Home page » Benefits for pensioners » What benefits do pensioners have for transport tax?

What transport tax benefits are available to pensioners in 2021? This question worries a significant part of the population. Many working citizens do not think about issues related to pensioners until they themselves reach this age.

- Should pensioners pay car tax?

- What benefits are provided for pensioners in 2021?

- How is the benefit calculated?

- In what cases is tax not paid?

- Conditions for providing benefits

- How is transport tax calculated for pensioners?

- How can a pensioner apply for benefits?

And here a number of questions arise related to benefits for pensioners. One of the frequently asked questions regarding taxation is vehicle tax.

What benefits are provided for pensioners in 2021?

The amount of transport tax benefits is set at the regional level.

First, you need to find out what transport tax breaks are provided for pensioners in a particular region of the country.

It must be remembered that the discount when calculating the transport tax begins to be applied after submitting the appropriate application to the tax authorities. If this is not done, the tax will be calculated at standard rates.

The pensioner needs to contact the local tax office, where they will explain the specifics of applying the tax benefit.

If local legislation provides for the right to a discount when paying a transport fee, then the pensioner will be offered one of the options for its use:

- A person is completely exempt from paying such a fee;

- Only 10% of the total tax amount is payable;

New in legislation

In June 2021, a bill was introduced to the State Duma to abolish the transport tax, providing for the recognition of Chapter 28 of the Tax Code and other tax-related norms as invalid starting from 2021. It also proposed that revenues from the abolition of the tax be included in the cost of the fuel excise tax.

However, already in July of the same year, this bill was rejected . Thus, it is necessary to be guided by the provisions of the current federal and regional legislation.

It is worth noting that the debate about the abolition of the transport tax has been going on for a long time: over the past 3 years, at least 3 similar bills have been submitted to the State Duma, and all of them were rejected. I would like to hope that in the near future the problem will be resolved in favor of taxpayers.

So, let's note the important points:

- the list of categories of citizens who are entitled to benefits when paying transport tax is enshrined in regional legislation; information can be obtained from the tax office;

- To receive transport tax benefits for pensioners, including transport tax benefits for military pensioners, you must prepare a set of documents and fill out an application in the prescribed form at the tax office at your place of residence;

- if vehicles owned by a pensioner are included in the list specified in clause 2 of Art. 358 of the Tax Code of the Russian Federation, then the obligation to pay transport tax does not arise.

In what cases is tax not paid?

Federal legislation has approved a list of categories of citizens exempt from paying transport tax in 2021:

- WWII veterans;

- Heroes of the USSR and Russia;

- Disabled people of groups 1 and 2, regardless of the time of receipt of disability;

- Large families with young children;

- Family members of those killed during military service;

- Owners of vehicles with a power of less than 100/s, purchased with the help of social services;

- Pensioners with transport power less than 5 l/s;

If a pensioner belongs to these categories, then he is exempt from paying the mandatory transport tax.

To clarify the benefits available in the region of residence of a pensioner, he needs to contact the local administration or tax service. You can also find out about providing a discount on transport tax on the Internet, on the State Services portal.

How to calculate transport tax benefits

Publication date: 06/10/2014 11:10 (archive)

In connection with the incoming questions from citizens about the procedure for calculating and providing transport tax benefits, the Federal Tax Service of Russia for the Yaroslavl Region reports the following.

The procedure for calculating and paying transport tax is regulated by the norms of Chapter 28 “Transport Tax” of the Tax Code of the Russian Federation and the laws of the constituent entities of the Russian Federation adopted in accordance with it. At the same time, subjects of the Russian Federation may establish transport tax benefits and the grounds for their use.

On the territory of the Yaroslavl region, transport tax was introduced by the Law of the Yaroslavl Region dated November 5, 2002 No. 71-z “On Transport Tax in the Yaroslavl Region”, which established benefits for the following categories of individuals:

— pensioners receiving a pension assigned in the manner established by the pension legislation of the Russian Federation;

— citizens exposed to radiation as a result of the disaster at the Chernobyl nuclear power plant;

- one of the parents (adoptive parents, guardians, trustees) in a family classified as large in accordance with the Law of the Yaroslavl Region “Social Code of the Yaroslavl Region” (from 10/01/2010).

The benefit is provided for a passenger car with an engine capacity of up to 100 horsepower (inclusive), and for a passenger car with an engine capacity of over 100 horsepower or another vehicle - for the amount of tax calculated for a passenger car with an engine capacity of 100 horsepower. This procedure for providing benefits has been established since 01/01/2011 by the law of the Yaroslavl region dated 10/01/2010 No. 28-z, which made appropriate changes to the above Law on transport tax in the region.

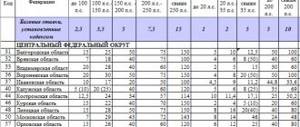

The transport tax rate established for 2013 and 2014 for a passenger car with a 100 horsepower (hp) engine is 15.8 rubles. Thus, the transport tax benefit for privileged categories of citizens whose vehicles are registered is no more than 1,580 rubles (100 hp x 15.8 rubles). A complete list of vehicles, as well as established rates and benefits for transport tax in the Yaroslavl region can be found using the Internet service “Property taxes: rates and benefits”.

