Chapter 28 of Title IX of the Tax Code of the Russian Federation (abbreviated as the Tax Code of the Russian Federation), as well as regional legal acts establish the obligation of persons to whom cars are registered to pay transport tax. Find out where to get a receipt for payment of transport tax in 2021 and how to fill out a declaration from this material.

An advantageous offer from the partners of our portal - Terem Loan! Apply for a loan in the amount of up to 30 thousand rubles for a period of up to 30 days.

100% approval!

Get money

When is the fee paid?

Individuals who have a car receive ready-made receipts from Federal Tax Service employees. To ensure that the calculations are correct, they can use special online calculators. The receipt contains the following information:

- personal data of the payer;

- the amount that must be paid to pay the fee;

- debt and penalties;

- the deadline by which payment must be made.

Attention! Individual entrepreneurs, like individuals, do not have to independently calculate the fee and submit declarations, unlike companies.

Tax notices are sent to citizens at the end of summer, but no later than a month before the deadline for making payments. Therefore, the last documents are sent before November 1st. If citizens have not received the document by the end of December, they can contact the tax office to obtain the document or details.

If a citizen uses his personal account on the Federal Tax Service website, he does not receive notifications. The same applies to real estate tax for an apartment or other property, so you will have to receive notifications and details through this account. Car owners are required to pay the tax by December 1 of each year. Otherwise, fines and penalties will be assessed.

Filling out a transport tax return for legal entities

Organizations, regardless of their legal form, do not have to worry about receiving receipts. They have their own procedure, which consists of filling out a declaration. The company's accounting department itself calculates the amount of the fee payable, taking into account amendments to regulations.

The declaration contains several sections:

- Title page - all information about the legal entity will be entered on it.

- Section I - informs tax authorities about the payment amount that the organization is going to pay.

- Section II - indicates the procedure for calculating state duty.

If a company owns several cars, then there is no need to fill out separate declarations for each car. The document is submitted in one copy for all vehicles owned by the legal entity.

In addition, there are some features of filling out the declaration:

- The form can be filled out manually or printed.

- When choosing the manual filling method, it is prohibited to use pens with colored paste (green, red, etc.). The document is filled out using pens with blue, black or purple ink.

- Double-sided printing of the declaration is prohibited. Each section must be printed out on a separate sheet of paper. Each sheet must be numbered.

- It is not allowed to correct the data entered on the form using an eraser or a proofreader. However, if there is a need to correct old information, these changes must be certified by the applicants by their signature on the document.

- One character is entered into one cell. Space is also a symbol.

- If, when calculating the amount of the state duty, it is calculated in rubles and kopecks, the latter are not recorded. If the amount is below 50 kopecks, then it is not paid. If it is higher, then it is rounded to the nearest ruble (for example, if the total amount is 1800 rubles. 60 kopecks, then 1801 rubles are payable).

- All information is entered into the document in capital block letters.

You can learn more about how to fill out the declaration correctly in order to avoid significant errors in Order of the Federal Tax Service of the Russian Federation dated December 5, 2021 No. ММВ-7-21/ [email protected] . The same order also contains a form attached, which can be downloaded directly from the legal document.

Payment Methods

Citizens who need to pay taxes can use different methods:

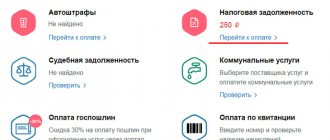

- State Services Portal. If you identify your account, you can view all taxes, debts and make payments on the website. You can pay property tax for individuals online through State Services, as well as pay transport, land taxes and other taxes. In such a situation, the portal acts as an intermediary between citizens and the Federal Tax Service. All debts are reflected in your personal account, and you can also log in through the portal on the tax service website. To do this, you do not have to visit the Federal Tax Service office to obtain temporary logins and passwords.

- Federal Tax Service website. Typically, citizens prefer to pay the transport fee on the tax office website. To do this, you need to register and log in to the site, and you will first have to come to the service branch to receive a login and password. Obtaining information about the tax amount is quite simple, since it is reflected in your personal account. Payment documentation is also generated here, and taxes can also be paid.

- Mobile bank. Many banks offer a mobile banking service that allows you to use your savings via the Internet. Here you can top up any card, transfer funds between bank accounts or pay taxes. To do this, select the tab that allows you to pay taxes or fines. You can easily find a receipt using your Taxpayer Identification Number (TIN), as well as using a barcode, details or QR. A receipt confirming timely payment will remain attached.

- Yandex.Money or other services. Some sites charge a large commission, so before paying out money, it is recommended to make sure that the chosen service is profitable.

