The presence of a vehicle (VV) significantly increases the owner’s potential: in speed and range of movement, in a variety of recreational places, in increasing business profitability. But in addition to additional opportunities, such property also imposes obligations, in particular, to pay the annual transport tax.

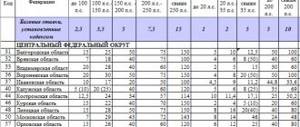

Let us remind you that when calculating the tax, the category of transport, its capacity and the regional tax rate are taken into account. Even for vehicles of one purpose, for example, for passenger cars, the owners of which are a fairly large percentage of our fellow citizens, the spread in tax amounts is quite large. The more expensive and more powerful the car, the greater the amount of tax that must be paid to its owner. At the same time, benefits are provided for socially important transport, as well as for car owners from the least protected segments of the population.

The presented material will be useful primarily to individuals. Of course, organizations also pay transport tax, but a legal entity, even if there is a benefit, is required to annually file a declaration indicating the reasons why payments have not been made. And for private owners, it is enough to enter the data once into the sample application for a tax benefit if they have rights to the privilege.

Preferential categories

The legislation allows for a number of grounds for obtaining tax breaks. Thus, some vehicles are not considered at all as an object of taxation according to federal regulations. This includes rowing boats, passenger cars equipped for use by disabled people, fishing vessels, agricultural transport, medical aviation, etc. The full list is given in paragraph 2 of Article 358 of the Tax Code of the Russian Federation.

In turn, preferences for privileged categories of citizens are established at the regional level, since transport tax collections replenish the regional budget. Most regions provide benefits:

- For pensioners.

- Heroes of the USSR and the Russian Federation.

- Disabled people of groups I and II.

- Large families.

- Veterans (disabled) of combat operations.

- Labor veterans.

- Representatives of a disabled child.

- Chernobyl victims and other persons who suffered radiation sickness due to working with nuclear installations.

Of course, not all subjects of the Russian Federation have introduced such benefits, and in some, if they have been introduced, they are differentiated depending on certain factors. For example, it is useless to write an application for tax benefits for pensioners in Moscow - the capital does not provide tax privileges for personal transport of this category of the population. And in St. Petersburg, the benefit will only apply to pensioners who own a domestic car with a capacity of up to 150 hp. With.

You can find out more about the availability of transport tax benefits in your region in this article.

Who benefits?

There is a list of people that is similar in many regions of Russia. Preferential conditions when imposing tax obligations on transport tax apply to:

- people who have been awarded the status of Hero of Socialist Labor, the USSR, the Russian Federation;

- having received awards - the Order of Lenin, the Order of Glory 3 degrees;

- WWII or military veterans;

- disabled people of all groups, as well as the parent (guardian, relative) of a disabled person;

- participants in the liquidation of the consequences of the accident at the Chernobyl nuclear power plant;

- parents with many children;

- retired people who own a Russian-made car with a power of 100-150 hp.

Benefits for the medal "For Courage"

In some regions, widows of military personnel, workers employed in radioactive danger zones, or those responsible for eliminating the consequences of accidents at nuclear facilities may be added to this list.

Important! If a citizen belongs to the preferential category of citizens, then he has the right not to make tax payments for vehicles with a power of less than 100 hp.

Tax deduction according to the Platon system

A special place among the beneficiaries is occupied by owners of heavy vehicles with a maximum weight of more than 12 tons, registered in the register of vehicles of the toll collection system (the so-called “Plato”).

Let us recall that one of the main goals of the transport tax is to replenish the budget in order to restore roads. The Platon system does the same thing: it collects funds for the damage that heavy trucks inevitably cause to highways. To avoid the situation of double payments, it was allowed to deduct payments for “Plato” from the amount of transport tax (Federal Law No. 249-FZ of 07/03/2016). As a result:

- The tax is not transferred at all if payments to compensate for damage to roads exceeded (or were equal to) the amount of tax for the same period;

- The tax is reduced by the amount of the payment if the latter was less than the amount of the calculated transport tax.

The deduction is valid for both individuals and companies.