For example, a taxpayer - a pensioner - owns a vehicle - a truck with an engine power of 98 hp, then the amount of transport tax, taking into account the provided payment benefit, will be 870 rubles. (98 hp x tax rate 25 rubles – benefit 1580 rubles). Before changes were made to the procedure for calculating benefits, a pensioner who owned a truck with an engine power of 98 hp did not have to pay tax.

If a pensioner owns a vehicle - a truck with an engine power of 120 hp, then the amount of transport tax, taking into account the benefits provided, will be 2980 rubles. (120 hp x tax rate 38 rubles – benefit 1580 rubles). Previously, before changes were made to the procedure for calculating benefits, a pensioner who owned a truck with an engine power of 120 hp, the amount of tax payable was 760 rubles.

A tax benefit is provided to citizens in respect of one vehicle of their choice on the basis of a written application submitted to the tax office at the place of residence and a document confirming the right to the benefit. The application and documents can be submitted to the inspectorate in person, sent by mail or through the Internet service of the Federal Tax Service of Russia “Taxpayer Personal Account for Individuals” in the form of scanned images of documents.

Conditions for providing benefits

At the regional level, transport tax is calculated individually.

The procedure for providing tax breaks to pensioners in 2021 takes into account the following criteria:

- The benefit can only be used by pensioners receiving a labor pension;

- The benefit is provided for one vehicle owned by a pensioner;

- If a pensioner belongs to several categories of beneficiaries, then he is entitled to one discount on the transport fee. Discounts cannot be combined with each other;

- The benefit may consist of complete exemption from tax, provision of a certain discount or payment of a fixed payment;

If tax benefits are not provided in the region of residence of the pensioner, then the tax coefficient for certain categories of citizens decreases.

Tax-free transport

Who has the right not to pay tax on vehicles - these are cars that were received from a social organization and are intended for transporting disabled people, and as mentioned earlier, the engine power should not be more than one hundred horsepower.

This type of transport also includes:

- equipment intended for agriculture and used, including for transportation;

- vehicles stolen and wanted.

Elena Smirnova

Pension lawyer, ready to answer your questions.

Ask me a question

Tax reduction is available to those citizens who own a vehicle and use it for public purposes, such as ships, airplanes and helicopters.

How is transport tax calculated for pensioners?

The main criterion influencing the amount of transport tax is the amount of horsepower in a pensioner’s vehicle.

In 2021, as in the previous year, the collection amount is calculated using the following formula:

Fee amount = tax coefficient * horsepower * ownership period (months) / 12 months

The presence of a benefit significantly reduces the tax rate. In some regions it is purely symbolic and amounts to 1-10 rubles per horsepower.

Features of paying transport tax for pensioners

A pensioner must pay transport tax, if he is the owner of a vehicle, for each vehicle separately. A fee is paid for motorcycles, cars, trucks, self-propelled vehicles and water transport (boat, cutter and motorcycle), highly specialized transport (ATV, snowmobile, etc.), that is, the transport tax is valid for pensioners.

The amount of the fee paid directly depends on the following factors:

- duration of ownership of the vehicle (in months);

- vehicle engine volume;

- type of vehicle (car, truck);

- year of issue.

These criteria are applied uniformly throughout Russia, but the tax rate itself may differ depending on the region and the decision made.

When does transport tax stop accruing for pensioners?

After submitting an application and documents to the Federal Tax Service for the provision of benefits, all provided data undergoes a thorough check. If they are true, the accrual of transport tax stops, i.e. receipts stop coming. As a rule, if a citizen manages to apply for a benefit before the onset of autumn, the tax will not be calculated. It is worth saying that different regions have their own methodology for providing benefits, including the date of their provision. In some regions, citizens recalculate the amount of tax for all periods after retirement, returning the paid funds to their current account; in others, the benefit is accrued from the date of submission of documents. In this regard, a pensioner should not neglect the right to cancel the transport tax, and will contact the Federal Tax Service immediately after it appears.

Who is charged for transport fees?

Any owner of personal transport is required to pay the appropriate tax. Your own transport can also be anything - a car, a boat, a bus. A citizen who has registered his or her vehicle with the State Traffic Safety Inspectorate automatically becomes a taxpayer. Having purchased and registered a vehicle, a citizen of the Russian Federation becomes obligated to pay tax from the moment of registration.

Contributions are made based on notifications received by mail or in your Personal Account on the Federal Tax Service website. From this document you can find out how much and for what year the contribution is required. To make it more convenient for the payer to pay, a receipt is attached to the letter. The tax can be paid at any bank branch. Payment must be made every year, without delay. For example, taxes for 2021 must be paid by December 1, 2021.

Attention! If you are late or do not pay this tax at all, you will have to pay a fine. So it is recommended to repay the debt without delay.

Transport taxes must be paid annually