Types of compensation under compulsory motor liability insurance in Rosgosstrakh

Compensation for an insured event under compulsory motor liability insurance in Rosgosstrakh is carried out in the form of cash payments or payment for the restoration of the vehicle. In a statement to the insurer, the injured person reflects his wishes regarding the format of damage coverage. However, the decision on whether to make a cash payment or repair the policyholder’s vehicle is made by the insurance company. Such rights are provided for in legislative norms. They also have exceptions to the rules under which the insurer is obliged to make a cash payment:

- car damage beyond repair;

- estimated amount of repair work exceeding RUB 400,000;

- death of the victim as a result of injury in an accident;

- moderate or severe injuries as a result of an accident;

- the disabled person's status;

- absence of an agreement with the service station servicing the model of the damaged car.

The insurer can compensate for damage from an accident in money if there is a written agreement with the insured. He has the right to refuse to repair the car at a service station with which a service agreement has been concluded under compulsory motor liability insurance in a situation where the workshop does not comply with the standards covering the scope of repair work in relation to vehicles. You can also reject the offer when it is located further than 50 km from the victim’s residential address.

The insurer is more likely to decide to send the car for repairs after an accident at a service station in the following situations:

- classifying the vehicle as a passenger car;

- car age not exceeding 4 years;

- registration of a car on the territory of the Russian Federation;

- the car is owned by an individual;

- availability of a service agreement for the damaged vehicle model.

