Is it possible to pay taxes through the State Services portal?

As you know, individuals, along with organizations, are required to pay a certain list of taxes. Most often these are land and transport payments, as well as property taxes.

In order to pay off your debt to the budget, it is not at all necessary to go somewhere. Currently, payments can be made online. One such way is to use the State Services portal.

REFERENCE!

According to paragraph 1 of Art. 409 of the Tax Code of the Russian Federation, citizens are required to pay taxes no later than December 1 of the year following the reporting period. In case of non-compliance with this rule, a penalty is charged in relation to the violator in the amount of 1/300 of the refinancing rate of the Central Bank of the Russian Federation, calculated from the amount of debt and multiplied by the number of days of delay.

What needs to be done before making a payment?

Before you make a payment, you must complete the following two basic steps:

- go through the registration procedure on the State Services portal;

- obtain up-to-date information on current tax debt.

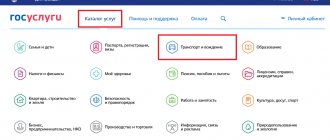

So, in order to find out the exact amounts for certain types of taxes, a citizen must sequentially perform the following steps:

- Go to the “Government Services” website, find the “Services” section (in the top menu), select “Authorities” and follow the link “Federal Tax Service of Russia”.

- A list of options will appear on the screen. You need to select the “Tax debt” section.

- After this, you will need to log in to your “Personal Account” and click on the “Get service” button.

- Next, enter your Taxpayer Identification Number (TIN) in the special field and click on the “Find Debt” button.

After these steps, up-to-date information about outstanding tax debts to the budget will appear on the screen.

Checking transport tax

Every Russian who owns any vehicle is obliged by the state to pay transport tax once a year. It is from these funds that the budget for construction, repair, and maintenance of roads and roadside areas is formed. To calculate TN, general bases and rates are assigned, which are accepted by local regional budgets, and the funds contributed by payers end up in local budgets.

Interesting

Vehicles subject to this type of tax include not only cars and trucks, but also motorcycles and scooters, boats and motorboats, all-terrain vehicles, tractors and snowmobiles, and even helicopters and airplanes. Tax rates and bases directly depend on the type of vehicle, its engine power, passenger capacity, total cost, and year of manufacture.

Such a fee for any officially registered vehicles will be charged continuously until the car is deregistered, regardless of whether it is used for its intended purpose or chickens are raised inside. Let's figure out together how to view the transport tax on a car at State Services, so that in any situation we have the necessary information and the ability to control the situation at hand.

Registration

Those who have previously used the services of the state portal can safely skip this sub-item, since they already have their own account. Therefore, it will be enough to simply log in by entering your phone number and a unique password. If you are trying to interact with the system for the first time, you will have to register first, which may take quite a lot of time.

- Go to the main page of the single portal of State Services.

- Find the “Registration” button on the right.

- In the fields provided, enter your data, which will include your last name, first name, email, and personal phone number.

- Wait for confirmation from the system, which will be sent to your phone in the form of an SMS text message and rewrite the received code in the field provided for this.

- Create a unique password of at least six characters, containing letters of different case, numbers, allowed symbols and write it twice.

In fact, pre-registration is complete and now you can use many of the portal’s services, but not all. In order to ensure full access, you will have to put in a little more effort and wait a lot.

Data confirmation

You will have to provide more personal information, that is, initiate data editing. The system will require you to enter your passport details, as well as SNILS. After this, your data will be checked again and you will be sent another code via SMS message. But even these manipulations will not be enough to view the car tax in the State Services, much less pay it.

To complete registration, you will need to make a special request to confirm the identity of the user, that is, you. There are two options that differ in time. In the first case, you need to go to the nearest Rostelecom subscriber service, where you can get a special activation code quickly and without problems. The second option is to order a letter with this code to your personal address of residence or registration (registration), if they do not match. In this case, the delay may be up to two weeks, and the deadline for paying taxes may already have expired by this time.

