How to sign up for MTPL insurance

At the beginning of 2021, an amendment to the Law came into force, according to which citizens who are not the owners of a car have the right to drive someone else’s vehicle only after entering the name of the second driver into the current OSAGO policy. We will tell you in detail how to add the data of a new person in accordance with the legislation of the Russian Federation.

Insurance is issued for one year. If the insured driver gets into an accident and, due to his fault, the vehicle of the second participant in the accident is damaged, the insurance company will fully compensate for the costs of restoring the damaged car. If at the time of the traffic accident there was a person driving who was not included in the policy, all financial responsibility will fall on him. To avoid unpleasant situations, carefully read the article on how to add a driver to your insurance online or when visiting the insurance company’s office. Registration of an electronic policy takes less time, but requires a more responsible attitude towards filling out the electronic form.

Is it possible to include an additional person in the insurance?

Clause 3 of Article 16 of the Federal Law “On Compulsory Civil Liability Insurance of Vehicle Owners” provides for the possibility of changing the information specified in the MTPL agreement:

3. During the period of validity of the compulsory insurance contract, which takes into account the limited use of the vehicle, the policyholder is obliged to immediately notify the insurer in writing about the transfer of control of the vehicle to drivers not indicated in the insurance policy as authorized to drive the vehicle, and (or) about an increase in the period of its use beyond the period specified in the compulsory insurance contract. Upon receipt of such a message, the insurer makes appropriate changes to the insurance policy. In this case, the insurer has the right to demand payment of an additional insurance premium in accordance with insurance tariffs for compulsory insurance in proportion to the increase in risk.

it is allowed to add additional drivers to the insurance policy .

When do you need to make changes to your insurance policy?

According to the current legislation, the driver is no longer required to take a power of attorney from the owner of the car and have it certified by a notary. A document delegating the authority to perform certain actions with a vehicle is needed only to transfer property rights to another person: a friend, acquaintance, close or distant relative. Such registration activities include re-registration of the car to a new owner, its sale, export abroad, etc. To drive someone else's car, it is enough to include your name in the compulsory civil liability insurance policy for vehicle owners.

There can be many situations when a car owner transfers his car to another driver. For example, a father wants to give the right to drive his own car to his son or daughter, a husband to his wife, a friend to a friend, an employer to an employee.

The law does not establish a limit on the number of authorized persons. How many people to add to the insurance is decided solely by the car owner. The standard form provides for entering the data of only 5 insured persons, but if necessary, you can add the names of people on the back of the official document. The owner of the car has the right to enter any number of drivers into the form, but if there are many of them, it is better to purchase compulsory motor liability insurance “without restrictions.”

Additional payment for a new policyholder is made at any time, even if the policy has not yet expired. The amount is calculated using a formula based on the number of days remaining until the end of the already paid period. That is, the insurer calculates the amount payable exclusively for the actual period of use of the car under insurance.

What are the consequences of lack of insurance for a driver who is not included in the policy?

Remember that driving someone else’s car without an MTPL policy is strictly prohibited. If a traffic police officer, when checking documents, discovers that the driver’s name is not included in the insurance, he will issue a fine in the amount of 500 rubles or more.

If an accident occurs due to the fault of a person driving someone else's car, the costs of restoring the movable property of the injured party are transferred to the person who was driving at the time of the accident. The insurance company is not obligated to compensate for damage to a damaged car.

Another significant point. If the driver independently added his name to the document, then if the traffic police officer checks who is included in the MTPL policy by insurance number, the violator will be issued a fairly large fine. But the biggest danger lies in the fact that if you get into a traffic accident, the insurance company will refuse to compensate for the damage, and “petty fraud” will lead to significant expenses.

Online purchase of a policy

CASCO and OSAGO are the two main products chosen by vehicle owners. They differ not only in terms of registration, but also in the types of insurance cases.

OSAGO

OSAGO is a compulsory type of insurance that insures the property, life and health of third parties who were injured as a result of an accident. Today, all drivers and car owners must have such a policy with them. In order not to sit in queues, the Ingosstrakh company offers its clients to apply for compulsory motor liability insurance online. What you need to do for this:

- Go to the official website of the company.

- Go to the “OSAGO” menu.

- Click "Calculator".

- Calculate the future value of the policy.

- If you are satisfied with it, then click “Apply for eOSAGO”.

You can submit a request only after registration. In your personal account, you confirm the scanned documents required to issue a policy and fill out all fields of the application form. You send a request and receive a response in a few minutes. If you have filled out all the information correctly, then all you have to do is make the payment and receive an electronic policy by email.

By purchasing an MTPL policy online, you can buy insurance in just a few minutes and receive a certificate without leaving your home, without needing to have it certified at the company’s office.

