Good afternoon, dear reader.

Every year, vehicle owners must pay transport tax for each vehicle they own. In most cases, taxes are calculated and paid without any problems. Nevertheless, overlaps sometimes occur.

Let's get started.

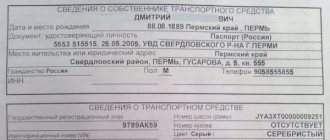

For the purposes of this article, the following example will be considered:

Ivanov Ivan Ivanovich owns a car and an apartment. At the same time, he must pay property tax - 4,100 rubles and transport tax - 5,900 rubles. Total - 10,000 rubles.

At the same time, Ivan Ivanovich knows in advance what taxes he must pay, and if any mistake is made in his personal account, he will immediately notice it.

Let's consider 2 typical problems that a taxpayer may have:

Why may I not receive a receipt for my apartment tax?

This form of tax calculation and reporting means that the tax authorities must send a special tax notice to the homeowner.

This document reflects:

- Payment amount.

- Full name of the taxpayer.

- Object of taxation.

- Due date.

- Penya.

However, often for one reason or another, notifications do not reach the recipient.

The wording of the new Tax Code of the Russian Federation in Article 52 provides that notification to citizens may be received in one of the following forms:

- A registered letter sent using postal services.

- Delivery with personal delivery.

- Via electronic data transmission channels.

- Through the Internet service “Taxpayer Personal Account”.

It is worth noting that those citizens who have received an account in a special service will not receive paper payment notifications. In connection with the transition to electronic notifications, this category of citizens will have priority in sending receipts through the service.

Additionally, it should be noted that paragraph 4 of Article 52 of the Tax Code of the Russian Federation provides the following: “If the amount of tax for the current one has not reached 100 rubles, then it is not presented for payment.” This is due to the excess costs of processing the payment amount, or, more simply put, the lack of profitability. An obligation of this nature is transferred to the next year and is not considered overdue.

The main reasons why the receipt may not have arrived in the mail are:

- Sending notification electronically.

- The tax amount has not reached the minimum value.

In such cases, notification from the Federal Tax Service does not arrive in standard form. If the user who has connected his personal account wishes to continue receiving paper notifications, he must first notify the tax authorities about this.

Possibilities of the State Services portal for payment of TN

To begin with, it is worth noting what advantages the State Services portal has when paying transport tax for a car:

- simple and clear interface - a beginner will definitely not get confused on the site;

- everything is done via the Internet, so you don’t have to visit a bank branch;

- the service is available at any time of the day, so you can pay off the fee even at night;

- availability of technical support, where you can find out the answer to any question;

- no queues;

- support for three types of payment instruments.

Among other things, it is also important to have a version of the site:

- for visually impaired citizens;

- for foreign citizens with translation (Germany, Great Britain, France).

What should I do if the payment arrived at a different address, how can I request a new one?

It is worth noting that representatives of the Financial Tax Service emphasize that in the absence of a receipt for tax payment, the payer himself must take the initiative and contact the inspectorate in person, without waiting for a second notification .

In a situation where payment documents did not arrive due to an incorrectly specified address or its loss in the mail, the tax authorities will make payments for all unpaid periods. The Federal Tax Service is notified:

- In a special form.

- With the additional provision of copies of documents confirming ownership of the property.

- Touch each object once.

Step-by-step instructions for registering on the Unified Portal

To view transport tax on State Services, you must first register. To do this, you should specify the registration data in the following order:

- Surname.

- Name.

- Mobile phone number or email address.

After the data has been entered, you should click the “register” button to receive information. A screen will then appear to confirm that the phone number you entered was correct when registering.

In a short period of time you will receive an SMS message with a confirmation code, which must be entered in the input field. After that, click the “confirm” button.

A mobile phone number will be needed for the following purposes:

- account identification;

- to notify you of suspicious account activity;

- for notifications when receiving government services.

The phone number is not used to send advertising messages or for other commercial purposes.

After the number is confirmed, you need to come up with a password to enter the e-government State Services portal. It should be entered twice and press the “save” key.

Above is the initial stage of registration on the portal. At the same time, you will be able to use some services. But it’s better to fill out all the registration information initially.

The more information about yourself a person enters, the more services will be available. It is important to enter all your data correctly, as it will be verified.

To access certain services, you must complete an identity verification procedure. It is a code that consists of numbers and letters. It should be entered in the settings on your page.

