Purchasing a car requires a large investment. Obtaining a car loan allows you to reduce the one-time burden on your budget. However, even the use of this method does not make the car accessible to all categories of citizens. To simplify the purchase of a vehicle and promote the domestic auto industry, the state comes to the aid of borrowers. First-time car buyers can take advantage of the First Car program. It began to operate in the summer of 2021, in accordance with the resolution of July 7 No. 808. From July 30, 2021, the program was extended by government decree No. 870 and, according to the Ministry of Industry and Trade, will be valid until 2021.

In accordance with Government Decree No. 870, the specifics of providing state aid have undergone some changes. In order to increase the availability of Russian-made cars for residents of the Far East, the discount provided under the First Car and Family Car social programs in the Far Eastern Federal District has been increased to 25% of the cost of the purchased car.

Attention! If you have any questions, you can chat for free with a lawyer at the bottom of the screen or call Moscow; Saint Petersburg; Free call for all of Russia.

The approval of Government Resolution No. 870 does not renew the “First Car” and “Family Car” car loan programs in 2018, but allows banks to reimburse part of the costs incurred as a result of providing a discount on the down payment within the framework of the above programs, and will also allow for the reimbursement of lost income for loans issued in 2015-2017 to citizens for the purchase of vehicles.

The “First Car” and “Family Car” programs in 2018 were valid from January 1 to May 16. A special program for citizens of the Far Eastern Federal District, launched on April 11, 2021, continues to operate to this day.

The issue of implementing the preferential car loan programs “First Car” and “Family Car” in 2019-2020 is being studied by the Ministry of Industry and Trade and the Ministry of Finance.

Conditions

Any citizen of the Russian Federation who is independently purchasing a car for the first time in his life can take advantage of the “First Car” program in 2021. A person will be able to receive a 10% discount on the purchase of a car. The service is valid only for the first vehicle purchased on credit. In 2021, its cost should not exceed 1.5 million rubles, and its weight should not exceed 3.5 tons. As part of the program, you can only purchase a car that was assembled in the Russian Federation. The car loan will have to be paid off within 3 years.

Features of the program

In general, state car lending has certain differences from the standard installment plan for vehicles, which is offered by many banks. The opportunity to apply for a preferential car loan is provided only if the applicant meets a number of requirements.

It is important to know! Moreover, the loan characteristics are the same for each client who uses the government subsidy program.

Main conditions

It is important to remember that a car loan under the state program is not the same as a regular loan from a bank. Therefore, there are strict requirements and rules for provision.

The main conditions include:

- The maximum cost of a vehicle is RUB 1,450,000;

- A domestically produced car (or a foreign brand, but assembled on the territory of the Russian Federation);

- The car was produced no earlier than 2016;

- The loan is provided exclusively in national currency;

- The Bank has the right to simultaneously provide additional insurance;

- Maximum repayment period – 3 years;

- The loan is given only for a new vehicle;

- Purchases are made exclusively in the showrooms of official dealers.

Thus, a car loan with state support in 2021 allows you to obtain funds for the purchase of a car manufactured in the Russian Federation, the price of which does not exceed 1.5 million rubles. In this case, you need to repay the cost with interest no longer than 3 years. For many categories of the population, such conditions are more favorable than in conventional banks, even despite a number of restrictions.

Requirements for borrowers

Banks participating in state subsidy programs make certain requests for citizens who want to receive an installment plan to purchase a car. Due to this, credit institutions can protect themselves from potential damage.

Basic requirements for participants in the state program:

- Mandatory presence of Russian citizenship;

- Age from 21 to 65 years;

- Absence of a child under 6 months in the family;

- Impeccable credit history;

- Constant earnings and income.

Attention! It should be remembered that not every bank participating in the state program provides a car loan without a down payment in Moscow or other cities. Therefore, this factor must be taken into account in advance.

Vehicle requirements

The list of cars offered for purchase on a car loan with government support is strictly limited. It includes common domestic and foreign models, the weight of which is no more than 3.5 tons. One of the main conditions is that the car must be new and purchased from a dealership. Moreover, its price should not exceed 1.5 million rubles.

