The service of online payment of transport tax on a car by an individual is available today on many websites. However, as you know, you can’t trust everyone on the Internet, so when paying taxes, use the services of trusted resources. Today we will just talk about sites with which you can make payment for TN and not fall into the hands of scammers.

You will find detailed instructions in the body of the article, and we have briefly answered the main questions about paying car tax below:

Payment via Sberbank Online

Payment through State Services

Payment without receipt

Pay vehicle tax online

You can pay your car tax right here using a special form on our website. To do this, enter your INN, SNILS or receipt number from the tax notice in the line and click on “Search”.

Search and payment of transport tax

You can also pay car tax online using:

- The official website of the Federal Tax Service - nalog.ru;

- Internet banking “Sberbank online”;

- State portal of public services;

- Internet wallets (for example, Yandex.Money), etc.

Read the procedure for paying transport tax by individuals through State Services and Sberbank-Online in separate articles.

Each payment method has its own advantages and disadvantages. For example, the best portal for tracking tax revenues is the Federal Tax Service website. However, you will not be able to register on it via the Internet - you can get a login and password to enter only if you personally visit the tax office. As for the State Services portal, in order to be able to pay taxes, the user must obtain a standard account after waiting for the passport data to be verified by the Ministry of Internal Affairs.

Those who do not have access to their personal account on the Federal Tax Service website should remember that they can pay the road tax on a car on time only using the receipt number from the tax notice. You cannot find and pay your car tax using your tax identification number until it becomes overdue. We will tell you how to pay tax without a receipt here.

Online tax payment

Modern technologies make it possible to pay almost all taxes online. To do this, you must have funds on your bank card and a means of accessing the Internet (phone, tablet, personal computer).

Portal "Government services"

You can pay the transport tax through the State Services portal, which will be a guide to the website of the Russian Tax Inspectorate. The fact is that the taxes themselves are not visible on the portal; debts for all types of taxes are reflected there. But State Services can provide invaluable assistance in authorizing your personal account on the website www.nalog.ru. If you do not use State Services, then to activate your personal account on the website of the Federal Tax Service of the Russian Federation, you need a personal visit to the nearest tax office to receive an identification card, which shows your login and password.

And with the help of authorization through the State Services portal, this can be done in a couple of minutes, without leaving your computer. After which all information on taxes, including transport tax, will be available to the taxpayer. And many payment methods will be offered.

When choosing Government Services, you need to select a payment method and make a payment.

Read more about paying taxes through State Services on our website.

Tax service website

Pay transport tax online - the official website of the tax service helps with this. As mentioned above, in order to be able to see and pay taxes on the tax service website, you first need to register and authorize the taxpayer’s personal account. All information about payment methods can be obtained from the Federal Tax Service “Pay Taxes” service, which was developed as detailed instructions. There you can also generate a payment document and pay the obligatory payment through partner banks online.

Sberbank Online

The Sberbank Online application provides a lot of opportunities to make various payments to any citizen who wishes to use it.

In order for a car owner to pay transport tax, he needs to take only 4 steps:

- open the application and log in as an authorized user;

- select the tabs “Payments”® “Taxes, fines, traffic police”® “Search and payment of taxes to the Federal Tax Service”;

- select one of the proposed search options (TIN, document index, by details, barcode, QR);

- confirm the payment.

Detailed instructions for paying taxes through Sberbank Online are available on our website.

Yandex. Money

“How to pay transport tax using Yandex. Money?" — some vehicle owners are interested. First you need to create a Yandex e-wallet using Yandex. Email and current phone number. You can pay from a replenished wallet or directly from a bank card. In this case, the wallet will work as protection for missing a payment. To pay transport tax, you need to know the receipt index or TIN of the car owner.