This code is sent by registered mail to the specified address and confirms the identity of the owner.

It is much faster to register an account at one of the service centers . The authorization code for the ID card will be issued there, this significantly speeds up the process.

It is important to take into account that in order to register an organization, an individual must first be registered.

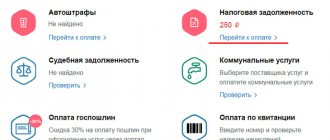

Anyone who has registered on the Unified Portal has a personal account . Knowing your SNILS, mobile phone number that was used during registration and password, you can find out the debt for transport tax through State Services.

And also make an application for traffic police fines, debts from bailiffs, obtain information about the status of your personal account in the Pension Fund and much other information.

Is it possible not to pay tax if it hasn’t arrived?

Until 2015, most property tax payers were guided by the rule that if the payment did not arrive on time, then the obligation to pay tax did not arise.

Attention! If the tax authorities have not sent the documents before December 1, then, as a general rule, the payer himself must contact the Federal Tax Service in order to avoid a fine. If the application is late, the person will be subject to a fine equal to 20% of the payment amount.

However, there is no need to contact the tax authorities:

- If before the current year the taxpayer was sent a receipt for payment of this kind at least once . In this case, the Federal Tax Service knows about the property and the taxpayer must make a payment to the budget in the manner prescribed by law.

- If the receipt was not sent in connection with the provision of benefits to the person . Since benefits are provided at the request of the applicant, the person must be aware of the fact of their provision.

Accordingly, the absence of the need to pay tax may be due to the provision of benefits or failure to achieve the minimum amount of 100 rubles.

Brief information about the site

Note! When checking your debt, you should know the specifics of the service. “Government Services” reflects tax debts, the payment period of which has already expired, and penalties are charged on them. Current accruals for which there is still time to make payment without sanctions are not taken into account in the total debt. You can view and pay these amounts using the debt search service by receipt number or on the tax service website nalog.ru.

By taxpayer identification number

With this option, you can control only your taxes. The result will be displayed on the screen in decrypted form. The debt can be paid immediately. Payment details will be entered by the portal automatically.

Before requesting debt information, you should carefully check all entered data. Otherwise, the presence of a possible error cannot be excluded, which entails failure to provide the necessary information.

Starting in 2021, you can pay not only your own taxes, but also those of others. You can do this in person or using the special service of the Federal Tax Service “Payment of taxes for third parties”. To do this, you will need to first provide information about yourself (in the “category” field you need to select “individual”, and then enter your full name and tax identification number), and then information about for whom you are paying the tax (category of person, full name and tax identification number) .

Login to the portal

- Carrying out technical work on the resource by specialists. As a rule, a corresponding notification immediately “pops up” for users, with a recommendation to visit the site later.

- Malfunctions in the normal functioning of the portal. In this case, the requested information becomes available a little later.

- Lack of necessary information on the portal, which in turn was not sent there by the tax service. In this case, the citizen should contact the local tax office for clarification.

More to read —> Discount for large families camp at sea

All information is available only after completely filling out the electronic application. Within 2-5 minutes after sending it, the amount of tax debt will be displayed on the screen. The program will offer to pay the debt directly on the website. This is done using the “Proceed to payment” button.

If paying online is not suitable for any reason, you can print out a full receipt. To do this, click the “Generate receipt” button under the form with the information. An intermediate page with payment information will open.

Now there are problems in State Services

Please note: on tax debt receipts, this number may be signed as “Document Index”. Sometimes there are forms in which the UIN is written in the “Code” line. In any case, it is not difficult to determine - it is a number of 20-25 digits. An example of the location of the UIN on the form can be seen directly below the input field (link “Where is the UIN on the receipt?”).

Another section on VAT: “If the tax authority has proven that entrepreneurial activity is carried out by an individual who is not registered as an individual entrepreneur and who has entered into relevant agreements as an individual, then in relation to income from this activity this person is, in particular, a VAT payer.”

.

For example, a person receives interest from a bank. Or he receives rubles from a dollar deposit due to exchange rate differences. There is no sign of systematic profit making - this is not considered entrepreneurial activity.

Received a tax notice. I thought a lot.

