We are going down the path of appeal.

In relation to “automatic” fines, a special procedure has been established for appealing decisions. The basis for it is the fact that at the time the violation was recorded, the vehicle was in the possession or use of another person (Article 2.6.1 of the Code of Administrative Offenses of the Russian Federation). Obviously, for the owner-legal entity this basis is always met.

Thus, the first path that an organization can take is to appeal the decision to impose administrative liability for violations recorded automatically. This must be done within 10 calendar days from the date of receipt of the “letter of happiness”. The complaint must indicate the decision number, describe the circumstances of the case, and also the fact that the car was under the control of another person at that time. Further, with reference to Art. 2.6.1 of the Code of Administrative Offenses of the Russian Federation to demand that the organization be released from liability. The complaint is signed by the head or other person who has the right, on the basis of the Charter or a power of attorney, to act on behalf of the organization in relations to appeal decisions on bringing to administrative responsibility.

Attached to the complaint are copies of documents certified by the organization’s seal that confirm that a third party was driving the car at that time. This is, first of all, a waybill or a one-time power of attorney, as well as documents that confirm the actual transfer of the car on that day. If the car was transferred to a third party for a long period of time, you must also submit a lease or loan agreement or a power of attorney and a transfer deed. It would not be amiss to attach a copy of a document certified by the organization that confirms the person’s authority to sign it: an extract from the Charter and the protocol (decision) on the appointment of a manager, an order on the appointment of a deputy, a power of attorney, etc.

All this is sent to the official who issued the decision on the administrative offense, who within three days must transfer the case materials to a higher authority of the traffic police. You can also send documents directly to a higher authority of the State Traffic Safety Inspectorate (Article 30.2 of the Code of Administrative Offenses of the Russian Federation).

The traffic police must consider the complaint within 10 days and notify the organization of the date, place and time of the meeting on the case, and its representative can participate in this event. During the consideration of the case, the facts indicated by the organization may be recognized as reliable or unreliable. In the first case, the decision to impose a fine on the organization is canceled and the fine is re-imposed on the driver in the usual manner: with the drawing up of a protocol and observing the presumption of innocence, so that he finds himself in a more advantageous position. In the second case, the decision is not canceled and the decision of the inspectors can be appealed to a higher authority of the State Traffic Safety Inspectorate or an arbitration court (such a complaint is not subject to state duty).

Is it possible to appeal driver fines issued to a legal entity?

Judicial practice shows that it is possible.

The owner of the car is released from liability if, during the consideration of the complaint against the decision, it is established from the camera that at the time of recording the vehicle was in the possession or use of another person (Part 2 of Article 2.6.1 of the Code of Administrative Offenses of the Russian Federation).

It is necessary to collect evidence that a specific driver was driving at the time of the violation. The RF Supreme Court indicated that the following can be used as evidence:

- power of attorney for the right to drive a vehicle;

- MTPL policy if the driver is included in it;

- rental or leasing agreement for a vehicle;

- testimony of witnesses and (or) the driver.

The organization can additionally provide a waybill with a note about the duration of the driver’s shift.

As a rule, courts of first instance refuse to appeal to legal entities and indicate that they are responsible for the actions of their drivers. But there are cases when organizations reached the Supreme Court, and it made a decision in their favor (Case No. 45-AD14-12, Case No. 48-AD16-4).

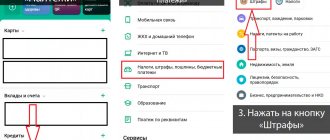

If you need help appealing fines, enter the UIN of the decision on the appeal page from the Online State Traffic Safety Inspectorate service. For small fines, the service will automatically create a written complaint and tell you what documents to attach and where to send it. Our lawyers will help you with large fines and controversial situations.

Legal assistance with appealing fines

Appeal the fine

We pay and collect

Can an organization take a different route: not appeal the decision, but pay a fine and subsequently recover the amount from the true culprit? Let's figure it out.

I think there is no doubt that the organization can pay the fine: the decision was made specifically against the company. In this case, the employee is obliged to compensate the employer for direct actual damage caused (Article 238 of the Labor Code of the Russian Federation), which means a real decrease in the latter’s available property. Payment of a fine received by an organization actually due to the fault of an employee entails a reduction in the employer’s cash assets (in the form of money). However, in this case it is impossible to talk about full financial responsibility for committing an administrative offense confirmed by a government agency (clause 6 of Article 243 of the Labor Code of the Russian Federation). After all, in accordance with the resolution on bringing to responsibility, the offense was committed not by the employee, but by a legal entity. Therefore, liability occurs only within the limits of the employee’s average earnings (Articles 22, 241–243 of the Labor Code of the Russian Federation).