Receiving the information

Only after the client has completed the full registration procedure with identification confirmation will he be able to gain access to all, without exception, functions and capabilities of the site. Then questions like “Why is my transport tax not listed in the State Services?”, “Where can I see the amount for payment?” and the like, will immediately lose relevance, as the information becomes available. Typically, the Federal Tax Service sends receipts for payment of TN to the postal addresses of payers, but anything can happen, and it is for such cases that the portal with its unique capabilities comes in handy.

- Log in to the site by logging in with your account.

- Go to the “Tax debt” subsection.

- In the drop-down window on the site, various options will appear, among which you will need to find “Checking tax debts.”

- On the right or bottom of the page there is a “Get service” button. Feel free to click it, so you will see all the fees that you have ever not paid or even managed to pay off.

Then you will need to choose again. For example, you will be asked to show or print a receipt, as well as immediately pay the debt using a method convenient for you. Options include a credit or debit card, e-wallet or mobile payment. But this is not at all necessary, you can simply print out the receipt and go with it to the nearest bank branch, where you can pay in cash and receive a paper check in your hands.

How to access the “Personal Account” on the website nalog.ru?

Another way to pay tax debts online is to use a special service on the website nalog.ru.

To use this option, you also need to first log in to your “Personal Account”. You can do this in one of the following ways:

- By entering the login and password specified in the registration card in the appropriate fields. You can get it at the tax office by presenting your ID.

- Use of a qualified electronic signature - it must be issued by a certification center accredited by the Ministry of Telecom and Mass Communications of the Russian Federation.

- Log in to your “Personal Account” through your account in the Unified Identification and Logistics System, that is, through the details used for authorization on the “Government Services” portal.

Information about taxes on the website nalog.ru

On the website nalog.ru you can obtain information about taxes subject to transfer to the budget as follows:

- First of all, you need to log in to your “Personal Account”.

- The main page will display the total amount of tax debt. To obtain more detailed information, you must click on the “Details” button (located to the right of the tax amount).

- A section called “My Taxes” will open. It will reflect the following information:

- list of taxes indicating the amount charged;

- notifications from the tax authority about their payment.

- By selecting a specific type of payment from the list, you will be able to obtain the following information about it:

- object of taxation;

- name of the tax authority that issued the invoice;

- amount to be paid.

ATTENTION!

If you want to pay off tax debts through nalog.ru, you should also first check the exact amount to be transferred to the budget for a specific type of payment.

Nuances of obtaining information through State Services

Citizens of the Russian Federation can use the State Services portal. Those who have completed the registration procedure on it. The user must also have information about their passport, SNILS, and Taxpayer Identification Number filled in in their profile and undergo automatic verification.

Important. For some operations, it is necessary to first confirm that the Unified Identification of Information and Accounting (Government Services) account belongs to a specific person.

State Services do not allow you to check your car tax for the current year. By default, the service displays only information about already overdue payments. You can obtain information about tax accruals in the current calendar year through your personal account on the Federal Tax Service website. An ESIA account can also be used to log in.

Important. The State Services service allows you to know any payments, including transport tax, both through the web version and through an application for mobile devices. In the latter case, the same account as on the site is used to access information.

Paying taxes through “State Services”: procedure

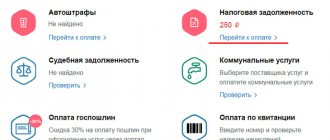

On the Gosuslugi website you can not only get up-to-date information about debts to the budget, but also pay them off immediately. Using this method, individuals can pay the following types of taxes:

- on property;

- for transport;

- to the ground.

IMPORTANT!

It is worth keeping in mind that on the State Services portal you can make transfers to the budget in two ways: through the “Tax debt” option or by using the receipt number (UIN).

Depositing property tax

According to tax legislation, citizens who are the owners of any movable or immovable property are required to pay the appropriate payment to the budget. We are talking about paying property taxes.

To make a payment through the State Services website, you must follow the following steps sequentially:

- First of all, you need to log into your “Personal Account” by entering your password and login in a special field.

- The “Payment” tab will be located in the top menu. You should follow it.

- A list of different payments will appear on the screen. Among all the proposed options, you should select the “Payment by receipt” tab.

- An empty field will appear on the screen where you need to enter the UIN indicated in the property tax payment receipt (column “Document Index”). After this, you need to click on the “Pay” button.

