact details of the victim;

- date, place and time of the incident;

- circumstances of the accident (the more detailed, the better);

- application for insurance payment;

- personal information of the policyholder, his policy number and car details (make and registration plate);

- PTS details;

- date and signature of the applicant.

.

What is insurance compensation under the policy?

OSAGO or compulsory insurance is a form of state protection for victims of road accidents . An insurance policy compensates victims of road accidents for damages by covering the costs of whoever is at fault for the accident. Payments compensate for damage caused to a vehicle, property or health of persons. That is, the insurance company pays for all the inconveniences.

If both drivers are at fault for the accident, then the amount of payments will be determined by whose fault is greater and who suffered less losses (you can find out the payment standards for the table of prices for spare parts and compensation for personal injury from this article, and here we talk about the features of the maximum compensation under OSAGO ). In many cases, these issues are resolved in court.

Document submission deadline

The insurance contract must indicate the deadline for submitting documents to receive compensation. According to clause 42 of the MTPL Rules, the maximum period for filing is 5 days. In remote regions where there are problems with transport accessibility, etc., this period can be extended to 15 days.

If the victim is late with the application for reasons beyond his control (for example, he was staying in a medical institution), he can apply to the Investigative Committee with a request to extend the deadline. If the reason for the violation is not valid, the insurance company receives a legal basis for refusing compensation, which cannot be challenged even in court.

Deadlines for receiving payment

Compensation must be paid within 20 days from the date of submission of documents. The report begins:

- from the date of stamping, if the application is sent by mail;

- from the date of acceptance of the application, if submitted in person.

The payment terms are distributed as follows:

- 5 working days – to inspect the car and assess the damage;

- 5 working days – for additional examination, if required;

- 10 days for paperwork.

If the deadlines are violated, the client can go to court and collect a fine from the company (0.1% for each day of delay). If the policyholder is not satisfied with the amount at which the insurance company assessed the damage he received, then it is also possible to resolve the problem through the court.

Types of insurance for individuals

Whatever type of contract you enter into with the insurer, the relationship is always regulated. And the insurance policy is confirmation that the parties have discussed the terms of the service, the client has read all aspects and agreed with them.

For what types of insurance services is this document issued?

- personal life and health insurance;

- tourist. Anyone traveling abroad is always offered appropriate insurance to cover in case of unforeseen circumstances;

- property That is, in this case, the contract protects against loss or damage to any property, most often real estate;

- responsibility. For example, protecting your neighbors in case you have a flood or fire;

- from job loss. Typically used when concluding loan agreements with banks, especially for mortgages;

- CASCO, OSAGO, well known to car owners.

These are the main types of services provided to citizens by insurance companies. And each time a contract is concluded, a policy is formed, which is transferred for safekeeping to the client. When an insured event occurs, a person applies for compensation with a package of documents, which necessarily includes a policy.

Let's sum it up

The correct list of documents is one of the prerequisites for receiving insurance payment. The sequence of actions should be as follows:

- the driver needs to write an application demanding compensation, attaching personal documents and documents for the car;

- depending on the specific case, other documents may be needed, the final list of which is provided by the insurer;

- in case of harm to health, documents confirming this fact are required;

- if the breadwinner died in an accident, members of his family and/or persons who were in his support can receive compensation for him by writing an application and attaching documents confirming the right to payment;

- the application is written in free form, indicating personal, contact and passport details, the circumstances of the accident, and the requirement for payment;

- the maximum period established for sending a list of documents is 5 days, in some regions it can be extended to 15 days (if specified in the insurance contract);

- after receiving all documents, the insurer is obliged to pay compensation within 20 days from the date of stamping the letter (if the application is sent by mail) or the day of receipt (if the application is submitted in person);

- if the policyholder fails to comply with the deadlines, compensation may be refused (unless the reason is considered valid);

- If the insurer does not comply with the deadlines, the driver can go to court and collect a fine in the amount of 0.1% of the payment amount for each day of delay.

Thus, the driver who is counting on compensation from the insurance company must take care of collecting documents at the time of the incident in order to avoid problems and delays in payment.

Deadline for contacting the insurance company

Insurance companies strictly set the deadline for applying for insurance compensation. This is done to prevent drivers from “collecting” accidents and then demanding compensation for them. Within this period, the injured party in the accident must collect all the necessary documents and write a corresponding statement. The deadline for filing an application for compulsory motor liability insurance after an accident in 2021 is 5 working days. If the “injured” driver does not meet the specified period of time, the insurer may rightfully refuse to pay. If you only write an application and do not provide any other necessary documents, then after 3 days you will receive a letter from the insurance company stating that you have not provided a complete list of documents. If you ignore the letter, no one will consider your application.

If you still do not have time to submit an application within five days, then you can file a lawsuit with a request to extend the time for you, but only if you missed the deadline due to significant circumstances.