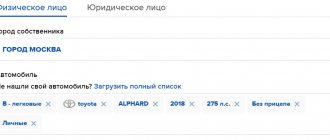

Cost of compulsory motor liability insurance in insurance companies:

| Company | Price |

| Capital | click the button calculate 7908 RUR Company calculator |

| Helios | click the button calculate 7908 RUR Company calculator |

| Sogaz | click the button calculate 8233 rubles Company calculator |

| Haide | click the button calculate 8525 rubles Company calculator |

| Asko insurance group | click the button calculate 8986 rubles Company calculator |

| Muscovy | click the button calculate 9216 rubles Company calculator |

| Hope | click the button calculate 9216 rubles Company calculator |

| Rosgosstrakh | click the button calculate 9488 rubles Company calculator |

| Tinkoff insurance | click the button calculate 9488 rubles Company calculator |

| Uralsib | click the button calculate 9488 rubles Company calculator |

| Osk | click the button calculate 9488 rubles Company calculator |

| Volga Insurance Alliance | click the button calculate 9488 rubles Company calculator |

| Siberian House of Insurance | click the button calculate 9488 rubles Company calculator |

| Medexpress | click the button calculate 9488 rubles Company calculator |

| Hoska | click the button calculate 9488 rubles Company calculator |

| Rosenergo | click the button calculate 9488 rubles Company calculator |

| Liberty | click the button calculate 9488 rubles Company calculator |

| Yuzhuralzhaso | click the button calculate 9488 rubles Company calculator |

| Nasko | click the button calculate 9488 rubles Company calculator |

| Central Insurance Company | click the button calculate 9488 rubles Company calculator |

| Energy guarantor | click the button calculate 9488 rubles Company calculator |

| Ergo | click the button calculate 9488 rubles Company calculator |

| Spassky Gate | click the button calculate 9488 rubles Company calculator |

| Euroins | click the button calculate 9488 rubles Company calculator |

| Sibirsky saved | click the button calculate 9488 rubles Company calculator |

| Alpha insurance | click the button calculate 9488 rubles Company calculator |

| Yugoria | click the button calculate 9488 rubles Company calculator |

| Sun | click the button calculate 9488 rubles Company calculator |

| Jaso | click the button calculate 9488 rubles Company calculator |

| Max | click the button calculate 9488 rubles Company calculator |

| Renaissance | click the button calculate 9488 rubles Company calculator |

| Reso | click the button calculate 9488 rubles Company calculator |

| Ingosstrakh | click the button calculate 9488 rubles Company calculator |

| Intouch | click the button calculate 9488 rubles Company calculator |

| Zetta | click the button calculate 9488 rubles Company calculator |

| Adonis | click the button calculate 9488 rubles Company calculator |

| Astro-Volga | click the button calculate 9488 rubles Company calculator |

| Basque | click the button calculate 9488 rubles Company calculator |

| Bean insurance | click the button calculate 9488 rubles Company calculator |

| Geopolis | click the button calculate 9488 rubles Company calculator |

| Guta insurance | click the button calculate 9488 rubles Company calculator |

| Dalakfes | click the button calculate 9488 rubles Company calculator |

| Agreement | click the button calculate 9488 rubles Company calculator |

| Yuzhural-asko | click the button calculate 9488 rubles Company calculator |

Peculiarities of using driver class tables and KBM coefficients to determine compulsory motor liability insurance rates.

The results obtained on the calculator will be saved in your personal account.

You can always look at them and make another calculation

How much will OSAGO cost next year?

Next year the cost of compulsory motor insurance will be:

| there was an accident | new price of OSAGO | overpayment |

| no accidents | 7512 RUR | |

| accident with 1 payment | 12257 RUR | 4745 RUR |

| accident with 2 payments | RUB 19,373 | 11861 RUR |

| accident with 3 payments | RUB 19,373 | 11861 RUR |

What does the calculation of the cost of compulsory motor insurance consist of:

| parameter | meaning | description |

| Base rate | 4118 RUR | Passenger cars (“B”, “BE”) |

| Territorial coefficient | x2 | Moscow |

| Engine power | x1.2 | from 101 to 120 hp (inclusive) |

| KBM (discount for accident-free driving) | x1 | Insurance for the first time (class 3, kbm 1) |

| Age and experience of drivers | x0.96 | |

| Insurance period | x1 | 1 year |

| Drivers | x1 | Limited number of drivers |

| Total | 7908 RUR |

How changes are made to the OSAGO policy

Reso guarantee OSAGO calculator

There is no clear legislative regulation of this procedure, therefore insurance companies, when asking to include another person in the MTPL policy, use general rules regarding contractual obligations. This means that either the insurer’s representative makes changes to the current policy, signs and seals them, or takes the policy away from the policyholder, destroys it, and in return gives a new one with the changes made.

Note that the legislator did not limit the number of persons included in the MTPL policy. However, based on the cost of services for adding an additional number of persons, it would be more advisable to purchase a policy without limiting the number of persons included in it. This way you can save a lot.

If you know for sure that no one else will be included in the insurance, and the insurer insists on purchasing a policy without a limited number of persons, then you have the right to refuse.

Moreover, you have the right to write a complaint against such an insurer to the appropriate authorities (police, prosecutor's office, RSA, Society for the Protection of Consumer Rights). The law is on your side, but many simply do not know this, which is what some irresponsible representatives of insurance companies take advantage of.

What problems may arise when applying

The process of changing electronic policies is still being finalized, as the technology has only recently been released. Problems often arise with making edits. For example, the insurer’s website does not process the request or the applicant has to pay a lot extra for the driver.

According to the law, the driver has the right not to carry a printed version of the MTPL with him. But police officers cannot always check the base due to lack of equipment. It is recommended to print out the amended MTPL in advance to avoid problems on the roads.

Adding a new driver to your policy is a simple procedure. The policyholder only needs to fill out an application, prepare documents and send a request to the insurance company. Within a day, all changes will be made to the database, and the driver will be able to drive the car.

Related article: Can an insurance company refuse to insure a car under MTPL and what to do if it refuses?

Where to contact

What to do if the screen on your phone is cracked. What to do if your laptop screen is broken

Only insurance company employees can add a new driver. You should come to the company’s office and have three documents with you:

- Passport of the citizen who must be included in the insurance policy.

- Driver's license of the person who will drive the vehicle.

- A valid MTPL policy.

