Many vehicle owners, upon receiving a notification from the fiscal service, blindly pay the tax assessed to them. Not everyone checks the specified amount, and only a small part notices some inaccuracy in the Federal Tax Service notification. But there may be a mistake. And, as practice shows, this is not such a rare occurrence. The inspection staff may simply make a mistake, or the taxpayer himself may be at fault - he did not submit or did not submit information on the sale or purchase of a vehicle in a timely manner.

And further about why this happens, what can and should be done to correct the situation.

Why does incorrect accrual occur?

There is a misconception in our society that responsibility for the correctness and accuracy of tax calculations lies entirely on the shoulders of the tax authorities. But this is not entirely true. It is the taxpayer, represented by an ordinary citizen, who must correctly and accurately pay his obligations to the budget. He is obliged to provide the inspection with correct data; it must be up to date and submitted in full at the right time. In other words, if an individual has received a notification from the Federal Tax Service regarding the payment of transport tax, then he must independently double-check the data.

For what reasons may an error be made in the amount of accrued transport tax:

- the tax base was calculated incorrectly or the wrong tax rate was applied. The reason is the human factor. A Federal Tax Service employee may apply the wrong tax rate, incorrectly read information about the region where the vehicle is registered, fail to take into account benefits, etc. There are many options. There is only one action - the owner must submit a written statement to the inspectorate as quickly as possible and point out the mistake made. As a rule, an application must be accompanied by documentary evidence of a fact that excludes an error. Because the error may not be in the calculations themselves, but in the database.

- data on the sale of the vehicle was not submitted to the tax service on time. The most popular reason for the error. The buyer of a car is required to register the car immediately after purchase; if he does not do this, the seller will receive a transport tax notice based on the full reporting year. The situation can be corrected by contacting the Federal Tax Service and presenting documents confirming the purchase and sale. In this case, there should not be any special problems. The recalculation will be made within one to two working weeks.

- When a car was stolen, the corresponding certificate from the traffic police was not submitted to the tax service. If the vehicle is stolen, the owner of the car receives a document about this fact from the traffic police. He provides it to the inspectorate. The tax is calculated only for the period during which the motorist actually used the vehicle. But there is a problem here: if there is no official document, then the Federal Tax Service will not make a recalculation based only on a written application.

- registration of place of residence at a new address during the reporting period. It's simple: two tax inspectorates can charge transport tax at once. A popular mistake, especially if a person changes his region of residence. The error can be easily corrected by contacting the inspectorate at your new place of residence. There is no need to contact your old place of registration. Inspections interact with each other; they will independently eliminate the discrepancy.

In any case, what did not cause such an error, a prompt response to this fact is necessary. And there is only one way out of the situation - contact the inspectorate, pointing out the incorrect accrual.

Important information: It is worth remembering that the Federal Tax Service provides the opportunity for Russian citizens to formulate appeals electronically. To do this, you need to have a personal account on the official website of the tax office.

What to do if the transport tax is calculated incorrectly?

If the vehicle owner believes that the tax amount is incorrect, he should immediately clarify this issue. To do this, you need to contact the regional tax office, according to the official registration of the car owner, for clarification and to submit an application for recalculation.

Cases when the owner of a vehicle does not agree with the tax amount sent occur quite often. Most often, there are errors related to numbers, that is, engine power indicators or the tax rate were incorrectly applied. You can also separate into a separate group those notifications that were sent without taking into account tax benefits.

Additionally, we recommend that you familiarize yourself with the rules for calculating tax for individuals.

Grounds for recalculation

Errors in calculating the amount of tax can occur for various reasons, ranging from software failure to human factor. Let's look at standard situations and find out what grounds for recalculation may be in 2021:

- The first thing any person who receives a “chain letter” from the tax service does is print it out and look at the amount. If the amount seems wrong, it starts reading the rest of the data. Lawyers recommend that you carefully read every line of the letter and make sure that the specified personal data and information about the car are correct. It often happens that inside the letter is someone else’s notice and receipt, not even addressed to the recipient. There are times when the full name is written correctly, but the number of horsepower of the car does not correspond to reality. For this recalculation, you must submit an application to the tax service and provide copies of the STS and PTS. This can be done both on paper and electronically.

