The collection of taxes from vehicle owners is provided for by the legislation of most states. In the Russian Federation, the need for its payment by citizens and legal entities is enshrined in Chapter 28 of the Tax Code. Based on its provisions, transport tax in our country is regional. Accordingly, each subject of the Federation sets the collection procedure, current rates and payment terms independently, in accordance with its legal regulations.

Transport tax concept

All citizens who have registered the right to own vehicles must annually make a mandatory payment to the regional budget. It is calculated individually for each car, taking into account the region, age of the car and its power. It is established by the authorities based on the specifics of the city or region and the income level of local residents. The main purpose of such a fee is to provide transport infrastructure and carry out measures aimed at reducing the harmful effects of exhaust gases on the environment. Taxpayers are the owners of the following types of transport:

- Land (cars, motorcycles, self-propelled vehicles on wheels or tracks, scooters, buses).

- Water (motor boats, cutters, sailing ships, motor ships, tugs).

- Airborne (helicopters, planes, etc.).

It is important to know! Persons whose vehicles are put on the wanted list are exempt from paying tax, subject to the provision of documents confirming this fact. This may be a certificate of initiation of a criminal case from the police. Federal executive services that have passenger cars on their books also do not have to pay the mandatory fee. The same applies to organizations if they own urban transport (trolleybuses, trams, railway locomotives, any non-propelled vehicles).

How is tax calculated?

To understand how to reduce car tax, you must first find out how it is calculated and what formulas are used for this. The procedure provided for individuals and legal entities will be slightly different. Let's consider the main points for ordinary citizens:

- The assessment is carried out by the tax authority, the payer in fact receives only a receipt, according to which he undertakes to make payment within the established period.

- The region is taken into account, for example, for St. Petersburg the rate will be higher than for Sevastopol, the Republic of Crimea or Ingushetia.

- Payment is made at the location of the vehicle.

- The cost of the machine (the indicator used in the calculations) is determined by the Ministry of Industry and Trade of Russia.

It is easy to check whether the accrued tax is correct. The official website of the fiscal authority (nalog.ru) offers a program in the form of a calculator; all you need to do is enter all the key data. In the process of making calculations, the following formula is used:

TN=SNxNBx(KMV/12)xPK

TN – Transport tax

CH – Tax rate

NB – Tax base

KMV – Number of months of ownership

PC – Increasing factor

The user is required to provide information about the vehicle, which can be easily found in the vehicle title or certificate. But we should not forget that luxury goods are subject to an increasing tax rate, so if a car costs more than 3 million, then more will need to be contributed to the treasury.

It is important to know! Legal entities carry out all calculations themselves. This is done for each vehicle separately, money is paid quarterly, ¼ of the total tax received for the year.

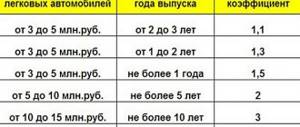

How to apply an increasing coefficient for transport tax

The list of passenger cars with an average cost of 3 million rubles, subject to use in the next tax period, is posted no later than March 1 of the next tax period on the official website of the Ministry of Industry and Trade of the Russian Federation on the Internet. This follows from paragraph 2 of Art. 362 Tax Code of the Russian Federation. The cost of the car and the moment of its registration do not play a role.

Particular attention should be paid to the last column of the list, which indicates the age of the car, which is counted from the year of manufacture. For example, a car that was released in 2021 is 1 year old in 2016, 2 years old in 2021, etc. (letter of the Ministry of Finance of the Russian Federation dated May 18, 2017 No. 03-05-04/30334, Federal Tax Service of the Russian Federation dated March 2, 2015 No. BS-4-11 / [email protected] ).

If there is a car on the list, but its age is different, the increasing factor is not applied (letter of the Federal Tax Service of the Russian Federation dated January 11, 2017 No. BS-4-21/149).

If your car is on the list, then pay tax for 2021 with an increasing coefficient.

| Group of cars according to the list | Year of car manufacture | Kp coefficient |

| From 3 to 5 million rubles. | 2017 and later | 1,1 |

| From 5 to 10 million rubles. | 2015 and later | 2 |

| From 10 to 15 million rubles. | 2010 and later | 3 |

| Over 15 million rubles. | 2000 and later |

Categories of beneficiaries

A reduction in transport tax is not required for persons exempt from paying it. The subsidy is provided to all socially vulnerable segments of the population. These currently include:

- Families with a large number of children, one of the cars used.