To recover damages, the employer must issue an appropriate order within a month from the date the organization paid the fine. Based on this document, the accounting department withholds the required amount from the employee’s salary (Article 248 of the Labor Code of the Russian Federation). In this case, no more than 20 percent can be withheld at a time (Article 138 of the Labor Code of the Russian Federation). If the month period is missed, you will have to either obtain the employee’s written consent to compensate for the damage, or apply to the court to recover it (Article 248 of the Labor Code of the Russian Federation).

Now let's look at tax issues. Fines and other sanctions imposed by government agencies (clause 2 of Article 270 of the Tax Code of the Russian Federation), paid by the organization, including for violation of traffic rules, cannot be included in expenses. But the amount received from the employee is necessarily included in income. Since clause 3 of Art. 250 of the Tax Code of the Russian Federation requires that amounts of compensation for losses or damage be included in non-operating income. It turns out that refusal to appeal the decision and payment of a fine with the subsequent recovery of this amount from the employee entails an increase in the organization’s tax liabilities.

DRIVE2 communities and traffic police Blog A fine came, but another person was driving

2. The running of the statute of limitations provided for in Part 1 of this article is interrupted if a person held administratively liable evades execution of the decision to impose an administrative penalty. The calculation of the statute of limitations in this case is resumed from the day of discovery of the specified person or his things, income, on which, in accordance with the resolution on the imposition of an administrative penalty, an administrative penalty may be applied.

1. The validity of the fine is valid for 2 years, but for a decision that has entered into legal force! That is, during this period they may charge you a fine and charge you under Article 20.25 for non-payment. After 2 years, if you have not paid the fine, it will be canceled. 2. The statute of limitations for administrative offenses is 3 months. Art. 4.5 Code of Administrative Offenses of the Russian Federation. If no ruling was made against you within this period, then they no longer have the right to prosecute you.

GURUGLAZ, buddy, what kind of nonsense is this? As I understand it, if the culprit agreed, he would simply give the money for the fine. and why would the department that issued the fine send his passport details and registration? he will then say “it wasn’t me, it’s all a lie...” and then what?

Fine for the car owner (read more...)

I bought a car, wrote a purchase and sale agreement, didn’t register it in my name and sold it to another owner, the other owner also didn’t register it in his name and put it in a place where there was a playground and went into the army, now I’m getting fines that it’s worth it and is in the way, what should I do when I sold it to someone else? I didn’t write a purchase and sale agreement to the person, but the real owner gave my agreement with him to the traffic police.

Good evening Natalia, of course, problems may arise during registration, this issue must be resolved with the seller during the conclusion of the purchase and sale transaction, and if necessary, clauses relating to these issues must be written down in the DCP - signed by the seller.

Fine for car owner

Contact the traffic police with a purchase and sale agreement and inform that the car was driven by another person, the owner, and also write an application for deregistration of the car in your name. You will be denied withdrawal, but this will be proof of your application. If you pay the fines, you acknowledge that the car is yours and you were driving it.

I sold the car and, due to my own carelessness, did not ensure that it was re-registered on time. The new owner managed to receive fines in the amount of about 20,000. When I found out about this, the bailiffs had already imposed penalties and seized the car. I can’t hand it over to the archives, the cards were seized, and going to court is not an option at the moment either. Can I somehow remove the seizure of the car from the bailiffs using the DCP, hand it over to the archives, and later, through the court, collect everything from the new owner?

We don’t complain or charge

And finally, the organization can take the third route: pay the fine without further collecting this amount from the employee. As a rule, this happens if the car was driven by the head of the organization or the violation was committed due to official necessity: for example, the passenger was late for the train or the airport. I’ll say right away that there is a legal basis for this (Article 240 of the Labor Code of the Russian Federation).

However, when using this right, the employer is faced with a tax problem: is it necessary to charge personal income tax on the amount that it was decided not to collect from the employee? The position of the Russian Ministry of Finance is clear: if the employer does not recover damages from the guilty employee in the form of an “automatic” fine, the latter will receive income in kind (see letter dated November 8, 2012 No. 03-04-06/10-310).

But one can argue with this. After all, income, according to Art. 41 of the Tax Code of the Russian Federation, economic benefits in cash or in kind are recognized, determined for individuals in accordance with Chapter. 23 Tax Code of the Russian Federation. The rules for determining income in kind for personal income tax purposes are established in Art. 211 of the Tax Code of the Russian Federation. These include full or partial payment of any benefits for an employee: goods, work, services or property rights. In the case under consideration, the organization pays the fine not for the employee, but for itself as the owner of the vehicle (Article 2.6.1 and Part 1 of Article 32.2 of the Code of Administrative Offenses of the Russian Federation). And even more so, payment of a fine cannot be considered payment for goods (work, services) or property rights in the interests of the employee.