- Personal visit to a bank or Federal Tax Service branch. Such methods are suitable for people who do not save time, and therefore are willing to allocate approximately 30 minutes or several hours, since in these organizations a significant queue often forms.

- Using ATMs. To make a payment, you need to insert a card into the device, as well as provide the correct details, which can be viewed on the notification received from the Federal Tax Service.

The choice of a specific method depends on the wishes and capabilities of the taxpayer.

Is it possible to pay without documents?

Often, receipts do not reach car owners, which is due to the negligence of tax inspectors, software failures or other reasons. Therefore, until December 1, citizens do not receive a notification containing payment details. If you fail to make a payment, large fines and penalties will be assessed, which negatively affects the finances of citizens. Therefore, it is possible to pay tax without a receipt. You can get the information you need in different ways:

- applying to the Federal Tax Service department with a passport, after which the inspection employee issues details and advises on methods of making payment;

- taxes are paid through the State Services website without entering details, but this requires an authorized personal account, and the “Federal Tax Service” section is initially selected, and then the free information service is ordered;

- through your personal account on the Federal Tax Service website, but for this you need to have a login and password.

Attention! On the service’s website you can not only get the details, but even print out a receipt.

What happens for late payment?

Late payment of transport tax is punishable by special penalties. Even a small delay will cost you extra money and time to solve this problem.

What is the liability for overdue tax:

- accrual of penalties for each overdue day (Part 1 of Article 75 of the Tax Code of the Russian Federation);

- deduction of debt from the debtor’s official income (salary, pension, unemployment benefits);

- a fine of 20 percent of the debt with a penalty;

- restriction of travel abroad of the Russian Federation - with a debt of 10 thousand rubles;

- arrest and seizure of property;

- withdrawal of funds - applies only to legal entities. persons

The initiators of such actions may be the tax service or the bailiff service. In some cases, the decision to impose liability in the form of seizure of cash and property is made by a judicial authority.

According to paragraph 2 of Art. 44 or clause 4 of Art. 57 of the Tax Code of the Russian Federation, a fine for transport tax can be charged only after the notification is received personally by the citizen.

If a notice is received and the amount of money is not transferred on time, the penalty is calculated using the following formula:

The amount of tax per one transport unit x the number of overdue days x 1/300 of the refinancing rate established by the Central Bank of the Russian Federation = penalty.

Expert opinion

Mikhailov Kirill Anatolievich

Lawyer with 10 years of experience. Specialization: civil law. Extensive experience in defense in court.

In the case where the notice was not sent by mail, and the payer was not notified in any other way about the debt, and a penalty is accrued, you can appeal the actions of the Federal Tax Service inspectors to higher authorities or in court.

The obligation to pay tax on an existing car falls on its owner and it is better to pay the debt in a timely manner, avoiding the accrual of penalties and fines and violations of the law.

What should you do if you find an error in the receipt you received? In this case, you should contact the tax service and submit an application to eliminate the incorrect information in the document. Inspectors will forward your application, along with the provided documents for the car, to the State Traffic Inspectorate for recalculation of the car's power.

When the data is updated, a new notification will be generated and sent to you.

Car tax is mandatory and you cannot avoid paying it. The payment procedure is easy to follow if you have the receipt in your pocket.

And if it is missing, you will have to restore the paper on your own, using online resources or visiting the tax office. To avoid unpleasant consequences, pay the transport tax immediately after receiving the receipt.

To avoid losing your payment, take a photo of it on your smartphone.

In practice, there are cases when a notification about the payment of transport tax (TN) does not arrive. But this cannot become a reason for failure to fulfill obligations to pay the tax. You can find out what are the reasons for not receiving a notification, what to do if receipts for transport tax have not arrived, and why you need to pay the TN in this article.

- Probable Causes

- Options

- In the absence of car registration

- Checking and paying for TN

- Paying tax without a receipt

- Is it possible not to pay tax?

Probable Causes

If the tax authorities have not sent a notice of payment of the TN, there may be quite a few reasons for this. Legislative provisions establish that taxpayers are obliged to pay the tax within the time limits specified by law.

If citizens do not receive the notification in question on time, they will not be able to pay the TN within the specified period. So, a receipt may not arrive at TN if:

- The vehicle is registered in the name of a citizen who is a beneficiary, for example, a pensioner.

- Due to technical and information failures, the road service did not inform the tax authorities that the car had a new owner. This must be done within 10 days from the date of registration of the car.