- Victims of the Chernobyl accident.

- Citizens with 1 or 2 disability groups.

- Combatants or WWII veterans.

- Persons holding the title “Hero of Russia” or the Soviet Union.

- People awarded the Order of Glory.

- Parents or legal representatives raising a child with a disability.

Each region has its own list, these are just the main ones. Therefore, before contacting the tax authority, you should clarify the existence of your right and collect all the necessary documents to confirm it.

Disabled people of group 3 are not included in the preferential category, and those with 1 or 2 can count on exemption only if their vehicle is registered with the guardianship authorities.

What form should I use to submit a transport tax return for 2021?

For the tax period of 2021, the declaration must be submitted using a new form approved by Order No. ММВ-7-21/ [email protected] [email protected] dated December 5, 2016

The need to update the declaration is due to the termination, as of January 1, 2019, of the provision allowing the deduction of fees for damage to federal roads caused by heavy trucks from the amount of transport tax. In this regard, the procedure for filling out the document has also changed.

There are few other changes:

- barcodes for types of vehicles have been updated;

- benefits and deductions have been clarified;

- instead of three different codes intended for buses, one common one will be introduced.

Please note: this year's transport tax return must be submitted to the tax authorities for the last time. The reason for this is the introduction of amendments to the Tax Code of the Russian Federation by Law dated April 15, 2019 No. 63-FZ, canceling the filing of transport tax returns for the period 2021 and subsequent tax periods. According to the Order of the Federal Tax Service of Russia dated 09/04/2019 No. ММВ-7-21/ [email protected] , from 01/01/2021 the effect of the Order of the Federal Tax Service dated 12/05/2016 No. ММВ-7-21/ [email protected] , which approved the declaration form, becomes invalid.

Control ratios, with which you can check the correctness of filling out reports, are given in the letter of the Federal Tax Service of the Russian Federation dated 03.03.2017 No. BS-4-21 / [email protected]

Options to reduce your tax amount

The tax rate is set by regional authorities, so in some cities the question of how to reduce transport taxes is especially acute. After all, the gap can be very significant. In order not to overpay, people are looking for ways to reduce the amount.

Technical

When making calculations, the fiscal authority takes as a basis data obtained from documents provided by the owner. If there is an error in them, then you often have to pay increased tax. Error in power indication occurs for the following reasons:

- "Human factor". An error was made during registration.

- Actual power was significantly reduced due to the heavy depreciation of the vehicle.

- Repair work and modernization of equipment were carried out, for example, gas equipment was installed.

In this case, it is necessary to revise the indicator if it does not correspond to reality in order to save money. The changes made to the PTS are the basis for revising the tax burden. To do this, an examination is carried out, the data of which is sent to the MREO for making adjustments, and then to the fiscal authority.

Status-preferential

In this case, reduce transport

car tax is possible only through the acquisition of a preferential category. For example, obtaining pensioner status, the birth of a third child in the family, registration of group 1 or 2 disability. In this case, there is even a reduction or complete cancellation of the rate. Organizations can also use this method; they are also provided with benefits if there has been a change in status.

Jurisdictional

Another popular way to reduce the transport tax on a car over 250 horsepower is to replace its territorial registration. Different regions of the country have their own tax rates on car ownership. For example, the lowest levels are observed in Ingushetia, Chukotka, and the Republic of Crimea. This is an excellent technique for reducing burden. Main options for jurisdictional methods:

- Registration in another region where reduced rates are used (you can view these in open sources).

- Registration of a car in a subject of the Russian Federation, where the owner has the right to receive benefits.

- Vehicle registration in another state.

- Deregistration of vehicles.

This tax minimization is completely legal and allows owners of expensive funds to significantly reduce their costs. There are no penalties for such actions, even if the tax authority becomes aware of them. There is simply no prohibition on registration outside the place of registration.

Economic

Reducing the rate in this way implies an adjustment by reducing the nominal period of ownership of the car. That is, in fact, it will be owned more, but officially less. If you deregister a car no later than the 15th, no tax will be charged, and you also don’t have to pay if you register it on the 16th or later. That is, a person owns a car for a month, but no tax is charged. The basis for such actions is a change of owner.

How to reduce the transport tax on a car is chosen by everyone for himself, taking into account the status of the citizen, his personal circumstances and capabilities. Choosing the right tactics can sometimes significantly change the amount by several thousand, or even tens, if we are talking about expensive transport.