How to participate?

To take advantage of the “First Car” government program, you should contact a bank or car dealership. A potential program participant must meet a number of requirements. Necessary:

- obtain a driving license;

- have Russian citizenship;

- do not own other cars until participating in the state program.

The funds provided by the state can be used to reduce the loan amount or used as a down payment. Those who purchase a car with cash do not receive a discount from the state.

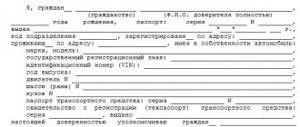

Required documents

If a citizen plans to take part in the “First Car” state program, a driver’s license will be required. Without them, you will not be able to take advantage of the offer. The list of additional documents depends on the requirements of the selected financial institution. Usually needed:

- passport of a citizen of the Russian Federation;

- income certificate;

- documentation confirming the absence of ownership of the car;

- document confirming official employment;

- SNILS and INN.

Experts advise first contacting the bank and finding out the exact list.

How to take part in the “First Car” state program in 2018

If you meet all the requirements of the program and want to take part in it, you only need two documents:

- Passport.

- Driver license.

You will also be asked to sign a pledge not to use other car loans this year. This is necessary to ensure that the same person does not use the state program twice.

The maximum loan term under this program is three years.

Step-by-step instructions for purchasing a car under the “First Car” state program in 2021

Having made sure that participation in the state program is available, the citizen can proceed directly to the registration procedure. To do this you will need to do the following:

- Contact a bank or car dealership and submit an application. The list of institutions participating in the program is limited. It is better to study in advance the list of banks ready to provide the service. Contacting a car dealership saves time. The organization allows you to submit an application to several institutions at once. However, not all car dealerships cooperate with banks that provide funds under the 2021 First Car government program. This fact is worth taking into account.

- Present a driver's license and a package of documents. The list will need to include papers confirming the complete absence of cars in the property before participation in the state program. A credit history check will then be performed.

- Wait for the bank's decision. The standard application analysis process takes 3-14 days. However, preferential lending implies an increased period for studying the application. The answer will be given within a month from the date of application.

- The citizen will then be contacted. If the bank agrees to issue funds under the “First Car” state program, the citizen will have to leave a receipt confirming that he will not take out other cars on credit for a year. The requirements are imposed to ensure that a person is not able to take advantage of the discount again.

- Complete the registration procedure. The lender will automatically transfer the money to the seller's account. Car loans and subsidies are not issued in person. When the calculation is made, the person must receive documents for the car and complete the registration procedure with the traffic police in accordance with the requirements of current legislation. Then the title of the vehicle is transferred to the bank. The documents will be stored there until full settlement with the financial institution.

When the registration procedure is completed, the person becomes the full owner of the vehicle. However, the list of legal actions that can be performed with a car is limited. A citizen will not be able to sell a car without the bank’s permission or donate it.

State program “First car” 2017-2018: conditions, how to apply

The popular state program “First Car”, successfully operating in 2021, will be extended for another year. We tell you in detail how to become a participant and under what conditions.

Attractive? Quite!

The state program, which was decided to be extended until 2018, allows you to buy the first car in your life on favorable terms.

Russian drivers could purchase their first car for personal use under the state program in 2021, but next year the conditions for participation have not yet changed. A borrower who takes out a loan from a bank receives a 10% compensation of the down payment from the state if he meets the following criteria:

- has Russian citizenship;

- has a valid driver's license;

- did not previously own a car.

The borrower also agrees not to enter into other loan agreements for the purchase of a car, and this intention must be confirmed in writing. The previously existing criterion of no other outstanding car loan taken out in the last 5 years has been abolished.

An important condition is to have a driver's license. If it is confiscated for violating traffic rules, lost, stolen, etc., then you will have to wait a little while drawing up the contract. You also cannot take a car using the passport of an elderly grandmother or register it in the name of a minor, but you can take out a loan the very next day after receiving your license (the date of issue does not matter).