- The citizen did not inform the authorized body that he was the new owner of the car, which was registered with the traffic police.

- Technical difficulties occurred during the recalculation of the fuel tax, and errors were discovered in the accrued fuel tax.

- A document that was sent by mail from another region was lost.

- The citizen received the login and password of his personal account and registered on the website https://www.nalog.ru/. In this case, the taxpayer will no longer receive a tax notice and must track tax receipts on the Federal Tax Service website.

- The addressee changed his place of registration and did not notify the authorized body about this. In such a circumstance, the notification will be sent to the previous place of residence.

Options

If the culprit of the incident is the postal service, then the citizen needs to go to the postal organization. If this is due to an employee of the authorized body that carried out the calculations for a particular car, then you need to contact the tax service.

If a tax notice is lost, the person is advised to print this document without contacting the tax authorities. This can be done through the personal account (PA) of the taxpayer, for which you need to register on the Federal Tax Service website using the login and password that the taxpayer received from an employee of the competent authority.

Another method of authorization is registration on the State Services portal, for which the citizen needs to go to the MFC and confirm the account.

To print a receipt you need:

- On the tax.ru website, select the “Physical” section. faces."

- Press the “Log in” button.

- Click on the option “Public services, login using an account from the public services portal” after the login and password have been entered. Then you need to enter a password to log into your account.

- After selecting the “Taxpayer Documents” section, select the TN notification and print the document.

In the absence of car registration

If the owner of the vehicle has not received the notice by the first day of the tenth month, then he must contact the tax service before the end of the year and report that he bought the vehicle. After this, employees of the authorized body must calculate the payment amount and issue an appropriate invoice by sending a registered letter with the payment amount.

If the car was purchased a year ago, then employees will calculate the tax from the date of purchase of this vehicle.

Checking and paying for TN

In addition to notification of payment of the TN, a citizen has the opportunity to find out about the existence of a debt via the Internet. To do this, he must register on the Federal Tax Service portal and create a personal account using the password and login provided by an employee of the authorized body, otherwise he will have to personally visit the tax service to receive a login and password.

If a citizen finds out that the TN has not been paid for a long time, then he needs to log on to the official website of the FSSP and check whether legal proceedings have been initiated in this case.

Paying tax without a receipt

If a receipt for payment of the tax charge has not been received, then the taxpayer must follow a certain algorithm of actions to pay for the tax charge, namely:

- Print the receipt or personally contact the competent authority;

- Make a receipt payment through: any bank, personal account in Sberbank Online, payment terminal of Sberbank of the Russian Federation.

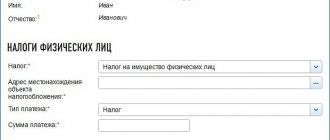

Payment of the tax amount can also be made through the State Services portal or on the tax.ru website, for which you need to go to the specified site and:

- by pressing the "Email" button. services”, click on the “Pay taxes” button;

- by selecting the option “Pay taxes for individuals.” persons”, click on “TN”;

- indicate the payment amount, and then select the “Next” button;

- Having entered the TIN, click on the “Next” button and pay.

Is it possible not to pay tax?

Until now, if the taxpayer did not receive a notice of payment of the tax charge, then he could not pay the tax charge. This legislative provision has been repealed and, according to the legislative changes made, if a citizen does not receive a receipt, he is obliged to take action to pay the tax, that is, he is not exempt from paying tax if he does not receive a receipt.

The receipt can be found on the tax.ru website, after which you need to print this document and pay through a banking institution.

If a citizen refuses to pay the TN, this will lead to unfavorable consequences, for example, the imposition of a fine, the size of which in 2021 may be large, up to 20% of the total debt. In addition to a fine, other penalties are possible in the form of:

- accrual of penalties on unpaid taxes for daily non-payment;

- seizure of the taxpayer's vehicle by court decision;

- deprivation of a driver's license;

- a ban on traveling abroad in a car for which the tax amount has not been paid.

So, if a tax notice does not arrive, the taxpayer should not remain idle. He should review and obtain a second receipt either in person on site or online. After this, it is necessary to print out the receipt and pay the TN, otherwise the citizen cannot avoid adverse consequences.

Every driver in the Russian Federation needs to know exactly when the car tax arrives. After all, the state does not always send a notification regarding this payment, and its delay costs the vehicle owner much more than the payment itself. Upcoming changes in legislation may change not only the date of payment of the transport fee, but also the entire regulations of this procedure.

Payment through State Services

Most often, citizens prefer to use the portal to pay taxes or fines. But it is important to figure out how to pay personal property tax or transport tax through State Services. It is advisable to study the step-by-step instructions to avoid mistakes.