Transport tax when using the Platon system

From 01/01/2019, the benefit established by the Law of 07/03/2016 No. 249-FZ, which provides for a reduction in transport tax by the amount of payment for road damage caused by heavy trucks to federal roads, ceased to apply. Deductions were provided for tax periods 2016–2018. Now the preference has ceased to apply.

Transport tax is a regional tax. When introducing it into effect in the territory of their region, legislative (representative) bodies of a constituent entity of the Russian Federation can establish differentiated tax rates for each category of vehicles, as well as taking into account the number of years that have passed since the year of production of vehicles and (or) their environmental class. Additional tax benefits may also be provided to owners of heavy trucks.

Another change in the procedure for calculating and paying tax is related to the need for owners of heavy trucks registered in the Platon system not only to calculate, but also to pay advance payments for transport tax, if the region provides for the payment of advance payments for it. In Moscow, according to Part 1 of Art. 3 of the Law of Moscow dated July 9, 2008 No. 33, there is no such obligation. The innovation is caused by the termination of the provisions of the already mentioned Law of July 3, 2016 No. 249-FZ. It was allowed to calculate but not pay tax advances until 01/01/2019.

Reduced truck tax

In the case of vehicles intended for the transportation of large cargo, federal legislation provides only one way to reduce the tax on such vehicles. This may be a deduction for the fee, reduced by making payments to the Platon system account. The load is not reduced in full, but is only transferred to the area of mutual settlements within the program.

Additional benefits are also established in this category. Disabled people of groups 1 and 2, combat veterans, large families and other citizens equivalent to them can count on them. It is worth checking with the tax authority for a complete list, as it may have its own differences in each region.

Offers

Initiative No. 89F41538 was published on the ROI website, the author of which complains that due to inflation, exchange rate changes or other reasons, over time the cost of a car may exceed 3 million and then you will have to pay a luxury tax (increased transport tax).

The author of the initiative proposes to revise the list of passenger cars and leave only the premium class in it. In this case, there will be no need to control the maximum permissible price for passenger cars.

In his opinion, in this way social justice will triumph.

Illegal reduction methods

Despite the fact that there are a fairly large number of legal ways to reduce the rate, some use fraudulent methods. They often reduce it for taxable transport through illegal actions. This is especially practiced among those who make a profit from the sale of used cars. Common options that are not recommended to use include:

- Falsification of an examination about a decrease in engine power in a car.

- Re-registration of equipment from an individual to a commercial organization registered in another region.

- Registration of transport for a relative with a preferential category.

- Registration of transit numbers.

Attention! Many of the listed methods are useless today, since legislation is constantly being improved and limits the room for maneuver for fraudsters. Therefore, you should not invent new methods, and use only legal and proven ones.

Procedure for filling out the declaration

First, section 2 of the declaration is completed for each vehicle. The vehicle type code ( line 030 ) is indicated in the appendix to the procedure for filling out the declaration.

Data about the car - identification number (VIN), make, registration number, registration date, year of manufacture are taken from the title or registration certificate. The registration termination date (line 080) is indicated only for vehicles that were deregistered in the reporting year.

The tax base ( line 090 ) is the engine power in horsepower. Line 100 indicates the horsepower code - 251.

The environmental class ( line 110 ) is reflected in the PTS. If it is not there, a dash is placed in line 110.

Line 120 is filled in only if the tax rate depends on the number of years from the year of manufacture of the car.

Line 140 indicates the number of complete months of car ownership during the reporting year, and line 160 indicates the Kv coefficient. If you owned the car all year, put 12 in line 140 , and 1 line 160

Line 150 places 1/1.

The Kp coefficient ( line 180 ) is indicated only for expensive cars.

Lines 190 and 300 reflect the calculated tax.

Lines 200–290 are filled in if benefits are used.

After completing section 2 for all vehicles, you can move on to section 1.

Lines 021 and 030 display the total tax amount for all cars if advances are not paid.

If advances are paid, they should be indicated in lines 023–027 , and in line 030 - the tax payable at the end of the year.

Liability for fraud

Citizens who use false documents that allow them to use benefits will face a fine and, in some situations, criminal liability. The punishment is determined in each individual case based on the severity of the offense.

Reducing the tax rate for an individual is an important task, which will reduce expenses from the family budget. A variety of methods have been invented for this, and it is recommended to use only legal ones, otherwise, serious punishment is provided for fraudulent actions.