An application must also be written requesting the entry of a new vehicle operator. During this procedure, the personal presence of the owner is required to avoid unpleasant situations. Insurers must be sure that the car is not wanted or taken without the owner's knowledge. The owner can also write a power of attorney certified by a notary, but this is a waste of money and time. The presence of the citizen who needs to be added to the insurance document is not necessary; it is enough to have copies or originals of his documents.

After the application is accepted, the insurance company employee enters the database and makes the necessary changes, then makes the appropriate note in the policy. The new OSAGO policy must be signed by the insurance agent and the seal of the company that made the amendments. But most often a new policy is issued and the old one is taken away. You cannot add one more person on your own.

Read more about the procedure for adding a driver to the MTPL policy in our article, and you can find out how many names you can add to the policy for free here.

Methods for adding another driver to the electronic MTPL policy

According to Law N40-FZ “On Compulsory Motor Liability Insurance”, if the owner of a car wants to transfer the right to drive the vehicle to another person, then he is obliged to enter it into the Compulsory Motor Liability Insurance. Otherwise, if stopped by a police officer, the driver will be fined 800 rubles. In this case, the person no longer has the right to drive this car (at the next traffic police post he can be stopped and fined again).

If the contract with the insurance company was drawn up a long time ago, this does not mean that new drivers cannot be included in the compulsory insurance. The main thing is that the person meets the minimum legal requirements: have a driver’s license, the right to drive a vehicle and be over 18 years of age.

Also, if the driver does not have insurance, then in the event of an accident due to his fault, he (or the owner of the vehicle) will pay compensation for the damage caused. There will be no compensation from the insurance company, since the driver was not her client.

There are several options for adding a new person to the insurance:

- at a branch of an insurance company;

- through the online service of the insurance company (with the introduction of E-OSAGO, all companies undertake to implement an online form for registration and adjustment of the policy);

- calling an insurance agent to your home (the service is available only in a few or others).

Article on the topic: List of problems with the MTPL policy.

Features of adding a driver to the MTPL policy and its cost, more details here.

Dependence of the cost of the policy on the added driver

Based on length of service and age, the cost of the issued or existing policy changes. After all, these parameters are related to the age/experience coefficient and the KBM coefficient.

Age-experience coefficient

How much does it cost to include a driver without experience in the insurance? This question interests those who add people who have recently received a license. If a person does not have driving experience, his license was issued less than 3 years ago, then the price of the policy increases by 70 or 80%. In this situation, it is worth considering additionally the age of the person. Upon reaching age 22, a 70% increase is calculated. When the driver is 22 years old or older, but his license is less than 3 years old, the policyholder will have to pay an additional 80% of the full cost of insurance.

In addition to an increase in the price of insurance due to the addition of a person without experience, an additional payment is possible when adding a person with more than 3 years of experience, but under 22 years of age. You will need to pay an additional 60%.

Bonus-malus coefficient

An important role when changing policy data is played by the individual KBM coefficient. It is assigned to each driver separately. This value depends on accident-free conditions when included in the MTPL insurance policy. When a person is first added as a driver to insurance, he is assigned class 3, and his BMR is equal to 1. After a year, the class will increase if no insured events occur due to the fault of the included person.

The discount for break-even insurance will also increase (BMR after the first accident-free year is 0.95). Accordingly, the price of a car title decreases every year by 5% (if other rates and coefficients do not change).

Given the bonus-malus ratio, the total cost of the policy may remain the same or increase depending on the added driver. Conditions when the policyholder does not have to pay extra:

- The person entered has more than 3 years of driving experience;

- Admitted to driving corresponds to the age category - more than 22 years;

- The BMR of a new driver is equal to or greater than that of the people already insured.

You can check the bonus-malus coefficient on the RCA service or on the service of another site. Nowadays, services for checking this coefficient are widespread on the Internet. There are online calculators for calculating the cost of compulsory motor insurance. You should indicate the region of insurance, validity period, age and length of service of persons allowed to drive, and vehicle power.

“Unlimited insurance” option

There are often situations when, when contacting an insurance company, an employee suggests that the policyholder change the policy to “unlimited”. This involves driving a car by any person who has a license. The price of such a policy will increase by 80%. This is convenient to do when you want to register young drivers without experience. But this option has several disadvantages:

- Drivers will not be assigned a bonusmalus coefficient, which in the future may provide a significant discount when added to another MTPL policy. In this case, KBM will be accrued only to the owner.

- Large surcharge - if the cost of compulsory insurance is about 10,000 rubles, then you will have to pay an additional 8,000 rubles.

Therefore, it is worth considering maintaining “limited” insurance. After all, sometimes an added driver will not affect the cost of the policy.

The driver receives a discount for break-even driving if he has fully covered his annual insurance. When included in the current policy, the discount will be assigned to those who were added during the initial registration of compulsory motor liability insurance.

Video: Calculation of how much it costs to add one more driver to MTPL insurance

Responsibility for driving a vehicle by a driver not included in the policy

The OSAGO form is included in the package of documents, which must always be with the driver. If the conditions or parameters of the insurance process change (personal data, identification characteristics change, new drivers are added), it is necessary to exchange the policy according to the latest information. The obligation to notify is stated in Law No. 40 (Part 8, Article 15). By ignoring this obligation, the policyholder violates the insurance rules.

In addition to stating a dishonest attitude towards obligations under compulsory motor liability insurance, there are more unpleasant consequences during a meeting with a representative of the traffic police, who has the right to question the validity of the policy. As a result, a driver with an old policy risks receiving an administrative fine, just like when driving a vehicle without compulsory motor liability insurance. The punishment is determined in accordance with Art. 12.37 in part 2 of the Code of Administrative Offenses of the Russian Federation. To avoid a fine, you will have to go to court to appeal.

If the insurance is declared invalid and serious discrepancies are revealed between the actual situation and the form presented after the accident, the insurance payment will be denied due to violations on the part of the insured. It is easier to make changes to the MTPL policy from Rosgosstrakh than to later try to force an insurance payment to be paid or a fine to be annulled.

List of documents

The Civil Code does not contain specific rules on the operation of “automobile insurance”, but only introduces the concept of liability insurance. The general legal principle is the individual liability of the tortfeasor.

Many people know that ten days after purchasing a car they can drive without insurance. This period is established in the law, which requires the driver to insure his motor third party liability no later than ten days after purchasing the car (as well as receiving it for rent, free use, operational management, etc.). Some citizens, based on this, practice driving without policy, carrying with you a periodically updated purchase and sale agreement.