On a note! It is impossible to buy a car under the state program entirely in cash, so the buyer will have to sign a loan agreement with the bank to receive compensation.

Bank criteria

It should be remembered that a specific bank participating in the auto industry support program will put forward additional criteria for the borrower. The most common:

- age restrictions: from 18 to 60-65 years;

- availability of regular income (official employment);

- work experience (from 3 months or more);

- permanent registration;

- willingness to insure purchased vehicles.

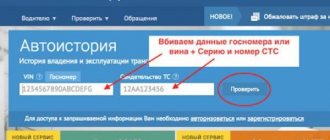

The presence of a previously purchased car will be checked using the traffic police database (some banks require a certificate from the State Traffic Inspectorate) and the borrower’s credit history, while ownership of motor vehicles is not a reason for refusing to issue a loan.

Important! The government has limited the maximum rate on car loans in this area to 11.3% per annum (for other similar loan offers without government support - 15-16%).

Large banks such as VTB24, Rosbank (Rusfinance Bank) and Sberbank participate in preferential lending programs. On the official website of the chosen credit institution, you should definitely clarify the full conditions, as well as additional ones, for example, whether it is possible in the future to change insurance or transfer the vehicle for use to third parties.

What can I take and where can I go?

For socially significant projects, the government has selected passenger vehicles that meet a number of criteria:

- the cost does not exceed 1.45 million rubles. (previously – one hundred thousand cheaper);

- maximum weight – up to 3.5 tons;

- year of release – no later than 2021

Important! The loan is provided for a maximum period of 3 years.

Those wishing to purchase their first car under the extended state program in 2021 are probably interested in which cars are included in the list. These are still products of the Russian automobile industry or foreign cars assembled on Russian cars, Nissan, Volkswagen, Skoda, etc. Full lists of vehicles provided should be studied on the bank’s website.

The passenger car must comply with the parameters set forth in government decree 719, including during production the permitted technologies for body welding, painting, etc. must be used. But it will definitely be a budget model with a minimum configuration.

To purchase, you should select a suitable car from a dealer, and then draw up an agreement with him, making sure that the partner bank that provides the loan to the car dealership buyers participates in the preferential car loan program.

On a note! The easiest way is to check the list of partner dealers on the credit institution’s website, and there you can study the additional conditions for providing a loan from the bank.

How much will they compensate?

You will be able to take out the first car in your life on credit with some restrictions, because only cars worth no more than 1.45 million rubles participate in the state program - this is one of the mandatory conditions. Thus, it turns out that the maximum discount by which the initial payment will be reduced will be 145 thousand rubles.

Important! An automaker can also offer good conditions when its special programs are combined with the benefits of preferential government loans.

Participants in the “First Car” state program will be exempt from paying taxes in 2021. This decision was made by the Ministry of Finance, and the entry into force of adjustments to Article 217 of the Tax Code of the Russian Federation was approved by Duma deputies from November 2021. Personal income tax will not be charged for the 10% that are compensated from the federal budget.

Possible disadvantages

Before buying a car under the “First Car” state program, economists recommend calculating the final overpayment. It may well turn out that the dealer’s current promotion for a specific brand will be more profitable than the conditions of the state program.

RBC analysts recalled the following negative aspects that accompany the issuance of a preferential loan. According to government regulations, the down payment must be at least 20% of the cost of the car (half of which is paid by the government), while for other car loans there may be no down payment. Although the need to deposit money immediately depends on the chosen bank.

In addition, standard car loans do not limit the number of cars purchased. You can buy as many of them as your financial capabilities allow. As part of the “First Car” state program in 2021, as in previous periods, the conditions clearly stipulate not only how to complete the purchase, but also that at a discounted price it can be the only one in the buyer’s life.

The “First Car” state program has been in effect since the first days of 2018, but until what date it will last is still unknown. The fact is that to support the domestic automobile industry, a certain amount is allocated annually, calculated for a specific number of personal vehicles (in 2021, this is about 30 thousand cars). If they are sold out before the end of the year, the program will either be curtailed or extended with additional funds from the federal budget.