Authorization on the portal

You can use government services on the website only after authorization. To do this, a new account is created, which is identified in the Pension Fund or Federal Tax Service department, as well as in other government agencies where you need to apply with a passport.

Attention! Some citizens are confident that the transport tax has been abolished, but in fact it will have to be paid in 2021.

Checking the correctness of the fee calculation

In your personal account, select the “Service Catalog” tab, where the “Taxes and Finance” item is located. A subsection called “Tax debt” is selected. This section provides information about the amount of debt.

If the information is available, then you just need to click on the “Pay” button to deposit funds. But first it is recommended to make sure that the calculation is correct. To do this, use a standard formula or online calculators.

Selecting a payment method

There is no option to pay the fee on the site itself, so a third-party method is chosen. Through the State Services portal, transport tax is paid in the following ways:

- Bank card. To do this, indicate the basic details of the available plastic. Some banks charge a fee for this transaction.

- Mobile payment. When using this option, you have to pay a commission, and its size depends on the operator.

- Online wallet. WebMoney or Yandex.Money is used for payment.

Information about the tax paid can be found in the “Payments” section. Sometimes citizens are faced with the fact that after payment the information in their personal account still does not change. Therefore, you need to wait a few days during which the money is credited.

Payment stages

Typically, a bank card is used for these purposes, which is available to almost every person. Therefore, the following actions are performed:

- on the main page, select the “Federal Tax Service” section, after which the details of the debts are studied;

- press the item to pay off the debt;

- a payment form appears where you select a bank card;

- information about the card is entered, represented by the number, expiration date and three-digit code on the back;

- click the “Pay” button;

- an SMS with a one-time code is sent to the phone to which the card is linked, allowing you to confirm the operation;

- After confirming the payment, a new page is displayed informing you that the payment was successful.

After this, payment information is updated in your personal account within a few days.

How to get a receipt

If a person is used to paying through a terminal or bank, then he will have to receive a paper receipt. It can be requested from Federal Tax Service employees during a personal visit to the department. Additionally, you can receive a receipt in electronic form on the website of the State Services or the Federal Tax Service, after which the document is printed.

Information contained in the receipt

After making the calculations, the Federal Tax Service sends a notification to the address of the car tax payer about the need to pay state duty and directly the receipt itself to the address where the car owner is registered. The notification must necessarily contain information about the body that sent the notification (full name of the government agency, reference data for communication), information about the car tax payer (full name, place of residence), the region in which the tax is collected, the amount payable , deadline for payment. In addition, at the end of the document there is a warning about penalties for non-fulfillment or late payment, indicating the interest rate of the penalty. The receipt for payment of transport tax by an individual contains the following information:

- About the owner of the vehicle (address, full name, tax identification number);

- About the recipient of the payment (Federal Tax Service of the Russian Federation, bank account for payment);

- About the exact amount of the state fee;

- About the final date for fulfilling the duty;

- Other details (BIK, KBK, KPP, OKTMO, etc.).

The receipt for transport tax has recently been issued taking into account modern requirements. There is a QR code in the upper left corner of its form, which makes the payment much easier. For example, if payment is made through a bank application, you can select the appropriate payment method, point your phone or tablet camera at the QR code, and all details are calculated automatically. You will only need to confirm the payment. When making a payment through a terminal equipped with a scanner, you need to bring the receipt to the scanner, directly bringing the code closer to it. The device reads the necessary information, including the payment amount. The owner of the car only needs to enter his TIN in the terminal. In some cases, the driver's license number and passport information may be requested.

Difficulties using the portal

When using the State Services portal to pay the transport fee, difficulties may arise. These include:

- lack of internet connection;

- Maintenance work is periodically carried out on the site;

- Often the portal is blocked by antivirus or other security programs;

- errors may be made when entering details;

- the money is credited within several days, so there may be a delay;

- The portal is often attacked by hackers.

In most cases, citizens do not face these problems.

Pros and cons of making payments online

Using different services on the Internet to pay taxes has advantages:

- no need to visit organizations;

- payments are often made without charging a commission;

- the process is completed within a few minutes;

- You can pay different fines or taxes using several receipts in one place.

Disadvantages include the possibility of a failure and the lack of instant transfer of funds to the Federal Tax Service. Payment of the transport fee is carried out in different ways. Often citizens prefer to use the State Services portal; for this, money is transferred from a card, as well as using electronic money or mobile payment. This method has not only advantages, but also some disadvantages.