This is a very undesirable behavior model, because... it is designed to help circumvent the requirements of the law, and most importantly, it undermines legal principles.

The compulsory nature of road insurance is due to the fact that the culprit may be insolvent and, even if he wants to, will not be able to pay the victim, and he, in turn, will not be able to give the car for repairs without money and will actually be left without personal transport. Loss insurance provides guarantees of financial stability in case of unforeseen events.

Motorists suffered from the uncertainty of the consequences after an accident, when a careless maneuver and a blow to someone else’s property caused a simultaneous blow to their pockets. Car insurance brought guarantees that damage up to 400 thousand rubles (for 2021) will be paid from insurance funds.

For the initial registration of compulsory motor liability insurance you need:

- Policyholder's passport.

- Vehicle passport

- Vehicle registration certificate.

- Driver's license of each insured person.

- Vehicle diagnostic card.

If a husband and wife decide to buy a car, but one of the spouses (usually the wife) does not drive, although he has a license, it is better to insure both of them just in case, incl. and to reinforce the joint status of the property.

Several years ago, motorists complained en masse about a strange “coincidence”: insurance offices did not have forms for compulsory motor vehicle insurance, but they appeared paired with insurance for a house or apartment. Even Rosgosstrakh, one of the most popular Russian insurance organizations, complained about the “shortage” of forms. However, electronic contracts were not executed due to “technical problems.”

Registration online is not difficult: large insurance companies, “Max”, “VSK”, “Nadezhda” offer sections on their websites in which the user enters data about the car and people. The fields must be filled out carefully and the correct data must be entered, because an error can slow down the formation of the contract, and in some cases lead to a recourse claim against the insured after an accident.

Bankruptcy of a company does not deprive the beneficiary of the right to payment, nor does it remove the obligations of recourse and subrogation from the perpetrators. In March 2021 the insurance company was declared bankrupt, and bankruptcy proceedings were introduced in its respect by the Arbitration Court of the Republic of Tatarstan. Its former “daughter” with a similar name, Yuzhuralasko, is not affected by the bankruptcy procedure, and the organization’s interaction with clients proceeds as usual.

As for ASKO policyholders, payments in their favor, if necessary, will be made at the expense of the DIA. The DIA will file recourse and subrogation claims. IC "Yugoria" went through bankruptcy proceedings, but as of 2021. Yugorie has no problems with creditors, the company operates normally.

Among the well-deserved insurance companies, it is worth mentioning AlfaStrakhovanie, the largest private insurer; Alfa clients have access to offices from the so-called Vyshny Volochok to Khabarovsk; RESO-Garantiya, one of the most stable insurers, as well as SOGAZ, which, according to SPIEF news, signed an agreement with the VTB group to merge insurance companies.

What is the difference between regular and electronic MTPL

For many drivers, technological progress has not yet been achieved, so they prefer to use the standard procedure for obtaining or renewing a motor vehicle license agreement.

First of all, the main difference that an electronic auto liability policy has is that it can be issued via the Internet in 30 minutes. No more wasting time on the road to the insurer’s office, no longer sitting in traffic jams in any weather, wasting money on gasoline and time in line

The procedure takes very little time, and if you provide reliable information, in an hour you will be able to travel on more important matters with brand new insurance. The second and important advantage is that the insurer cannot impose unnecessary additional services on you, threatening to refuse to issue compulsory motor liability insurance. Such actions are illegal, but unfortunately, they occur in many remote regions. A significant advantage of electronic OSAGO is that you will not be able to lose all the accumulated discounts for accident-free driving, since your history is stored in the RSA database and all insurance companies have access to it

The calculation occurs automatically, the representative only checks the information. The electronic policy can be printed on plain paper for your own convenience and quick verification by a traffic police officer. If you have lost this piece of paper, you can always print it out again, whereas a regular policy will have to be restored through the insurance company. The car owner does not need to provide a lot of documents for the car to the insurance company; all the information is already in the RSA and AIS databases.

Registration of an electronic motor vehicle license is quick and convenient, and its cost is the same as when concluding an agreement on a paper OSAGO policy.

Today, one common myth about compulsory motor liability insurance is that in electronic form you will have to pay more for it. Fortunately, this is not the case, thanks to an automatic calculator you can find out the cost of your insurance within 3-5 minutes.

The online process differs from the usual one in that it takes about 30 minutes. They will not be able to impose unnecessary services on you, threatening to refuse to complete documents.

Advantages of an e-policy

As written above, the main advantage is the speed of registration. There is no point in wasting time and money on gas to get to insurers. No need to stand in line and spoil your nerves. Decorating the house takes 20-30 minutes.

Opportunity to keep all acquired benefits. The history of each car owner is stored in the RSA register, and any insurance agent has access to it. Calculations are carried out automatically.

Absence of any imposed services. Usually agents offer to buy life insurance, health insurance, in general, everything that you won’t need, but will force you to spend your savings on it. For insurers this is a loss, but for ordinary motorists this is a huge benefit.

The E-policy can be printed on a plain sheet of paper. You do not need the original document. If you lose a document, simply print it again. This solves the issue of paid renewal.

Many car enthusiasts ask the question: what is the difference between a familiar insurance contract and an electronic one? If we compare the terms of the contract, there are no differences. For each contract, the insurance company is guaranteed to pay funds to the culprit, within the approved limit.

| Standard OSAGO | Electronic OSAGO |

|

|

Electronic MTPL CASCO calculator Passenger cars Passenger taxis Route buses

Buses Buses

Share Tweet Send

Renew your MTPL policy from RESO-Garantiya

The term of the new contract must begin 60 days after the date of purchase of the new insurance online and no later. The renewal can be completed before the policy that is still in force expires.

If you purchase a policy earlier, you will not have interruptions during which an unpleasant accident may occur on the road.

Many drivers are interested in savings when renewing their insurance policy. The main way to save money is to drive your vehicle carefully. If a motorist has driven the car carefully all year, he is entitled to a five percent discount when renewing the policy. You can accumulate a fifty percent discount this way.

If the driver has had one or more accidents, then the price of the policy increases by 50%, and sometimes even doubles. You can save money by registering drivers who are allowed to drive your car. If you don't bring anyone in, that also reduces the cost.

RESO-Garantiya gives its clients the opportunity to buy an MTPL policy online. The service is in demand among motorists. This is due to the fact that there is no need to come to the office in person, provide the car for inspection, and this simply saves time, and the company’s website works around the clock.

