Each contract for compulsory motor liability insurance that was concluded starting September 1, 2014, recorded in the Unified System of the Russian Union of Auto Insurers. Any insurance company, after signing the contract, is required to download information no later than 1 business day. Thanks to this, anyone can check the MTPL policy for authenticity. This will avoid problems due to the actions of attackers.

Each policyholder has the opportunity to find errors or typos in the policy, as well as find out whether the insurance is genuine or counterfeit. This will help you receive payments and avoid becoming victims of fraudulent activities.

How to independently determine the authenticity of a policy

You can check the reality of a paper version of an insurance policy quite simply - this can be determined visually. But to check e-OSAGO you will have to use the Internet.

Paper

In order to be sure of the authenticity of the insurance, you need to know the characteristics that the original must have:

- The paper should be thick, have red fluff on the front side, and a protective metal strip on the back side.

- The size is approximately 5 millimeters larger than an A4 sheet.

- Filling must be done exclusively by machine.

- The certificate form was printed by Goznak JSC; this is written at the bottom of the form on the front side.

- The RSA watermarks can be seen in the light.

- The paint does not wear off.

- The insurance company's seal is clearly visible.

- The certificate has a QR code.

To read a paper certificate using a QR code , you need to install a special application on your mobile device.

Electronic

An electronic MTPL policy may be invalid under the following conditions:

- A personal account was not created at the time of concluding the contract.

- The payment to the insurance agent is transferred to a personal card or electronic wallet, and not to the organization’s current account.

- The email with the policy was not sent from the insurance company's address.

- The letter does not contain insurance rules, instructions for checking validity, or accident notification forms.

- The policy does not contain an electronic signature.

Checking a policy issued online (E-OSAGO)

Based on the Decree of the Bank of Russia dated November 14, 2021 No. 4191-U, the websites of all insurance companies and professional associations of insurers are required to ensure uninterrupted and continuous activities for concluding compulsory insurance contracts in electronic form. Therefore, car owners can easily insure or renew insurance for the next year without leaving their home. The procedure for preparing a document in an online service is described in detail in many sources - we will not touch on this topic here, we are only interested in checking the authenticity of a document issued remotely via the Internet.

For all insurance companies in Russia, policy verification is the same. As a rule, after issuing an E-MTPL on the Internet, the insurance data immediately goes into the AIS RSA, only if the system is very busy, then this process can take one or maximum two days. In this case, after waiting, make another request.

When you already know for sure that the transfer of data to the database has occurred, go to the RSA website, in the provided field indicate the series (XXX - always for policies issued online), the policy number (only numbers are entered). After some time, a line with the status of the document is displayed.

Check the policy by number in the RSA database

When you see the policy status “held by the policyholder,” you can be sure that your insurance is valid.

But if the following messages appear, which are considered invalid statuses, you must immediately check with the insurer:

- lost;

- not valid;

- printed by the manufacturer (this means that it was not handed over to the insurer).

There is still a chance that you will see one - “is with the insurer”, which means that the data has not yet been updated in the RSA database, visit the site a little later and make sure it has changed.

Where and how to check your insurance for authenticity

It is useful for every car enthusiast to know how to check the authenticity of an electronic OSAGO policy. To do this, you need to go to the website of the Russian Union of Motor Insurers, where you do not need to register.

The action plan is:

- Select the “ MTPL ” section on the page.

- Go to the page "Checking the MTPL policy».

- Record information in the form.

- Enter the captcha to complete the verification.

- Click on the button "Search».

In addition to your own insurance, you can check the availability of insurance from another participant in a road accident, and also find out the list of persons who are allowed to drive a vehicle under this agreement.

The policy can have several statuses:

- Is located with the policyholder (that is, information about him has not yet been transferred to the RSA).

- Lost.

- The insurance period has expired.

- Printed, but not yet submitted to the insurance company.

The only resource from which information can be used in legal proceedings. It allows you to check the validity by the policy number, as well as by car data.

Check the OSAGO policy for authenticity in the RSA database

Fraudsters are extremely creative. Issuing false insurance policies is one of the most common ways to deceive people. Does the purchased policy protect you or does it act as a useless piece of paper? Find out this on the official resource of the Union of Auto Insurers of Russia - https://autoins.ru/. Registration, authorization in your personal account and other additional actions are not required.

To do this, go to the “ MTPL ” tab and find the “ Policy Check” item in the menu.

Enter the document details, go through the anti-bot check and click “ Search ”. The answer to checking the MTPL policy using the RSA database for authenticity will not be long in coming.

