Every driver treats his car with special reverence and love. This is not surprising, because in a sense this is his favorite child. And at the same time, as the number of unscrupulous people on our roads grows, the number of accidents also increases. It's good if the car is insured, however, this is not enough. Every driver must know what to do if their car is damaged in the yard.

What to do if your car is damaged in the yard

Of course, car owners who have insurance have it easiest. After all, if the damage is minor, the driver can immediately call his company and ask for a meeting. As a rule, such a problem is always considered as an insured event.

Important! If you think the damage is significant, call the police first. They will draw up a document confirming the establishment of criminal proceedings, and after the required period, its closure. With these papers you can contact the insurance company and you will have a better chance of receiving an insurance payment.

It is clear that if a car is damaged in the yard, there may be several reasons for this. Here are the most famous ones.

- A careless driver drove out of a parking spot and hit your car. At the same time, he fled the scene.

- Night hooligans, of whom there are more and more, damaged the car's paint with an ordinary nail.

If you behave correctly immediately after the incident, you have every chance of receiving insurance compensation. So, let's figure out what to do if your car is damaged in the yard.

What to do if your car is damaged in a yard with CASCO coverage

So, you came to the parking lot in the morning and discovered damage to your car. What to do first?

Many drivers have a CASCO policy. This gives every reason to immediately seek help from a traffic police representative. However, there is one important condition that many drivers forget about: traffic police officers deal exclusively with traffic accidents. That is, if the damage to the car clearly proves that another vehicle was present at the incident, then the driver can contact the police, and the result will be positive. If, judging by the damage to the car’s surface, it can be decided that the scratches were caused by an attacker, it is useless to contact the traffic police. In this case, it is better to contact the local inspector, giving him all the details.

Advice! To act correctly in any unusual situation, it is better to call your personal lawyer and get advice. You should never leave the scene of an accident, especially if your car was damaged by another vehicle. This is a direct violation of traffic rules and entails liability.

Despite the fact that the owners of a CASCO policy can fully count on covering any costs of insurance events, you need to understand that if restoring the damage is not so important for you, it is better to do it yourself. Why? The point is that if you contact your insurance company for something as minor as this, they will help you. However, the occurrence of another insured event will significantly increase the cost of the policy in the future.

So, we damaged the car in the yard. What to do? CASCO is a reliable insurance policy. If the damage to your car is really significant, and you still decide to apply for payments, you need to know what to do correctly. So where to start?

- First of all, you should call the traffic police.

- They will draw up a report certifying the appearance of scratches on your car.

- Now you can contact the insurance company.

- Provide the policy, as well as a report drawn up by the traffic police.

- Wait for the insurance company's decision.

If you do everything correctly, you can rest assured that a positive decision will be made in your case. At the same time, you should not expect that you will receive all payments at once. The fact is that in criminal proceedings a thirty-day period is always given to conduct the necessary investigation. This means that you can only count on receiving your compensation after 30 days.

Motorist options

We recommend that you read the detailed instructions on what to do in the event of an accident.

Your car was scratched in the yard - what to do in such a situation? Options for action depend on specific circumstances. The culprit may flee the scene of the accident, or may wait for the owner of the damaged car. In addition, the procedure for compensation for damage is determined by the availability of insurance for those involved in the accident. Let's look at the algorithm of actions in more detail.

The culprit of the accident remained at the scene of the accident

Let's consider the first option: the culprit of the accident turned out to be law-abiding and waited for you at the scene of the accident. This somewhat mitigates the possible consequences, since there is no need to take action to find the offender.

To get started you need:

- report the incident to the traffic police;

- take photographs of the relative position of the vehicles and the resulting damage.

Traffic police officers will tell you where to file an accident report. They can direct drivers to the nearest highway patrol post. But before you go there, take a photo or video of the incident.