You can take out a policy not for a year, but for a shorter period. To buy a policy online you will need to have access to the Internet from any device. You need to leave an application and then provide the necessary documents. All information is checked automatically using the RCA database, and issuing a policy will take a maximum of one hour (most of all you will need to wait for confirmation).

After verification and payment, the policy will be sent to the email that was specified during registration.

Having a car license is an essential condition for any motorist. Therefore, the rules for its registration and the procedure for renewal are controlled by law. Many drivers are concerned about the cost of renewal. Virtually all insurance providers offer the same rates. This is primarily explained by the fact that basic tariffs for compulsory motor liability insurance are determined at the legislative level, and the insurance company does not have the right to determine prices at its own discretion. The cost of the service is affected by the following points:

- insurance period;

- car type;

- driving experience;

- presence of an accident;

- car mileage;

- number of people allowed to drive, etc.

All of the above circumstances can increase or decrease the cost of the contract. The list of such factors also includes the age and experience of the driver.

- Design

- Calculate

- Basic rates

- Order

- Electronic policy

- Renew at AlfaStrakhovanie

- Renew at Ingosstrakh

- Electronic policy calculator

- Calculate OSAGO

- Get an electronic policy

- For a new car

- Minimum cost of OSAGO

- Apply quickly

- Get insured

To determine the cost of a policy, various base rates, as well as increasing and decreasing factors, are used. So, the cost of the policy depends on:

- Cities where the car is predominantly used . In a metropolis, the risk of getting into an accident is higher than in small settlements, which is why the insurance premium is higher. For example, with all other parameters set in the calculator being equal, the policy price for Moscow is 15,407 rubles, and for small settlements in the Altai Territory only 5,390 rubles.

The company rightfully occupies a leading position in this type of car insurance. The reliability of the company is guaranteed by the authorized capital, the amount of which exceeds ten billion rubles.

RESO has a consistently high rating according to studies conducted by expert agencies, and good future development prospects are noted. The financial viability of the company is guaranteed by several leading foreign companies.

In order not to be denied insurance compensation, you must follow a certain procedure. It is usually specified in the insurance rules.

The State Traffic Inspectorate and RESO-Garantiya recommend the following procedure in the event of an insured event:

- Stop the car, turn on the hazard lights and put up a warning triangle . The sign must be located at a distance of at least 15 m from the car if it is located in a populated area and at a distance of at least 30 m if the accident occurred on a road outside the city.

RESO-Garantiya is far from being in first place in terms of the number of refusals to pay - only 5% (6,543) of the total number of refusals from all insurance companies, but reviews about the company are quite contradictory. People complain:

- for unreadable passwords, due to which it is impossible to issue an electronic policy;

- for non-payment of insurance compensation;

- for low payments for an insured event.

In this case, you must personally visit the company’s office. But recently this method has become less and less popular among drivers. This is explained by the fact that you will have to spend a certain amount of time getting to the office and getting back home. If you have an electronic insurance policy E-OSAGO, then renewing your policy online is much faster.

If you decide to renew your insurance directly in the office, then you need to take some additional documents with you:

- passport;

- driver's licenses of everyone who will drive this vehicle;

- diagnostic card;

- technical passport of the car or registration certificate.

If you want to make some changes to the terms of the contract, then you need to submit a written statement stating the changes you want to make. If you are satisfied with the current terms of the contract and you want to remain at your tariff, then the application for renewal will take a standard form, it will only require your signature.

At the moment, this is the fastest option that will allow you to renew your electronic MTPL insurance. You will spend no more than 2-3 minutes on this. If you have any difficulties, you can call your insurance agent and he will answer all your questions. If you want to make some changes to the current contract, this can also be done through your personal account.

If you want your policy to renew automatically, you must pay the renewal fee in advance. If you forgot to enter it, or did it intentionally, then the policy ceases to be valid in accordance with the period until which it was valid. After this, it is considered expired, and you no longer have the right to travel on public roads.

Each driver can save a certain amount when renewing the insurance contract:

- purchase online. You will not spend money on gasoline and save your time because... you don't need to go anywhere;

- if you use the car seasonally. You don't overpay for the months when your car is idle;

- no accidents due to your fault. If you have never had an accident due to your fault, then the insurance company will provide you with an additional discount on renewing your policy.

The RESO insurance company began its activities in 1991 as part of the RESO group, which at that time included more than 20 organizations operating in the field of medicine, insurance services, leasing and office work. The RESO-Garantiya service network has more than 900 branches and offices throughout the country.

Currently the company has a license for 100 types of services:

- life and health insurance;

- car insurance for individuals and legal entities;

- registration of insurance for the property of citizens and organizations;

- protection of tourists while on vacation within Russia and abroad;

- insurance of mortgage loans issued by Russian banks.

According to the requirements of the law, car owners have the opportunity to register for compulsory motor liability insurance on the company’s website.

But if you need to obtain CASCO insurance, you should contact one of the service offices with documents for the car, its owner and the driver’s licenses of all persons authorized to drive the vehicle. There is also an alternative option - calling an insurance agent to your home or work at a time convenient for you.

Traffic rules prohibit driving a car without a valid MTPL policy. Previously, you had to drop everything, go to the insurer’s office and stand in queues. Now you can issue an e-MTPL policy at a convenient time using any computer connected to the Internet. An electronic document is the same guarantee of compensation for damage to the injured party in an accident as a paper policy with a wet company seal.

- Driver's licenses of persons who will be included in the insurance

- Passport of the vehicle owner and persons who will be included in the insurance

- Vehicle Registration Certificate (VRC) or Vehicle Passport (PTS)

- Application in the form of the selected insurance company (formed online)

- Valid diagnostic card

Purchasing car insurance in Ukraine gives the policyholder the following benefits:

- the company additionally provides full assistance along the way, namely: technical maintenance, emergency dispatch, calling an ambulance, etc.;

- providing detailed advice around the clock;

- issuing an MTPL policy online in 5 minutes

- the ability to order a paper policy on government form via the Internet with home delivery;

- payment guarantee within 15 days.

In addition, the RESO company provides comprehensive insurance services, the program of which includes mandatory vehicle insurance.

To apply for electronic MTPL, you must have a minimum package of documents on hand. Its composition is regulated by Federal Law No. 40 “On Compulsory Motor Liability Insurance”. The document data is filled out in a form on the insurer’s website, and some of them are scanned and uploaded to the database in pdf format.