Other services

Other payment methods are not the most popular, such as:

- through the Russian Post, due to the fact that not every branch accepts payment of taxes, but at each branch there is always a considerable queue. The reason for the failure is usually cited as the consequences of optimization processes and a lack of specialists;

- through the federal payment system "City". It has been operating in the financial market for 19 years, accepting card payments online and in special terminals. You need to register on the site and fill out a significant number of forms, which makes the process difficult. Also, terminals are not located in every city;

- through private multifunctional self-service terminals. Taxpayers rarely choose this method due to the unknown nature of the device, its owner, the presence of a commission, and they often lack a receipt tape.

How to pay transport tax on a car online on the official website of the Federal Tax Service

How to pay transport tax on a car online with a bank card via nalog.ru:

1Login to your personal account.

2Click on the “Accrued” tab.

3A table will open, from which you can see what the tax was charged for and in what amount. To pay transport tax on a car, click on the “Pay charges” button.

4Tick the checkboxes for the taxes you want to pay and click on “Online payment”.

Next, all you have to do is choose a convenient method for transferring money and pay the bill. Information on paid tax debts is reflected in the “Paid” tab.

How to pay for car tax using Yandex.Money

If you have a personal wallet on Yandex.Money, you can use it to pay transport tax. You cannot pay tax from someone else's wallet. How to pay car tax via Yandex wallet:

1Log into your wallet;

2In the menu on the left, select “Goods and Services” and go to “Taxes”;

3Enter the receipt number or TIN (only for paying debts) click on “Check”.

4To pay off the debt, click “Repay”.

You can pay your bill either from an electronic wallet or using a bank card. Information about the debt will disappear from the site after a few weeks.

How to pay transport tax via WebMoney

If you have a WebMoney wallet, you can use it to pay auto tax. To do this, go to your personal account and select the “Payment” button on the left.

Next, go to “Fines and taxes”.

A window with possible search options appears, where you need to select “Taxes by TIN” (if you are already late with the payment) or “Taxes by UIN” (to pay using a receipt from the tax office). We choose to search by TIN, since we do not have a receipt.

Enter your tax identification number and click “Find.”

The service found our debt and penalties. Select payment of the tax amount and click “Next”.

Payment is made from the wallet, therefore, it is necessary to top it up in advance.

The system will pay for all debts at once, that is, for transport tax and penalties, so you should top up the total amount at once.

Next, click “Pay.” You will receive an SMS code that you must enter to confirm the transaction.

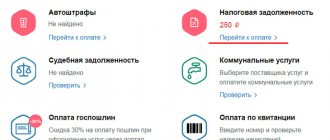

How to pay car road tax online (other methods)

In addition to the main methods of paying transport tax, I would like to highlight several more possible options:

1Service “Payment for Government Services”.

There is a website “Payment for State Services”, which also provides the opportunity to pay transport tax. You need to go to the website and enter the TIN number or tax receipt index.

After a short search, the system displays the presence of debt.

By clicking on one of the links, full information about the payment will open (who is the recipient, details, what kind of payment, etc.). All you have to do is enter the payer’s details below and click on the “Pay” button.

Next, you will be asked to place an order for a small amount with a bank receipt indicating that you paid. But you can also refuse it. After this, confirm the payment and select the payment method: from a mobile phone or from a bank card. But please note that there will be a fee for processing the payment.

2Qiwi wallet.

Surely many have heard about the QIWI wallet service. If you don't have one, you'll need to create one first. From this wallet you can make payments on many sites, and also use it as an independent payment instrument, that is, check the debt and pay it.

3Alfa-Bank personal account.

This method is suitable for those who have a card from this bank. To pay the tax you need:

- Log in to your personal account.

- Select “Transfer to the Russian budget” from the menu on the right.

- Fill out the form with the details from the receipt that came to you by mail and click “Continue”.

Next, all that remains is to confirm the payment by clicking on “Pay”.

Payment through the Federal Tax Service

Website of the Federal Tax Service - www.nalog.ru

You can pay the transport tax online on the official tax website - select current charges or debt. To find out the status of settlements with the budget or download an electronic receipt, you must log into your Personal Account for individuals.