Insured event under compulsory motor liability insurance

If you are a victim and you have a compulsory motor liability insurance policy issued by PARI Insurance Company JSC, the law provides for two options for you: Direct Compensation for Loss (DPL) and Compensation through Standard Compensation for Compensation. 1) Direct compensation for losses (Non-alternative PES). You are the victim of an accident and you have a policy of PARI Insurance Company JSC, and the culprit is insured by another insurance company. If your incident satisfies ALL of the following conditions: • as a result of the accident, damage was caused only to the vehicle, i.e. no harm was caused to human life/health or other property was damaged; • The accident occurred as a result of the interaction (collision) of two or more vehicles; • the civil liability of both participants in the accident is insured in accordance with the Federal Law “On compulsory insurance of civil liability of vehicle owners” dated April 25, 2002 No. 40-FZ; • there are no disagreements between the participants in the accident about the circumstances of the accident, the nature and list of visible damage to the vehicle recorded in the Notification of the accident, then you, as a victim insured under compulsory motor liability insurance at JSC IC PARI, must contact JSC IC to settle your insured event "PARI" within the so-called “PVU” – direct settlement. To do this, you must: 1. At the scene of an accident, perform the actions specified in the section “Actions at the scene of an accident.” 2. If the accident was registered with the participation of traffic police officers and at the scene of the accident you were not given a copy of the Protocol on an administrative offense and/or a copy of the Resolution on the case of an administrative offense, then you need to go to the traffic police department indicated by the traffic police officer at the scene of the accident and receive the above duly certified documents. 3. Prepare and submit the following documents to the employee of JSC IC PARI: • Application for direct compensation for losses under compulsory motor liability insurance (at the office of JSC IC PARI, employees will help you fill out the application). • Notification of an accident (original). The Road Accident Notification form is located in the brochure with the Rules along with the Compulsory Motor Liability Insurance Policy. You can see a sample of how to fill it out here. • A duly certified copy of the Protocol on an administrative offense (if compiled). • A duly certified copy of the Resolution in the case of an administrative offense (if issued). If a criminal case has been initiated on the basis of an accident, the victim presents documents from the preliminary investigation, inquiry and (or) judicial authorities on the initiation, suspension or refusal to initiate a criminal case, or a court decision that has entered into legal force. • A duly certified copy of the Ruling on refusal to initiate proceedings regarding an administrative offense (if issued). A ruling to refuse to initiate a case on an administrative offense is made in cases where the actions of the culprit of the accident (the causer of harm) do not contain the elements of an administrative offense. • Documents confirming the victim's ownership of the damaged property: vehicle registration certificate or vehicle passport (PTS). If at the time of the accident the vehicle had transit license plates, the provision of a title is mandatory. • A copy of the driver's license of the person who was driving the victim's damaged vehicle. • A notarized power of attorney with the right to receive insurance compensation from the owner of the vehicle, if another person applies for insurance compensation (original or notarized copy). • If the applicant is not the owner of the vehicle - documents confirming the right to insurance payment (for example, a rental agreement, leasing agreement, gratuitous use, etc.). • Bank details of the recipient of the insurance compensation (the transfer is made to the account of the owner of the damaged property or to the account of the person entitled to the insurance payment). You can submit these documents by visiting us at the address: 127015, Moscow, st. Nizhnyaya Maslovka, 5. If you do not live in Moscow (Moscow region), you can send documents by mail to the address: 127015, Moscow, st. Raskova, 34, building 14, JSC IC PARI, Loss Settlement Department. If you are in one of the cities where we have a branch, you can submit documents to the branch of PARI IC JSC in your city (addresses, telephone numbers and opening hours of branches are listed on the PARI IC JSC website, or contact our representative, if there is no our branch in your city. A list of our representatives in regions where we do not have branches, as well as their addresses and telephone numbers are presented on the website on our website. 4. Submit the damaged car for inspection and independent technical expertise. To do this, you You can agree on a convenient time and place for the inspection with the employees of JSC "Inc. "PARI" and receive a referral to an independent expert organization to carry it out. Next, you need to drive up at the agreed time and date to the address specified in the Referral and present the car to the expert for inspection. If your the car cannot move due to the damage received, then at the agreed time and date you must wait for an expert and present the damaged car to him. days) from the date of submission of ALL necessary documents listed above. Before your arrival, contact the specialists of PARI Insurance Company JSC to clarify the specific list of necessary documents in your case by phone: +7 (495) 363-68-63 (from Moscow, Moscow region) (from other regions) 2) Standard MTPL . You are the victim of an accident and you have a policy of PARI Insurance Company JSC, and the culprit is insured by another insurance company. If your incident does NOT satisfy at least one of the following conditions: • as a result of the accident, damage was caused only to the vehicle, i.e. no harm was caused to human life/health or other property was damaged; • The accident occurred as a result of the interaction (collision) of only two vehicles; • the civil liability of both participants in the accident is insured in accordance with the Federal Law “On compulsory insurance of civil liability of vehicle owners” dated April 25, 2002 No. 40-FZ; • there are no disagreements between the participants in the accident about the circumstances of the accident, the nature and list of visible damage to the vehicle recorded in the Notification of the Accident, with the exception of registering an accident using the GLONASS system or the “Road Accident.Euro Protocol” or “MTPL Assistant” applications, then you need to collect the appropriate package of documents (see . list of documents above) and apply for damages from the culprit’s insurance company. You can see the name of the insurance company of the person at fault in the accident in the Notification of the Road Accident filled out by you and the second participant at the scene of the accident, as well as in the traffic police certificate (in the form established by the Order of the Ministry of Internal Affairs in force at the time of the accident), if you filed an accident with the participation of traffic police officers. Before visiting the insurance company of the culprit, you can contact the specialists of PARI Insurance Company JSC by telephone (from Moscow, Moscow region) (from other regions). We will tell you what to do in your case before contacting the culprit’s insurance company. The victim's application for insurance payment is considered within 20 calendar days (excluding non-working holidays) from the moment of submission of ALL the necessary documents listed above.

What determines the size of the payment?

The amount of payments under compulsory motor liability insurance is influenced by many factors. These include:

- circumstances of the incident;

- type of damage - to property or health;

- format for registration of road accidents - according to the European protocol or the usual protocol;

- category of the applicant for payment;

- factor in the possibility of car restoration.

If property was damaged as a result of an insured event, the amount of compensation is determined by the amount of money necessary to bring the car to the condition it had before the accident. Its value cannot be more than 400,000 rubles. In a situation where an application for payment is submitted by the beneficiary due to the death of the victim, 475,000 rubles are credited to his account. If the car cannot be restored, then its owner is paid compensation in the amount of its market value, but not more than the limit values.

The amount of insurance payments under compulsory motor liability insurance for an accident registered under the European protocol usually does not exceed 100,000 rubles. for residents of the regions and up to 400,000 for residents of Moscow and St. Petersburg . This amount is paid to the victim of an accident if a notification of the event is registered in the mobile application, and in the absence of disagreements between the participants.

