HomeCustoms declaration New passenger customs declaration

A passenger customs declaration is a document filled out at customs by an individual to declare personal belongings not intended for commercial use, but only for personal consumption. Without this document, customs will not allow goods to be filled out.

Individuals must use a passenger customs declaration (PTD) to declare goods at customs. The law provides for the possibility of submitting this document both in paper and electronic form. Over time, depending on emerging requirements, the form of the document changes. On February 1, 2020, a new passenger form, approved by Decision of the EEC Board No. 124, came into force.

| Decision of the Board of the Eurasian Economic Commission dated July 23, 2019 N 124 On customs declaration of goods for personal use |

Deadline for payment of transport tax

The deadline for payment of transport tax by organizations for tax periods up to 2021 is determined by the laws of the constituent entities of the Russian Federation on transport tax. The deadline for tax payment cannot be later than February 1 of the year following the expired tax period (clause 1 of Article 363 of the Tax Code of the Russian Federation).

The organization pays transport tax for each car registered to it. This obligation remains until the car is deregistered with the traffic police, even if you do not use it (clause 1 of article 358 of the Tax Code of the Russian Federation, letter of the Ministry of Finance of the Russian Federation dated February 18, 2016 No. 03-05-06-04/9050).

The tax on a car registered for a separate subdivision is paid at the location of the OP (clause 1 of Article 363 of the Tax Code of the Russian Federation, letter of the Ministry of Finance of the Russian Federation dated October 29, 2013 No. 03-05-04-04/45850).

The tax is transferred at the end of the year, and in some regions there are quarterly advances.

KBK - 182 1 0600 110.

Transport tax is regional, therefore:

- tax rate within the limits established by Ch. 28 Tax Code of the Russian Federation;

- procedure and deadlines for tax payment;

- tax benefits and the grounds for their use are determined by the laws of the constituent entities of the Russian Federation in whose territory the car is registered.

Assistance in filling out the passenger customs declaration

Ours is a licensed customs broker (representative) and provides assistance in filling out the passenger customs declaration for individuals (importing or exporting goods and personal belongings), and, if necessary, services for completing the declaration at any customs office of the Russian Federation:

- At airports

- In seaports

- At automobile checkpoints (MAPP, DAPP)

- At railway checkpoints

- In the warehouses of transport organizations express carriers (UPS, DHL, FedEx, EMS and others)

If necessary, we carry out customs clearance of goods in any other customs procedures!

Procedure for calculating transport tax

According to Art. 362 of the Tax Code of the Russian Federation, organizations calculate the tax amount independently.

The tax period is a calendar year.

The tax is calculated for the year for each car registered to the organization (clause 1, clause 1, article 359 of the Tax Code of the Russian Federation).

Car tax = engine power in hp. x tax rate.

Engine power is taken from the title or registration certificate. If the power is indicated in kW, it should be converted to horsepower by multiplying by 1.35962. The result is rounded to the second decimal place. For example, 150 kW is 203.94 hp. (150 kW x 1.35962) (clause 19 of the Methodological recommendations for the application of Chapter 28 of the Tax Code of the Russian Federation).

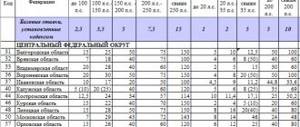

Rates are established by the law of the subject of the Russian Federation in which the car is registered (clause 1 of Article 361 of the Tax Code of the Russian Federation).

If the rate depends on the age of the car, then it must be calculated from the year following the year of manufacture (clause 3 of Article 361 of the Tax Code of the Russian Federation). For example, the year of manufacture of the car is 2016. Then in 2021 he is 0 years old, in 2017 - 1 year, etc.

If the car was not used for a whole year, the tax should be adjusted by the coefficient Kv. The value of the coefficient is determined accurate to the 4th decimal place using the formula (clause 5.15 of the procedure for filling out the declaration):

Kv coefficient = number of full months of vehicle operation / 12.

The month of purchase is included in the calculation if the car is registered before the 15th day inclusive. And the month of disposal of the car - if it is deregistered after the 15th (clause 3 of Article 362 of the Tax Code of the Russian Federation).

Having calculated the tax for each car, the results are summarized. Thus, the calculated tax for the year is obtained. If there are no advance payments in your region, this amount must be paid to the budget. If you paid advance payments, at the end of the year you will pay the difference between the calculated tax for the year and the advances.

In what cases is it not necessary to pay transport tax?

There is no need to pay transport tax if the vehicle is registered and deregistered:

- in the period from the 1st to the 15th of the month;

- from the 16th to the 30th of the month;

- when registering after the 15th of one month and deregistering before the 15th of the next month;

- one day.