Who is exempt from paying transport tax by regional laws

According to paragraph 1 of Art. 358 of the Tax Code of the Russian Federation, the objects of TN taxation are cars, motorcycles, scooters, buses and other self-propelled machines and mechanisms on pneumatic and caterpillar tracks, as well as airplanes, helicopters, motor ships, yachts, sailing ships, boats, snowmobiles, motor sleighs, motor boats, jet skis , non-self-propelled (towed) and other water and air vehicles registered in the prescribed manner.

We invite you to familiarize yourself with: What taxes are paid upon entering into an inheritance under a will and by law

In paragraph 2 of Art. 358 of the Tax Code of the Russian Federation provides a list of vehicles that are not subject to taxation. Accordingly, their owners have the right to be exempt from transport tax. Among such objects:

- rowing boats and motor boats with engines up to 5 horsepower (excluded from preferential objects from 01/01/2020);

- passenger cars specially equipped for use by disabled people, as well as with an engine power of up to 100 horsepower (73.55 kW), received (purchased) through social security authorities;

- passenger and cargo sea, river and aircraft owned by carriers;

- tractors, self-propelled combines of all brands, special vehicles of agricultural producers;

- vehicles that are wanted, as well as vehicles for which the search has been terminated, from the month the search began until the month of its return to the person in whose name it was registered. Facts of theft (theft), return of a vehicle are confirmed by a document issued by an authorized body, or information received by tax authorities in accordance with Art. 85 Tax Code of the Russian Federation.

From 07/03/2016 to 12/31/2018, there was an additional benefit that allowed the tax accrued on heavy trucks to be reduced down to zero by the amount of the fee paid to the budget for the damage caused by such transport to roads. It applied to both individuals (Article 361.1 of the Tax Code of the Russian Federation) and legal entities (clause 2 of Article 362 of the Tax Code of the Russian Federation).

Read more about the deduction in the article “Transport tax and the Plato system (nuances).”

The region can introduce transport tax benefits for both individuals and organizations. Basically, they have a social orientation, and beneficiaries usually include disabled people, pensioners, war veterans, people with state awards, etc. Benefits can be provided either in the form of a complete tax exemption or in the form of a rate reduction.

How to apply for a transport tax benefit

By default, notices sent by the IRS do not take into account your individual exemptions. They must be activated independently by contacting the tax office at the place of registration. To complete a package of documents, which includes:

- Personal Statement;

- Identification;

- TIN;

- Documents for the vehicle (registration certificate, certificate of registration of ownership);

- Documents confirming the right to the benefit (pension certificate, certificate of disability, certificate of a large family, etc.).

From January 1, 2021, the free form was replaced by an official application for tax benefits (order dated November 14, 2021 No. ММВ-7-21/ [email protected] ).

Sample application for transport tax benefit

How to write an application?

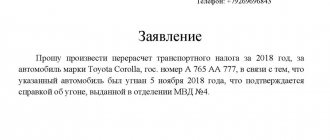

The Federal Tax Service does not regulate a standardized application form. But there is a departmental letter from the Federal Tax Service, which offers a sample. The person himself chooses the filling method: by hand or printed on a PC. Inspectorate employees are required to accept the application if it contains all the required data.

The procedure and type of information indicated in the application:

- In the right corner in the first lines is written the name and code of the tax inspection unit.

- The following lines after the name of the organization reflect personal information about the applicant - full name, passport details, registration address, taxpayer number, telephone number.

- After the word “application”, the applicant’s request in relation to the transport tax discount should be disclosed.

- The following lines describe the basis for providing the benefit (presence of disability, participation in hostilities, awarding the status of a large family, etc.).

- After describing the essence of the application, write information about the car - number, series of registration certificate, make, model, VIN.

- Please indicate the documents attached to the application.

- Put the date, signature with transcript.

Benefits for large families

If you want to print the application on your computer, you can download the form from the Federal Tax Service website or another page. There is also a completed example there.

If it is not possible to go online, the application form can be obtained from the tax office, where completed sample forms are available.