It’s been almost a year since Letter N SA-4-7/ [email protected] dated May 7, 2021

g., which came out jointly from the bowels

of the Ministry of Finance and the Federal Tax Service

. This manuscript brings to the lower level the Federal Tax Service the consolidated judicial practice related to the reclassification of the activity of individuals into entrepreneurial activity for tax purposes. In addition, it is strongly discouraged for tax authorities “on the ground” to ignore the established judicial practice.

Every year, vehicle owners must pay transport tax for each vehicle they own. In most cases, taxes are calculated and paid without any problems. Nevertheless, overlaps sometimes occur.

What to do if the payment arrived to another person with errors?

If the notification arrives with errors, it is important to remember that a special statement is attached to it, which can reflect everything with which the taxpayer disagrees.

The application reflects all errors, and it is sent to the inspectorate that calculates the payment. The owner can do this either through his personal account or by mail. If the data is incorrectly indicated, the Federal Tax Service must conduct an additional check.

It is worth noting that if errors are detected in the payment order (incorrect footage of the apartment, date of entry into ownership, full name of the owner, etc.), the owner can pay the amount that he considers correct . However, if the Federal Tax Service does not reveal any errors during the audit, the taxpayer will be charged a penalty.

The absence of a property tax payment does not exempt the property owner from paying it, and therefore, in the absence of a receipt, it is worth understanding the possible reasons for this situation.

https://youtu.be/yOrfVdXu4mY

How is tax verification done through the State Services portal?

In order to view your taxes on the State Services service, you need to go through some steps. Among them:

- Go to the website https://gosuslugi.ru.

- Enter your username and password for authorization.

- On the main page of the site in the “Categories” section.

- From the list presented, click on “Federal Tax Service of Russia”.

- Also, instead, in the service catalog, you can simply immediately click on “Taxes and Finance”.

- Next, select the “Tax debt” section.

- Click on the “Check” button, which is located on the right side of the screen.

- A page with payments will open, where the amount of tax debt will be indicated. If it is not there, the line “No unpaid charges” will appear.

- If you have a debt, you can pay it immediately using a bank card. This can also be done using the details from the receipt.

It is worth noting that tax information is verified using the TIN, which must be indicated in the profile.

How to check tax debts

There are three ways to check the availability of amounts due. This:

- Through the “Tax Debt” service on State Services. The TIN is required, and data on all amounts appears right there. Moreover, if necessary, debts are repaid by multipayment, that is, all at once.

- Using the informer in the State Services mobile application. There is no need to enter a password or login, there is also no need to remember about deadlines, and repayment is carried out in a few clicks on the screen.

- In your personal account on the website nalog.ru. To do this, you must log in using State Services. Payment on the site is also available using the portal.

Sources

- https://mfc-gosuslugi.com/nalog/kak-posmotret-i-oplatit-nalog-na-imushhestvo-cherez-gosuslugi

- https://hranirubli.ru/nalogi/kak-oplatit-nalogi-cherez-gosuslugi

- https://ogosuslugah.ru/kak-oplatit-nalogi-cherez-portal-gosuslugi/

- https://Gosuslugi-online.ru/kak-oplatit-nalogi-online-cherez-gosuslugi/

- https://OplataGosuslug.ru/main/ufns/

- https://vsegosuslugi.ru/nalogi-cherez-gosuslugi/

How to find out the amount of tax payable

Taxes are assessed by the tax office and indicated in the notice. If you have a plot of land, a house and a car, then all types of debts are indicated in one notice and are paid together or separately. Notifications are sent to taxpayers via Russian Post or to your personal account on the website nalog.ru, if you are registered there. Moreover, if you have a profile on the tax website, then you can receive a paper notification only after contacting the organization with a corresponding application.

View taxes on the Federal Tax Service website nalog.ru

Please note: in order to find out tax debts by the last name of an individual, this person must have an account and log in to the system with all the details. In the application you need to indicate your TIN - and only then will the desired answer be received. If the user already has an account, the debt will “hang” in his personal account, unobtrusively reminding him of the fulfillment of his civic duty.

Check taxes through State Services

On the Yandex website. Money has been operating the City Payments service for checking and paying taxes on Yandex for almost five years. Money. It’s very easy to find out your debt and pay it using your Yandex account. By selecting the “Payment of taxes” item in the services and goods section, you need to indicate the TIN and click the “Check” button. You can pay taxes here:

You do not need to verify your account to receive debt information. But you will need to do this to access most other services. You can verify your account in any of 3 ways:

You may like => Examples from the Practice of Positive Legal Responsibility in Administrative