- Unified database of insurance policies RSA

- Why is authentication needed?

- Procedure for checking a CASCO policy

Fraud is widespread in the modern insurance industry. Many car owners do not even know that they purchased a policy from an unlicensed agent. Such a transaction is dangerous because if an insurance event occurs, the driver will not receive financial compensation.

To implement policy verification, it is recommended to use the RCA database. The resource brings together all insurers who have the right to sell MTPL and CASCO insurance to clients. On the official website it is possible to verify the authenticity of a document using a unique number.

We recommend using our free service: CASCO Calculator.

How to check your CASCO policy

Despite the fact that the cost of a CASCO policy is more expensive than standard MTPL insurance, many motorists prefer this option. CASCO provides insurance against any type of damage, including in the event of vehicle theft or an accident, if the culprit is the owner of the car. Considering the growing popularity of full auto insurance, in addition to honest insurers, there are many fraudulent companies on the market engaged in forgery of documents, it is important to know how to check the CASCO policy for authenticity. Those in the “risk zone” are usually those who took out insurance not in the office of the insurance company (IC), but in the showroom at the time of purchasing the car or in mobile offices.

CASCO check

Since checking a CASCO policy by number in the PCA database is not available due to the lack of legislative regulations that could oblige drivers to purchase this document, car owners will need to check the authenticity of the forms through their insurance companies.

It is especially necessary to check a policy obtained from a third-party agent outside the office of the company he represents. To do this, you can use one of several methods:

- Visit the insurer's office.

- Call the insurance company that owns the policy.

In both cases, a request is made whether there is a document with a particular serial number in the company database.

Signs of original insurance

It is advisable to check the CASCO policy at the registration stage at the insurance company office. Pay attention to the appearance of the papers and the presence of different degrees of protection. Visual differences of the original document: • the form is made of thick fibrous paper, with “wet” seals of the organization and signatures of both parties (the owner of the car and the IC employee); • presence of the IC logo, details (full and abbreviated name of the organization, legal address, OGRN number, current account), watermarks and barcode; • there is a list of all covered types of risks, information about the amount, terms and methods of compensation for damage; • reliable information about the car and its owner, the territory (countries, regions) in which the terms of the agreement apply; • there is a list of persons authorized to drive the vehicle; • lists the cases in which the insurance company may refuse to pay a client; • it is specified who exactly will receive the funds upon the occurrence of an insured event (for example, if the car is pledged, the money may be paid not to the owner himself, but to a banking institution).

Each policy is issued in two copies. The first remains with the owner of the vehicle, and the other with the insurance company. When applying for CASCO insurance, it is important to familiarize yourself with the contents of both copies and make sure that they are identical.

The symbols on the form must be clear, the letters must be the same font, color and size. Poor image quality is the first sign of a fake.

In addition to the policy itself, the insurer must provide the car owner with the original payment receipt (paper check or electronic document), a memo on the insurance rules and a report with the results of the vehicle inspection. If the registration is handled by an agent, the text of the contract indicates the passport details of a specific employee of the insurance company. Before purchasing, it is advisable to study as much information as possible about the insurer itself. Remember that only companies licensed by the Central Bank have the right to engage in such activities in Russia, so it would be a good idea to check whether there is information about a specific insurance company in the state register of insurance entities.

Verifying the authenticity of the policy by external signs

You can familiarize yourself with the appearance of the insurance policy on the official websites of insurance companies or in the offices of insurers.

Download if necessary

possible here on the website, however, each company develops a unique document template and periodically updates it to reduce the risk of fraud to a minimum.

Each policy has the following degrees of protection:

- watermarks;

- barcodes;

- the insurer's logo with its bank details;

- company seals;

- signatures of officials.

After concluding an agreement with an insurance agent, the client must receive a receipt confirming payment for the policy, a printout with the insurance rules, a vehicle inspection report, and CASCO itself. In some cases, additional documents (for example, agreements) are drawn up.