2.jpg

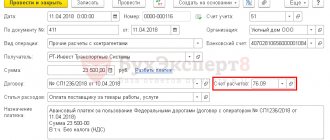

If the benefit applies to a participant in the Platon system, the application shall indicate:

in line 4.5.1 – “entry in the Toll Register”;

in line 4.5.2 – “toll collection system operator”;

in line 4.5.3 – the date of payment to the operator according to the Register data (the latest in time for the tax period for which the tax benefit was claimed);

in line 4.5.4 - the period for which the payment was made in relation to the vehicle (according to the Register);

in line 4.5.5 – we do not indicate anything (dash).

To submit an application, you can choose the most convenient way:

- Through the taxpayer’s personal account on ]]>the Federal Tax Service website]]>;

- By mail to the territorial office of the tax department;

- Through an authorized MFC;

- Personally.

Registration of benefits for land and property

An application for a land tax benefit and an application for a property tax benefit are completed in the same way.

The title page for these applications is identical, as are the fields for indicating the document giving the right to tax preferences. The only difference is in the designation of taxable property in respect of which the benefit will be applied.

Thus, an application for a pensioner’s land tax benefit will contain the cadastral number of the land plot and be confirmed by the number of the taxpayer’s pension certificate.

When to apply for tax relief

We recommend that you claim your rights to reduce tax fees before April-May. That is, before the start of the formation and mass distribution of notifications about the amount of transport tax for the previous period. In this case, the application will be taken into account when drawing up the notification, which will save you from the need for recalculation.

You do not need to renew your benefit application annually. If you have already claimed your rights to the benefit and did not indicate time restrictions, it will be automatically extended.

If an application for a benefit was submitted after the fact, the Tax Code allows for recalculation. But only for the last three years (clause 3 of Article 363 of the Tax Code of the Russian Federation).

26.05.2021How business support programs worked during the pandemic

During his speech on May 12 in the State Duma with a report on the government’s work over the past year, Mikhail Mishustin summed up the results of government programs to support business during the pandemic. How many companies received assistance and what financial resources did they manage to save thanks to the measures taken?

26.05.2021Who and how proved lost profits in court?

It is not so easy to obtain compensation for losses in the form of lost profits. To recover lost profits, the real possibility of obtaining it and its size must be established.

26.05.2021Don't miss your 2021 income tax deadlines

On May 28, 2021, the period for submitting income tax reporting and its payment ends. Be sure to complete all required duties if you want to avoid fines.

26.05.2021The director of a closed company must himself prove his good faith to creditors

The Constitutional Court found that if the director of a company excluded from the Unified State Register of Legal Entities is held vicariously liable, he is still liable to creditors and must prove his good faith.

26.05.2021Full financial responsibility during the performance of vacation duties: is it possible?

The employee was assigned a part-time position as a cashier while the main employee was on vacation. At the same time, the organization wants to draw up an agreement with the employee on full financial responsibility. Does the organization have the right to draw up such an agreement, given that the employee will perform the duties of a cashier temporarily?

26.05.2021Small Business Legal Mistakes

Legal problems are among the TOP 16 reasons why startups fail, according to the analytical company CB Insights. At the same time, in Russia, many beginning entrepreneurs often make similar, from a legal point of view, mistakes. We tell you how to minimize such risks.

26.05.2021The working day has been shortened by an hour: is there a right to child benefit?

The FSS refused to take into account the organization's expenses for paying child benefits to an employee. Fund employees referred to the fact that his working day was reduced by only an hour, and this could be considered formal compliance with the conditions for payment of benefits.

26.05.2021159 of the Criminal Code of the Russian Federation: anti-record for the number of prisoners

The number of entrepreneurs in pre-trial detention centers in the capital has increased at a record level. At the same time, it became known that the Prosecutor General’s Office, the Federal Tax Service and the Ministry of Internal Affairs are working on a bill that could add another article to the Criminal Code for tax offenses.

26.05.2021What prohibitions hinder business the most?

The “regulatory guillotine” has cut off some of the excessive prohibitions for business, but comfortable conditions are still far away: four out of five Russian entrepreneurs expressed fear of arbitrariness on the part of law enforcement agencies. There are especially many problems for the self-employed. Excessive regulation can be seen, for example, in the ban on selling goods subject to mandatory labeling. It is also prohibited to engage (without a license) in the transportation of passengers and luggage by passenger taxi.

