Receipt for payment of transport and property taxes

The receipt on the basis of which the tax for the use of the vehicle is paid is generated according to the PD-4 form. It must be delivered to payers at least 30 calendar days before the last payment date. And according to tax legislation, transport tax debt must be repaid before December 1 of the year for which the money is paid. For example, a citizen must pay the transport payment for 2021 before December 1, 2021.

It is believed that if there was no notification of the need to pay the debt, then there is no need to transfer money. But, as practice shows, tax officials can make a citizen happy by sending him several “forgotten” notifications at once. Thus, in the next calendar year they will be given the right to demand compensation for debts for 2021, 2021 and 2021. That is why it is better for a car owner not to take risks, but to ask how to get a receipt for payment of transport tax in order to pay off the debt yourself.

You can generate and then print the finished receipt on the official website of the tax service. This requires:

- Open the service “Payment of taxes for individuals”;

- Go to the “Make a request...” tab.

- A form will appear on the monitor in which the following information should be indicated:

- Full name of the person who is going to pay the debt;

- its identification number;

- indicate the type of tax you intend to pay;

- payer's registered address;

- payment amount;

- how payment will be made.

After filling out all the data, a new tab will open, where the generated receipt in PDF format will be displayed. If this does not happen, make sure you have Acrobat installed.

The opened receipt for property tax for individuals or for a vehicle can be printed immediately or saved to a flash drive.

- Why?.. 10 answers to strange questions that everyone has asked at least once

As for the payment method, there are two options available - non-cash and cash. In the latter case, the payer will receive a pleasant bonus in 2018. He will be given the opportunity to transfer funds without paying a payment commission.

In the first case, a citizen needs to visit a bank branch and pay there by presenting a printed payment slip to the cashier.

Mandatory data that must be present in the document include:

- Full name of the person who is the payer;

- the address at which this citizen is registered;

- its identification number;

- the bank to which the paid amount will be transferred;

- the day by which the money must be transferred;

- payment amount.

In 2021, receipts will feature a QR code.

With its help, a person will be able to pay off tax debts at any ATM where a reader is installed.

Who should calculate taxes and when and how to find out the debt

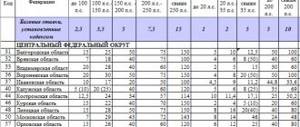

Property taxes for individuals are calculated by the tax authorities themselves. This is stated in paragraph 3 of Article 396, Article 408 and paragraph 1 of Article 362 of the Tax Code of Russia.

These articles provide rules for calculating each tax, and the payer can double-check the amount or calculate it in advance in order to plan his budget.

The inspectorate calculates taxes in advance and, based on the amounts received, generates tax notices - written messages to payers about the objects of taxation they have with a table indicating the size of the tax base, rates, accrued amounts and debts, as well as a penalty, if it is collected from the person. The notification is accompanied by ready-made payment notices and receipts for payment.

How to check and pay tax debts online

Notifications are sent out several months before the due date for payment of taxes for individuals.

There is a single deadline for payment of property payments - December 1 of the year following the year in which the objects of taxation arose.

Personal income tax must be paid by July 15 of the year following the year in which the taxable items arose.

How to find out about debt:

- receive a tax notice by mail - it arrives at the address indicated in the AIS-Tax database; usually this is a citizen’s registration; if the payer is actually located at a different address, you need to inform the inspectorate about this;

- visit the Federal Tax Service and inquire about the presence of charges and arrears;

- view the debt in your Personal Account on the website of the Federal Tax Service of Russia;

- monitor tax accruals through the State Services portal.

If the debts are small, then the inspectorate may not send a demand for payment of taxes, fines and penalties, but the penalty will be accrued every day. In the case of large amounts, the Federal Tax Service creates a demand, and if it is ignored, it proceeds with forced collection.

Tax deduction through the MFC - can you return more than a quarter of a million?

In the case of personal income tax, payers independently calculate income, except for wages - it is calculated and paid by the employer.

How to pay taxes through your personal taxpayer account

- Receive up-to-date information about property and vehicles, the amounts of accrued and paid tax payments, the presence of overpayments, and tax debts to the budget.