List of models

As part of the “First Car” state program, you can only purchase a car that meets the requirements. You can get a discount on a new vehicle. Used cars are not eligible for the program. The cost of a car in 2021 should not exceed RUB 1,500,000. The vehicle must be assembled on the territory of the Russian Federation. You can even purchase a foreign-made car within the program if the above requirements are met.

In order to simplify the choice of car, the law clearly sets out the list of vehicles that can be purchased under the program. Their list is presented in the table below.

| Car brands participating in the state program | |

| Nissan X-Trail | Kia (Rio, Cerato, Sorento) |

| Ford Kuga | Volkswagen Tiguan (1st generation) |

| Datsun (on-DO Access 2021, mi-DO Access 2017) | Chevrolet Niva |

| Mitsubishi Outlander | Toyota (RAV4, Camry) |

| Volkswagen (Jetta, Polo) | Hyundai (Creta, Solaris) |

| Mazda 6 | Mazda CX-5 |

| Renault (Logan, Sandero Stepway, Sandero, Kaptur, Duster) | Nissan (Almera, Terrano, Qashqai, Sentra) |

| Ford (Fiesta, Focus, EcoSport, Mondeo) | Skoda (Yeti, Octavia, Rapid) |

| Lada (Granta, Vesta, Largus), UAZ | Chinese car brands |

The list of car brands for preferential car loans can be updated and supplemented.

What cars are available under the program?

Not only is a complete list of cars under the program available on the Internet, but it is also possible to use a car loan calculator with state support provided in 2021. The list of cars that can be purchased is periodically updated. The most popular vehicles are presented below.

| car brand | Available models |

| KIA | • Rio • Cerato |

| Mazda | • 6 • CX – 5 |

| Nissan | • Almera • Sentra • Terrano • Qashqai |

| Toyota | • Camry • Corolla • RAV 4 |

| Renault | • Duster • Logan • Sandero • Kaptur |

| Ford | • Focus • Fiesta • Mondeo • EcoSport |

Among domestic vehicles, AvtoVAZ and UAZ cars are offered. The list of available machines is wider, and all models meet the requested requirements.

Participating banks with annual rate and down payment

Financial organizations are providing funds under the “First Car” state program in 2021. Not all companies have an offer. The list of credit institutions is published on the official website of the Russian Ministry of Industry and Trade.

- JSC "Gazbank";

- Cetelem Bank LLC; (Since December 22, 2014, Sberbank has been accepting applications for car loans only through its subsidiary Cetelem Bank.)

- PSA BANK Finance Rus LLC;

- PJSC VTB24;

- Volkswagen Bank RUS LLC;

- JSC MS Bank RUS;

- PJSC BANK URALSIB;

- PJSC NCB "RADIOTECHBANK";

- JSC "TatSotsBank";

- PJSC Sovcombank;

- PJSC "SAROVBUSINESSBANK";

- JSC RN Bank;

- Rusfinance Bank LLC;

- PJSC "Plus Bank";

- PJSC JSCB "Energobank";

- JSC UniCredit Bank.

The list of banks participating in preferential car loan programs may be updated and supplemented.

When choosing a suitable bank to start cooperation with, you should familiarize yourself with the data in the table below.

| Name of financial institution | Terms of cooperation | |

| Minimum loan overpayment amount | Starting payment | |

| VTB 24 | 5,5% | 0% |

| Rusfinance Bank | 6,7% | 0% |

| URALSIB | 8% | 0% |

| UniCredit | 6,5% | 10% |

| VOLKSWAGEN BANK RUS | 6,5% | 25% |

Personal income tax under the “First Car” program 2021

In 2021, the law equated the subsidy to a citizen’s income and required him to pay taxes. Personal income tax of 13% was charged on the amount. From the beginning of 2021, according to Federal Law No. 335 of November 27, 2017, the rule is canceled. Now a citizen who has taken part in the “First Car” program is not required to contribute funds from the provided amount to the state treasury.