25.05.2021The Central Bank of the Russian Federation intends to solve the problem of cash withdrawal through writs of execution

The Central Bank is looking for ways to solve the problem of cashing out money through writs of execution.

25.05.2021Is it possible to hold a driver who is involved in an accident in a company car to full financial liability?

The organization's driver went on a business trip to another city in a company car. There he got into an accident. The employer wants to hold him fully financially liable. Does he have the right to do this, given that no agreement on financial liability was concluded with the employee? If it is not possible to hold the employee fully financially liable, how much will the organization be able to withhold the amount of damage from wages?

25.05.2021When will the company have to return maternity benefits to the Social Insurance Fund?

If the company does not inform the Social Insurance Fund about the interruption of an employee’s maternity leave, the amount of overpayment of benefits may be recovered from the company. The editors of the Calculation magazine studied the opinion of the FSS and learned how to avoid such a development of events.

25.05.2021VAT when performing work by a bankrupt organization

The organization has been declared bankrupt, but continues to perform work and provide services under the concluded contracts. Starting from January 1, 2021, work performed by debtors declared bankrupt is not subject to VAT. But what about the VAT of an organization if it has not yet completed work under the contract begun in 2021?

25.05.2021Is it possible to extend a fixed-term employment contract?

The employee was hired by concluding an employment contract for a period of 1 year. But the employer had a production need to keep the employee for a few more months. Does an organization have the right to extend the term of an employment contract and not enter into an open-ended employment contract? The answer to this question was given by the Ministry of Labor in letter dated April 27, 2021 No. 14-2/OOG-3772.

25.05.2021How to avoid accusations of fictitious transactions

Recently, the Federal Tax Service issued a detailed letter No. BV-4-7/ [email protected] , designed to help inspectors prove unjustified tax benefits, including in court, because the explanation was drawn up on the basis of monitoring arbitration practice. Officials provided recommendations on the application of the provisions of Article 54.1 of the Tax Code of the Russian Federation, aimed at combating illegal violations that arise when the budget receives less funds due to abuse.

25.05.2021Cancel the possibility of disciplinary action through dismissal?!

Yes, that's possible. If the employee has committed misconduct or committed any violation, after dismissal it is canceled. It is impossible to rehire an employee and punish him for “old sins,” that is, for an offense committed before the conclusion of a new employment contract.

25.05.2021Sick leave without a note about violation of the regime: is the benefit paid in excess?

The medical clinic did not put a note about the violation of the regime on the sick leave. The FSS considered that this was the reason for excessive payments at its expense.

25.05.2021The Supreme Court tightened the conditions for “tax reconstruction”

With the help of “tax reconstruction”, a company that used tax evasion schemes is charged as much additional taxes as a bona fide person would pay in the same situation. In March, the Federal Tax Service in its letter recognized the possibility of reconstruction, and now the Supreme Court has explained in detail who can count on it. The Economic College called for taking into account the form of the taxpayer’s guilt and paying attention to whether he helped disclose the composition of the disputed transactions (determination dated May 19, 2021 No. 309-ES20-23981).

24.05.2021Three conditions to receive a 50% refund of the cost of a child’s trip to a children’s camp

You can receive a 50% refund on the cost of a trip to a children's camp if three conditions are met: pay with a Mir card, from May 25 to August 31, 2021, to a camp in a certain region of Russia.

24.05.2021Should individual entrepreneurs on PSN take into account premiums and bonuses from suppliers in “patent” income from retail trade?

Individual entrepreneurs apply PSN for the type of activity - retail trade.

From suppliers of goods he receives premiums and bonuses for fulfilling certain conditions of the supply agreement. Should these premiums and bonuses be taken into account when determining the amount of income received from the retail trade of goods on the PSN? The answer to this question was given by the Ministry of Finance in a letter dated August 25, 2020 No. 03-11-11/74565. 1 Next page >>

Cancellation of transport tax

Much was written about the imminent abolition of this type of tax at the beginning of 2018; moreover, the Ministry of Transport and the President of the Russian Federation have repeatedly spoken out in support of its elimination. But so far things have not gone beyond intentions.