Thus, if an organization refuses to recover damages in the form of an administrative fine accrued to it due to the actions of an employee, income subject to personal income tax does not arise. Tax risks can be reduced without carrying out the procedure for establishing damages recorded in the Labor Code of the Russian Federation, i.e. accept a fine against the organization and not draw up documents to establish the damage, the person at fault and the refusal to collect this amount from the employee.

Liability without an inspector

It is important for an accountant to know about three features of bringing to responsibility for violations that are recorded by a device operating in automatic mode (see Articles 2.6.1 and 28.6 of the Code of Administrative Offenses of the Russian Federation):

- it is not the driver who is involved, but the owner of the vehicle;

- the procedure is shortened: the decision is made without the participation of the “accused”; there is no stage of drawing up a protocol, familiarizing with it, or considering objections;

- the presumption of innocence does not apply: when appealing such a decision, the owner is obliged to provide evidence that he was not driving the car.

Sample complaint against a decision in .doc and .pdf format

Sample order to recover the amount of damage caused from an employee in .doc and .pdf format

Rewrite video recording fines

Please tell me what to do in my situation. Two vehicles are registered in my name and fines are sent to me (the owner) via video recording. How to transfer fines to another person from last year?

Have the fines been paid? And then too much time has already passed. In general, how is this done: Write a statement to your center for automatic recording of administrative offenses stating that a relative was driving at that moment, and attach the relative’s explanation. In relation to you, administrative proceedings are terminated, and in relation to a relative, they are initiated. In different regions, practice may be slightly different; in our country, for example, traffic cops first drive up and personally re-interview the relative.

Please tell me what to do in my situation. Two vehicles are registered in my name and fines are sent to me (the owner) via video recording. How to transfer fines to another person from last year? It took pure administrative practice to get the job done.

Paying a traffic police fine for another person (read more...)

Yes, anyone can pay the fine, since it is paid according to the resolution number, but the question will arise about transferring the check for payment to another person, since if the fine was imposed by a court, then the check must be submitted to the court, and if it was issued by an inspector, then the fines will not apply always removed from the database, and again they may be fined.

I paid a fine for another person, my last name is indicated on the check, and the payment form contains the name and name of the person for whom I paid. Will the traffic police take into account the fine? Or is it necessary that the payer be the one who is subject to the fine?

Paying a traffic police fine for another person

A situation has occurred. Another person is driving my car, he drives into the oncoming lane, the traffic police stops him and issues a fine. As a result, this person did not pay for it, and it comes to me as the owner of the car. Tell me what to do in this situation.

The owner of the car receives a fine if the offense is recorded by cameras operating in automatic mode, and the traffic police officers make a decision against the person who committed the offense and it cannot come to you.

How much can be withheld from an employee’s salary and what are the withholding periods?

The amount of deduction cannot exceed 20% of the salary amount. If the amount of damage is more than 20%, the employer can recover the remaining money only from the next salary (Article 138 of the Labor Code of the Russian Federation).

The withholding order must be issued no later than 1 month from the date the employer establishes the amount of damage. Usually the period is counted from the day the fine is paid. If a month has passed, money can only be withheld with the written consent of the employee or through the court (Article 248 of the Labor Code of the Russian Federation).

The total amount of the penalty cannot exceed the employee’s average monthly earnings (Article 241 of the Labor Code of the Russian Federation). If the actual damage is greater, you can agree with the employee on voluntary compensation or file a claim in court.

The driver is required to reimburse only the amount of the fine. If the legal entity does not pay the fine on time, all additional losses will have to be paid by itself.

For example, if an organization received a fine of 500 rubles and did not pay it, the fine will turn into a loss of 11,250 rubles:

Of this amount, only 500 rubles can be withheld from the driver for traffic violations. He is not to blame for the remaining losses: the organization itself must ensure timely payment of fines.

With any method of retention, the organization must receive fines on time so as not to miss the deadlines for appealing or collecting damages. Control fines automatically with the Online Traffic Police service. The service will send a daily report on new decisions by email and help you pay for them in a couple of clicks.

Control of fines for legal entities

Do you want to find out about all the organization’s fines on time and pay them at a discount?

Try for free

Don't miss new useful publications

We will tell you about the intricacies of the legislation, help you understand it and tell you what to do in controversial situations.