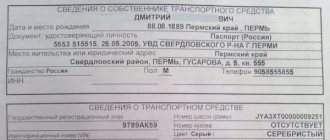

The fact of the accident is reflected in a special document - a certificate of a traffic accident. It states:

- address of the accident site;

- date of;

- driver data, the fact that they have a driver’s license and insurance;

- information about cars;

- the fact that the driver was examined for intoxication;

- detected vehicle damage.

A certificate is immediately issued to those involved in an accident.

If it is not possible to issue a certificate on site, you must subsequently apply in person to receive it. All references from traffic police officers about the impossibility of issuing a certificate are illegal. In case of refusal, you must file a complaint with the head of the traffic police. In any case, obtaining a certificate is necessary for you, since it will be needed in the future to receive insurance payment or recover damages through the court.

If the culprit of the incident and the owner of the damaged car have no disagreement regarding the damage caused, then there is no need to report to the traffic police. It is enough to arrive at the nearest traffic police post or police department and fill out the documents.

Subsequent actions to compensate for damage are determined by the presence or absence of insurance among the participants in the accident.

All participants have an MTPL policy

You can read more about how to correctly fill out a notification of an accident in the article by our lawyer.

If the liability of both car owners is insured, they have the opportunity to independently draw up documents about the accident. This requires compliance with certain conditions:

- Only two cars were involved in the accident;

- Car owners have no disagreements about the circumstances of the harm or the list of damages.

Both drivers fill out an accident report. It is important that the document contains the signatures of each driver, which certify:

- the fact that there is no disagreement;

- circumstances and pattern of the incident;

- list and nature of damage.

Within 5 days, the notice is delivered to the insurer personally or sent by mail with acknowledgment of receipt. By the way, there is no need to look for notification forms: they are issued even upon concluding the MTPL agreement in two copies.

The deadline for providing notification of an accident to the insurance company (5 days) is established by law. In addition, there is a period for notifying the insurer about an accident, which is prescribed as a separate clause in the contract. You need to notify your insurance company about an accident in a timely manner. Otherwise, the consequences for you may be unfavorable: in the absence of notification, the insurer will refuse to pay compensation.

Anyone involved in the accident does not have insurance

The lack of insurance for any of the participants in the accident leads to certain consequences. They boil down to the following points.

- The impossibility of registering an accident without the participation of police officers, even in the absence of disagreements.

- Holding drivers (one of them) accountable for lack of insurance. In such a situation, you will have to pay a fine of 800 rubles.

- Special procedure for compensation of damages. There are two possible situations here: either the culprit of the accident does not have a compulsory motor liability insurance policy, or the victim does not have it.

If an injured participant in an accident does not have insurance, this does not mean that he will not receive an insurance payment. However, to do this, you will need to contact not your insurer, but the insurance company of the person responsible for the accident. For this purpose, the driver through whose fault the damage was caused provides the following information:

- MTPL policy number;

- name of the insurance organization;

- address and telephone number of the organization.

Next, the driver whose car was damaged contacts the insurance company with a claim for insurance payment.

The situation is much more complicated when the person at fault does not have insurance. For him, the consequences are that he will compensate the harm to the victim independently, without the participation of the insurance company. For the victim, the procedure for compensation for harm becomes more complicated: if the driver at fault for the accident refuses to voluntarily pay compensation, then it will have to be collected through the court.

However, in any case, before going to court, it is advisable to send the claim to the “causer” of the harm. This will help reduce your material and time costs. There are no strict requirements for the content of the claim, so you can draw it up yourself, but be sure to indicate:

- addressee (full name, address);

- your data (full name, address);

- circumstances of the harm (attached a certificate of the accident);

- confirmation of the amount of damage caused (attached is an expert’s report on damage assessment);

- requirements for the addressee and the deadline for their fulfillment.

A technical examination will be required to confirm the extent of the damage. All expenses for the examination must subsequently be reimbursed by the culprit of the accident.

If the culprit of the accident fails to act or refuses the appropriate payment, then it is necessary to file a claim in court. You can go to court right away - this is the right of the victim. This will require additional expenses: payment of state fees, payment of legal assistance. However, if the claim is satisfied, all costs will be compensated by the defendant.