Their list:

- passport of a citizen of the Russian Federation (or other document identifying the owner);

- diagnostic inspection card;

- confirmation of vehicle registration - PTS, STS, registration certificate or other similar document;

- driver's license of the owner and all persons who will be included in the policy and allowed to drive.

Good to know! Legal entities do not have to provide a package of registration documents - it will be enough to enter the details of the registration certificate.

Highlights of the service

To start the procedure you will need:

- passport of the person who will be included in the policy;

- new driver's license;

- valid MTPL policy.

Please note: you cannot make changes to the MTPL policy yourself. If you violate this rule, you may not qualify for payments upon the occurrence of an insured event.

In addition, for non-compliance of documents, traffic police officers can initiate a criminal case for forgery.

It is advisable that the owner of the vehicle be present at this moment. If this is not possible, it is necessary to issue a general power of attorney for the representative. Such a document gives the person you choose maximum opportunities, up to the sale or pledge of the car

Please note: issuing a general power of attorney is a paid service, the cost of which must be confirmed with a notary

You can fill it out yourself or in his presence. In the first case, do not sign and date the form - this must only be done together with a notary. The validity period of a general power of attorney is 3 years, unless otherwise specified in the document. An error in specifying the validity period (i.e. more than 3 years) will invalidate it.

It is impossible to definitely answer the question of how much compulsory motor liability insurance costs for a year - a lot depends both on the car itself and on the driving history of the car owner.

What to do if one of the participants does not have a compulsory motor liability insurance policy in case of an accident, you can read here.

Changes are made based on an application to update the list of drivers. After this, the insurance company representative can supplement the existing contract or issue a new one in exchange.

Please note that although the policy only allocates five fields to list drivers, this number can be exceeded. Changes made must be sealed

Arguments for corrections

The main argument for making corrections to the current MTPL policy is a fine. Although this violation does not jeopardize traffic on the roads, you will be required to pay if it is detected. The same applies to situations where the new or second owner of the vehicle is not included in the MTPL insurance. In this case, the fine amount starts from 300 rubles.

In addition, if such a violation is discovered by the traffic police, they can detain you for forgery of documents and even initiate a criminal case. To prevent this from happening, contact your insurance company to make changes.

Please note: only a representative of the insurer can enter new data

Calculation principle

The cost of the registration procedure depends on the driving experience of the person being registered. If a person has recently received his license and has virtually no experience, an additional fee must be paid. It is provided to secure the possibility of increased risk.

Please note: if you add a new driver yourself and an accident occurs due to his fault, the insurance company will refuse to make payments. Moreover, the traffic police may impose a fine for forgery of documents.

If the registered driver is over 22 years old, has at least 2 years of experience and has previously participated in some kind of MTPL policy, the insurance company representative will issue a new policy. Usually they add a new person in a free line or print out a document with a complete list of those allowed to drive a vehicle. The changes made must be approved by the signature of the insurance manager and the seal of the organization.

Thus, when calculating the cost of registration, age and driving experience are taken into account

A discount factor of 5 percent per year is also taken into account. Its value is in the range of 1.0–1.8

It is used if:

- the driver has not reached the legal age, and the experience is within 1-3 years;

- the driver has reached a certain age and has less than 3 years of experience;

- the driver is older than the age specified in the Federal Law and has more than 3 years of experience;

- the driver has more than 3 years of experience, but does not meet the age requirement.

Methods for adding a new driver to the VSK OSAGO policy

The easiest way to change your insurance details is online. But if there are questions that require discussion, you should contact the VSK office.

The driver does not have the right to independently make changes to the “paper” OSAGO policy - this is prohibited by law.

Making changes to e-OSAGO

To begin, the driver must register on the website. You can make changes to the electronic policy as follows:

- Log in to your Personal Account and select the “Policies” section. Here you can independently add or remove a driver, make the list of drivers unlimited or vice versa, and also change your full name.

- Wait for the certificates to be reviewed by VSK Insurance employees (this happens within 2 business days).

- Receive a new e-OSAGO (the policy is sent to the email address specified during registration).

Also in your Personal Account you can change information about your driver’s license, enter new data about the state license plate of the car, and change the purpose of using the vehicle.

If the driver receives a refusal, he will need to visit the VSK Insurance office.

Making changes through an application in the office

To make changes in the office, you must submit an application. you can here:

Depending on the type of changes, the following documents are attached to the application:

| Type of changes | Documentation |

| Replacing the period of use of the vehicle | Civil passport, power of attorney, original MTPL policy, car passport (can be replaced with a vehicle registration certificate). |

| Changing car owner | Civil passports of the policyholder and the new owner, car passport, purchase and sale agreement (exchange, gift), original MTPL policy, insurance payment receipt (if available), notarized power of attorney. |

| Changing the surname of the person who was indicated in the policy | Civil passport, OSAGO (original), certificate confirming the fact of changing the surname (for example, a certificate of marriage or divorce). |

| Replacement of driver's license | Civil passport, MTPL (original), insurance payment receipt (if available) and a new driver’s license. |

If the policyholder has re-registered the vehicle with the traffic police and received a new registration plate, then the employees must provide a certificate of registration.

Adding another driver to your insurance

Changes are made based on the application. One copy is then left at the office, the second (with a stamp) is taken for yourself.

The stamp affixed confirms the fact that the company employee accepted the application.

This issue is considered by VSK Insurance employees within 10 working days. If the issue is resolved positively, a message is sent to the policyholder’s email address that the data has been successfully changed. The correctness of the entered data is checked by the applicant in advance. If the applicant discovers an inaccuracy, this should be reported to the insurer immediately. The driver who needs to be added to the policy does not have to come to the office: the presence of the owner of the vehicle is sufficient.

If you need to add a foreigner to your policy, you will need to provide the company employees with:

- driving license issued to a foreigner on the territory of the Russian Federation;

- national ID (if the state from which the foreigner arrived is a party to the Vienna Convention, then the ID is translated into Russian and certified by a notary);

- international certificate (if the state from which the foreigner arrived has not signed the Vienna Convention).

To add a driver to your insurance online, you need to go to the VSK Insurance website. Further instructions:

- Choose a policy.

- Select the “Edit” option.

- Enter the new driver into the insurance policy (the following data is required: full name, number and serial number).

If VSK Insurance employees make a positive decision, the applicant will be asked to pay for changing the policy. After this, the new OSAGO is sent to the email address. The new insurance can be saved on your mobile device or printed.

