Voluntary motor insurance is not cheap, especially full CASCO insurance. After all, the average cost of such a policy will be about 50,000 rubles. You can use the calculator to calculate the insurance premium individually for your car. And by terminating the CASCO contract early , the client of each insurance company hopes to receive part of the money paid for insurance. How does this happen?

Early termination of the CASCO agreement

Early termination of a CASCO policy is a process of changing the validity period of the contract, upon reaching which it ends.

For example, a CASCO policy was issued on October 12, 2015. It will be valid until October 11, 2016, that is, exactly 1 year. If the policyholder has a need to terminate it on March 14, 2016, then this will be considered early termination. But after March 14, 2016, the vehicle will no longer have full insurance coverage.

Methods and reasons for voluntary cancellation of insurance

Is it possible to get a refund when selling a car? There are several legal ways or reasons to terminate CASCO:

- Selling a vehicle. The main thing in this method is to submit documents to the insurance company confirming the fact that the car has changed its owner.

- Death of the insurance holder. In this case, the legal heirs of the policyholder must contact the company and confirm the fact of death and the right of inheritance.

- The insurance company lost its license. Policyholders have every legal right to demand a refund of money for the unspent insurance period under CASCO, even in cases where the revocation of the license is temporary. This right is enshrined in Article No. 958 of the Civil Code of the Russian Federation.

- When repaying a car loan early. If a car is purchased on credit, the new owner is forced to take out CASCO insurance for it. If a citizen does not need this type of insurance, then if the loan is repaid ahead of schedule, he has every right to terminate the insurance contract.

- The vehicle has been deregistered. If the car has been deregistered due to the impossibility of continuing to operate it for any reason, the policyholder has the full right to terminate CASCO insurance. The exception is cases when the insurance holder received a CASCO payment for the reasons for taking the car out of service.

Situations when a CASCO policy is terminated early

Termination of the CASCO agreement cannot happen just like that. There needs to be a specific reason for this. Thus, based on the insurance rules, each insurance organization establishes a certain list of cases in the event of which the CASCO policy can be terminated early .

You can terminate your CASCO policy early if:

- Refusal of the policyholder from the contract.

- In case the insurer fully fulfills its obligations to the client.

But at the discretion of the insurance company, situations such as refusal to pay the next insurance premium (when paying for insurance in installments) or complete loss of the vehicle as a result of events that are not an insured event may be added to this list.

How to return: step by step

When contacting the insurer's office, you need to know how the CASCO refund occurs. To do this, you need to follow several steps:

Preparation of documents. The policyholder must first study the insurance rules and understand whether he can count on early termination of the policy. Next, provide the required package of documents.

Fill out an application at the company office. When visiting the office, you will need to fill out an application and indicate:

- Insurance policy number.

- Personal and passport details.

- Personal account details.

- Reason for termination of the contract.

- Date, signature, transcript.

Large insurance companies fill out documents themselves and provide them to the client only for signature and review.

Receive a copy of the application. After visiting the office, the client must be given a copy of the application, which must have an acceptance mark. A copy may be useful if the insurer violates the deadlines for reimbursement of funds or does not transfer them at all.

You need to contact the office of the insurance company as soon as possible, since the refund of unused insurance will begin from the date of application.

Video on the topic:

Documents for early termination of CASCO

If you intend to carry out early termination of CASCO, you must provide the documents necessary for the procedure to the insurance company along with a written application. It must contain information such as the full name of the owner of the insurance, the insurance policy number and the date of termination of the contract.

The application can be obtained from the insurer or written by hand. Along with it you must provide the following:

- Original CASCO policy.

- Payment receipt.

IMPORTANT!!! It is not necessary to submit original documents to the insurance company. They can simply be presented as proof that they exist and that the policyholder has paid for everything. It will be enough to attach only copies.

After the application is accepted by an authorized employee of the insurance company, your policy will be checked against the database for the presence of arrears in payment of the insurance premium. If none is found, the documents are submitted to calculate the amount to be returned to the policyholder.

But there are some nuances here. Of course, the insurer cannot fail to return part of the premium for unused months of the CASCO agreement, but the methodology for calculating this amount may differ from company to company.

Registration procedure

As soon as the borrower has repaid the car loan, it is allowed to immediately write an application for the return of the promised money for the canceled insurance. The documents must be submitted to the company that previously issued the policy: it is obliged to return CASCO if the loan is repaid early. And when a CASCO agreement is one of the conditions for a car loan, the bank where the loan was issued acts as the insurer.

To get the money back, the car owner will have to follow the following algorithm:

- return the money you borrowed to the bank - pay off your car debt in full;

- receive in return an official document confirming the repayment of the loan - this must be a certificate from the bank;

- write an application to the insurance company and provide the documents necessary to terminate the transaction;

- wait for a response from the organization and clarify questions about the method of transferring money and the specific amount.

The final answer from the insurance company can be either positive or negative. If an official refusal is sent, which the owner of the vehicle considers to be unfounded, then you can go to court on the basis of the received paper.