Step-by-step instructions on how to pay car tax online:

- In the header of the main page of the site, click on the “Services and government” tab class=”aligncenter” width=”1803″ height=”488″[/img]

- Scroll down the page a little to the “Payments” section, select the first item;

- Further actions depend on if you have a receipt:

- Yes, then enter the index from it in the selected window, then click the Go button and pay by entering a bank card;

- There is no receipt. You can generate a payment document manually. But you need to know the payment amount and your TIN;

- We fill in the information about the payment - indicate the type: transport tax, enter the amount, details of the recipient and the taxpayer. It's easier than it seems - the service automatically fills in the fields when you enter personal data. All that remains is to enter your plastic data and pay.

If you find it difficult to generate a receipt or there is not enough data for this, then you can download the payment document electronically from your Personal Account.

Find out how to pay a traffic police fine by order number right now.

Personal Area

Pay and find out the transport tax through the online service Personal Account. It provides all the information about accrued and previously paid tax payments, you can identify overpayments or debts, receive and print a receipt and monitor the status of the payment.

There are three authorization methods:

- Enter the login and password from the registration card, which can be obtained in any tax office in the Russian Federation;

- Using an electronic signature, the verification key of which is issued by the Certification Center;

- Using a verified State Portal account class=”aligncenter” width=”1602″ height=”871″[/img]

After logging in, you will immediately be informed about the absence or presence of debts, including transport ones. Click the “Pay” button if the latter is indicated/

Summarizing everything written above, we can conclude:

- Payment by receipt online does not require commission or authorization;

- You can carry out the operation from a PC or in a mobile application;

- To view current payments, authorization is required.

How to pay transport tax through a Sberbank terminal (ATM)

For those who are not entirely comfortable with modern technology and its innovations, we suggest that you familiarize yourself with the instructions for paying transport tax through an ATM and Sberbank terminal.

The ATM and the terminal differ slightly in functionality, but the payment process is identical. Let's consider payment through the terminal:

- First, you need to decide how you want to make the payment: using cash or a card. If you pay with a card, insert it into the appropriate hole and enter the PIN code.

- Next, click on the “Payments” tab.

- Going to the next page, you must select “Taxes”.

- Using the institution number, we select the required tax office, after which all the details necessary for making the payment will be entered automatically.

- You will be required to enter payer information, payment type and amount to pay.

- Next, click “Pay”.

Important!

If you paid with a card, the money will be debited automatically; if in cash, the terminal will ask you to deposit money one bill at a time. It is very important not to deposit all the money at once, otherwise he will not accept it. As soon as the bills are accepted, two checks will appear, one large, one smaller. Keep a large receipt, it will serve as proof that you paid the tax if for some reason the payment does not arrive.

Now let’s consider payment through a Sberbank ATM:

As in the previous case, we select the payment method: cash or card.

If you choose a cash payment method, proceed directly to the third step.

Next, select the “Payments in our region” button, which is usually located in the right column.

A window appears in front of you in which you need to select “Search for payee”.

Now several options for searching for the required recipient appear on the screen: by TIN or by barcode. The second is the most convenient and simple, but unfortunately, the barcode is not yet stamped everywhere, and not all ATMs have a special camera that reads it. I don’t recommend searching by name, because before you find the item you need, you’ll have to look through a considerable list. Therefore, it is better to select the “Search by TIN” option.

We enter the recipient's TIN in the appropriate window, which is indicated on the receipt.

If you did everything correctly, then you will see several payment options for the desired recipient. In our case, you need to select the last option “By receipt of the Federal Tax Service”. Next, the ATM will ask you to present the receipt to a special scanner.

There may be several barcodes on a receipt, but the correct one is on the far left of the receipt. The ATM does not count the rest.

As soon as the scanner loads the information, the details will appear on the screen. Check them carefully, and if everything is correct, then click on “Continue”.

Next, enter the required amount into the bill acceptor. If it exceeds the payment amount, the ATM will offer to deposit it into your mobile phone account. Don't forget to pick up your receipt and check.