Standard CASCO contains the following information:

- data of the policyholder and the insurance company;

- specified insurance risks;

- the amount of insurance payments;

- the territory in which the policy remains in force;

- list of drivers allowed to drive vehicles;

- information about the insurance object;

- duration of the contract;

- additional conditions (for example, about opening a franchise);

- signatures and details of the parties to the transaction.

To avoid fraud, fill out the insurance contract at the same time as the specialist. Never sign your name on a blank form provided by the agent. All copies of documents must contain the same information. Be sure to check the accuracy of the information provided before concluding a transaction.

Checking CASCO policy by number

Each Russian insurance company has its own database of issued policies - both valid and previously issued. How to find out if a car is insured under CASCO? You can request relevant information from insurers by providing the policy number (usually found in the upper left corner of the form) and the date of issue. This can be done in several ways: • send a written request to the company branch by mail; • by contacting support by phone; • online - through an electronic form on the UK website. If the database does not contain information about a document with such a serial number, an employee of the insurance company will report this. The insurer is also obliged to notify the client if the policy is invalid (for example, if the insurance company terminated the contract due to a change in insurance risks) or the car insurance has expired. Please note: insurance company employees usually do not tell the caller directly that the policy is fake. In telephone mode, the car owner will only learn that information about the document is not displayed in the registry, after which he will be invited to a conversation at the security service department. You can also check your insurance using the vehicle number. Some companies provide such information by state registration plates or VIN code of the car.

"Rosgosstrakh" - How to Check the MTPL Policy for Authenticity using the RSA Database?

Buying a fake policy can lead to problems in the future, especially if there is an immediate need for it. It is impossible to receive funds under a fake MTPL, which is why the car owner will not only waste money on registration, but will also personally spend money on paying compensation to the injured party.

In this regard, drivers purchasing an MTPL policy are advised to check its authenticity. This applies to both products purchased from insurance agents and contracts executed at the organization’s office. In today's environment, fraud occurs at all levels.

You can check it thanks to the Russian Union of Auto Insurers. The organization provides all users with access to the OSAGO database. If the policy is in it, then it is genuine (information about insurance contracts is transmitted by the insurance companies themselves). Thanks to this service you can find out:

- Is the policy genuine?

- Who is the document for?

- What cars are included in it (and drivers).

- Which company provides insurance services?

The main advantage of the service is that it is free. The user does not need to pay either for access to the resource, or for its use and provision of information. The check can be carried out at any time of the day, regardless of your current location.

By form number

Each OSAGO form has its own unique number. You can check using this parameter. You need to do the following:

- Go to the official service page on the Internet .

- First enter the series of the form in the special field, then its number.

- Pass verification from bots.

- Click on the “Search” button.

If the policy is in the database, a new window will open with a table containing complete information about the document. The absence of a transition indicates that the form was not found, which means that the purchased OSAGO is fake.

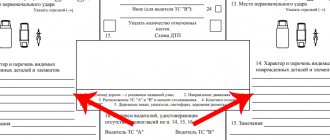

Checking the car included in the insurance contract

This method allows you not only to check the authenticity of the policy, but also to find out which car is included in it. The algorithm of actions is generally similar to the previous method:

- Go to the service page .

- Enter the series and form number.

- Specify the day for which you want to receive data.

- Pass verification from bots.

- Use the “Search” button.

In some cases, scammers provide users with original policies, but they include a different vehicle. In this regard, it is not recommended to refuse this type of verification.

According to the car

If in previous cases the form data was used, then this verification method involves entering the parameters of the vehicle included in the policy. The procedure will take longer due to the number of fields that need to be filled out. You need to proceed as follows:

- Go to the verification form .

- Provide vehicle details.

- Enter the date for which you want to provide information.

- Pass checks from bots.

- Click on the “Search” button

When you enter the correct data, the system will display information about the issued policy, as well as the drivers included in it. If this does not happen, it is recommended to make sure that the fields are filled out correctly.