How to proceed when registering an incident with the police?

If a compromise could not be found, or several cars were damaged in an accident, or there are victims, it will not be possible to do without calling the traffic police crew. Immediately find two witnesses, because they are necessary when drawing up the protocol. The inspector, after arriving at the scene of the accident, will record the circumstances of the accident, describe the damage to the cars and draw up an accident certificate issued to all interested parties. You should always ask the inspector to fill in the necessary information if you notice any inaccuracies in this document. Also, always insist that the certificate indicate that the vehicle may have suspected hidden damage. This mark will allow you to subsequently qualify for higher insurance payments. I sign the certificate with the witnesses you found earlier.

Analysis of road accidents. An obligatory step on the way to receiving insurance payments under a compulsory motor liability insurance policy is an investigation with the traffic police. Police officers identify the culprit of the incident and draw up a corresponding report, a copy of which is given to them. After completing this procedure, you should contact your insurance company, where you will need to write a corresponding application to provide you with payments upon the occurrence of an insured event. The document received at the police station will become the basis for presenting your legal claims against the insurer of the person responsible for the accident.

What if the person at fault for the accident does not have a compulsory motor liability insurance policy? First, you should try to find a compromise. If this fails, then the sequence of your actions is identical to the previous case. It will only be important to check without fail whether the data is recorded in the protocol that the culprit of the accident does not have a compulsory motor liability insurance policy. After this, you need to make an independent assessment of the damage and try to get money for the damage from the culprit through the court. How best to do this in our realities is a topic for another, larger article.

What to do if the culprit escaped? It is strictly forbidden to go after the culprit on your own. It’s better to try to collect as much data as possible that may be useful in finding the culprit: special features of the driver and the car, such as a figured crack on the windshield, the make and color of the car, etc. We need to try to find more witnesses to the accident, for example, random pedestrians. To all this, you should add possible video and photo evidence that records the details of the incident: the location of the car and its damage, etc. Check to see if there were video cameras nearby (if so, try to get their recordings). If necessary, do not be afraid to ask the police for help. For the rest, proceed as above. Always inform the traffic police about the incident, and then follow their instructions. Fill out all the necessary documents together with the police.

Similar actions must be taken in situations where the car was damaged without its owner. For example, your parked car was allegedly hit by another car, which then fled the scene. In both situations, payment of insurance under the MTPL policy is possible only by successfully finding the culprit of the accident. Otherwise, you can only compensate for the damage sustained by your car using CASCO insurance.

Maximum sum insured in Rosgosstrakh

The law defines limit parameters for payments under compulsory motor liability insurance. In case of damage to property, compensation is carried out within the limits of 400,000 rubles. If harm is caused to the health or life of the victims, then up to 500,000 rubles are paid. for each of them.

In a situation where the damage exceeds the legally stipulated maximum limits that can be paid under compulsory motor liability insurance, the missing amount is recovered from the perpetrator. Most often, the issue is resolved in court. However, before initiating proceedings through the authorized bodies, you should use the claim scheme for resolving the problem.

Reasons for refusal of payments

Rosgosstrakh may refuse payment under compulsory motor liability insurance in a situation where the deadline for notifying the insurer about an event classified as an insurance event is not met. For an accident, the parameters of which allow registration under the European protocol, policyholders are given 5 days to notify the insurance company. If road inspectors were involved in registering the accident, then the application to Rosgosstrakh should be no later than 3 years after the insured accident.

You can expect payment refusal in the following situations:

- creating a package of documents using counterfeit papers;

- appeal to Rosgosstrakh by a person who is not a victim or his beneficiary;

- lack of obligations from Rosgosstrakh - unformed compulsory motor liability insurance or a requirement to fulfill the rights to direct compensation for damage to victims from the insurer of the culprit;

- causing damage due to the intent of the policyholder or acts of force majeure.

What to do in case of a car accident

Algorithm of actions

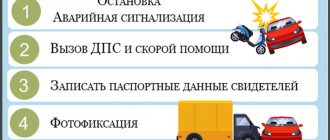

The procedure to follow after a car accident is as follows:

- Checking for victims in all cars involved in an accident. If they are, an ambulance call is required.