The claim is brought at the place of residence of the person responsible for the accident:

- to the magistrate - if the damage does not exceed 50 thousand rubles;

- to the district court - if the damage was more than 50 thousand rubles.

In the statement of claim we must indicate:

- name of the court;

- Full name, address of the plaintiff and defendant;

- the fact of violation of the plaintiff’s rights, and what this violation consists of;

- circumstances of harm;

- the price of the claim (i.e. the amount the plaintiff demands payment).

The following documents must be attached to the claim:

- a copy of the statement of claim;

- receipt of payment of state duty;

- copy of PTS;

- certificate of accident;

- expert's report on damage assessment;

- documents confirming additional expenses (for example, an agreement for technical expertise);

- power of attorney - in case of participation of a representative (lawyer).

If you do everything correctly, the claim will be accepted and subsequently satisfied by the court.

The culprit fled the scene of the accident

If the culprit of the accident fled the scene of the accident, finding him will be difficult, but, nevertheless, possible.

The initial actions in such a situation are still the same: call the traffic police, take pictures of everything, do not touch the damage and do not fix it yourself. The arriving traffic police officers will register the incident as an accident. But since its second participant is unknown, the case will be transferred to the search department, which will search for the culprit.

To speed up the search, try to actively facilitate it. Even before the traffic police arrive, study your surroundings: there may be cars nearby with their DVRs turned on. If you find them, contact the driver: wait for him or leave a note. In addition, many parking lots, as well as at the entrances of houses, have video surveillance. You can contact the property management company with a request to obtain the appropriate record.

If the car was in the parking lot for a short time, then it may be possible to find eyewitnesses. Interview them, find out and write down their details and contact numbers.

It is also necessary to carefully examine the place of damage: you can find traces of paint from another car on it. This will be useful for further searches.

If, using video recordings or eyewitness testimony, it is possible to find out the license plate number of the car, finding the culprit will not be difficult for the traffic police.

If there are no pieces of information about the offender, it is almost impossible to find him. After 3 months, the traffic police search will be stopped, and the victim will be able to receive compensation only if he has a CASCO policy.

Damage to a car by an individual

Cases of damage to the car by intruders are not excluded: be it street hooligans or your ill-wishers.

So, criminals damaged a car in the yard - what to do and who to contact? Such an event is no longer considered an accident, and accordingly, contacting the traffic police would be inappropriate. You need to call the police at number “02”.

Liability for intentional damage to someone else's property is established:

- administrative - if the damage is minor;

- criminal - if there is significant damage or when an act is committed for hooligan reasons.

The significance of the damage is determined based on the financial situation of the citizen, but is not less than 5,000 rubles. However, even in the case of minor damage, an administrative violation case must be initiated.

Arriving police officers will inspect the scene of the incident and draw up a report. The car owner should not rush to sign the protocol: first you need to study it and check whether it corresponds to reality.

A criminal case or a case of an administrative offense will be initiated into the incident. Law enforcement agencies will search for the violator. If he is found and found guilty, the victim will be able to recover damages in court.

Car damaged by fallen tree

There may be situations where damage to the car is caused by falling trees. A tree can fall on a car for various reasons: weather conditions, poor work of engineering services and the HOA. First you need to call the police, their employees will inspect the scene of the incident, and a report will be drawn up. Determine the circumstances under which the owner of a damaged car can claim compensation for damage.

Let us differentiate between an insured event under an MTPL and a CASCO agreement. If you have a compulsory motor liability insurance policy, damage is compensated only in the event of an accident. Under the MTPL agreement, liability is insured, and under the CASCO agreement, the car itself is insured. Insured events are specified in the insurance contract, as a rule, these are:

- causing damage;

- theft;

- hijacking

You don’t need to rely on compulsory motor insurance. But if you have a CASCO policy, you can receive insurance compensation. To confirm the insured event, obtain a certificate from the police.