- Not every car owner knows the size of the regional tax rate applicable to his own car, and this is often the reason for the incorrectly calculated amount of transport tax. An incorrectly applied tax rate can play a cruel joke on inattentive vehicle owners. Remember that transport tax is calculated at the rate of the region in which the car is registered. You can find out reliable information about the tax rate on the Federal Tax Service website using electronic services, or you can call or personally contact your local office. To recalculate, you must submit an application to the tax service and provide copies of the owner’s passport (pages with a photo and registration stamp), STS and PTS.

- Some transport owners believe that the tax was calculated incorrectly, based on the fact that they did not use the transport during the year and therefore require a recalculation. A legal basis for this could be vehicle theft. Moreover, the stolen car must be officially wanted, and there must be supporting documents from the traffic police. In case of theft of a vehicle, the transport tax will be recalculated for the actual time of use during the year.

There are no other grounds for recalculating the tax for the actual operating time. Even if the car is completely broken down, is in disrepair, or the owner drives it once a year, this is not a basis for recalculation. The owner of the vehicle will be required to pay tax for the full calendar year of ownership.

- In the event that the car is sold during the reporting period, but the tax has been received. This happens because information about the change of owners was not received by the tax office on time; the former owner receives a receipt with the amount of tax for the entire calendar year. The situation can be corrected with the help of an appropriate application and the submitted purchase and sale agreement.

- Some types of vehicles and some categories of citizens may be exempt from paying transport tax. Unfortunately, upon membership in the category of beneficiaries, the tax is not automatically calculated taking into account the discount. And if the owner of the vehicle has not submitted an application for a tax discount to the regional office of the Federal Tax Service in a timely manner, he will receive a receipt with the tax calculated on a general basis. To recalculate, you must submit an application for a tax rebate.

- A change of place of residence (registration) of the owner of a vehicle and a change of vehicle registration may result in an erroneously calculated double tax amount. Using a single database, the tax service can “see” the taxpayer at both the new and old address. Without submitting a corresponding application at the place of residence at the initiative of the car owner, the tax will be received twice.

We recommend that you find out which cars are not subject to transport tax.

Application to the tax authority

The transport tax was calculated incorrectly - this situation can be corrected with the help of an appropriate application. It should be:

- addressed to the head of the local branch of the Federal Tax Service;

- contain information about the applicant - the owner of the vehicle;

- contain data about the vehicle;

- written on a special form approved by the Federal Tax Service or by hand on a regular A4 sheet or printed on a computer in simple written form indicating erroneous information and a request for recalculation;

- dated and certified by personal signature.

To confirm that he is right, the car owner must indicate and (or) submit documents on the basis of which he claims erroneous data.

This could be: a traffic police certificate of theft, documents of beneficiaries, STS, PTS and others. Since the beginning of 2021, amendments have been made to the tax code, according to which the applicant has the right only to indicate, but not to submit the documents themselves - the grounds for recalculating taxes. This amendment also applies to transport tax. You can submit an application to the tax service in different ways:

- personally or with the help of a person representing your interests, by proxy of a notary;

- on paper via Russian Post (by registered mail, with a list of the contents and notification of delivery);

- on paper during a visit to the Federal Tax Service of the Russian Federation;

- in electronic form through the authorized personal account of the taxpayer on the official website of the tax service of the Russian Federation.

Result according to application

After submitting an application with attached copies of documents - grounds for recalculation, the car owner must wait within 30 calendar days for a response from the tax office. If the applicant indicated, but did not submit documents, the grounds for recalculation, and from 2021 he has the right to do so, then he will have to wait up to 30 working days for a response. During this time, tax specialists are required to make official requests to the relevant organizations, and having received a response from them, calculate the correct amount of tax.

As a rule, a new notification and receipt are sent to the applicant’s address indicating the amount, taking into account the recalculation made and the erroneous tax amount that was calculated earlier.

What to do if the receipt has not arrived? How to generate a receipt for paying taxes yourself? Read the article by our lawyer.

Refund of overpaid amount

All current information about taxes is reflected in two official government sources: on the Gosulugi portal and in the taxpayer’s personal account on the website of the Russian Tax Service. Some taxpayers may see the overpayment amount there. What does overpayment mean in a taxpayer’s personal account? How can you use it?

It happens that the owner of a vehicle first pays the tax amount, and then notices errors in the calculations and submits an application for recalculation. After checking the data, if the tax service confirms the error, an overpayment occurs. A receipt with the newly calculated tax and the amount of overpayment is sent in paper form to the applicant’s address, and the information is also reflected electronically in the taxpayer’s personal account. In the event of an overpaid amount of transport tax, the Federal Tax Service of the Russian Federation itself decides on the form in which to return the overpayment to the taxpayer: with a refund or against tax for the future reporting period. The period for making a decision is 10 days, and 5 days for sending a written notification to the car owner.