Taking into account the social significance of both programs, the Ministry of Industry and Trade of Russia initiated changes to Article 217 of the Tax Code of the Russian Federation in advance in order to avoid taxation of individuals who use the preferential car loan programs “First Car” and “Family Car -

said the Minister of Industry and Trade of the Russian Federation Denis Manturov.

Where can I get a soft loan?

Many banks that are on the top list of reliability according to the Central Bank of the Russian Federation offer car loans with government subsidies. The list of dealers and organizations available in the region must be specified separately for each subject of the Russian Federation.

All credit institutions are also subject to certain requirements to participate in the program:

- Has no debts on taxes, fees, fines and interest.

- There are no overdue debts for the return of subsidies to the budget.

- The organization does not go through the process of liquidation, restructuring or bankruptcy.

- Not a legal entity of a foreign state.

- It is not a legal entity in whose authorized capital foreign states registered in offshore zones participate.

- Has a concluded agreement on the provision of information with a credit history bureau.

Examples of financial institutions and the lending programs they provide:

- "Credit Europe Bank". Auto loan “Our people”.

- "Setelem Bank". Car loan "Lada Finance".

- "Rusfinance Bank"

Registration and control over credit institutions admitted to participate in the program is carried out by the Ministry of Industry and Trade of the Russian Federation. The Ministry of Industry and Trade and financial control authorities regularly conduct checks to ensure compliance with the conditions, goals and procedures for providing subsidies.

Innovations for 2021

The First Car program has undergone changes in 2021. The size of the limit within which you can purchase a vehicle has changed. The value increased from RUB 1,450,000 to RUB 1,500,000. The need to pay tax has been abolished. Now a citizen is not obliged to deduct 13% to the state from the subsidy received. You can study all the changes in detail by reading the Decree of the Government of the Russian Federation and the table below.

| Condition | 2017 | 2018 |

| Car cost | No more than 1,450,000 rubles. | No more than 1,500,000 rubles. |

| The need to pay personal income tax | Yes | No |

| Discount | 10% | 10% |

| Which car does it apply to? | Buying your first car on credit | Buying your first car on credit |

Pros and cons of canceling partial interest rate compensation

There are a number of advantages and disadvantages to using a proposal. The main advantages of participating in the program are:

- The service is available to all citizens who have decided to purchase a vehicle for the first time. The list of requirements is minimal. The offer can be taken advantage of by all persons with Russian citizenship who are purchasing a car for the first time and have received a driver’s license.

- The state program is combined with other proposals. Thus, using the service will allow you to receive an additional reduction in the rate for a certain model of vehicle.

- You can close a car loan at any time. If a citizen has the opportunity, he can take advantage of the discount and repay the loan a few days after registration. In this case, you will only need to pay interest for the period of use of the funds.

However, there are also disadvantages. These include:

- The program has a limited budget. In 2017, the funds allocated by the state ran out after a few months. If a person plans to take advantage of the offer, it is worth contacting the bank immediately after the start of the program.

- Trading a lower interest rate for the possibility of a discount does not always lead to more savings.

- Not all banks take part in the state program. This significantly reduces the choice. Before contacting a financial institution, it is recommended to find out in advance whether you will be able to take advantage of the offer. To do this, you should visit the bank’s official website or contact its representative.

Taxation of subsidies

In accordance with Article 217 of the Tax Code of the Russian Federation, participants in the state programs “First Car” and “Family Car” are exempt from paying personal income tax. This amendment was made in 2017; accordingly, previously received subsidies were still subject to taxation.

Currently, there are several car loan options that have their pros and cons. To understand all the intricacies, we recommend reading our articles about the methods, conditions and loan programs for buying a car, the nuances and pitfalls of selling and buying a credit vehicle.

Can I use recycling and the First Car program?

The “First Car” program in 2021 assumes that the vehicle will be purchased for the first time. The potential participant must not have previously owned any vehicles. The recycling program involves issuing a certificate for handing over an old car that the person previously owned. The rules contradict the requirements of the “First Car” state program. Therefore, it will not be possible to combine the subsidy and the funds that can be received from a certificate for turning in a car.