If a tree has fallen as a result of weather anomalies, you should obtain a certificate from the meteorological center. It should indicate the weather conditions on the day of the incident.

What to do if you don’t have CASCO insurance? All vegetation, including trees, belongs to the owner of the relevant land plot. And responsibility for causing harm lies with him. If the car was parked in the yard of the house, you need to contact the HOA; if in a parking lot, contact the parking administration; if the site is municipal - to the local administration. However, in this situation, it will be necessary to demand compensation for damage from the responsible persons in court.

In some cases, it is not worth spending your money and time on litigation:

- The car was damaged as a result of the elements (strong wind, hurricane, etc.). This circumstance excludes liability for damage.

- The car is parked in a place where stopping/parking is prohibited. In this case, all material costs for restoring the car fall on the shoulders of the owner.

What to do if your car is damaged in a yard with OSAGO coverage

So, your car was damaged in the yard. What to do? OSAGO is a compulsory insurance policy. As a rule, receiving payments under this policy is not as easy as if you were insured by CASCO insurance. However, even a small chance is worth taking advantage of. Especially if the damage is severe enough that you can see that repairs will be expensive.

In the case of an MTPL policy, you need to call the police as soon as possible. And it’s worth remembering that this is only relevant if two cars were involved in the incident. If the car was damaged by hooligans, call the local inspector. In this case, compensation can only be obtained if the culprit is found and his guilt is proven.

Procedure in case of an accident Read about what to do if your car is hit by hail here.

Find out what to do if your car is scratched at this link:

But what to do if you damaged your car in the yard and disappeared? Can you somehow help the investigation? Without a doubt. Perhaps these recommendations will help you.

- Interview all possible witnesses, neighbors, and passers-by. Probably someone saw this intruder.

- Post notices asking those who have seen or heard something to respond.

- Look around. It is likely that your yard has video surveillance installed. Especially if you have a cooperative. In this case, contact the department with a statement indicating that you need to review the records.

- Pay attention to whether any of your neighbors have a private video camera. If so, don't be shy and ask to see the latest footage.

- Walk around the block, paying attention to other cars. You may be able to find a car with the same damage as yours. Sometimes small fragments of paint and dents of the same shape remain on the bumper or fender. Any examination will be able to confirm whether this car hit your car.

All these measures can help the local police officer find who damaged your car. If his guilt is proven, your chances of receiving compensation will increase. If the vehicle that hit your car is found, you may even be able to recover some insurance benefits. Especially if the damage is not too severe and the amount of payments will be sufficient.

Important! If damage to the car occurred before your eyes, and the guilty driver cannot be detained, try to write down the license plate number of his car. This will significantly increase the chances of finding the offender.

What to do if your car is damaged without insurance

In this case, there is no point in counting on any payments. You will only be able to receive compensation if the at-fault driver makes contact.

In some cases, insurance companies may pay compensation to the injured party if the at-fault party has nothing wrong with the policy. Simply put, a compulsory MTPL policy is intended for this. For your own safety, we recommend that you insure it immediately after purchasing a car. Otherwise, you may encounter a number of problems.

Who to call in case of an accident? Find out what to do in case of an accident here.

How to receive insurance payments, read the link:

How is damage compensated?

Damage caused by damage to the car is compensated through an insurance policy. However, this is only possible if the identity of the culprit has been established. If the car was not insured, a pre-trial claim should be brought against the person responsible for the accident. The next step is a lawsuit demanding compensation for moral damage. The amount of payments depends on the degree of damage caused, which is determined during a special examination. If the driver who damaged someone else’s car left the scene of the crime, he faces deprivation of his license for up to two years and arrest for up to fifteen days.

If the car was damaged by utility workers, auto experts still recommend contacting the police. After drawing up the appropriate application, an assessment of the damage caused is made. However, as judicial practice shows, utility companies do not voluntarily admit their guilt. As a result, such protracted lawsuits end with the payment of the requested compensation.

Have you ever noticed damage to your car? What did you do in this situation? Write comments and follow our news.