If the owner of the vehicle knows about the overpayment at the time of submitting the application for recalculation, then he can indicate in the same application a request for the return of the overpayment amount or for offset. This can also be done using a separate statement.

Stage 1. Preparing a statement about errors in the tax notice

So, the taxpayer has discovered an error and he must report it to the inspectorate. It's clear. But how is such a statement formed?

The advantage is that the law allows the use of any form of address. The main thing is that the document contains the following details:

- Name of the territorial inspection where the application is submitted;

- Legal address of such inspection;

- Full name of the subject;

- Applicant identification number;

- Information about the vehicle for which recalculation is required;

- The period within which the error was made;

- Reasons for the error.

It is necessary to clearly formulate the reasons that indicate the identified inaccuracies. You must refer to the attached documents. If necessary, you can independently provide links to legal acts regulating this issue.

By the way, the owner of the vehicle has the right to contact the tax service within 3 years from the moment the mistake was made. For example, if an error was made regarding the tax for 2021, then a citizen can receive a recalculation in 2021, and in 2021, and even in 2021.

At the end of the application, you usually need to put the date of compilation and a signature.

How is transport tax calculated?

First of all, you need to understand what the transport tax , and also timely monitor all legislative changes in this area.

To calculate transport tax, it is necessary to take into account the tax base based on:

- engine power (horsepower);

- the size of the share in the ownership of the vehicle (the car belongs entirely to you or you are only a co-owner);

- tax rate, which is established by the laws of the constituent entities of the Russian Federation per horsepower (in the absence of such a law, it is necessary to apply the rate specified in the Tax Code of the Russian Federation).

It is also important to consider the period for which the tax is calculated. To calculate the transport tax, the entire month the vehicle is registered is taken into account. Moreover, if the vehicle was deregistered before the 15th day of the month (inclusive), then the month the vehicle was deregistered is not included in the tax calculation.

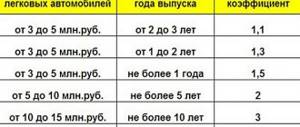

From 2021, the coefficient for calculating transport tax (the so-called luxury tax) has been reduced for some expensive cars. Previously, for passenger cars costing from 3 to 5 million rubles inclusive, three coefficients were used, which depended on the age of the car. If two to three years have passed since the car was manufactured, the coefficient was equal to 1.1. If one to two years have passed - 1.3. And if no more than a year had passed, then a correction factor of 1.5 was in effect. Now, for passenger cars worth from 3 to 5 million rubles inclusive and not older than three years, a coefficient of 1.1 is applied. This rule is effective from March 7, 2021 (no transitional provisions were provided).

view the list of vehicles worth from 3 million to 5 million rubles on the official website of the Russian Ministry of Industry and Trade. Typically, this list is published annually no later than March 1.

For example, let's calculate the transport tax that will be paid in 2021 for an Audi TT RS Coupe under the following conditions:

- engine power is 400 hp;

- one owner;

- tax rate - 150 rub./hp;

- the car was registered on November 5, 2017 (which means it was registered for two full months out of 12);

- the car was released in 2021, its cost is 4,170,000 rubles%

- included in the above-mentioned list of passenger cars with an average cost of 3 million to 5 million rubles.

Stage 2. Submitting an application to the tax authority

So, the application has been drawn up, now it needs to be submitted.

There are several submission options:

- directly to the inspectorate. This requires the personal presence of the vehicle owner. It is also possible to submit a petition through a proxy. In this case, a notarized power of attorney is required.

- by mail. The legislation allows the formation of appeals to government bodies through postal operators. In this case, you need to send a notification letter.

- in electronic form through the official website of the Federal Tax Service. As mentioned earlier, for this you need to have an authorized personal account.

There is no fundamental difference. The effectiveness of the treatment is the same. But you need to remember: that with the first option you need 2 copies of the document, and in other cases only one. This is due to the fact that when submitting in person, one copy of the document with a mark is given to the applicant or an authorized person.

Do not forget that documents confirming specific data must be attached to the application.

Stage 3. Waiting for a tax notice with corrected data

When tax officials receive the application, they are obliged to carefully study it and recalculate the liability. To do this, they have 30 days, but not from the moment the paper is sent, but from the moment it is registered in the office.