- Monitor the status of settlements with the budget.

- Receive and print tax notices and receipts for tax payments.

- Pay tax debts and tax payments through banks that are partners of the Federal Tax Service of Russia.

- Download programs for filling out a personal income tax return in Form No. 3-NDFL, filling out a declaration in Form No. 3-NDFL online, sending a declaration in Form No. 3-NDFL to the tax office in electronic form, signed with the taxpayer’s electronic signature.

- Monitor the status of the desk audit of tax returns using Form No. 3-NDFL.

- Contact the tax authorities without a personal visit to the tax office.

How to Print Tax Receipts from the Internet

- for users – through the taxpayer’s Personal Account;

- for other persons: by personal contact to any tax office, or by sending a postal message, or using the Internet service of the Federal Tax Service of Russia "".

How to generate receipts for paying taxes on the Federal Tax Service website

These authorities provide information to the tax service on the basis of information available in their information resources (registers, cadastres, registries, etc.) If, in the opinion of the taxpayer, the tax notice contains outdated (incorrect) information about the property or its owner ( including the period of ownership of the object, tax base, address), then to check and update it you must contact the tax authorities in any convenient way:

In fact, this process is simple and at the same time unique, because it allows a person to create a document himself before the letter arrives in the mail. A person should not worry about when and how to pay car tax and where to get a receipt. When registering a vehicle with the state, data about the car and the owner are automatically entered into the tax database of the Russian Federation service.

- Name of the legal entity; Address (location) of the legal entity; OGRN; GRN; TIN; checkpoint; Information about the state registration of the organization; Date of entry in the Unified State Register of Legal Entities (registration of a legal entity); Name of the registering authority that made the entry (Tax); Address of the registration authority; Information on amendments to the Unified State Register of Legal Entities; Information on state registration of changes made to the constituent documents of legal entities; Information about licenses, registration as policyholders in funds, information about registration.

How to pay taxes as an individual entrepreneur

An entrepreneur pays taxes and fees either once a quarter - these are current or advance payments, or once a year - based on the results of the past 12 months. He can use the following methods:

Useful documents to download

1. Issue a paper receipt

To do this, take a receipt form from the Federal Tax Service in advance or fill it out manually, go to a branch of any bank and pay the tax. Most often, Sberbank is used to pay taxes and fees. The disadvantage of this method is that there are queues at banks and you will have to pay an additional commission.

Entrepreneurs without a current account often pay through receipts. This is convenient, because a receipt is an analogue of a payment order.

- How to reset personal income tax declaration 3, sample form 2019

2. Through the entrepreneur’s personal account or from a card

This is convenient because the entrepreneur can pay via the Internet or mobile application. But you will have to fill out the payment yourself and the possibility of error remains.

The taxpayer’s personal account is a channel of communication and data transfer between the taxpayer and the state.

Using a taxpayer's personal account (TPA) simplifies life and helps:

- Find out about the presence of debts and overpayments for taxes - personal income tax (personal income tax), property tax for individuals, transport and land taxes.

- Send any documents through your account. Everything related to notifications, messages, statements. This is especially convenient when you urgently need to submit an application for benefits or confirm the availability of tax deductions. In addition to the official document, attach scanned copies of real documents.

- Pay taxes using TIN for free

- without visiting the tax office

- Fill out and send reports on form 3-NDFL

- Create a payment order and pay taxes yourself

4. Through specialized services. For example, this one.

1. Using the login and password in the registration card.

The password can be complex and consists of several characters taken at random by the machine. It is difficult to repeat it and it is advisable to change it to your password within the first month. You will receive a registration card at any Federal Tax Service by presenting an identification document.

2. Using an electronic digital signature (EDS).

- Tax personal account of the taxpayer login, registration, debt verification

EDS is a person’s “live” signature translated into electronic format. It is issued for one person and virtually confirms all actions performed using an electronic signature. It helps you quickly pay taxes for individual entrepreneurs through the taxpayer’s personal account.

To obtain an electronic signature, you need to prepare documents: passport, SNILS, INN, OGRN individual entrepreneur.

