The difference between electric vehicles

Initially, vehicles with electric drive were created with the aim of reducing the amount of harmful gases emitted into the atmosphere during the operation of diesel engines. But today, such cars are also considered much more economical than conventional cars. After all, for a full charge of the battery, the owner of an environmentally friendly vehicle will have to pay only 200-300 rubles, while for a tank of gasoline filled to the brim, the car owner will be required to pay from 3,000 to 5,000 rubles.

However, this is where the advantages of electric cars end. But the disadvantages of such a vehicle should be emphasized:

- High cost;

- Problematic maintenance (not all technical stations undertake the repair of Leaf, Tesla and other similar cars, since they contain heavy electronics, which require special stands);

- Limited mileage (a full battery charge is enough for 250-300 km of travel. Well, specialized gas stations with environmentally friendly fuel do not exist in every city).

At the same time, customs clearance of electric vehicles has become preferential quite recently. Until 2021, the demand for this type of vehicle reached its minimum level.

What is the cost of customs clearance?

Calculating the cost of customs clearance of an electric car in Russia, according to the 2021 calculator, will consist of five main components:

- Payment for the work of checkpoint employees (this includes: paperwork, checking the vehicle and entering it into the traffic police database);

- Unified state duty (only disabled people of groups 1 and 2, labor veterans, military officers, parents of large families and pensioners are exempt from this payment);

- Tax on importing a car into Russia (the amount depends on the amount of horsepower);

- Excise tax (levied exclusively on legal entities);

- Recycling fee.

It is important to know! According to the rules of the border checkpoint, customs clearance of Tesla, Leaf and other electric vehicles occurs in the same way as registration of gasoline cars. This limitation is due to the fact that environmental transport also requires a Russian vehicle vehicle.

Main settings

The largest duty for importing any car into the Russian Federation is the horsepower tax, which is calculated at several rates. The amount of this tax depends on the following criteria:

- Vehicle age;

- Its original cost (calculated from the purchase/sale certificate);

- Social status of the vehicle owner (as mentioned earlier, some categories of citizens receive benefits during customs clearance of a car).

What tariffs exist today and how duties on electric vehicles in Russia in 2021 differ from them, we will consider below.

Rates

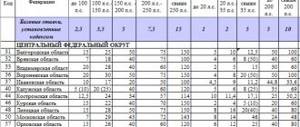

You can calculate the cost of customs control for a car with a gasoline or diesel engine using the table below:

| Actual age of the vehicle | Working volume of the combustion engine (in cubic centimeters) | Collection for each cm/cube (in euros) |

| Less than 3 years | 1000 — 3000 | 1 |

| From 3 to 5 years | Less than 1000 | 1.5 |

| 1000 – 1500 | 1.7 | |

| 1500 – 1800 | 2.5 | |

| 1800 – 2300 | 2.7 | |

| 2300 – 3000 | 3 | |

| More than 3 thousand | 3.6 | |

| More than 5 years | Up to 1000 | 3 |

| 1000 – 1500 | 3.2 | |

| 1500 – 1800 | 3.5 | |

| 1800 – 2300 | 4.8 | |

| 2300 – 3000 | 5 | |

| Over 3 thousand | 5.7 |

It is important to know! But when clearing an electric car through customs, the same duty will be calculated at different rates. You need to calculate the full amount to pay before arriving at the border, since checkpoint employees do not provide such services.

Transport tax for owners of electric cars may be canceled or reduced in the Vologda region

A project is being implemented in Vologda, which is also aimed at popularizing environmentally friendly electric vehicles. This idea is supported by the deputy of the Legislative Assembly of the region, head of the Association of Motorists of the region Anton Kholodov. He is ready to work on the issue of reducing or eliminating transport taxes for such car owners.

In recent years, the issue of zeroing or reducing the transport tax on electric cars has been actively discussed in Russia. In November 2019, in Moscow and the Moscow region, owners of electric vehicles were completely exempt from paying taxes. Following the capital, similar projects began to be developed in several other regions, including the Vologda region.

According to motorist Alexander Shevel, zeroing or reducing the tax will give people an additional incentive to purchase environmentally friendly cars. A Vologda resident purchased a Japanese electric car “Nissan Leaf” in March of this year. In seven months, we managed to save 30 thousand rubles on fuel and maintenance. The savings per year will exceed 58 thousand rubles.

