What is “Bonus-Malus Class” in OSAGO

One of the significant factors affecting the cost of insurance is the driving skills and experience of each driver.

For the insurance company, careful and experienced car owners who are not prone to reckless behavior on the roads are considered more profitable clients. By concluding an agreement with such clients, the company reduces the risks of insured events and subsequent compensation payments. The reduction in the cost of compulsory motor liability insurance is used as a motivation for careful drivers who do not violate traffic rules and do not provoke accidents. To measure the size of the discount, the bonus malus coefficient is used.

The bonus-malus coefficient is a discount for drivers for each year of driving without an accident.

What is KBM and what does it depend on?

BMC is the bonus-malus ratio.

KBM depends on the driver class. To calculate the cost of the policy, there are 15 driver classes: M and from 0 to 13, where M is the lowest level. The lower the level, the higher the KBM, by which the initial cost of compulsory motor liability insurance is multiplied: Final insurance price = cost x driver's KBM

Expert opinion

Valery Volkov

Insurance expert

Buy eOSAGO through RSA

For example, for class M the BMC is 2.45. That is, the policy for such a driver will rise in price by almost two and a half times . You can get into class M even if you have committed one accident during the year for which the insurance company made payments. Therefore, the preservation of funds for the purchase of an MTPL policy will depend on daily compliance with traffic rules.

Bonus-Malus table

Dear readers!

Our articles talk about typical ways to resolve legal issues, but each case is unique. If you want to find out how to solve your particular problem, please contact the online consultant form

It's fast and free!

Or call us by phone (24/7):

If you want to find out how to solve your particular problem, call us by phone. It's fast and free!

+7 (495) 980-97-90(ext.589) Moscow,

Moscow region

+8 (812) 449-45-96(ext.928) St. Petersburg,

Leningrad region

+8 (800) 700-99-56 (ext. 590) Regions

(free call for all regions of Russia)

Depending on how careful the driver was on the road, the malus bonus can increase or decrease the cost of issuing a policy. For each year in which the driver did not have accidents or other insured events, a discount of 5% of the total cost of insurance is awarded. The maximum value of the bonus malus can reach 0.5, which is equivalent to reducing the cost of insurance by 50%.

What else to read:

- My car was scratched in the yard, what should I do?

- Europrotocol 2021

- How to get money instead of repairs under compulsory motor liability insurance: a detailed review

The driver’s requests for compensation payments, accordingly, increase the CBM coefficient and the amount of payment for concluding the contract. For drivers with a high level of BMI, the price of an insurance policy increases by 2.4 times.

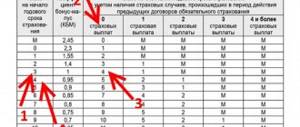

To calculate the bonus malus coefficient, a special table with established standards is used.

| KBM value | Class | Percentage markup and discount | The number of accidents committed by the driver during the period of validity of the previous insurance policy | ||||

| 0 | 1 | 2 | 3 | 4 | |||

| Stated class | |||||||

| 2,45 | M | 145% | 0 | M | M | M | M |

| 2.3 | 0 | 130% | 1 | M | M | M | M |

| 1,55 | 1 | 55% | 2 | M | M | M | M |

| 1,4 | 2 | 40% | 3 | 1 | M | M | M |

| 1 | 3 | — | 4 | 1 | M | M | M |

| 0,95 | 4 | 5% | 5 | 2 | 1 | M | M |

| 0,9 | 5 | 10% | 6 | 3 | 1 | M | M |

| 0,85 | 6 | 15% | 7 | 4 | 2 | M | M |

| 0,8 | 7 | 20% | 8 | 4 | 2 | M | M |

| 0,75 | 8 | 25% | 9 | 5 | 2 | M | M |

| 0,7 | 9 | 30% | 10 | 5 | 2 | 1 | M |

| 0,65 | 10 | 35% | 11 | 6 | 3 | 1 | M |

| 0,6 | 11 | 40% | 12 | 6 | 3 | 1 | M |

| 0,55 | 12 | 45% | 13 | 6 | 3 | 1 | M |

| 0,5 | 13 | 50% | 13 | 7 | 3 | 1 | M |

Check KBM RESO: instructions for use

Bonus Malus Reso is a system that adjusts the premium paid by the client according to the individual's claims history. A bonus is typically a discount given when renewing a policy if no claims were made in the previous year. Bonus-Malus systems are very common in vehicle insurance. This system is also called no-claims discount. The fundamental principle is that the higher the frequency of claims made by the policyholder, the higher the insurance costs for the insurer and vice versa.