If the policy is electronic

E-OSAGO is an electronic policy format that you can issue yourself without leaving your home. It has many advantages, including saving money and time. But it was not without its drawbacks. If the question arises of how to include a driver in an electronic MTPL policy that has already been issued, then there is only one answer - not at all.

The main condition for making adjustments to the insurance agreement is that they must be made exclusively by an employee of the company. Independent manipulation of the “automobile license” is useless and illegal. An insured who decides to add a driver to an electronic MTPL policy without a visit to the insurance company will face criminal liability for forgery of documents and the impossibility of receiving compensation in the event of an accident.

However, some companies provide the service of an employee visiting the home to make amendments to the electronic policy. And this is the only way to add a new driver to e-OSAGO.

What documents are required

To change your electronic MTPL policy you will need the following documents:

- policyholder's passport;

- passport and driver's license of the driver, who must be included in the document;

- printed OSAGO form (if E-OSAGO is adjusted at the Insurance Company office).

If the application is made at a company branch, then copies will be made of the documents, and the whole procedure will take about 30 minutes (maximum - during the working day, a notification will be sent to the policyholder’s phone about the completion of the process).

You can add a driver to your policy yourself on the Insurance Company website, you need to:

- Log in to your personal account.

- Then find the line “Make changes” and click on it.

- In the section you need to find the number of the concluded contract, check whether the series and number of the ID card or driver's license match. There is also a column “add a new driver”.

- It is important to ensure that the data entered is correct. Any typos or errors may render the policy invalid. A person allowed to drive will be without insurance and will be forced to pay a fine.

- Next, the changes are saved and a special statement is drawn up - a notification to the insurance company about the procedure performed. Only an employee of the insurer has the right to enter new drivers into the RSA database and certify the adjustments.

- After verification and additional payment (if required), the policy will be valid.

To include a driver in an electronic MTPL policy, it is important to complete the application correctly. This can be done either independently or by turning to the insurance company for help.

The application is drawn up by the owner in free form. It must contain the following information:

- the title consists of a mention of to whom and from whom the right to drive a car is transferred;

- the application contains a complete list of persons who will be indicated in the insurance, including their full names and document details;

- description of additional papers, or rather their copies;

- date of filing, signature with name decoding.

Article on the topic: OSAGO policy without payments in case of an accident, what it is and how to get insurance.

A sample application can be downloaded here.

Compiled in two copies at once. Both are transferred to the insurer’s office and certified with a stamp. One copy remains with the policy holder, the other with the company.

How to add a driver to the electronic MTPL policy from IC AlfaStrakhovanie, you can find out more here.

In what case may a foreigner have the right to drive a car in our country?

The rules of civil liability for the absence of an insurance policy force motorists to purchase it without fail.

But for many, such registration will not be profitable, and sometimes even financially unjustified, especially when the vehicle will be driven by several people.

According to the current regulations, an unlimited number of vehicles can be included in the MTPL insurance policy.

That is, each motorist, depending on the case, can include his relatives and friends in the documentation. Additional pages will be included with the insurance policy.

There are three options here. The first is if he received a national license of the Russian Federation, along with the rights of his state, that is, he has several driver's licenses. You can get them, for example, while staying in Russia on a visa or residence permit.

Secondly, if your guest is a citizen of a country that has signed the Vienna Convention, then he can drive a car in Russia with his national rights, only they will need to be notarized into Russian. The fact is that the countries of the Vienna Convention have made similar traffic rules, so there is no need to relearn when moving to another country.

The third option is an international driver's license. It is required when driving in countries that have not signed the Vienna Convention, such as China.

Important fact: why do you need to be included in the policy every year?

The problem today is that the notorious bonus-malus coefficient disappears if you are not included in the insurance - any, even a foreign car, which you will never even drive - within one insurance period - 1 year. This is stated in the Insurance Rules.

That is why, in order to maintain KBM, you need to have an insured vehicle every year. For the same reason, there is a significant disadvantage of unlimited policies - they take into account KBM only for the owner of the car.

Why does the policy price change?

The procedure for adding additional persons to the ownership of an insurance policy is regulated as free of charge. But the insurer thereby increases the number of insured events and risks for itself, and therefore must increase its own income.

Thus, the insurance company charges an additional coefficient for each motorist, based on his personal data.

The main criteria for changing the cost of compulsory motor liability insurance with additional persons are:

- Driving experience.

- Accident-free driving record.

| Motorist category | Coefficient |

| Under 22 years of age and without 3 years of driving experience | 1.8 – 80% of the policy cost |

| Age – from 22 years, driving experience – less than 3 years | 1.7 – 70% of the cost of the remaining days |

| Age – from 22 years, driving experience – from 2 years | 1.6 – 60% of the cost of compulsory motor liability insurance |

| Age – from 22 years, driving experience – from 2 years | 1 – changes to insurance are made free of charge |

Thus, if a motorist has reached the age of 22 years and has not been involved in an accident for a period of three years, then a loyal discount may be offered for this case.

But for a beginner, especially a younger one over 22 years old, you don’t need to count on such privileges, but on the contrary, you should pay almost the full price.

Although such additional payments for the additional inclusion of other motorists in the insurance are financially more profitable than taking out an additional policy.

The procedure itself costs nothing, but the cost of the policy itself may change if the risk of an accident increases. For example, a new participant may have less age and driving experience than the owner of the car. The cost of the policy is determined by the MTPL class of the riskiest driver, so the manager of the insurance company has the right to ask for a refund of the discount for accident-free driving that was previously given to the car owner.

If the “new guy” is over 25 years old, has more than three years of experience driving a car, and has previously entered into MTPL agreements, then it is possible that he will not have to pay anything extra. You will have to check with the insurance company how much it costs to include a newbie in your insurance, as it is difficult to calculate on your own.

Alteration

The owner of the policy and the car are required to submit applications and bring documents. This is not stated in the law, but insurers require it. And if for some reason he cannot be present, he needs to write a power of attorney to carry out the operation in this document. You also need to have the paper certified by a notary.

If a motorist needs to register additional persons, he must seek help from any insurance company (for example, Rosgosstrakh or VSK). Independently adding other drivers to your policy is illegal and entails criminal liability.

Moreover, such actions simply do not make sense, because if you get into an accident with serious consequences, you simply cannot count on payment of monetary compensation.

Unfortunately, not all insurance organizations allow clients to make changes via the Internet. Most of them prefer to carry out all operations only in person. This is explained by the difficulties associated with identifying individuals who are entered into the MTPL.

