Procedure for paying transport tax by an individual

The individual to whom the vehicle is registered must pay transport tax.

This tax is calculated by the tax office based on the data it has from the traffic police. The taxpayer himself does not calculate anything, but it is in his interests to check the calculation made by the tax authorities. A notification containing a tax calculation is sent to an individual no later than 30 working days before the payment deadline (Clause 2 of Article 52 of the Tax Code of the Russian Federation). The notification is sent by mail to the person’s registered address. Users of their personal account receive notifications only there, unless they specifically asked for a paper version to be sent to them.

In Russia, a single deadline has been established for paying property taxes - no later than December 1 of the year following the year of assessment. That is, taking into account the delivery period (6 business days), a paper notice must be sent to the taxpayer no later than 36 business days before the tax payment deadline.

In practice, tax authorities send notifications in advance, taking into account the identification of possible discrepancies in calculations. Increasing the time interval between the receipt of the notification and the tax payment deadline gives the Federal Tax Service the opportunity to adjust the calculation before the payment deadline due to justified objections of the taxpayer. Changing the calculation for individuals is carried out only by the tax authorities.

For taxpayers who have not received a notification from the Federal Tax Service regarding the transport registered to them, there is an obligation to inform the tax authority about the availability of such transport (clause 2.1 of Article 23 of the Tax Code of the Russian Federation). Notification must be made by December 31 of the year following the year for which the tax was not filed.

Information can be provided on paper in the form approved by Order of the Federal Tax Service dated November 26, 2014 No. ММВ-7-11/ [email protected] , or through the taxpayer’s personal account on the Federal Tax Service website. Failure to provide information about the availability of transport subject to taxation threatens with a fine in the amount of 20% of the unpaid tax amount for the relevant object (clause 3 of Article 129.1 of the Tax Code of the Russian Federation). This norm came into force in 2021.

How to check and pay transport tax

The rate is the amount per horsepower. The more powerful the car, the greater the “cost” of one liter. With. The age of the car also affects the cost of transport tax.

Tariffs are different in each region. They are determined by local authorities and depend on the income of the population. For some cars in the region you will have to pay several times less than in the capital. Read more about rates in regions.

The amount that must be paid to the Federal Tax Service depends on:

- the number of horsepower of the car,

- edge or region in which the car is registered,

- ownership time per year,

- vehicle cost

- year of vehicle manufacture

If a car is more expensive than 3,000,000 rubles, an increasing factor is applied - from 1.1 to 3, depending on the price and production date.

Learn more about how to calculate transport tax.

If the owner's car:

- re-equipped for the needs of people with disabilities;

- engine power up to 100 hp. With. and received through social protection of the population;

- is agricultural machinery, such as a tractor or combine.

In addition to federal ones, there are regional acts that establish additional benefits. Almost all regions have benefits for large families. The amount of the benefit also differs.

And even until 2024, those who own an electric car in Moscow, St. Petersburg or one of nine other regions are allowed not to pay taxes.

Read more about what benefits exist when paying transport tax.

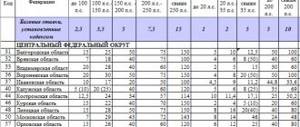

In Moscow, the amount of tax depends primarily on the power of the car. If the nameplate power is up to 100 hp. p., price per liter. With. - 12 rubles. The rate then increases as power increases:

- 100–125 l. With. — 25 rubles;

- 125–150 l. With. - 35;

- 150–175 l. With. - 45;

- 175–200 l. With. - 50;

- 200–225 l. With. - 65;

- 225–250 l. With. - 75;

- over 250 l. With. - 150.

When calculating the amount of contributions to tax authorities for a car more expensive than 3,000,000 rubles, the Federal Tax Service applies increasing coefficients:

- 1.1 - with a cost of 3–5 million rubles, age no more than 3 years;

- 2 - 5–10 million, no more than 5 years;

- 3 - 10–15 million, no more than 10 years, or from 15 million and age no more than 20 years.