- Call the State Traffic Inspectorate, who will issue a certificate, and notify your insurer.

- Recording all the circumstances of the accident in a photo or video (it is important that everything remains in its place).

- Conversation with witnesses, if any. Recording their testimony on camera and obtaining contact information.

- Clearing the road from the car after the State Traffic Inspectorate officers arrive and draw up a protocol.

- Checking and signing the protocol. Particular attention should be paid to the correct indication of the personal data of the participants in the incident, information about the car and policy details.

- A visit to the State Traffic Inspectorate to obtain a certificate of initiation of a case or refusal of it.

- Transfer of a package of documents to the insurance company (before the expiration of the five-day period after the accident).

Next, a day will be appointed for the examination, before which no repair work can be carried out. The amount of insurance payment will be established on the basis of this technical inspection report.

If everything is done correctly and the incident really falls into the category of insured events, it is possible to receive compensation in the form of:

- Money;

- payment for repair work.

Important! If the company refuses to compensate for damage, but the case is insured, you can seek fulfillment of obligations through the court.

How to make an application

The statement that an insured event has occurred does not have a legally regulated form. Each insurance company has its own criteria according to which the document must be drawn up, so it is better to write it in the company’s office.

There are also general requirements for information that must be contained in the application. This:

- insurer details;

- information about the participants in the accident (personal, passport and contact information);

- information about the vehicle;

- description of the insured event – structured with as much detail as possible;

- listing the consequences that occurred;

- details of the mandatory policy;

- signature and date of document preparation.

Note! Before writing a document, you should contact your insurer and find out the requirements for filing an application.

List of documents

The following list of documents must be submitted along with the application:

- personal passport;

- driver's license of the policyholder and all persons specified in the agreement and having the right to drive the vehicle;

- notification of an accident;

- a certificate from the State Traffic Inspectorate regarding the initiation of a case or refusal;

- valid policy;

- documents for the car - STS and/or PTS;

- receipts for expenses incurred (for example, payment for parking before the examination);

- account details for transferring payments;

- power of attorney if the applicant’s interests are represented by a third party.

Depending on the policy of a particular insurer, this list may be supplemented.

Contact options

The following list of documents can be submitted to the company:

- by visiting the insurer's office in person;

- sent by registered mail.

You can apply for compensation for damage:

- by contacting the insurance company of the culprit;

- submitting an application to your insurer (for direct compensation for damage).

The second option is relevant if:

- the number of vehicles involved in the accident is at least two;

- each driver has a valid MTPL;

- The damage was only to cars.

Note! Unreported incidents are not paid by insurance companies. This means that if the drivers resolved the dispute on the spot and the culprit immediately handed over compensation, it is useless to apply for payment.

Is it possible to challenge a refusal to pay?

If the insurance company Rosgosstrakh refuses to provide repairs under compulsory motor liability insurance or a monetary payment, the victim has the right to challenge the decision. Before initiating proceedings, you should familiarize yourself with the reasons for rejecting a claim for reimbursement. If they are relevant and comply with the law, then you should not waste your time.

You can challenge a refusal to pay through a claim procedure. To do this, you need to file a pre-trial claim and attach documents confirming your right to payment. The law does not regulate the time frame within which a victim can challenge the decision of the insurance company.

After filing a claim, the insurer is given 10 days to review and make a decision. If the victim’s claims are rejected or if there is no response within the established time frame, it is necessary to contact the courts.

The procedure and stages of receiving payments under compulsory motor liability insurance in Rosgosstrakh

If the victim has the right to receive compensation, then after notifying Rosgosstrakh about an incident classified as an insured event, he must draw up documents about the insurance accident according to the European protocol or with the participation of the police. Having collected a package of documents, you need to contact the insurer’s branch to submit an application for payment with documents confirming the event.

If notification of the insured event was made through an electronic application, then you can find out the status of the payment through the Rogosstrakh service. After reviewing the package of papers and approving the application for compensation, the victim is paid or given a referral for repairs.