CASCO

Unlike MTPL, CASCO is a voluntary type of insurance. If with MTPL you insure the risks of compensation for damage to third parties, then here you insure your own risks associated with your car - theft, damage, etc. Applying for CASCO insurance online is quite simple. The procedure is identical to OSAGO. On the official website of the Ingosstrakh company, go to the CASCO menu and click “Buy online”. You will also have access to the “Renew” and “Submit Application” functions. Customers who have other products from the company can receive a 5% discount on the cost under the CASCO agreement.

How much does it cost to add someone else to your MTPL policy?

When calculating the cost of insurance, the following are taken into account:

- Driver's age (under 22 and over 45);

- Driving experience (up to one year and more than 11 years);

- Accident-free driving coefficient (bonus-low).

When taking out the first compulsory civil liability insurance policy for vehicle owners, this indicator is equal to 1. The adjustment CSB depends on the number of years during which the driver has never been involved in an accident. For each accident-free year, an additional 5% is subtracted from the calculated value (unit). The maximum coefficient can be 0.5.

The standard cost of a policy is calculated based on its base price multiplied by the bonus-malus coefficient (BMR) and the bonus-experience indicator (BSR).

For example, if a new policyholder’s driving experience exceeds 3 years, and he has not been in an accident for 5 years, then if the cost of the current OSAGO is 9,000 rubles, the additional payment will be 1,800 rubles . The formula looks like this:

9000*0,75*1,6=10800, 10800-9000=1800.

If the second driver is a person with good KBM and KBS indicators, then the insurance will not be more expensive.

How much will you have to pay extra for a new driver?

Sogaz offers to add drivers to your insurance for free. The policyholder does not need to pay for re-issuance of documents online or at the insurer’s branch. However, when online or offline adding persons allowed to drive to compulsory motor liability insurance, the risks of the insurance company change, due to the likelihood of an accident and the need to compensate the victim in the incident for losses caused.

If experienced drivers with experience and driving skills no worse than those of the car owner and persons previously admitted to driving a car are included in the Sogaz policy online or at the insurer’s branch, then the policyholder will not need to pay anything extra under compulsory motor liability insurance. When expanding the list to include citizens who increase the risks of the insurance company, it seeks to minimize them and change the cost of the policy by calculating it with updated coefficients focused on the parameters of drivers with the worst indicators - driving experience up to 3 years, age up to 22 years, and with fixed emergency episodes in the previous period.

Procedure

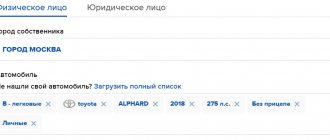

To make changes to the insurance, the car owner or an authorized person must come to the office of the insurance company where the auto insurance policy was purchased. Edits to the current document are made by an employee of the company. The insurer may require the driver to:

- Original passport of the car owner;

- Vehicle registration certificate;

- The original of the current MTPL policy;

- Passport of the driver whose name will be included in the policy, and his driver’s license.

In rare cases, the insurance agent may ask for a handwritten statement. There is no significant difference in the package of documents and procedure for an existing policy and when applying for new insurance.

After examining the submitted documents, the manager will carry out the necessary calculations and name the amount of additional payment for the remaining days. After payment, the insurer will fill out a new form or add the driver’s name to the current MTPL policy. If changes are made to a valid document, it is additionally certified by the signature of an authorized person and the company’s seal. Information is submitted to the database within 3 working days .

You can also add a person to the electronic MTPL policy online. To receive an electronic version of the policy, you need to log in to the official website of the insurer where you purchased the current document, and then log into your personal account of the insurance company. Using the system’s prompts on how to add a driver to the electronic MTPL policy, the insurer must fill out all significant fields of the form. including the new driver's age and driving experience. After automatically determining the amount of the surcharge, you need to transfer money from your bank card to the insurance company’s account online. The document can be printed on a printer. A printed auto insurance policy has the same legal force as a printed paper one. This norm is defined in the Law on Compulsory Motor Liability Insurance (MTPL) in Article 32, paragraph 1.

The advantages of registering a vehicle license via the Internet are obvious. Firstly, it saves time, and secondly, the manager will not be able to impose on the policyholder services that he does not need. All accumulated discounts and bonuses for accident-free driving are retained by the insured person. The history is stored in the RSA database, to which all insurers and state traffic inspectors have access. If you lose your policy, the form can always be printed again.

Where can a driver add new data to his electronic insurance?

Any information in electronic insurance online is entered exclusively through your personal account.

Initially, it was planned that within two weeks after registration, changes could be made to the issued document. But the system failed and online adjustments were stopped.

Today, owners of a personal account can enter additional information in case of a change in last name, passport and driver’s license information, as well as renew and terminate contracts. Unfortunately, it will not be possible to enter a new driver into OSAGO online.