- What is transport tax

- Who may not pay

- Step 1. Check debt

- Step 2. Calculate

- Step 3. Pay

- How to reduce transport tax

- What happens if you don't pay

Step 3. Pay transport tax

If you received a receipt by mail or know the exact amount, it is most convenient to pay online. It is enough to enter the TIN. You can pay for anyone, for example, for your wife or mother, but you need to know their Taxpayer Identification Number.

Payment does not go through immediately - usually within 10 days. Sometimes mistakes happen on the tax office’s side and they don’t see the payment. In this case, keep your payment receipt. This is the only way to prove that you paid the tax.

Now the transport tax or the so-called luxury tax is imposed on cars no older than 5 years, which cost 375 minimum wages as of January 1 of the year for which the tax is paid. That is, in 2021, Ukrainians must pay for cars from 2015 inclusive, which cost more than 1.77 million hryvnia. The tax amount is 25 thousand annually.

If everything remains unchanged, then from 2021, cars manufactured in 2021 and later at a cost of 2.25 million hryvnia will be subject to tax.

The new car market could suffer if the bill passes. Buyers can switch to a cheaper option or buy a used car to avoid paying annual vehicle tax.

It will also make it harder to sell a car that currently doesn't count as a luxury car, but with the new bill will fall under that classification. Prices for such cars may fall on the secondary market.

All this together threatens to reduce market volumes and reduce state budget revenues from customs.

How will they punish those who do not pay taxes?

Transport tax must be paid before August 1st. If this is not done, the car may be seized and not released abroad.

Now the transport tax or the so-called luxury tax is imposed on cars no older than 5 years, which cost 375 minimum wages as of January 1 of the year for which the tax is paid. That is, in 2021, Ukrainians must pay for cars from 2015 inclusive, which cost more than 1.77 million hryvnia. The tax amount is 25 thousand annually.

If everything remains unchanged, then from 2021, cars manufactured in 2021 and later at a cost of 2.25 million hryvnia will be subject to tax.

The new car market could suffer if the bill passes. Buyers can switch to a cheaper option or buy a used car to avoid paying annual vehicle tax.

It will also make it harder to sell a car that currently doesn't count as a luxury car, but with the new bill will fall under that classification. Prices for such cars may fall on the secondary market.

All this together threatens to reduce market volumes and reduce state budget revenues from customs.

How will they punish those who do not pay taxes?

Transport tax must be paid before August 1st. If this is not done, the car may be seized and not released abroad.

- Cash market

- NBU

| 1 USD | 1 EUR | 1 RUB | |

| Buy | |||

| Sell | |||

| 1 USD | 1 EUR | 1 RUB | |

| Buy | |||

| Sell | |||

- Buy

- Sell

- Spot

- NBU

Calculation of transport tax in a tax notice

A tax notice about transport tax is generated on a form approved by order of the Federal Tax Service of the Russian Federation dated 09/07/2016 No. ММВ-7-11/ [email protected] (as amended on 12/18/2018).

When generated, the form includes data on the required number of taxes that an individual is required to pay, including transport, land, property tax and personal income tax not withheld by the tax agent. If the taxpayer has benefits that cover all relevant amounts of accrued taxes, then a notice for such taxes is not created.

For transport tax, the tax notice form contains the following information:

- Tax calculation table for the past year for all transport facilities that were registered to the taxpayer. The form of the table reflects the entire sequence of the calculation formula for each object of taxation: the tax base is multiplied by the rate, adjusted by coefficients (taking into account the registration period and the presence of an expensive car), and reduced by the amount of available benefits.

- A tax recalculation table for previous years of a similar form. It contains a link to the notification number for which the recalculation is made, and a place to indicate the result of the recalculation.

The task of the taxpayer who received the notification is to verify the accuracy of the data on the basis of which the calculation was made:

- the fact of the presence or absence of the specified transport;

- the correctness of the base from which the tax is calculated;

- the correctness of the registration period of the vehicle for the taxpayer;

Find out who pays transport tax when the owner changes in the middle of the month from this publication.

- the legality of applying the coefficient for an expensive car;

To find out whether you will need a multiplying factor for your car, read this material.

- the fact of application of a benefit to which the taxpayer is entitled.

You can check the correctness of your own calculation on the Federal Tax Service website using a calculator.