«Before the electric car, I owned combustion engine cars. If we take into account the consumption of a car with an internal combustion engine of about 10 liters per 100 km, then the savings in the consumption of an electric car will be 9-10 times, less in winter. I think that the limiting factor for the spread of electric vehicles in Russia is the lack of charging infrastructure. And the abolition of the transport tax will encourage people to purchase electric vehicles,”

– said Alexander Shevel.

The Vologda resident himself installed a charging station in the courtyard of his house: he pulled a power cable from the entrance and installed an electrical cabinet near the house. He says that all the owners of electric vehicles he knows do this, because... There is only one charging station in the city. Let us remind you that it was installed on Belozerskoye Highway, 2 in December 2019. In 2020-2021, within the framework of the “Development of Electric Transport” project office in Vologda, it is planned to install six more gas stations for electric vehicles.

«In 2021, the City Socio-Economic Development Strategy until 2030 was adopted, which we are implementing with the help of project management. This year we have developed several projects, one of them is “Development of Electric Transport”. The project includes both the development of public and personal electric transport. We understand that infrastructure needs to be created in the city. Therefore, together with business, we developed an action plan in accordance with which gas stations will be built in the city. There is a demand for them not only from residents of our city, but also from tourists,”

– comments the Deputy Mayor of Vologda, Head of the Department of Economic Development of Vologda Svetlana Pakhnina.

Entrepreneur Alexey Logantsov is creating a small network of gas stations on the territory of Business-Soft LLC. Three charging stations with a capacity of 22 kW have already been installed, and a more powerful station with a capacity of 50 kW is being installed. Currently, Business-Soft has one electric car in its fleet, and in the future it is planned to purchase several more.

«People often ask me: “Why do you need infrastructure if there are no electric vehicles?” But until there is infrastructure, there will be no electric transport either. As soon as 3-4 charging stations appear, people will then buy electric cars. I believe that now the region and the city are actively developing in the field of electric transport, and reducing or completely eliminating the transport tax will give another impetus

“says Alexey Logantsov.

Currently, the initiative to abolish the transport tax is being worked on by the deputy of the Legislative Assembly of the region, Anton Kholodov, in order to subsequently send it for consideration to the regional parliament and the Government.

«There are now more than 6 thousand electric vehicles in Russia. Most often, it is not the popular Tesla, but the inexpensive and economical Nissan Leaf. In Russia they also produce an electric car, it is called “LADA Ellada”, it takes 8 hours to charge from an outlet and can travel 140 km. In the Vologda region, a whole fleet of electric vehicles has already been formed - about 30 cars. And this area is actively developing, gas stations and service infrastructure are being built. Authorities around the world actively support such car enthusiasts because it is environmentally friendly and profitable. I hope that in the Vologda region we will also follow this path

“, commented Anton Kholodov, deputy of the Legislative Assembly of the Vologda Region.

Let us add that in October 2021 alone, Russians bought about 700 used electric vehicles and about 100 new ones, which is 2 times more than last year. According to the all-Russian trend, in the coming years the number of electric cars in the Vologda region may also increase several times.

Features of calculation for electric vehicles

By taxation

VAT and Unified Tax, cars with gasoline and diesel engines are no different from electric cars. But the horsepower rate for the second type of vehicle is completely different, and its total amount cannot exceed 8,500 euros, which does not apply to standard vehicles. These are the numbers stated in Art. 164 Tax Code of the Russian Federation. As for the customs code, it evaluates environmentally friendly cars somewhat differently.

Main settings

Despite the fact that they require less money for customs clearance of electric vehicles in Russia, a single rate is calculated for them according to the same criteria as for other types of vehicles. Namely:

- Year of issue;

- Actual cost (indicated in the purchase/sale document);

- Driver status (disabled person, pensioner, or breadwinner with many children).

But when calculating the cost through an online calculator, the listed indicators will be multiplied by a reduced rate, which will ultimately affect the reduction in the amount of tax for customs clearance.

Rates

The coefficient for the fee for registration of an environmental vehicle on the territory of the Russian Federation is calculated based on the following parameters:

- Motor power up to 90 hp. – duty-free border passage;

- From 90 to 150 horsepower - the cost of each hp. will be 37 rubles;

- Over 150 horses – excise tax price per 1 hp. will rise to 365 rubles.