Such clarifications are given in the letter of the Federal Tax Service of the Russian Federation dated June 19, 2017 No. BS-4-21/ [email protected]

In addition, no tax is paid in case of car theft (letter of the Ministry of Finance of the Russian Federation dated October 3, 2017 No. 03-05-06-04/64192).

The agency explained which documents can exempt the owner of a car from paying transport tax if it is stolen.

According to paragraphs. 7 paragraph 2 art. 358 of the Tax Code of the Russian Federation, a vehicle will not be taxed provided that supporting documents from law enforcement agencies are provided to the Federal Tax Service. They may be:

- certificate of theft;

- resolution to initiate a criminal case.

In addition, the department reminded that a lost car can be deregistered with the State Traffic Safety Inspectorate (Order of the Ministry of Internal Affairs of the Russian Federation dated November 24, 2008 No. 1001). To do this, the owner will need to send an application to the appropriate traffic police department.

Let us note that Art. 85 of the Tax Code of the Russian Federation obliges the traffic police to independently, without the participation of the owner of the vehicle, report to the Federal Tax Service the fact of deregistration of a stolen car. This is done within 10 days. If a stolen car is found, it can be registered again.

New form of passenger customs declaration in 2021

From February 1, 2021, a new passenger customs declaration form must be used at customs. It can be downloaded in advance, filled out and printed on a printer on both sides of a sheet of white A4 paper. In addition, you can use existing printed forms in A4 and A5 format.

Attention! There is no need to fill out a passenger declaration if the weight and value of the items transported across the customs border does not exceed the duty-free import limit.

The duty-free import limit differs for different types of transport:

- For air transport up to 10,000 euros and 50 kilograms;

- For land, sea and river up to 500 euros and 25 kg;

- International postal items up to 200 euros and 31 kg.

A passenger customs declaration is needed by individuals to declare goods for personal use. An individual, in accordance with Article 260 of the EAEU Labor Code, fills out the PTD if:

- Goods delivered in unaccompanied baggage;

- Goods are delivered by the carrier;

- Goods delivered by MPO;

- Goods delivered in accompanied luggage for which customs duties must be paid;

- Goods delivered in accompanied luggage, but exempt from customs duties;

- Temporarily exported valuables for their subsequent identification upon import;

- Cultural values,

- Personal car;

- Personal car parts;

- Cash or checks, if their amount exceeds $10,000, and the exchange rate corresponding to the time of crossing the border is taken. If the amount exceeds $100,000, then the funds must not only be declared, but also their origin must be indicated, and supporting documents must also be provided, with the exception of traveler's checks;

Transport tax when using the Platon system

From 01/01/2019, the benefit established by the Law of 07/03/2016 No. 249-FZ, which provides for a reduction in transport tax by the amount of payment for road damage caused by heavy trucks to federal roads, ceased to apply. Deductions were provided for tax periods 2016–2018. Now the preference has ceased to apply.

Transport tax is a regional tax. When introducing it into effect in the territory of their region, legislative (representative) bodies of a constituent entity of the Russian Federation can establish differentiated tax rates for each category of vehicles, as well as taking into account the number of years that have passed since the year of production of vehicles and (or) their environmental class. Additional tax benefits may also be provided to owners of heavy trucks.

Another change in the procedure for calculating and paying tax is related to the need for owners of heavy trucks registered in the Platon system not only to calculate, but also to pay advance payments for transport tax, if the region provides for the payment of advance payments for it. In Moscow, according to Part 1 of Art. 3 of the Law of Moscow dated July 9, 2008 No. 33, there is no such obligation. The innovation is caused by the termination of the provisions of the already mentioned Law of July 3, 2016 No. 249-FZ. It was allowed to calculate but not pay tax advances until 01/01/2019.

How to apply an increasing coefficient for transport tax

The list of passenger cars with an average cost of 3 million rubles, subject to use in the next tax period, is posted no later than March 1 of the next tax period on the official website of the Ministry of Industry and Trade of the Russian Federation on the Internet. This follows from paragraph 2 of Art. 362 Tax Code of the Russian Federation. The cost of the car and the moment of its registration do not play a role.

Particular attention should be paid to the last column of the list, which indicates the age of the car, which is counted from the year of manufacture. For example, a car that was released in 2021 is 1 year old in 2016, 2 years old in 2021, etc. (letter of the Ministry of Finance of the Russian Federation dated May 18, 2017 No. 03-05-04/30334, Federal Tax Service of the Russian Federation dated March 2, 2015 No. BS-4-11 / [email protected] ).

If there is a car on the list, but its age is different, the increasing factor is not applied (letter of the Federal Tax Service of the Russian Federation dated January 11, 2017 No. BS-4-21/149).