The main advantage of paying transport tax via an ATM or the Internet is the time savings and the absence of commission. Of course, you can make a payment through the cash register with the help of a cashier-operator, but there are long lines, a commission, and possibly an additional payment for filling out the PD-4 form.

Is transport tax paid at the place of registration of the car or the owner?

Funds received from transport tax payers go to the local budget. According to the Tax Code, taxes should be paid at the location of the property. For cars and other land vehicles, the location is considered to be the residence address of the car owner.

Payment of tax and advance payments of tax is made by taxpayers to the budget at the location of the vehicles.

Part 1 Art. 363 Tax Code of the Russian Federation

The location of property for the purposes of this article is recognized as: ... for vehicles not specified in subparagraphs 1 and 1.1 of this paragraph - the location of the organization (its separate division) or the place of residence (place of stay) of an individual, for which, in accordance with the legislation of the Russian Federation The vehicle is registered with the Federation.

clause 5 art. 83 Tax Code of the Russian Federation

This means that, regardless of where the car is registered, you pay tax to the budget of the region in which you live. For example, if the car was registered with the Moscow State Traffic Safety Inspectorate, and you live in St. Petersburg, the payment of the car tax should be sent to the Federal Tax Service of St. Petersburg.

As for taxpayer organizations, for them advance payments for transport tax in 2021 are made at the location of the organization or its division. Learn more about the specifics of paying legal auto tax. read here

History of transport tax in Russia

The history of transport tax in Russia dates back to the 20s of the 20th century. Almost 100 years ago, vehicles were horses, horse-drawn carriages, bicycles, etc. However, in the resolution of the All-Russian Central Executive Committee “On the volost budget” of 1924, there is already a clause “Tax on vehicles” in the section “Income sources”. Since then, the transport tax has undergone many changes, and the list of objects of taxation has become wider.

By 1981, technological advances had led to the exclusion of cyclists, horse owners and other riding animals from the tax bracket. Starting this year, the amount of transport tax began to be affected only by the power of the car. In 1991, for the first time, transport tax rates were differentiated depending on their capacity.

After another 10 years, the Federal Road Fund of the Russian Federation was abolished. The new federal law on tax rates brought them closer to the values that look familiar today. This meant one thing - a sharp increase in tax rates, while regional authorities could increase or decrease them. Previously, before this reform, all contributions from drivers went to special road funds. And then all the fees were spent on maintaining the roads in good condition. Now the entire transport tax goes to the regional budget and is distributed by it for various needs at its own discretion.

In 2013, the Federal Law “On Amendments to Article 362 of Part Two of the Tax Code of the Russian Federation” was adopted. He supplemented the rules for calculating transport tax by introducing increasing coefficients for expensive cars. Since then, there have been no significant changes. We have described only briefly how long the transport tax has existed in Russia and how many changes the procedure for its calculation has undergone. At the same time, many car enthusiasts sincerely do not understand what and why they pay. After all, even if the car has been sitting in the garage for years, but it has more power, you have to pay more tax than if the roads are intensively used by less powerful cars. In addition, as we wrote above, the very purpose of collecting transport tax has become very vague. Over the past few years, rumors have regularly appeared and all sorts of discussions have arisen about the “cancellation” of the transport tax, or rather replacing it with either an environmental tax, or its inclusion in the price of gasoline, etc. However, the Russian government opposed these initiatives, since this would lead to a loss of budget revenues of the constituent entities of the Russian Federation. And when something will change is unknown.

Is it possible to pay transport tax in installments?

It is not prohibited to pay transport tax in installments. You can completely break the amount into as many parts as you wish. For those who are planning to pay car tax in installments, we have some advice:

1Keep every payment receipt.

When paying taxes in installments, there is a high probability that one of the payments will be lost. If at least one contribution does not reach the tax office, you will be considered a debtor. Payment receipts are proof that you have fulfilled your debt obligations to the tax authorities on time and in full.

2Make your final payment by December 1st.

The deadline for paying car tax is December 1. By this day you must pay the entire amount. If you do not have time to pay the tax, you will also have to pay penalties, which are accrued for each day of delay.