At the initiative of a number of deputies, on June 5, 2021, ]]>draft bill]]> No. 480908-7 “On amendments to the Tax Code of the Russian Federation regarding the abolition of transport tax” was submitted. To compensate for the shortfall in revenue, the document proposes an increase in fuel excise taxes. Hypothetically, this would solve at least two problems:

- reducing the tax burden for those who rarely use their vehicle;

- eliminating the problem of non-payment (the collection rate of this tax in the constituent entities of the Russian Federation does not exceed 50%).

However, the bill did not pass beyond preliminary consideration by the State Duma. On July 2, 2021, the relevant committee returned the project for revision. Thus, it is premature to talk about abolishing the tax. Read more about this in our article.

Benefits for paying transport tax (exemption from payment) in Moscow

Let's look at the list of beneficiaries using the example of the Moscow law on transport tax. In the capital, the procedure for paying transport tax is regulated by the Moscow Law “On Transport Tax” dated 07/09/2008 No. 33. Art. 4 of this law.

We invite you to read: Pensioner of the Ministry of Internal Affairs transport tax - advice from lawyers and lawyers

According to this article in Moscow, the following are entitled to transport tax benefits in 2019-2020:

- Organizations providing services for the transportation of passengers by public urban passenger transport - for vehicles carrying passengers (except taxis).

- Residents of the special economic zone of technology-innovation type "Zelenograd" - by vehicles registered on them from the moment of inclusion in the register of residents of the special economic zone.

- Heroes of the Soviet Union, Heroes of the Russian Federation, citizens awarded the Order of Glory of three degrees.

- Veterans and disabled people of the Second World War.

- Veterans and disabled combatants.

- Disabled people of groups I and II.

- Former minor prisoners of concentration camps, ghettos, and other places of forced detention created by the Nazis and their allies during the Second World War.

- One of the parents (adoptive parents), guardian, trustee of a disabled child.

- Persons who own passenger cars with an engine power of up to 70 horsepower (51.49 kW) inclusive - for one vehicle registered to them.

- One of the parents (adoptive parents) in a large family.

- Individuals entitled to receive social support in accordance with the Law of the Russian Federation “On the social protection of citizens exposed to radiation due to the disaster at the Chernobyl nuclear power plant” dated May 15, 1991 No. 1244-1, federal laws “On the social protection of citizens of the Russian Federation exposed to radiation due to the accident in 1957 at the Mayak production association and the discharge of radioactive waste into the Techa River" dated November 26, 1998 No. 175-FZ and "On social guarantees for citizens exposed to radiation as a result of nuclear tests at the Semipalatinsk test site" dated January 10, 2002 No. 2-FZ.

- Individuals who, as part of special risk units, took direct part in testing nuclear and thermonuclear weapons, eliminating accidents of nuclear installations at weapons and military facilities.

- Individuals who received or suffered radiation sickness or became disabled as a result of tests, exercises and other work related to any types of nuclear installations, including nuclear weapons and space technology.

- One of the guardians of a disabled person since childhood, recognized by the court as incompetent.

- Organizations recognized as SEZ management companies and carrying out activities for the purpose of implementing SEZ management agreements - in relation to vehicles registered to these organizations, from the moment of conclusion of agreements on the management of special economic zones with the federal executive body authorized by the Government of the Russian Federation. The benefit is provided for a period of 10 years, starting from the month of registration of the vehicle.

- Management companies of the International Medical Cluster and project participants who have entered into agreements on the implementation of the project with the management company of the International Medical Cluster and carry out project implementation activities on the territory of the International Medical Cluster (from 01/01/2018 to 12/31/2027 - Article 4 of Law No. 33 as amended by the law Moscow on amendments to certain laws of Moscow in the field of taxation dated November 29, 2017 No. 45).

- From 01.01.2020 to 31.12.2024 - persons who own vehicles equipped exclusively with electric motors.

We invite you to familiarize yourself with: Procedure for refunding overpaid tax amounts

Individuals are provided with benefits only for one vehicle registered to them. It should be remembered that benefits do not apply to cars with an engine power of more than 200 hp. With. This rule does not apply only to parents of a large family.