At the same time, until 2021, no import tax was collected from drivers for the import of electric vehicles into Russia. But today it is no longer possible to clear customs of this kind of vehicle for free, which not all car enthusiasts know about.

Why people in Russia don’t want to use electric cars

Despite the environmental friendliness of an electric car during its use and economic efficiency, it is not in great demand among Russians. The low level of consumer demand for electric vehicles is due to the following reasons:

- In terms of acquisition cost, an electric car is quite an expensive vehicle compared to an internal combustion engine car. In Russia there are no preferential programs for the purchase of electric cars (in Germany there is a subsidy for such a purchase).

- Russian climate conditions are not entirely suitable for traveling by electric vehicle.

- There is no developed infrastructure (gas stations for charging batteries).

- ICE cars are still ahead in terms of range. Manufacturers are constantly working in this direction.

In addition to the above circumstances, Russians are in no hurry to switch to electric vehicles due to the significant duties that must be paid when importing such cars into the Russian Federation.

Stages of customs clearance

When crossing the border on environmental transport, a single algorithm is provided for all individuals and legal entities, which consists of four simple steps:

- Payment of a deposit (this fee is charged as a kind of guarantee that the citizen will go through all subsequent procedures, and it must be paid not at the border itself, but by bank transfer, a few days before the car is imported into the Russian Federation);

- Passing the checkpoint (upon arrival at the border post, customs officers conduct a thorough inspection of the vehicle and related documents);

- Vehicle registration (at this stage, the owner of the electric car provides all the necessary papers and certificates to calculate the total cost of the tax and enter his vehicle into the traffic police database. He is given no more than 2 weeks for this procedure. If during this time he does not have time to pay all the duties, the stages of customs clearance will have to be completed anew. Therefore, you need to calculate the exact amount to pay and collect a package of documents even before you buy a car);

- Obtaining a Russian-style PTS (when registering a car, the State Traffic Inspectorate issues the driver a new certificate, which also indicates the presence of his vehicle in the traffic police database. This is the final procedure that does not require any financial costs).

Based on this, it follows that the import of an electric vehicle into Russia (2021) follows the same rules as for conventional gasoline or diesel units. The only privilege provided for owners of environmentally friendly transport is a reduced customs duty rate.

Features of taxation of electric vehicles in the Russian Federation

Electric cars are no exception and are subject to transport tax on a general basis - this is provided for in Article 358 of the Tax Code of the Russian Federation. The same code stipulates that transport tax is collected in the regions independently and credited to the corresponding budgets, and at the federal level it only determines the procedure for collecting the tax, the subjects and objects of taxation, the deadlines for depositing amounts into the budget and the size of the base rates. The calculation of fuel tax is based on engine power; the greater it is, the higher the tax. The general formula for calculating tax is as follows:

TN = NB x NS x (KMV / 12), where:

- TN - transport tax;

- NB - tax base;

- NS - tax rate;

- KMV - the number of months of car ownership per calendar year.

If ownership was carried out for a whole calendar year, then the amount of the tax is the product of the tax rate and the number of horsepower. Using the base rates as a basis, the authorities of each region determine the size of local rates applied within the territory under their control. Most often, local rates are several times higher than the established base rates, especially in such megacities as Moscow and St. Petersburg. At the same time, regional authorities can adjust the taxation procedure, the timing of payment of the state tax on transport and provide preferential categories of tax payers. For example, the Kaluga Region, as an experiment, established a preferential category of payers - owners of electric vehicles, who are 100% exempt from paying transport tax.

Will the transport tax on electric cars be abolished?

Many drivers are discussing the issue of abolishing duties on the import of eco-friendly cars into the Russian Federation. But where does this information come from if this type of vehicle is subject to mandatory taxation? The answer is quite simple: exemption from customs duties is provided only for countries of the Eurasian Economic Commission, which include:

- Armenia;

- Belarus;

- Russia;

- Kazakhstan;

- Kyrgyzstan.

Attention! But when buying a car on the American or European market, such privileges will not apply to citizens. But not everyone knows about this nuance. Therefore, there is often a rumor among car enthusiasts about the complete exemption of eco-cars from taxes.

We found out what duty on electric vehicles in 2021 is imposed on people importing vehicles from neighboring countries, and on those who bought environmentally friendly vehicles far beyond its borders. In conclusion, it is worth adding that the customs code, like the legislation of the Russian Federation, tends to constantly change. Therefore, the above information may become irrelevant in a few years.