Penalties stop arriving only after the tax office has received information about full payment of the car tax, and this may take several days. Therefore, if payment is late, first pay the tax in full, and only after a few days pay off the outstanding penalties.

Can I pay in installments?

“Is it possible to pay transport tax in installments? Wouldn't this be a violation of the law? What if I can’t afford a one-time payment?” Such questions are most often of interest to car owners.

The law does not prohibit paying transport tax in installments, even 1 kopeck per day. However, in this case it is important to note two points:

- if you make payments in installments before the reporting deadline (December 1), this will be the best option;

- If you make payments in installments after the reporting deadline (December 1), then you will already be paying the debt, and penalties will be charged for each day of delay.

Is it possible to sell a car if the transport tax has not been paid?

You can sell a car with a transport tax debt in any case - debts do not affect the ability to draw up a purchase and sale agreement. But the question of whether the new owner will be able to register such a car in his own name is not so clear-cut.

1When will it be impossible to re-register a car with transport tax debts?

The buyer will not be able to register a car if it has restrictions on registration actions. Bailiffs have the right to impose such a ban if the owner has evaded paying taxes for a long time and enforcement proceedings have been initiated against him.

You can see if a car has a registration restriction on the official website of the State Traffic Safety Inspectorate. To do this, go to the “Car Check” service in the “Services” section on traffic police.rf and enter the car’s VIN code in a special form.

If there is such a restriction, you should first pay off your debts, wait until the enforcement proceedings are closed, and only then sell the car.

2When can you sell a car?

If you have a small debt to the tax office and no enforcement proceedings have been initiated, you can sell the car. However, you will still have to pay off the debt and also pay a new tax for the year in which you sold the car.

The tax amount in this case will be calculated taking into account the number of full months of car ownership (calculated from January to the month of registration of the car for the new owner). For example, if you sold a car and the new owner registered it in his name on March 20, 2021, in 2021 you will have to pay 3 months of car tax.

Remember that the tax for a sold car ceases to be calculated not from the date of drawing up the purchase and sale agreement, but from the date of registration of the car with the traffic police. Until the new owner registers the car in his name, you will pay for it.

Transport tax - reporting

From January 1, 2021, the tax return for transport tax was canceled . The last time organizations had to report for 2021.

Organizations must independently calculate transport tax, including advance payments for it, for 2020 and transfer it to the budget without filing a declaration.

The tax authorities will monitor the correctness of the calculation based on information received from the traffic police and other sources. The inspection will reflect the results of its calculations in a message in the approved form - Message on the amount of transport tax. According to general rules, the inspectorate will be able to send it no later than 6 months after the tax payment deadline. Other deadlines are established for recalculation or upon liquidation of an organization. The tax office will send notifications via TKS or to your personal account. If there is no other possibility, the notification of the calculated tax will be sent by mail or delivered personally to the head (representative) of the organization against signature. The message will contain information about the object of taxation, tax base, tax period, tax rate and the amount of calculated tax.

If an organization does not agree with the inspection’s calculation, it has the right, within 10 days after receiving the message, to submit to the Federal Tax Service Inspectorate explanations or documents confirming the correctness of its version. Having considered the objections, the inspection will send the organization a response in the recommended form - On the results of consideration of the message about the amount of transport or land tax. Depending on the outcome of the review, the tax authorities:

- or they will clarify their calculation and reduce the amount of tax if the organization proves that it is overestimated;

- or they will present the organization with a demand for repayment of the arrears if they do not accept the organization’s objections.

For what year is transport tax paid in 2021?

In 2021, car owners pay taxes for 2021. According to the Tax Code of individuals. persons are required to pay the car tax in full for the previous tax period, that is, for the previous year, before December 1.

The tax is payable by individual taxpayers no later than December 1 of the year following the expired tax period.

para. 3 p. 1 art. 363 Tax Code of the Russian Federation

The tax period is a calendar year.

clause 1 art. 360 Tax Code of the Russian Federation

This means, if you didn’t have a car in 2021, but bought it in 2021, you won’t have to pay car tax on it this year, and you should expect the first letter from the tax office only in a year.