In which cities can you buy a car under the “First Car” state program?

Financial institutions participating in the First Car program in 2021 are not present in all cities. The offer can be taken advantage of by a person residing:

- in Moscow;

- in St. Petersburg;

- in Kazan;

- In Nizhniy Novgorod;

- In Volgograd;

- in Samara;

- in Ufa;

- in Chelyabinsk;

- in Novosibirsk;

- In Ekaterinburg;

- in Rostov-on-Don.

The list is not complete. To determine whether it will be possible to participate in the program, you need to take into account the financial institutions present in a particular locality.

If a citizen has a choice of several banks, it is worth analyzing in detail the tariff plans provided. Additionally, you will need to prepare a package of documents. It should be as complete as possible. This will allow you to receive funds on favorable terms. The specifics of the offer also depend on the size of the down payment.

Are there age restrictions for the program?

If you read the Decree of the Government of the Russian Federation, it turns out that persons wishing to take part in the state program must have a driver’s license and never be the owner of a vehicle. Age requirements are not specified in the legal act. This means that any citizen eligible to receive a car loan can take part in the First Car program in 2021. The age of the borrower must meet the requirements of a particular bank.

Conditions for participation in the program for borrowers

To participate in the program, you must meet certain requirements. At first it was planned that one of the main conditions for participation would be age. According to the developers, the program is aimed at young people under the age of 30. But later this decision was revised, and the conditions for participation were softened.

Selection criteria for candidates for the first car program:

- The vehicle to be registered must be the first. If at one time the borrower already owned a car, then he cannot qualify for participation in the program, even if at the moment there is no car registered to the borrower;

- The borrower must have a valid driver's license category "B";

- The program is valid only for Russian citizens;

- The borrower must be employed and must prove his income.

The accuracy of the information provided is checked by the credit institution issuing funds for the purchase of a car and the traffic police. The bank’s security service will also check the borrower’s credit history through the BKI.

If, in all respects, a person is suitable for participation in the state program, then it should be taken into account that during the execution of the transaction, in addition to the obvious financial obligations, he will have to sign an agreement that in 2021 he will no longer purchase any vehicles on credit. The same condition was mandatory in 2021.

You can only take part in the first car promotion in 2021 once.

Is life insurance necessary?

The requirements for participants in the First Car program are set out in Government Decree No. 364 of April 16, 2015. The provision of funds is carried out in strict accordance with the regulatory legal act. There are no provisions regarding compulsory life insurance in the government decree. This means that a person can use the service without purchasing a policy.

It is illegal for a bank to impose insurance. A citizen has the right to use the service without purchasing a policy.

Nuances

If a citizen plans to take part in a preferential lending program, it is worth taking into account a number of nuances. In 2018, citizens will be able to purchase 55,000 passenger cars on credit on preferential terms. If we take into account the trends of the current year, funds will run out in March. The subsidy will not be available for most of the year. If a person plans to participate in the program, he must contact the bank immediately. Otherwise, there is a possibility that you will not have time to take advantage of the offer.

The number of models available for purchase on preferential terms may be reduced. It is known that the Ministry of Industry and Trade will not subsidize vehicles produced using the SKD method. Cars are manufactured in this way at the Kaliningrad company Avtotor. In order for a car to take part in the subsidy program, it must meet the criteria of Russian Government Decree No. 719. The regulatory legal act reflects a number of operations that must be performed on the territory of the Russian Federation in order for a car to become available for purchase on credit on preferential terms. The localization value should be 30%.

The “First Car” program in 2021 will be of interest to citizens who have only recently received the right. If a person already owns a car, but wants to purchase a new vehicle, he can take part in the “Family Car” state program. The offer is available to citizens of the Russian Federation who are parents of two minor children. If the requirement is not met, it will not be possible to purchase a car on credit on preferential terms. By taking advantage of the state program in a timely manner, a person can save significantly.