What can the system show?

- False policy or real one;

- The current value of the BM coefficient;

- Calculation of the approximate amount of insurance compensation - in the event that damage will be compensated under compulsory motor liability insurance.

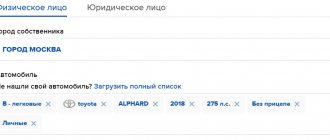

According to state car number and VIN

You can also check using the vehicle data. This helps determine whether you have insurance, as well as which insurance company issued it.

To check, you need to enter the state number, information from the PTS and STS. By indicating the last name, first name and patronymic, as well as the date of birth and driver’s license number, you can determine whether the driver is included in the insurance.

Why establish the authenticity of an insurance document using the RCA database?

Verification of the authenticity of the issued policy is necessary for the following reason. Insurance payments can be made only if there is a valid and necessarily genuine MTPL policy. If the document turns out to be invalid, the motorist is personally liable for damages and will do this out of his own pocket.

Either a completely fake policy or a stolen form that was lost by the insurer can be considered false. Even a policy printed in a typographical manner and containing standard details also falls into the category of fakes. To avoid problems with the authenticity of the document, you should check the policy. This way you can make sure that the car is really insured under MTPL.

The need for this check is due to the emergence of a significant number of fraudulent organizations on the domestic MTPL market. At the same time, the ways of deception are different. One option is to sell counterfeit MTPL policies that do not provide the right to receive insurance payments.

Using a fake policy poses considerable risks, in particular:

- refusal to register a vehicle by traffic police officers;

- If you contact the insurance company to receive compensation for damage caused, this may be considered a violation of the law.

In order not to encounter such difficulties, you need to pay close attention to the issue of checking the purchased policy . A valid document will entitle you to enjoy all the benefits of the insurance.

Is it possible to find out the car number using the MTPL policy?

You can get information about whether a car is insured or not if you know the contract number. When you enter information about it on the RSA website, all the key information will be displayed. It will also include vehicle license plate information.

This is basic information that every motorist should know in order to avoid problems with the law.

It is recommended to check car insurance information in a timely manner, because an expired or falsified policy is a direct violation of the law, often leading to criminal consequences. And even if the new owner of the car did not know about it, this ignorance will not free him from responsibility and fines.

How to find old insurance?

How to find previous insurance? If the issued policy is lost or destroyed, you should contact the insurance company whose insurance policy you needed. In accordance with the law, all contracts and copies of policies are stored in archives and policyholders have the right to restore data upon request, unless this contradicts the law and the company's Charter. What information about the MTPL policy can be obtained by its number? Through official sources, the MTPL insurance number allows you to find out the status and validity period of the policy, as well as data about the car. This information can be obtained from the Union of Auto Insurers.

In the event of an accident, they require from the culprit not only the OSAGO contract number, but also his full name. This is due to the fact that the databases are compiled manually and there is a risk of information distortion. For example, during the verification of the validity of the policy, it is discovered that the insurance is registered under the data of a fictitious person, although the number of the vehicle and the policy do not cause disagreement. In this case, the insured is required to write a request to his insurance company with a request to correct the incorrect data.

Find all your previous MTPL policies

This function will allow you to obtain the following information:

- The presence or absence of accidents, both for the driver and the vehicle

- All detailed information on registered insurance cases

- The period for which the car is insured and until when (specific date)

The form can also be filled out at the insurer's office. Why might the KBM be calculated incorrectly? KBM is the bonus-malus coefficient, in simple words it is a driver’s discount card when taking out an MTPL policy, the maximum discount can reach 50%. It takes years of accident-free driving to accumulate a certain discount. Often on forums, motorists ask the question: “Why was my KBM not counted, or was it calculated incorrectly?”

Unified MTPL database (check policy)

Important This form is for checking both paper policies and electronic policies of the XXX series purchased via the Internet! Usually, electronic insurance is included in the database immediately after registration, but sometimes due to the workload of the database, this can take several days.

The correct status for valid insurance is “held by the policyholder” (but if immediately after purchase the status is still “held by the insurer”, then this may be normal - the agent may not have had time to make changes to the database, wait a couple of days and only then sound the alarm) .

Definitely “bad statuses” of an MTPL policy are “lost in force” (why exactly it lost force can be seen in more detail by checking below) or “lost”. The status “printed by the manufacturer” means that such a form was not even handed over to the insurer.

How can I restore the KBM without the old insurance if there are no policies for previous years?

In other words, on the same website you can check the authenticity of the contract in two ways. Read on to learn how to online check an electronic MTPL insurance policy for authenticity using the PCA database using the VIN code and car number.