Important: if the applicant provides incomplete information or does not present supporting documents, then representatives of the Federal Tax Service have the legislative right to extend the period for consideration of the case for another 30 days. In total, the maximum possible period for recalculating transport tax is 60 days.

In any case, the taxpayer will receive a new notification with a new tax amount.

When is transport tax recalculation required?

Recalculation is possible if additional circumstances are identified that affect the amount of the tax liability. Among these circumstances are the following:

- Tax office error in the calculation due to the use of incorrect power values and rates;

- The benefit granted to the car owner is not taken into account; each region develops a benefit system independently;

- The vehicle has been sold, but the tax authorities have not received information about this;

- Vehicles were stolen in the reporting year;

- Changing the residence address of the vehicle owner and the place of registration of the vehicle.

If the amount of transport tax stated in the notification does not suit the taxpayer, then he should immediately contact the tax authority to clarify the position of the tax authorities and provide justification for recalculating the tax.

Stage 4. Submitting an application for a refund of the overpaid amount

There may be a slightly different situation: the owner of the vehicle paid the tax according to the notification received, and then discovered an error. The inspectorate recalculated the tax for him, and it turned out to be less than what went to the budget. In this case, the taxpayer can recover the amount of overpaid tax.

To get your money back, you must again submit an application to the inspectorate. When visiting the branch, such an application form will be provided in paper form. But it can also be submitted through your personal account on the Federal Tax Service website.

Stage 5. Refund of overpaid tax

When the tax office receives such an application, it can consider it no more than 10 working days. When a decision is made to return the overpaid amount, the taxpayer will be notified within 5 days of the decision.

Important: if an entity has a debt on some taxes and payments, then first the overpaid transport tax will be counted towards the repayment of such debt, and only then the balance will be paid.

The money will be credited to the bank card within 1 month after the date of receipt of the application from the subject.

What to do if tax recalculation is required

The procedure for the transport tax payer comes down to collecting the necessary supporting documentation justifying the need for recalculation, writing an application to the Federal Tax Service and transferring the documents to the tax authorities.

When submitting an application for recalculation, you must have your passport, originals and copies of documents confirming the need for an adjustment calculation.

Depending on the specific situation, you need to collect the necessary documents, which may include:

- if the value of one of the elements of the formula for calculating the tax is incorrect, documents confirming the correct value, for example, PTS, where the motor power is indicated. If the rate is used incorrectly, links are provided to the paragraphs of legislative acts of the region where the current rate is indicated. If increasing factors are used incorrectly, a vehicle title and a document confirming the average cost of the vehicle are provided as confirmation. The tax office receives data for calculations from the traffic police, so in some cases, corrections must first be made in the traffic police registers, and then the transport tax must be adjusted in the Federal Tax Service;

- if the benefit is not taken into account, the application shall indicate points of regulatory documents confirming the existence of a preferential system in the region, and also attach documentation confirming the right to the benefit;

- when selling a car, when the information does not have time to arrive in the Federal Tax Service database in a timely manner, it is necessary to confirm the fact of implementation of the purchase and sale agreement;

- if a car is stolen, a certificate from the traffic police is provided;

- When changing the address of residence and registering a vehicle with the State Traffic Safety Inspectorate, documents confirming the new address of the taxpayer are attached to the application.

Peculiarities

A not bright prospect for car owners is the ability of the tax authorities to recalculate the transport tax after it has been paid. The initiator of the recalculation is the inspectorate itself. And, of course, the recalculation is made upward, not downward. And here everything is simple: the taxpayer pays the tax and sleeps peacefully, and the Federal Tax Service recalculated his debt and also assessed a penalty on the balance of the debt.

Again, there is only one way out: write a statement to the inspectorate, defend your case, or, as a last resort, go to court. At a minimum, they can write off penalties and fines.

Responsibility for evasion

Many car enthusiasts wonder what will happen if they don’t pay taxes. And for this there can be everything within the framework of administrative law. The most common option is a fine, the amount of which is up to 15-20% of the debt amount. No one has canceled the ability of the Federal Tax Service to charge a penalty for each day of delay.

Additionally they can:

- confiscate a car to pay off a debt with the involvement of bailiffs;

- seize other assets, including seizure of a bank account;

- prohibit travel outside the Russian Federation.

But, as a warning, the Federal Tax Service, by court decision, begins to collect the debt from wages. Therefore, it will not be possible to evade your direct obligations.