If your car is on the list, then pay tax for 2021 with an increasing coefficient.

| Group of cars according to the list | Year of car manufacture | Kp coefficient |

| From 3 to 5 million rubles. | 2017 and later | 1,1 |

| From 5 to 10 million rubles. | 2015 and later | 2 |

| From 10 to 15 million rubles. | 2010 and later | 3 |

| Over 15 million rubles. | 2000 and later |

What form should I use to submit a transport tax return for 2021?

For the tax period of 2021, the declaration must be submitted using a new form approved by Order No. ММВ-7-21/ [email protected] [email protected] dated December 5, 2016

The need to update the declaration is due to the termination, as of January 1, 2019, of the provision allowing the deduction of fees for damage to federal roads caused by heavy trucks from the amount of transport tax. In this regard, the procedure for filling out the document has also changed.

There are few other changes:

- barcodes for types of vehicles have been updated;

- benefits and deductions have been clarified;

- instead of three different codes intended for buses, one common one will be introduced.

Please note: this year's transport tax return must be submitted to the tax authorities for the last time. The reason for this is the introduction of amendments to the Tax Code of the Russian Federation by Law dated April 15, 2019 No. 63-FZ, canceling the filing of transport tax returns for the period 2021 and subsequent tax periods. According to the Order of the Federal Tax Service of Russia dated 09/04/2019 No. ММВ-7-21/ [email protected] , from 01/01/2021 the effect of the Order of the Federal Tax Service dated 12/05/2016 No. ММВ-7-21/ [email protected] , which approved the declaration form, becomes invalid.

Control ratios, with which you can check the correctness of filling out reports, are given in the letter of the Federal Tax Service of the Russian Federation dated 03.03.2017 No. BS-4-21 / [email protected]

The difference between the new passenger declaration and the old one

The main difference between the old form of 2021 and earlier years from 2020 is the number of columns (items and subitems) required to fill out. In the old one: paragraph 3 includes five subparagraphs (3.1 - 3.5); in the new 3 paragraph consists of ten subparagraphs (3.1-3.10), and also in the new one an expanded 5 paragraph has been added, which was previously 3.3.

- New passenger declaration form (View)

- Old passenger declaration form (View)

Procedure for filling out the declaration

First, section 2 of the declaration is completed for each vehicle. The vehicle type code ( line 030 ) is indicated in the appendix to the procedure for filling out the declaration.

Data about the car - identification number (VIN), make, registration number, registration date, year of manufacture are taken from the title or registration certificate. The registration termination date (line 080) is indicated only for vehicles that were deregistered in the reporting year.

The tax base ( line 090 ) is the engine power in horsepower. Line 100 indicates the horsepower code - 251.

The environmental class ( line 110 ) is reflected in the PTS. If it is not there, a dash is placed in line 110.

Line 120 is filled in only if the tax rate depends on the number of years from the year of manufacture of the car.

Line 140 indicates the number of complete months of car ownership during the reporting year, and line 160 indicates the Kv coefficient. If you owned the car all year, put 12 in line 140 , and 1 line 160

Line 150 places 1/1.

The Kp coefficient ( line 180 ) is indicated only for expensive cars.

Lines 190 and 300 reflect the calculated tax.

Lines 200–290 are filled in if benefits are used.

After completing section 2 for all vehicles, you can move on to section 1.

Lines 021 and 030 display the total tax amount for all cars if advances are not paid.

If advances are paid, they should be indicated in lines 023–027 , and in line 030 - the tax payable at the end of the year.

Form and main points of the passenger declaration

In paragraph 1 you need to indicate the necessary information regarding the declarant (full name, passport details, address).

In the 2nd point, you need to select the method of travel: accompanied baggage, unaccompanied baggage, Delivered goods without entry or exit. The main differences are contained in the more detailed 3rd paragraph.

In paragraph 3 of the new passenger customs declaration form, which is called “information about goods,” you must indicate:

Procedure: import (free circulation), export, temporary import, transit.

Sub-items:

- 3.1. Cash

- 3.2. Products eligible for discounts

- 3.3. Goods for which the duty-free import limit has been exceeded

- 3.4. Cultural values

- 3.5. Weapons and weapon components

- 3.6. Narcotic drugs, psychotropic substances, etc.

- 3.7. Animals, plants

- 3.8. Collection materials on mineralogy, paleontology, etc.

- 3.9. Samples of human biomaterials

- 3.10. Other goods subject to prohibitions and restrictions and requiring the submission of supporting documents.

The 4th paragraph should contain additional information about the goods specified in the 3rd paragraph. This is the name of the product, its description, weight and cost.

In addition, paragraph 5 “Information about vehicles” has been added to the New Declaration.

At this point you need to select a procedure: import (free circulation), temporary import, export, temporary export, transit.

Indicate the availability of benefits;

Enter data regarding the specific imported vehicle (automobile, motor vehicle, trailer, watercraft or aircraft) or its part that has been replaced.