Calculation of the refund amount

Typically, the amount due for refund to the policyholder is calculated as follows:

Dear OSAGO? Restore KBM now

and stop overpaying insurers!

The service will send an application to RSA. Recovery time for KBM: from 12 hours. Find out more

Refund amount = (Premium – Insurance expenses)xn/N – Payments

Where,

Premium – the amount paid for the CASCO policy,

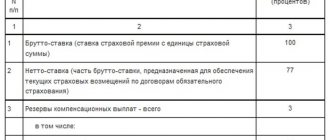

Expenses of the insurance company – funds spent by the insurance company to maintain the contract. Typically this value ranges from 30% to 50% of the insurance premium,

n – months remaining unused,

N – total term of the insurance contract,

Payments – money paid for a loss.

Example

Let’s imagine that on October 15, 2016, the policyholder decided to terminate the CASCO policy issued on February 15, 2015, for which there was one payment in the amount of 10,000. The insurance premium was 60,000 rubles.

(60000 – 30%)x 4/12 – 10000 = 3860 rubles

Thus, the client will receive 3860 rubles for the remaining 4 months.

The refund of the premium upon termination of CASCO will proceed as follows:

- Checking the correctness of filling out the application and the completeness of the package of documents.

- Calculation of the amount due for refund.

- Transfer of funds to the policyholder’s personal account, or withdrawal from the insurance company’s cash desk. This will need to be decided at the time of application.

How much can you return?

Dear readers!

Our articles talk about typical ways to resolve legal issues, but each case is unique. If you want to find out how to solve your particular problem, please contact the online consultant form

It's fast and free!

Or call us by phone (24/7):

If you want to find out how to solve your particular problem, call us by phone. It's fast and free!

+7 (495) 980-97-90(ext.589) Moscow,

Moscow region

+8 (812) 449-45-96(ext.928) St. Petersburg,

Leningrad region

+8 (800) 700-99-56 (ext. 590) Regions

(free call for all regions of Russia)

When, after consulting with a company specialist and studying the insurance rules, it is obvious that a refund of the unused portion of the funds is provided, then you should find out the amount of the payment. It is worth knowing that the calculation is made by a specialist from the insurance company using a special formula specified on the official website or in the insurance rules.

You can determine the CASCO refund amount as follows:

- Divide the amount of the insurance premium by the number of days the policy is valid (this action will allow you to determine the cost of insurance for one day).

- Calculate how many days are left until CASCO expires.

- Multiply the cost of one day of CASCO by the remaining number of days of the policy.

- Subtract the RVD (costs of conducting the business) from the amount received.

Each insurer sets the costs of conducting a case at its own discretion. However, according to the internal regulations of the insurer, the size of the RVD varies from 30 to 50%.

The financial company transfers the unused portion of the insurance premium to the client’s account within 20 days after accepting the package of documents. If a financial organization violates payment terms, the policyholder has the right to file a complaint with the Central Bank or RSA. When applying, you will need to present a copy of the application for termination of the contract with a note of acceptance from an employee of the insurance company.

How to return CASCO

Probably every serious and responsible driver must know about motor vehicle risk insurance. CASCO is rightfully considered one of the leaders in this area. This is a smart way to protect yourself, passengers and your car from accidents, natural disasters, theft, etc. There are cases when the policyholder, for certain reasons, wants to terminate the contract and get his money. But such a procedure can be done only by carefully weighing each step.

1

The first thing you need to do is leaf through the insurance contract. Study all points carefully. Pay special attention to the section on termination of the contract. As a rule, it is placed at the very end. If paper documentation is lost, read the terms and conditions on the official CASCO website.

2

Next, make sure that at the time of termination the contract is valid for no more than ten months. Otherwise, you are unlikely to be able to return the due part of the money.

3

Carefully study the conditions under which the contract may be subject to termination. One of the most common reasons for a CASCO gap is the sale of an insured vehicle.

4

Without wasting any extra time, go to the insurance company to file a claim. After all, the balance is calculated only from the moment you submit a written application. And remember that only the policyholder has the right to terminate such a contract, and not his relatives or the new owners of the car.

5

Be prepared for the fact that when filling out the documents you will be required to indicate the reason for this decision. If you are selling your car, provide a sales contract. After filling out the application, contact the insurer with a request to calculate the amount of payment to be returned.

6

We warn you in advance, do not expect that the refund amount will be proportional to the year of validity. Typically, the insurance company retains an amount slightly larger than what is required in the term ratio. The funds spent on running your business are calculated in her favor.

7

After filling out the document, ask company employees to make a copy and certify it. You can then expect payment within two to three weeks. In some cases, funds arrive earlier, but if there are any inaccuracies or problems, the period may take a little longer.

8

If you notice that the waiting period lasts more than a month, feel free to go to court. In such cases, the court decision is always on the side of the policyholder. Sooner or later, you will still receive your portion of the insurance premium.

Of course, when terminating a contract, you must be very careful and careful so as not to suffer unnecessary financial losses. But you need to be even more vigilant when concluding it. Since some companies prescribe in advance a lot of nuances in the conditions that simply will not allow you to receive an insurance premium in the event of a possible rupture.