When paying via the Internet, it is most convenient to use the service of the Federal Tax Service - pay the tax. On the service, the entrepreneur pays taxes online for free without commissions or additional payments.

To do this, go to the website and select the “Individual Entrepreneurs” section. Then click the “Fill out payment order” button, then go down and click the “Skip and proceed to fill out the payment document” button.

In the “Taxpayer” field, indicate “Individual entrepreneur”. In the “Payment document” field, put a dot on “Payment document” and click “next”.

Suppose an individual entrepreneur decides to pay imputation or UTII. To avoid mistakes when writing 20 digits of BCC, first select “Type of payment”. In our case - “Tax on total income” and in “Name of payment” we select the required tax “Single tax on imputed income for certain types of activities”.

The numbers in the “KBK” field appeared automatically and you will only be left with “Payment Type” - payment.

Now let’s choose the tax itself for which we will pay. To begin, put a tick in the “Define by address” field and enter the IP registration address. And again the required numbers will appear in the “OKTMO” field. All you have to do is select “IFTS code” from the table and click next.

On the next page, select the current payment in “Basis of payment”. This is TP - Payments of the current year and we indicate the tax period and payment amount. All that remains is to enter your personal data - full name, tax identification number and, if desired, your place of residence. That's it, the payment order is ready!

All you have to do is choose the type of payment - cash or non-cash payment.

When paying in cash, you need to print out a receipt and go to any bank. Now you will be calm and confident that you transferred the money to the correct KBK and OKTMO, and will not remain in “unexplained payments”. Unexplained payments can be returned using letters, but this is long and tedious.

For non-cash payments, pay taxes online through the provided banks or government services. There is a large selection of banks on the site and you can always choose the appropriate option.

Your browser does not support iframes!

Each owner of a vehicle and property must pay the appropriate taxes on time. But, to implement this obligation, you need to print out a receipt for paying tax according to the TIN.

Where can I get a new copy of the receipt for taxes paid long ago?

A situation is possible when a person paid tax to the budget on time, but after some time received a demand from the Federal Tax Service to pay it. When visiting a government agency, it turns out that the payment is not listed in the Federal Treasury system.

Typically, such situations are associated with payment using incorrect details or loss of payment in the document flow and the expiration of a large amount of time - several years.

What is the FSSP - how to find out your debts on a website on the Internet?

You can only find a receipt from two or three years ago at a bank.

Methods:

- if a person paid charges with a bank card or through an open savings account, then you need to order an account statement for a certain period - it will reflect all monetary transactions, incl. for lost payment;

- if a citizen paid in cash, he will have to remember in which specific bank branch, on what date and in what amount he paid; If this information is available, the bank will accept an application to seek payment.

Paid receipts must be kept for 3 years.

What opportunities does the “Payment of taxes for individuals” service provide?

The Internet service “Payment of taxes for individuals” allows an individual taxpayer to:

- generate payment documents for the payment of property, land and transport taxes before receiving the Unified Tax Notice (in advance);

- generate payment documents for the payment of personal income tax, as well as payment documents for the payment of a fine for late submission of a tax return in Form No. 3-NDFL;

- generate payment documents for debt payment;

- print generated documents for payment at any credit institution or make non-cash payments using the online services of banks that have entered into an agreement with the Federal Tax Service of Russia.

Thus, using this service, individuals can pay the following taxes:

- Property tax for individuals

- Land tax

- Transport tax

- Personal income tax paid on the basis of a tax return for personal income tax ( in form 3-NDFL )

- PFDL paid by foreigners employed by individuals on the basis of a patent. (only regarding advance payments)

Who should do the tax calculations?

Most taxes, and in particular transport taxes, are calculated by tax department specialists. Based on the calculation data, a documentary notification is drawn up. This document contains:

- the amount that the taxpayer is obliged to pay;

- stages of calculating this amount.

In addition to the notification, the citizen is sent a payment slip in form No. PD-4. The necessary documentation is sent to the recipient in the form of a registered letter.

Please note that after counting 6 days from the date the letter was sent, it is considered received.

Based on the documents received, he can pay the money at the nearest bank branch.

However, if it is absent, a person should independently generate and print tax receipts using the TIN.