To do this, go to the RSA website. Now we need to indicate the VIN number, vehicle number, body number and chassis number.

Having specified all the data, you will see a window that will contain information about the series and number of the contract, the name of the insurance company and the number of persons allowed to manage it.

Checking the insurance policy

Such a check does not give 100% confidence that you have a valid policy (after all, fraudsters could make a “duplicate” of the real form), but it allows you to reject obvious fakes and stolen forms. But in order to exclude “duplicates” you need to check which car is insured under your policy... 2.

Find out which car is insured using a specific form. In addition to the license plate number, VIN code or body number, in the results you can find out a more detailed status of the form, for example, why the insurance is not valid (the contract could have been terminated early or the policy could have been lost by the insurance company): 3.

Attention Find out the MTPL policy number by license plate number, VIN or body number + check whether the driver is included in the insurance. This check is the reverse of the previous one, here, based on the car’s data, you will find out which insurance company it is insured with, the policy number and its type (limited or unlimited). Checking by VIN is the most complete.

How to check the authenticity of a compulsory insurance policy based on your last name?

The main reasons for the incorrect calculation of the KBM discount:

- If the driver replaced his driver’s license, the insurance company could mistakenly fail to indicate his new number in the AIS RSA database, which would entail resetting the KBM and equating it to the initial level - 1

- If the driver was included in several policies over the last year, and in the first of them he was listed alone with a KBM, for example, 0.5. In another, several drivers were entered with a coefficient of less value, then the insurance company could simply make a mess and calculate the wrong bonus-malus. Before the restoration procedure, you need to find out the number of policies in which it was included

- The human factor, for example, an employee of an insurance company made a mistake when entering data into the AIS RSA.

How to find out your MTPL insurance history

Please note: Enter information about the vehicle strictly as it is indicated in the PTS and STS. The best option to avoid mistakes would be to rewrite all the necessary information from the expired MTPL policy, because it was in this form that it was entered into the unified RSA database.

The insurance agent entered the information incorrectly when he first took out insurance for you. If you are sure that you are entering all the information correctly, then perhaps the mistake was made not by you, but by the insurance company employee who originally entered the data into the database.

To solve this problem online, write to the technical support of the insurance company’s website. How to distinguish a fake OSAGO policy from a real one Of course, there is another way to detect a fake - visually. To check the OSAGO form, take it in your hands and evaluate its dimensions.

It should not exceed the size of an A4 sheet.

How to find out your MTPL insurance history?

Secondly, such a service is useful for car owners themselves, because having an accident-free insurance record in one company and taking advantage of an already determined discount on the cost, suddenly the company closes and the owner automatically loses his status. Thanks to BSI, both parties are now more secure.

Insurance companies have begun to expose the scammers, and owners are receiving their earned discount, despite changing companies. Advantages and disadvantages of creating a BSI The advantages of such a service are completely undeniable:

- Exposing scammers

- It is inadmissible to issue several policies simultaneously for one vehicle

- Preservation of the owner’s positive driving history, even if the insurance company has closed its activities, etc.

Previously, before the advent of BSI, a fraudulent trick was common: up to 3 MTPL policies were purchased for one car at once.

This service helps you find an MTPL policy in the database by car number, after which you can easily check the insurance contract for its validity period using the first method, which we described at the very beginning of the article. Possible options when checking a policy Situations are different, but you should not rush to conclusions.

However, if you end up with one of the options described below, then the insurance is not valid. 1. Cannot find the MTPL policy. In this case, the auto insurance contract is fake and should be replaced. 2. The policy has not been issued.

If the status says “Hosted by the insurer,” then you only have a copy of the contract in your hands, and the original remains with the insurer. 3. Lost power. The MTPL policy was previously issued to you, but due to some reason it was canceled. 4. Insurance is expired.

What it is?

First of all, let’s figure out where exactly on the insurance policy form the so-called number we are interested in is located. Basically, all forms of insurance policies in the form of compulsory motor liability insurance have a green tint and approximately the same structure.

If you look directly at the document, the insurance policy number will be listed at the top right of the document . As a rule, this is a 10-digit numeric code that characterizes the code of the department that issued this document, as well as other features that are known only to employees of the insurance organization.

The insurance policy number is entered into a unified database of Russian auto insurers. Basic information on the form is attached to this code, which can be obtained by anyone who owns the data about the number. Thus, using the policy number, one can easily determine the validity period of the form, its owner, as well as other necessary data about the car and its owner.