We damaged our car in the yard at night and fled – what to do?

There is nothing more unpleasant than finding your car damaged in the morning. What is the algorithm of action in this case? So, you damaged your car in the yard: what to do?

- Decide whether you need help or whether you will handle the repairs yourself.

- If you still need it, call the traffic police.

- Immediately report the incident to the insurance company.

- Upon arrival of the police officers, carefully re-read all the documents and fill them out if necessary.

- Contact the insurance company and submit all the necessary documents and certificates.

- Write a statement and wait for a decision on your case.

Who will pay for the damage?

Your car is scratched in the yard or in the parking lot - what should you do? Who will pay for the damage caused?

If the participants in the accident have insurance, the insurance company will compensate for the damage. Let’s take a closer look at where and with what documents you should apply for this.

If you have a CASCO policy

CASCO programs are different in different organizations. However, this type of insurance is more reliable in the sense that you can receive insurance compensation even if:

- you caused an accident;

- a tree fell on your car;

- your car was scratched and the perpetrator could not be found.

You must notify the insurer about the insured event immediately (another deadline may be set in the contract), and then visit his office within 5 days and fill out an application.

What documents will be required to receive payment?

- insurance contract (original);

- copy of driver's license;

- vehicle registration certificate;

- a certificate of an accident, a certificate from the hydrometeorological center or other supporting documents;

- when carrying out repairs - an original/copy of the work order indicating the cost of all spare parts, materials and work.

Then the insurer makes an insurance payment or sends the vehicle for repairs.

In case of minor damage to the car (for example, a scratch on one of the parts), many insurance organizations do not require the provision of the entire package of documents. It is enough to write a statement to the insurer and provide the opportunity to inspect the vehicle.

There is only OSAGO policy

If you have a compulsory motor liability insurance policy, only the injured party can count on compensation for damage. The driver at fault will carry out repairs at his own expense.

If both participants in the accident have an MTPL policy, then everything is simple: you can apply for insurance compensation from your insurance company. This must be done within 5 days. Before going to the insurer, you will need to collect the following documents:

- copy of the passport;

- vehicle passport (copy);

- OSAGO policy;

- notification of an accident.

You must write an application for direct compensation for losses at the insurer's office.

What is direct damages? For the damage caused by the person at fault in the accident, his insurance company is responsible, not yours. Insurers enter into agreements among themselves that provide for direct compensation for losses. You go to your insurer, who compensates for the losses caused, but he does this on behalf of the culprit’s insurer. In the future, insurance companies themselves sort out among themselves who owes whom.

The insurer is given 5 days to inspect the vehicle and perform a technical examination. If he does not perform these actions, you can independently send the car for examination, and subsequently include the costs in the amount of the insurance payment.

Within 20 days, the insurance company makes a decision on compensation for losses. Currently, insurance payments are not provided; the insurer organizes and pays for repairs at a service station. The victim himself chooses the station where the car will be repaired. Then he is given a referral for repairs.

If the culprit of the accident has a compulsory motor liability insurance policy, but the victim does not, you must contact the culprit’s insurance company for compensation for losses. To do this, you must first, even at the time of the incident, find out the contact details of his insurance company.

What to do if your car is damaged by children in the yard

It is important to remember that persons under 14 years of age do not bear administrative or criminal liability. You can communicate with them only in the presence of official guardians. This means that if you are faced with a juvenile delinquent, you will have to tinker a little.

If you only have compulsory insurance, you will have to call the traffic police, explain the situation, and provide evidence. After this, the parents of the perpetrator can be sued. If your car is insured by a CASCO policy, you can immediately contact your insurance company. Although it is still better to first obtain documentary evidence of the origin of the scratches. Such a document can only be issued by police officers, for example, a local inspector.

Your car was damaged in the yard: now you know what to do. And your correct actions will protect you from possible troubles associated either with traffic police officers or with your insurers. Be careful and have a smooth road!

And the video below will help you more competently understand the current situation.