How to find out the malus bonus class using a table

The table is very easy to use. To do this, you will need only two initial factors:

- existing KBM;

- number of requests to the insurance company for compensation.

To find out how to find out the driver's malus bonus, it is worth visiting the office of the insurance company where the policy was issued. You must have your driver's license, insurance contract and passport with you.

After presenting the documents, you can obtain the necessary information from the manager within 10-15 minutes.

You can also find out your existing CBM online through the database of Russian insurers.

When the current BMR is known, all that remains is to find the corresponding value in the table. Next, select the desired column with the number of accidents and insurance cases per year. In the cell at the intersection of the selected column and the row with the current parameter, the BCM class for the next period is indicated.

Recalculation of KBM through RSA: step-by-step instructions

The Russian Union of Auto Insurers (RUA) is a unified database created on January 1, 2011, with the aim of systematizing data. The database contains information on all concluded contracts. It is important to note that since December 1, 2015, the union of auto insurers does not deal with issues of recalculation of discounts. These rights are transferred entirely to the insurance company.

A motorist has the right to file a complaint if the insurance company refuses to accept documents or does not correct the data after an inspection. All requests should be sent by email

The complaint should indicate similar information as in the application that is written when contacting the office of the insurance company. Additionally, it is recommended to attach the refusal that was received at the office of the insurance company.

Important! You can immediately contact the RCA if the insurance company is declared bankrupt and leaves the financial services market. For convenience, we offer it on our portal.

Example of calculating KBM

The easiest way to understand the calculation technology is through examples. For clarity, it is better to use cases in which the driver has never had an accident, and when he has repeatedly applied for insurance payments.

With a BMR of 1, in class 3, the car owner pays 100% of the policy cost. There is a premium for classes from M to 2, and a discount for classes from 4 to 13.

Calculation in case of an accident

The client had been taking out an insurance contract with the same company for several years. Over the years, he has never been in an emergency due to his own fault. As a result, at the time of receiving the last contract, his class met indicator 8. This means that he received a policy with a 25% discount. The CBM is equal to 0.75.

During the term of the last contract, the client experiences two emergency situations. He is found guilty of what happened.

When trying to obtain an insurance contract for the next period, he was faced with the fact that the cost of his insurance had increased. That is, with an existing class of 8, you need to move along the line to the column in which 2 accidents are indicated.

Thus, his class when drawing up an insurance contract for the next period corresponds to the value 2. This means that for him the payment for registration is 40% more than the average. His BMR is now 1.4.

Calculation without accident

When registering for the first time, the driver is assigned class M by default. A newcomer, having signed a contract with the specified parameter, purchased insurance at a price twice as expensive as the average.

He traveled the entire insurance period without any accidents or insurance claims. At the next registration, its class increased to 0. The cost of the insurance policy decreased by 0.05%. For each accident-free year, the price of insurance will be reduced by the specified percentage.

Restoration of KBM

The KBM class assigned to each driver is by no means a constant value. It can change downward or increase. When the class is downgraded, the price of car insurance increases. For every year of careful driving, the car owner's rating increases by one point. According to the current KBM table, this entitles the driver to a 5% bonus.

But sometimes it happens that a class in the KBM ranking is downgraded for no apparent reason. The driver did not cause a single accident over the past year, but for some reason his rating became lower.

There are usually two reasons:

- The car owner changed his driver's license or last name. As a result, the automatic identification system assigned him a basic third class, like any newbie.

- The insurer did not enter information about its client’s accident-free driving over the past year into the AIS RSA database, as a result of which his rating was not raised.

You can rectify the situation by contacting your auto insurer, or directly to RSA using the official website. Review of the application may take up to 30 calendar days. After the restoration of the KBM, the driver has the right to demand that the insurer recalculate.

How is KBM calculated for compulsory motor liability insurance without restrictions?

Sometimes car insurance is issued with permission for an unlimited number of drivers to drive. In such conditions, it makes no sense to determine the KBM for each driver. The price reduction system is used in relation to the car owner.