Where to find a sample tax notice for transport tax

You can understand what a completed tax notification for transport sent by the tax office will look like by reading the notification form for property taxes contained in the order of the Federal Tax Service of the Russian Federation dated 09/07/2016 No. ММВ-7-11/ [email protected] The notification form is presented on our website (see download link below).

In any case, an individual who is a transport tax payer will not have to fill out such a notification independently. The tax office is required to do this.

The notice must include all payment details. Starting from 2021, tax authorities do not send receipts for paying notices through the bank.

The notification must be accompanied by an application form, which can be used by the taxpayer in case of disagreement with the data included in the notification to submit objections to the Federal Tax Service.

Sending tax notices

The tax notice is sent by the tax authority (local tax office) to the citizen’s place of residence by registered mail. The delivery of such notification is carried out by the telecom operator - FSUE Russian Post. The tax notice must be received by the taxpayer 1 month before its payment. Moreover, the obligation to pay arises from the moment the tax notice is received.

Should you worry if your car tax hasn’t arrived? What reasons? What to do? Where to contact?

What to do if the transport tax is calculated incorrectly

If the taxpayer does not agree with the result of the tax calculation, then he must submit his objections, supported by documents, to the Federal Tax Service. You can do this in three ways:

- send to the Federal Tax Service by mail the completed form of the application for objections that was sent to the taxpayer along with the notification, attaching copies of the necessary documents;

- directly contact the tax authorities with objections, presenting the necessary supporting documents to the Federal Tax Service;

- send a message through the “Taxpayer Personal Account” service.

The Federal Tax Service will check the data provided by the taxpayer and, if correct, recalculate the tax. In this case, the individual will receive a new notification with a new set of accompanying documents. In order for the tax to be paid on time, the taxpayer needs to promptly respond to the initial notification containing incorrect data.

What to do if you don't have a tax receipt?

If the tax notice has not arrived by November 1, you need to apply for its provision to the tax service. It doesn’t matter how this will be done - in person or using an electronic service. You can also receive a notification by contacting the MFC.

A tax notice is not sent in some cases:

- if there is a tax benefit or deduction that exempts a person from paying;

- if the total amount of tax payable is less than 100 rubles;

- if the taxpayer is the owner of an electronic account, where the notification is received, and if he did not send a notification that he needs a paper printout.

You can pay taxes in several ways:

- through a payment terminal of any bank in the Russian Federation;

- on the official website of government services;

- using the services of the Federal Tax Service of the Russian Federation.

It is worth noting that the use of a single tax payment will save time that will be spent on processing payment documents and will allow you to avoid errors when filling out several payment slips.

Results

The individual to whom the vehicle is registered must pay transport tax. The amount of tax due is reflected in the notice. It is generated by the tax office and sent by mail or placed in the taxpayer’s personal account.

If the notification is not received or inaccuracies are found in it, you must inform the tax authorities about this.

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

When will the tax authorities send a message?

Messages are sent for the past calendar year.

The organization's message will be sent to the location of its vehicles.

The organization must receive the message within the following time frames:

- within 10 days after drawing up a message about the calculated amount of tax payable for the expired tax period, but no later than 6 months from the date of expiration of the established deadline for paying tax for the calendar year;

- no later than 2 months from the date of receipt by the Federal Tax Service of documents or other information entailing the calculation (recalculation) of the amount of transport tax that must be paid for previous years;

- no later than 1 month from the date the tax authorities receive information contained in the Unified State Register of Legal Entities that the relevant organization is in the process of liquidation.

Fulfillment of the obligation to pay transport tax does not depend on the direction of messages.

Organizations must calculate taxes independently. (letter of the Federal Tax Service of Russia dated July 17, 2021 No. BS-4-21/ [email protected] ).

However, if the organization has not received a message from the inspectorate, it should notify the tax authorities about this (Clause 2.2 of Article 23 of the Tax Code).

The form of such a message that the organization must send is approved by order of the Federal Tax Service of Russia dated February 25, 2020 No. ED-7-21/ [email protected]

Previously on the topic:

From 2021, transport tax will be calculated in a new way