The sequence of actions of a victim in an accident under compulsory motor liability insurance

The first step after an accident is to call the State Traffic Inspectorate. Its employees are required to draw up a protocol. The vehicle must not be moved before their arrival. The scene of the accident and all damage caused should be photographed or video recorded. You must obtain the contact information of his insurer from the at-fault driver. The victim has the right to demand that the traffic police inspector send the guilty motorist for a medical examination in order to determine probable intoxication: alcoholic or other.

The Federal Law “On Compulsory Motor Liability Insurance” in Article 11 establishes the general sequence of actions after a road incident. The most significant stages are the following:

- You should contact the offender’s insurer and report the incident on the road, and if necessary, answer any questions.

- Submit a claim for damages and provide it to the insurance company. A representative of the organization must inspect the vehicle; this procedure must be carried out in the presence of the person responsible for the accident (if he does not appear at the specified place at the appointed time, the inspection can be carried out without him). In case of serious damage to vehicles, an examination will be required.

- Make copies of the road accident documents that need to be sent to the insurer (it is best to do this using a preliminary inventory). It is important to make sure that the date of acceptance is indicated on the document, as it affects the date of payment.

- Receiving payment. The insurer is obliged within 20 days after receiving the set of documentation. For every day the deadline is exceeded, the organization is obliged to pay a penalty.

- Restoration of vehicles.

Insurance payments do not cover the cost of restoration work in all cases. This is due to the fact that compensation involves approximate calculations. In a situation where the total cost of restoring the car does not fit within the specified limit, it is necessary to save checks for the missing funds and then send them to the insurance company of the at-fault driver.

Important! If hidden damage is discovered during restoration work, additional examination will be required. It must be carried out in the presence of a representative of the insurer.

Required documents

To receive payment from Rosgosstrakh, you need to prepare a package of papers that confirm the fact of the incident, determine the nature, nuances of the damage and the applicant’s right to compensation. It includes:

- passport;

- power of attorney or documents on the death of the victim when the beneficiary applies;

- documents confirming ownership of the car;

- papers from the police, traffic service or medical institution - the package is determined by the type and nature of the incident;

- notification of an insured accident;

- bank details of the recipient of the funds.

If damage to health was caused as a result of an accident, then in order to receive compensation for treatment and the cost of medicines, you will need an extended certificate from the hospital, ambulance station and from a forensic expert. When bringing the culprit to administrative responsibility, a protocol must be attached to the set of papers.

Application form for payment of compulsory motor liability insurance Rosgosstrakh

The victim must personally submit an application for payment to Rosgosstrakh at a branch of the insurance company. The procedure cannot be carried out online. It is possible to send the document by registered mail. The application must contain the following information:

- details of the applicant and recipient;

- details of the incident;

- about the existence of an administrative violation;

- list of damage to property, life and health;

- registration number of the notification of the occurrence of an insured event;

- results of the examination - if it was carried out;

- the amount of expenses - if the victim can indicate it.

Procedure in case of an accident

When a traffic accident occurs, it is very important to do everything correctly and in a certain sequence:

- First of all, a traffic police officer is called to the scene of the incident to draw up a report on the incident and identify the person responsible.

- Within 5 days from the date of the incident or another period specified in the CASCO policy agreement, you must contact the insurance company to report an accident with the insured car.

- At the request of the insurance company, provide the damaged car for an appraisal examination and receive the results of its conclusion.

- If you disagree with the results of the examination carried out by the insurance company, you need to independently conduct an independent examination of the vehicle.

- Submit an application to the insurance organization for compensation for the insured event under CASCO, attaching the necessary documents.

How to find out the amount and status of the case

Rosgosstrakh clients can obtain information about the status of their insurance business via the Internet on the company’s website. To do this, you do not need to register with the service. To find out the amount of payment under OSAGO, you must:

- Open the official website of the company.

- Go to the “Insurance” menu.

- Open the “Insured Event” section.

- Click on the link “Find out the status of the case.”

- Fill out the form - personal data of the policyholder and his individual number.

- Click on the “Check status” button.

Payment information is displayed on the screen. In a situation where the issue has not yet been reviewed by the insurance company, the screen will display that compensation is not determined. If the insurer's decision is positive, he will be notified. He will also be asked to wait for the money to be transferred or to receive a referral for repairs under OSAGO from Rosgosstrakh. If the resolution to the application is negative, you will be informed of a refusal to pay.