Calculator for calculating motorcycle transport tax in 2021

To find out what tax you will have to pay this year, use the free online calculator on our website. Since the tax rates used for calculation differ by region, to calculate your motorcycle road tax, select your region from this list and enter the required data into the calculator on the new page.

| Select your region | ||

| 77, 99, 97, 177, 199, 197, 777 Moscow | 78, 98, 178 St. Petersburg | |

| 01Republic of Adygea | 30Astrakhan region | 57 Oryol region |

| 02, 102 Republic of Bashkortostan | 31Belgorod region | 58Penza region |

| 03Republic of Buryatia | 32Bryansk region | 59, 81, 159 Perm region |

| 04Altai Republic | 33Vladimir region | 60Pskov region |

| 05Republic of Dagestan | 34, 134 Volgograd region | 61, 161 Rostov region |

| 06Republic of Ingushetia | 35Vologda region | 62Ryazan region |

| 07Kabardino-Balkaria | 36, 136 Voronezh region | 63, 163 Samara region |

| 08Republic of Kalmykia | 37Ivanovo region | 64, 164 Saratov region |

| 09Karachay-Cherkessia | 38, 85, 138 Irkutsk region | 65Sakhalin region |

| 10Republic of Karelia | 39, 91 Kaliningrad region | 66, 96, 196 Sverdlovsk region |

| 11Komi Republic | 40Kaluga region | 67Smolensk region |

| 12Republic of Mari El | 41, 82 Kamchatka region | 68Tambov region |

| 13, 113 Republic of Mordovia | 42, 142 Kemerovo region | 69Tver region |

| 14Republic of Sakha (Yakutia) | 43Kirov region | 70Tomsk region |

| 15Republic of North Ossetia | 44Kostroma region | 71Tula region |

| 16, 116 Republic of Tatarstan | 45Kurgan region | 72Tyumen region |

| 17Republic of Tyva | 46Kursk region | 73, 173 Ulyanovsk region |

| 19Republic of Khakassia | 47Leningrad region | 74, 174 Chelyabinsk region |

| 21, 121 Chuvash Republic | 48Lipetsk region | 75, 80 Transbaikal region |

| 22Altai region | 49Magadan region | 76Yaroslavl region |

| 23, 93, 123 Krasnodar region | 50, 90, 150, 190, 750 Moscow region | 79Jewish Autonomous Region |

| 24, 84, 88, 124Krasnoyarsk region | 51Murmansk region | 83Nenets Autonomous District |

| 25, 125 Primorsky Krai | 52, 152 Nizhny Novgorod region | 86, 186 Khanty-Mansi Autonomous Okrug |

| 26, 126Stavropol region | 53Novgorod region | 87Chukotka Autonomous Okrug |

| 27Khabarovsk region | 54, 154 Novosibirsk region | 89Yamalo-Nenets Autonomous Okrug |

| 28Amur region | 55Omsk region | 95Chechen Republic |

| 29Arkhangelsk region | 56Orenburg region | |

When calculating the cost of road tax, be sure to indicate the type of vehicle in the calculator. If you want to find out the auto tax for an ATV, select “Motorcycle, scooter” in the vehicle type.

Pay transport tax using the TIN of an individual

As we have already said, you can pay transport tax online using your Taxpayer Identification Number (TIN) before it becomes overdue only through the taxpayer’s personal account on the Federal Tax Service website. To pay your car tax on time using any other online resource, you should use the payment document number that you will find in the letter from the tax office.

If you did not have time to pay the Taxpayer Tax before December 1, you can do this using your Taxpayer Identification Number (TIN) through a special form on our website, using the State Services portal, Sberbank-Online or one of the electronic wallets.

These and many other services make it possible to make payments without leaving your home. All you have to do is choose a convenient payment system and don’t think about TN again until next year.