Exceptions are made only when foreigners and drivers without experience are included in the number of policy holders.

What do you need to register other drivers online? After concluding an insurance contract, you get access to your personal account, the entrance to which is password-protected. All changes to the registration of a new driver can be made only through this resource.

Can a second, third or fourth policy owner be added by phone? To protect themselves, none of the well-known insurance companies will practice this method of registration. This again has to do with establishing a person's identity. In a telephone conversation, you can only agree on a meeting with an agent and the possibility of a future change in the number of drivers.

Motorists without experience are considered a risk group. If you want to add a driver who has just received a license to your policy, remember that he must be 22 years old. This will significantly reduce documentation costs.

On a note! Driving experience is usually understood not as driving experience, but as the time that has passed since the date of obtaining a driver’s license.

MORE: What is DSAGO and why is it needed?

That is, if you have been driving a car since the age of 15, but did not bother to obtain the necessary documents, your driving experience is zero.

How much does it cost to make changes to MTPL insurance? Several factors influence the final cost of the policy:

- The age of the person being entered is up to 22 years or older;

- Driving experience – more or less 3 years;

- Accident-free experience or individual accident rate;

- The number of persons previously included in the policy;

- The number of days remaining until the end of the contract (the fewer days left, the more expensive the insurance will be).

| Driver age | Driving experience | Maximum KBM (bonus-malus coefficient) | Percentage of the total cost of compulsory motor liability insurance |

| Up to 22 years old | Up to three years | 1,8 | 80% |

| 22 years and older | Up to three years | 1,7 | 70% |

| Up to 22 years old | More than three years | 1,6 | 60% |

| More than 22 years | More than three years | 1 | 0% |

Table 1. Calculation of the cost of compulsory motor liability insurance

Important! The price of the policy is regulated by law and cannot be increased at the discretion of the insurance company. And one more thing - despite the apparent high cost, adding other motorists will cost much less than concluding a new contract.

As you can see, you can make changes to your insurance for free only if the driver has acceptable experience and has never been in an accident. But if a person is under 22 years old and has been in an accident more than once, the service will be provided for a fee in any case, because this is associated with a huge risk.

Of course, in some cases, organizations may make some concessions, but for this, the policy owner must be given guarantees in the form of a long and accident-free experience. For each year of emergency driving of a car by an additional driver, the MTPL owner is entitled to a 5% discount.

In order for this data to be taken into account when preparing documents, the entered motorist is required to provide a certificate from the traffic police about the absence of accidents due to his fault. It should also be noted that a discount for accident-free driving is given only if the person was previously mentioned in the MTPL.

When calculating the price of compulsory motor liability insurance, you need to take into account a few more points:

- If you received a policy with a discount, and the person added to the policy has no reason to use it, then this discount will not apply to him;

- The greater the discount you received when signing the contract, the more you will need to pay extra for an inexperienced and young driver, since his BMR is still very high;

- If the policy was originally issued for a young motorist, no additional fee will be charged when making changes. In this case, the cost of compulsory motor liability insurance has already been calculated taking into account the highest possible BMR.

If you have ever taken out an MTPL insurance policy via the Internet, then you should already know that all actions with insurance in the future can only be carried out through the user’s personal account, which must be created if you decide to buy an electronic MTPL.

When it first became possible to make changes to the policy via the Internet, any driver could make changes to an already issued document within about 14 days. But, soon, several rather significant shortcomings were discovered in the operation of the system of changes via the Internet, the main one of which was the inability to identify the person whose data was entered into the policy.

An attempt was made to request scanned copies of documents, but it soon exhausted itself, since such a procedure took too much time and was somewhat inconsistent with the technical capabilities of insurance companies.

READ MORE: Unemployment benefits in 2021 – what it is, how to apply for and receive it

After several attempts to somehow rectify the situation, the ability to make changes to the policy online was suspended.

Thus, such a function is currently not available, but still it is not abandoned and a solution to the issue is not far off. In the meantime, owners of a personal account can make changes to the policy in the event of a change of surname, passport data, driver's license, as well as terminate contracts and issue a renewal of their existing agreements.

In case of additional entry, new drivers will have to come to the company office.

Price issue

It’s probably no secret to anyone that any action related to the issuance, modification, or re-issuance of insurance documentation will entail a certain fee. The cost of the service is determined by the current regulations of the law and cannot be increased just because the insurance company wants it.

The cost of compulsory motor liability insurance is calculated individually based on driving experience and accident-free status. It is these indicators of the person included in the insurance that will influence how much the policy costs.

Driving experience

There is a certain algorithm of actions for calculating the cost of additional payment under compulsory motor liability insurance. So, if the registered driver has not reached 22 years of age and has a driving experience of less than 3 years, then the coefficient taken into account when calculating the cost of compulsory motor liability insurance will be the highest - therefore, the policyholder must pay an additional 80% of the full cost, taking into account the remainder of the current period under this policy.

If the additional driver has already reached his 22nd birthday, but still does not have 3 years of driving experience, then the coefficient will be equal to 1.7 (70% of the total cost, taking into account the remaining days).

If the entered driver is under 22 years old, but has more than 2 years of driving experience, the coefficient is 1.6 (60%).

To add a new driver to the insurance, the policyholder (or his representative with a notarized power of attorney) must come to the company’s office with the policy and the driver’s license (or a copy thereof) of the person he is going to add.

However, representatives of some companies are not so scrupulous in this matter. They will not require the presence of the policyholder; the driver himself and someone else’s insurance policy will be enough.

For example, if you are under 22 years old and have little driving experience, then the maximum coefficient will be 1.8. If the age is more than 22 years, the coefficient decreases to 1.3.

Please note that the surcharge is charged for the remaining term of the policy, and not for the full year, as the insurance agent may claim.

If you had discounts, they can be canceled if the terms of the contract change - a new driver is added, or a limited number of drivers changes to an unlimited number and vice versa.

Let's look at an example: Driver 21 years old, driving experience 2 years.

4-6 rub. 3-5 rubles Free. If not in the office, maybe 150 rubles used to be a hundred or a hundred and a half. With the new rates it may increase. If your KBMs match, then there is no charge. Depends on your registration, your kbm, its kbm and expiration date.

According to the MTPL Rules - “63. The amount of insurance payment in case of damage to the victim's property is determined. b) in case of damage to the property of the victim - in the amount of expenses necessary to restore the property.