All discounts are assigned to the owner of the car and directly to the car. That is, when purchasing another car, the client automatically loses the earned discounts and receives the initial third class. In the future, discounts begin to accumulate again.

Determination of KBM under the contract without limiting the number of drivers

Domestic auto insurers provide the opportunity to purchase an MTPL policy without limiting the number of drivers. This option is ideal for enterprises engaged in passenger or cargo transportation. There is no limit on the number of drivers allowed to drive a particular vehicle. You can, if necessary, make a replacement at any time without making adjustments to your auto insurance policy.

True, to obtain information on the KBM, the car owner will have to provide a number of additional data:

- VIN number of the vehicle.

- Vehicle registration number.

- Body number for the car.

- Chassis number for frame construction vehicles (trucks, buses, SUVs).

We invite you to read: Participation of the prosecutor in criminal proceedings

How to determine the malus bonus class using the RSA database

The verification procedure using the RSA database is available online. The system is simple, intuitive and understandable for any user. To obtain the necessary information, it is enough to have the details of your driver’s license and compulsory motor liability insurance contract.

The actual check will only take a few minutes. To submit a request, you must follow a certain procedure:

- log in to the RSA website;

- open the online verification application;

- in the “owner” section, select an individual or legal entity;

- indicate the type of insurance contract (with or without restrictions);

- enter your full name, license series and number, date of birth, car insurance information;

- indicate the expected start date of the new contract;

- enter captcha text;

- send a request.

In how many seconds will information be received about the current CBM, the number of accidents during the period of validity of the car insurance and the new coefficient.

How to restore KBM under OSAGO

Like any Internet service, the RCA electronic database can produce an erroneous result with a reduced discount rate. In such cases, it is better to fix the problem immediately after it is discovered. There is a high probability that when drawing up a contract, the insurance company will receive the same data with an error and calculate an inflated cost of the policy.

You can correct the situation in the following ways:

- Internet insurance services;

- application to the insurer;

- complaint directly to the RSA;

- contacting the central bank.

Insurance companies post applications on their websites to correct errors in the PCA database. The interface of online assistants is different and so are the methods of use.

If an error is discovered after concluding a contract and paying an inflated amount, you should submit an official statement directly to the insurance company.

The application is written to the director and supported by documents confirming erroneous calculations. The request for recalculation can be submitted in person or sent by registered mail. The main thing is to fix the filing date.

Within 10 days after receipt, the insurance company must recalculate the cost and correct errors in the database.

If after the specified period no action has been taken from the insurance company, you must file a complaint with the RSA. The application is written in the same way as when interacting with the insurance company. This indicates an unsuccessful attempt to resolve the issue directly with the company.

The complaint can be sent by mail or written online. In the latter option, you need to go to the RSA website and use the page for citizens' requests.

If none of the above methods failed to resolve the problem, you should contact the Central Bank through its official website.

If the client immediately contacted the Central Bank without attempting to resolve the issue with the insurance company, the bank will return the request with a recommendation to go through the previous procedures.

Documents for recalculation of KBM

To recalculate the KBM coefficient, documents should be prepared. The list is the same for all insurance companies and includes:

- passport of the policyholder under the contract;

- driver's license;

- a previously concluded MTPL agreement (if available);

- policy in which an error was made.

When filing an application remotely, you should scan or photograph the listed documents and send them to the insurer.

Sample applications (standard, for alphastrakhovaniye, RGS and Ingosstrakh)

For your convenience, we invite you to enter your details on our portal. If necessary, you can always get advice on filling it out from our expert, who works on the site in real time.

You can submit an application to other companies not only in person, but also on the official portal:

- An application for recalculation of KBM to Alfastrakhovanie can be sent on the official portal alfastrah.ru through the “ask a question” section. In this section, you must fill out all fields of the application.

For personal contact we offer it on our website.

- An application to Rosgosstrakh for recalculation of the KBM can be left on the company’s official website, at rgs.ru in the feedback section.

In the electronic form, you must select the type of appeal and provide all the necessary data. If you contact us personally, we offer

- An application for recalculation of the KBM in Ingosstrakh is completed on the portal ingos.ru, through the feedback form.

If necessary, you can do it completely free of charge on our website.