- The page that opens will offer several ways to pay property taxes. It can be done:

- via a bank card (Mir, VISA, Mastercard);

- using an electronic wallet (“Yandex.Money”, “WebMoney”, etc.);

- using a mobile phone.

Repayment of land tax debt

Payment of land tax through the Gosuslugi portal will be made according to the same algorithm as described above in the text. Only in this case, in the field for entering the receipt number, you will need to indicate the UIN reflected in the payment order for the payment of land tax.

Payment of transport tax

Transport tax should be paid by analogy with the instructions prescribed for paying debts to the budget on the property of an individual.

In this case, the UIN contained in the transport tax payment receipt should be entered in a special field. That's the only difference. All other actions will be repeated.

Alternative methods of paying tax

Gone are the days when a car owner had no choice about paying tax on his car. Now every vehicle owner can independently choose a payment method: cash or non-cash payment. He can choose how he will pay the tax: online or by visiting a financial institution in person that accepts payments. He also has the right to choose the organization through which he prefers to pay his car tax.

Additionally, we recommend reading our author’s article, which will tell you about other ways to find out about the amount of transport tax.

Tax service website

The Federal Tax Service website is the most convenient Internet service that reflects the most up-to-date information about the tax affairs of each individual person or organization. Payment of transport tax through the website requires the availability of funds on a bank card. Moreover, the site makes it possible to use a card from any of 37 partner banks and other payment systems. You can also use State Services as a payment platform that can pay taxes even through leading mobile operators (the amount of the commission is set by the operator).

Bank

Any banking organization that has special permission from the Central Bank of the Russian Federation for this type of financial transactions can accept payment of transport tax. This can be done through an operator operator or through a special device (ATM, terminal).

With this payment method, the payer will need a receipt with details and an identification document.

Transport tax can be paid for yourself or another person; this is not prohibited.

How to pay taxes through Sberbank online? Read the article by our lawyer.

Personal visit to the Federal Tax Service

Not every vehicle owner knows that he has the opportunity to pay transport tax directly at any branch of the Russian Tax Service. Tax officials do not advertise this service with an unspoken instruction from above, but at the same time, they do not have the right to refuse the taxpayer to accept money. You need to go to the information window and express your desire to pay “tribute” to the state at a given moment and in a given place.

Can I pay another person's taxes and how do I do it?

It is worth noting that you can pay taxes not only for yourself, but also for another person. This opportunity appeared for citizens in 2016. For example, adult children can pay tax for their parents, a husband for his wife, etc.

ATTENTION!

In order to make a tax payment for another person via the Internet, you need to know the UIN of his receipt, that is, the unique accrual identifier.

In this case, the payment itself can be made using one of the following methods:

- Go to the “State Services” portal by selecting or “Payment by receipt”.

- Use the nalog.ru website by clicking on the “Payment of taxes for third parties” tab.

It is worth emphasizing that knowing the UIN receipt, you can pay taxes for any person (not just a relative). In this case, the money will be sent strictly for its intended purpose, even if it is debited from the payer’s card.

How do you know that money has been credited towards paying off your tax debt?

Often, citizens who have paid taxes through the “Personal Account” on the Gosuslugi portal or through nalog.ru wonder when the latest information will appear that the debt to the budget has been closed.

It is worth emphasizing that a note about the repaid debt will appear in your “Personal Account” within 10 days from the date of receipt of payment. In this case, the date of actual tax payment is the day the money is written off from the bank account (electronic wallet).

Thus, in order to make sure that the debt is repaid, you must periodically log into your “Personal Account” and check the status of settlements with the budget.

Possible difficulties when working with the portal

Verified account for government services

Here are a few problems that portal users most often talk about:

- it is impossible to send a payment due to work on the portal;

- any personal data is entered incorrectly;

- Some fields during registration are not filled in;

- The user's identity has not been confirmed.

You can pay transport tax through State Services in three different ways. It is enough to register in the system, select the appropriate one from the list of services, enter the data and pay. In addition, you can re-register a purchased car through the website. You can view all reports and remaining debts through your personal account.