The court will most likely take your side.

According to federal law, the policyholder must inform the company in writing about all changes in data made to the policy, but in practice, penalties for ignoring this clause can be avoided, since the official deadline for reporting changes has not been established.

READ MORE: Do you need insurance for an ATV?

Also, the same legislation does not indicate that changes in the electronic MTPL policy provide for refusal of payments or cancellation of the contract. Insurers can only invalidate insurance if the data was initially provided incorrectly.

We should consider separately only those cases where the probability of an insured event changes due to a change in data. This is where insurers can find fault, because the amounts of payments due to new circumstances may differ significantly from those provided for in the contract before adjustments were made.

In addition to how to add a driver to an electronic MTPL policy, many are interested in information about the rules for making adjustments to other columns.

You must come to the company office in person to change:

- period of use of the vehicle;

- driver's license number;

- registration information;

- vehicle registration number;

- PTS number;

- any personal data specified on the insurance form.

To do this, you must have a valid insurance policy and documents confirming the replacement of certain data. So, to change personal information, it is often enough to provide a passport with a new registration. When changing your last name, it is better to first change your passport, title and license, and then go to the insurance company.

Then he will certify the changes made with his signature and company seal.

Nuances

Since the electronic “vehicle citizenship” product is relatively new, there are still some nuances with its design and changes to it:

- Only the policyholder who has already taken out MTPL can issue an electronic contract for attractive vehicle insurance. The same rule applies to additional drivers: if the registered citizen has never taken out car insurance and has never been included in such a document, then E-MTPL will not be issued.

- The cost of an electronic insurance policy may increase when adding a new driver, if his class, age and experience require it. This is due to the fact that the tariff for compulsory motor liability insurance for several drivers is formed according to the highest coefficients among all entered ones.

- When communicating with traffic police officers and when an insured event occurs, it is best to have a printed E-MTPL policy. This is not required by law, but it can save a lot of time that law enforcement will spend verifying the authenticity of the insurance. Read more about ways to check an electronic OSAGO policy for authenticity online and offline in this material.

In general, E-OSAGO is a good, convenient and modern financial instrument. Yes, it has nuances that require corrections, but this happened at the very beginning of the introduction of paper compulsory motor liability insurance. It is better to start getting used to the new format of compulsory insurance policies now; there is a high probability that in the near future this will become the main way to insure a car.

RESO e-OSAGO

By purchasing a compulsory civil liability insurance policy online, you can not only save personal time, but also purchase the policy in a convenient environment. Therefore, calculating and buying a policy in RESO e-OSAGO using an online calculator today is a convenient way for all motorists.

Online calculator RESO e-OSAGO:

| Vehicle owner | |

| Place of registration of the owner of the vehicle | |

| Contract time | |

| Period of use of the vehicle | |

| Vehicle type | |

| Vehicle engine power | |

| Age and experience | |

| The contract is concluded | |

| Insured events for the 1st year | |

| Insured events for the 2nd year | |

| Insured events for the 3rd year | |

| Insured events for the 4th year | |

| Insured events for the 5th year | |

| Insured events for the 6th year | |

| Insured events for the 7th year | |

| Insured events for the 8th year | |

| Gross violations | |

| OSAGO policy price: | 7840,80 |

OSAGO insurance in

OSAGO occupies a leading position among the services provided by RESO. Among the insurance policies offered by the company, the most popular are:

- Standard OSAGO is mandatory for all car owners, providing for the payment of compensation to the party injured in the accident. In this case, compensation for losses falls on RESO, and the policy owner is released from financial responsibility.

- "RESO Auto-Help-Economy", like standard MTPL, protects the policyholder from expenses in the event of an accident. They are expected to visit the accident site by the emergency commissioner, organize emergency evacuation of the damaged vehicle and assist in eliminating the vehicle breakdown directly in road conditions. This service is most suitable for inexperienced drivers who want to further protect themselves.

- DGO, the liability limit allocated to the standard policy increases. If the funds paid under the main OSAGO policy are not enough, additional compensation is paid under the DGO, which covers damage caused to health, life and property of third parties.

What documents are required when applying for online compulsory motor liability insurance through the official RESO website?

When purchasing a policy electronically through the official website, you must provide:

- policyholder's passport;

- vehicle passport;

- vehicle registration documents;

- driver's licenses;

- maintenance document.

To buy an OSAGO policy online on the official website

First of all you need:

- Go to the official website of RESO.

- Go to the “Apply for a policy online” section.

- There, select the MTPL policy option that suits you. In case you haven't been a client yet.

- Create a personal page in your account that helps track the expiration date of the policy and its renewal on the website of this company, with participation in the “RESO” campaign, etc. To do this, you need to indicate your country of residence, enter information from your passport data - full name and date of birth, enter your mobile phone number and address of actual residence. Having agreed to work with your data, you need to enter the code.

- After the verification is completed, you receive a login; you need to come up with a password for your personal account and provide an additional email address for feedback. Attention, the code is entered from the SMS sent to your number.

- You can log into your personal account after entering your login and created password with a confirmation code.

- On the highlighted menu, on the left side, the item “Issue a policy” is indicated.

- When filling out the page, you must indicate the passport details of the insured vehicle: make, type, model, year of manufacture, power, number of passenger seats, etc., driver’s license and other documents for the vehicle.

- When you fill out the fields on the page, you need to click on “Calculate”. The calculation of compulsory motor liability insurance will occur automatically, according to the applicable tariffs and entered data.

- If the data is successfully verified, you will only have to pay for insurance, for example through an electronic card.

- After payment, the MTPL policy can be downloaded in PDF format.

You should have a printed document with you, which may make your communication with the traffic police officer easier and you will get rid of unnecessary troubles.

How can you save money by purchasing an MTPL policy?

You can save personal funds when purchasing an MTPL policy:

- Driving a car without accidents. For a year of accident-free use of MTPL insurance, an impressive discount on KBM is provided. Attention! The KBM coefficient is not tied to any vehicle, but to the driver personally.

- By purchasing compulsory motor liability insurance for a limited number of drivers. With an increase in the number of persons admitted to management, the cost of the policy itself increases, since the risk of an accident increases. It is preferable to enter the name of only one driver.

- By choosing a specific period of use of the car.

- Buying a basic tariff, since a standard MTPL costs significantly less than policies with additional bonuses.

- Using the OSAGO online calculator service, which helps calculate the price of a policy in different insurance companies.