Websites for checking your CASCO policy

How to check if a car is insured under CASCO? The most convenient way is to use an electronic database and search for information about the policy online. This function is provided on the official web resources of all insurance companies, and a link to the corresponding page is usually placed in the main menu or header: • INGOSSTRAKH; • RESO-Garantiya; • VSK; • Alpha Insurance; • Agreement. An alternative option is to check the car using the NSSO (National Union of Liability Insurers) database. The organization maintains a common database for all participating companies (about 30 insurers). Clients of insurance companies who have joined the NSSO can check the CASCO policy on the Union website. Additionally, it is worth “running” the insurance number through the databases of invalid policies. For example, on this page of the Soglasie insurance company website you can find lists of insurance numbers lost by the company in recent years.

How to Check the Authenticity of OSAGO on the Official Website of Rosgosstrakh?

The insurance company has developed a special service for its clients to check policies. Any citizen of the Russian Federation can use it. To access the resource, you must:

- Go to the website of the insurance organization .

- Enter the policy form number.

- Specify the security code.

- Click on the “Check Form” button.

If the policy is genuine, the system will provide information about it. The check takes no more than a few minutes (regardless of the chosen method of its implementation).

If the policy is invalid

Having discovered a fake CASCO policy, you should immediately report fraud to the police. The application must include as much information as possible about how and where the insurance was purchased: name of the organization, date of purchase, name of the agent who handled the paperwork. The fake policy itself is attached to the application as evidence. Unfortunately, the chance of returning funds taken by fraudsters is small. A car owner who finds himself in a similar situation will be forced to take out new insurance on the insurance company website or directly at the office of the insurer.

Unified database of insurance policies RSA

Checking auto insurance policy forms can be done in various ways. And one of them is checking the authenticity of the document in a special form located on the insurer’s website. The peculiarity of such verification forms is that they are programmatically linked to the RSA and FSSN database.

As a result, the presence of such a level of verification significantly raises the level of the insurance company and its authority.

However, despite the desire of vehicle owners to obtain information about whether their CASCO policy is genuine or fake through the RSA databases, this is impossible to do in practice. The thing is that these databases contain only MTPL policy numbers. The latter must be acquired by car owners without fail, therefore RSA keeps strict records of these documents.

This is not the case with CASCO, since it is completely voluntary insurance against material damage. Consequently, only the insurer from whom the document was purchased can check the form for authenticity.

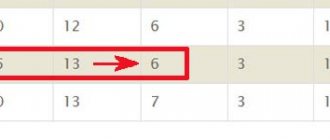

Find out the number of the insured car using the AlfaStrakhovanie policy number

The RSA service also provides the opportunity to find out the registration plate of a vehicle by the contract number. That is, which car is linked to MTPL insurance. To do this, go back to the “Information for policyholders and victims” section.

The report shows that the car number is P788SK152. The car was insured by AlfaStrakhovanie Insurance Company, but now the policy is invalid. The service also indicated the VIN number of the vehicle.

Possible consequences of buying a fake

By purchasing a CASCO insurance contract, the policyholder expects full financial protection from risks associated with the operation of the vehicle (more details about what CASCO covers and insures against can be found in our article). Such protection can cost several tens of thousands of rubles, which attracts a lot of scammers who, when selling a policy, count on the fact that the policyholder will not apply for compensation during the entire term of the insurance.

As a result, if you do not immediately recognize a fake, you may be unpleasantly surprised when contacting the insurer. And even if law enforcement officers detain the culprits, the only thing the policyholder can count on is the return of the money he gave to the scammers , and the car will have to be repaired at his own expense.

What to do with a fake policy

If the policy turns out to be fake, it cannot be used - it is illegal and may result in a fine. If fraud is detected, you must:

- Collect all documents and contact your insurance company and then the police.

- The client will be asked to provide all information about the transaction and describe the seller.

- If the fact of forgery is revealed during an inspection when the agent is nearby, you should immediately call the police and try to detain the criminal.

Related article: features of comprehensive insurance for six months Financial compensation for fraud will be paid only if the fraudster is arrested. In the case of CASCO insurance, you will have to enter into a contract again - with a real insurance company.

Insurance policies are often used by scammers to make a profit. You must be careful, use trusted agents and control the contract drafting process.